Target-Date Fund Flows Bounce Back in 2021

Fidelity and American Funds dominate, while Vanguard sees a seismic shift to its CITs.

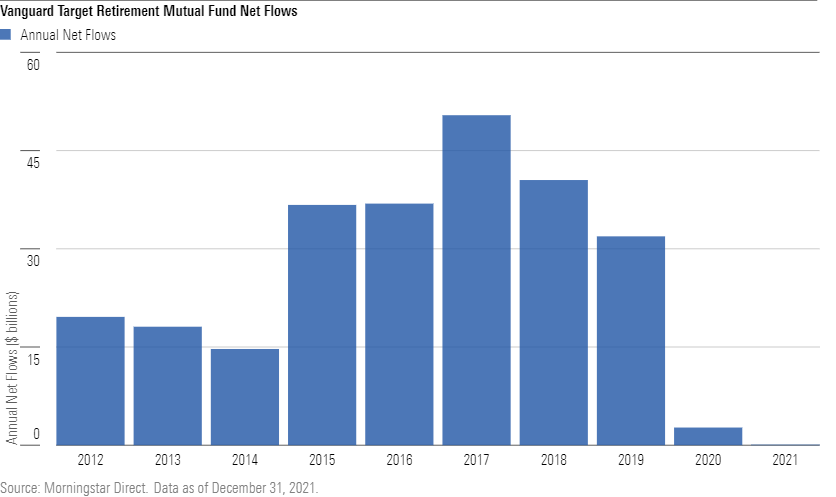

Investor contributions to target-date mutual funds made a comeback in 2021 after the popular retirement savings vehicles saw net redemptions for the first time in 2020. During the 2021 calendar year, net flows into target-date mutual funds totaled about $24 billion, up from net outflows of $7.2 billion in 2020. Despite the rebound, net contributions were still down from their $69.9 billion peak in 2017 and less than half of the $59.8 billion of net flows in 2019. Exhibit 1 shows the annual net flows into target-date mutual funds over the past five calendar years.

The economic angst caused by the coronavirus pandemic led to an uptick in hardship withdrawals and a slowdown in contributions in 2020. In 2021, plan sponsors at defined-contribution plans have continued to accelerate their shift from mutual funds to collective investment trusts, particularly when it comes to target-date funds. CITs typically cost less than their mutual fund counterparts and some providers are willing to negotiate fees even lower. As plan sponsors have homed in on costs, it's propelled CIT growth. At the end of 2020, about 43% of target-date assets were in CITs, up from less than 20% in 2014. Assets and flows into CITs are voluntarily reported, usually on a lag compared with the more regulated mutual funds. So, year-end CIT data for the target-date universe is currently unavailable.

Fidelity and American Funds Lead the Way in Mutual Funds

Exhibit 2 shows the top 10 target-date mutual fund series ranked by net flows and the year-over-year percentage change in net flows.

For the second year in a row, Fidelity Freedom Index Series, which earns a Morningstar Analyst Rating of Silver, raked in the most flows among target-date mutual funds. In 2021, the series took in $26 billion of assets, up 66% from 2020. At the end of 2020, the firm slashed the minimum investment on its institutional share class to $5 million from $100 million. Impressively, Fidelity is the only provider to have two series on the list as Fidelity Freedom Blend had net flows of $3.3 billion, enough to land the fifth spot on the list. Though the firm's flagship series, Fidelity Freedom, did not benefit from the same success and suffered $16.7 billion in outflows.

Silver-rated American Funds Target Date Retirement Series continues to hold the number two spot, which it has since 2016. It is one of two series in the top 10 that invests in all active underlying funds; T. Rowe Price Target Series landed at number 10. Target-date series with all active funds have been losing market share to index-based and blend series largely because of their higher fees. American Funds continues to be the exception thanks to its strong performance. Over the past 10 years, the series, on average, delivered higher returns than roughly 97% of peers.

Vanguard Target Retirement's Shift to CITs

Unlike many target-date series, Vanguard Target Retirement didn't see a rebound in flows to its mutual funds in 2021. Though it remains the largest mutual fund series with $660 billion in assets, it received only $71 million of net flows, down from $2.7 billion in 2020. Notably, 2021 marks the second year in a row it failed to grasp the top flow spot, which it had held from 2008 through 2019. The slowdown to a trickle of net inflows to Vanguard's target-date mutual funds is illustrated in Exhibit 3.

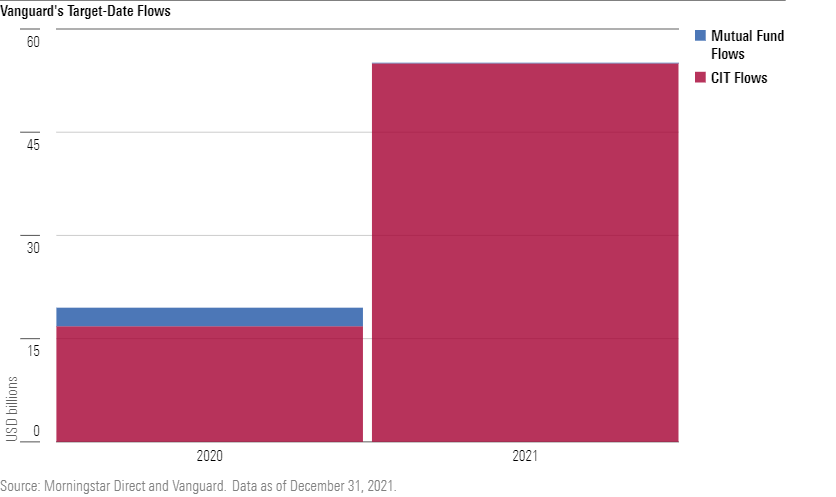

Vanguard's target-date mutual fund flow data doesn't tell the full story. The series serves as a prime example of the growing popularity of target-date CITs. For the second year in a row the majority of inflows to Vanguard's target-date series went to its CITs, not its mutual funds. Vanguard reported investor net contributions amounting to about $55 billion to its CIT target-date strategy, accounting for 99.9% of the series' total net flows for the year, up from 86% in 2020. Exhibit 4 illustrates the shift of flows to its CITs from mutual funds.

Its 2021 CIT flows outpaced the combined total of Fidelity Freedom Index's and American Funds Target Retirement Series' mutual fund flows. Vanguard continues to hold its large presence in the target-date space, especially since other providers tend to not have as strong of flows to their CIT versions of their target-date funds.

/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

/d10o6nnig0wrdw.cloudfront.net/05-02-2024/t_60269a175acd4eab92f9c4856587bd74_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)