The Outlook for Healthcare in the COVID Era

Looking ahead to market disrupters.

Eddie Yoon runs Fidelity Select Health Care FSPHX, one of the best healthcare funds around. Healthcare is a big part of the economy, and in the coronavirus pandemic era, it has been largely responsible for getting the economy moving again.

Given that influence, I thought it would be interesting to hear from Yoon about the state of healthcare in America.

Morningstar U.S. equity strategist Robby Greengold and I talked with Yoon on Sept. 26, 2022. What follows are excerpts from that chat. Because things are always changing in the investment world, his views may have since changed and certainly will change more the further we get from that date.

Russel Kinnel: You’ve assembled a team of specialists in support of this fund and any other fund at Fidelity that invests in healthcare. Would you tell us a little about them?

Eddie Yoon: The other hat that I wear at Fidelity is the global sector leader of the healthcare team, and a part of that is being involved in running the team of analysts. So, I think about the way that we’re structured. There’s this broad, diversified healthcare fund that I run. But then there are also industry funds. And usually the most-senior analysts within those verticals run those industry funds. So, Karim Suwwan, who has his Ph.D. in immunology, runs our pharmaceutical fund [Fidelity Select Pharmaceuticals FPHAX].

Rajiv Kaul heads our biotech effort. He’s been on the team longer than I’ve been on the team, and he knows literally everybody. It’s pretty impressive how quickly he can get in touch with people, not only on the thought leadership side but also CEOs of public and private companies.

Eirene Kontopoulos has been on the team for over 10 years. She has her Ph.D. in neuroscience. She runs Fidelity Advisor Biotechnology FBTAX. She started running money in one of our multimanager products doing a sleeve of biotech for a bunch of our small-cap strategies. She’s been an extraordinary contributor to the healthcare team over her career.

Justin Segalini runs our Health Care Services fund [FSHCX]. He’s been on the team for coming on six years now. Healthcare services is one of the hardest things to do well consistently over time, and making the call between industries and the stocks within those categories is a very difficult skill set to have, but he’s done a very nice job of that.

Robby Greengold: Besides subject-matter expertise, what are other ingredients that you consider crucial for success in healthcare investing?

Yoon: It’s important for the team to be together for a long time. Investing is hard, and admitting that you’re wrong is hard. The more you can see other people get stuff wrong, you realize that you’re not going to lose your job, but that we’re trying to be collaborative and find the right answer. I think we’ve built a lot of trust, and that trust really allows for deep discussion about a lot of things that nobody knows the answer to.

Think about when the pandemic started and we’re trying to figure out the outlook for vaccines. If you can’t have really deep conversations about the science and be intellectually honest about it, then how are you going to be able to get things right and admit when things are wrong? And the healthcare team doesn’t agree most of the time. The ideas that are the biggest contributors to investment performance are where we tend to have similar conclusions that are equally differentiated from the consensus, but that is derived through a lot of debate. There are certain categories of drugs where there’ll be three different opinions on the team, and as sector leader, it’s important for me to encourage that debate but then ultimately also make a decision and have a view that we can communicate to managers in the department and express in our portfolios.

Greengold: What are the most challenging aspects of investing in healthcare?

Yoon: Well, I think the inherent uncertainty of investing in healthcare, but also the volatility that comes in any given year. The market views a lot of healthcare as this monolithic bucket of volatility, when in the long run, it’s actually highly idiosyncratic, and we’ve been able to prove that out quantitatively. But when markets are volatile, and you’ve run against a defensive benchmark, you compound negative alpha over short periods of time, and that can be very stressful, emotional. Living through that is hard.

Sticking to the investment process when things are difficult is something that is very important to me, and letting people know that we’ve been through this before and you have to have conviction when the market is going against you. I had a big drawdown in 2016, and that was a big learning experience, and all of that is helping us manage through this period.

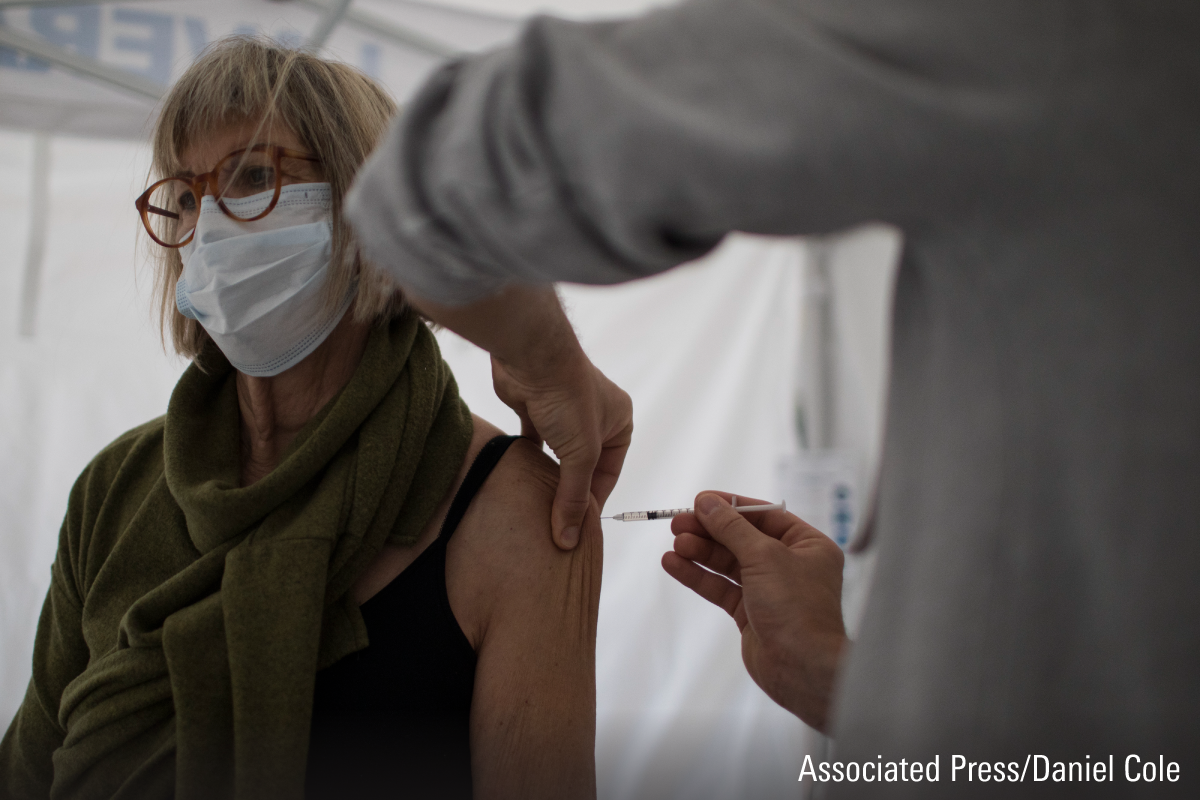

Kinnel: What’s the current state of the spread and treatment of COVID-19?

Yoon: It really matters where you sit in the world. The United States is very different from China where vaccines are less effective and fewer people have been exposed to COVID-19.

Here in Boston, the city does really great surveillance around wastewater. So, I spent a lot of time looking at the wastewater surveillance data to see what’s going on in the community. In the U.S., the vast majority of the high-risk population has been vaccinated, has gotten COVID, or both. Unless the virus really mutates in an untoward way that makes it more virulent, I think, generally speaking, the national health emergency that the government declared is probably going to end at some point next year.

The coronavirus is going to be a circulating respiratory virus forever, and the highest-risk population will have to stay vigilant, and there will be more vaccines that you can choose to take or not choose to take. But the industry will develop more therapies for coronaviruses. I think we can put this pandemic behind us in 2023. Outside the U.S., the story is very different. Like in China, they will struggle a little bit more.

As for antiviral medications, they’re interesting, but they’re not as effective as they were touted to be when they were first approved. But we have a lot more in the healthcare toolkit than when we started the pandemic, and we have underlying immunity.

Kinnel: There’s been talk about how mRNA vaccines have a lot of potential applications beyond COVID-19. What’s your take?

Yoon: MRNA in its original construct before the pandemic was going to be used for cancer vaccines. It’s a very elegant technology. You can hypothetically take a cassette with a different genetic code on it and swap that cassette out based on what you’re trying target. It sounds simple, but it’s actually not that simple.

We haven’t figured out the science behind cancer vaccines. We’re kind of throwing these random antigens into these mRNA vaccines and hoping that they work. But I think the right answer for cancer vaccines is: Let’s figure out cancer biology first, and then figure out how to vaccinate cancer.

MRNA was a great solution for COVID, and it helped the world get through the pandemic. But does that mean it’s going to be the silver bullet for everything else biotechnology firms are testing? I’m not as excited, but we’ll see.

Kinnel: What have the vaccines meant for the companies that make them?

Yoon: First, [the vaccines’ development] showed that the regulatory machinery can work with industry in periods of extreme stress to get a pandemic-saving medication to market.

These mRNA companies have generated probably $100 billion in cash flow. This will allow [them] to invest very heavily in the development of mRNA in other modalities. Pfizer PFE has also used that money to make a lot of acquisitions. But it’s worth remembering that, in general, mergers in pharma have been value-destructive for [the acquirer’s] shareholders.

Kinnel: Over the past decade, biotech had a huge run and then a sharp correction. Where does that leave the industry today?

Yoon: Going back to the late 1990s, biotech has gone through two major boom-and-bust cycles. If you think about the progress that biotechnology has made, it’s massive. When we go through capital markets corrections like we’ve been through, now valuation is on your side. If you can pick the right company after this big reset in valuation, that’s really the recipe for blockbuster returns, assuming you’ve picked the right asset.

The vast majority of biotech companies are going to run out of money before they get a drug approved.

Greengold: Where else are you finding attractive investments?

Yoon: There’s a lot of innovation in healthcare business models. We find lower-risk innovation when you go outside of biotechnology, and also less capital intensity. That’s where I try to differentiate myself.

Many healthcare investors focus just on drugs and medical devices, whereas I look for innovations throughout the healthcare industry. How do I find the best risk-adjusted returns and the lowest risk innovation where I can generate the best risk-adjusted returns for fundholders?

The move to value-based care is completely reorganizing how the U.S. healthcare infrastructure is positioned, and through that reorganization, the companies that are going to help move the system to a value-based-care model are going to generate enormous shareholder returns for investors. But it’s also going to be great for the government and great for employers, who are the biggest payers of healthcare in our country today. And consumers actually like their value-based-care providers because they put care first.

We’re laying the foundation for a new model of how healthcare is delivered and the information that comes into that healthcare universe. There’s enormous value to be extracted, both in terms of helping the system save money and for shareholders that capture a small margin when [value-based care saves] the system hundreds of millions of dollars. To me, that concept is so visceral, and it sort of is the North Star behind everything that I invest in.

Kinnel: And we can see some of those companies in your top holdings.

Yoon: Yes. I think it’s helpful to give you a sense and size for this opportunity: There are more than 55 million people in Medicare, and UnitedHealthcare [a subsidiary of UnitedHealth Group UNH] has 10 million of them. It speaks to the size and scale of United, but it also speaks to the nascency of which this industry is operating at today. If you fast-forward 10 years from now, demographics are going to push many, many more people into this Medicare program.

We have to go through a period where some of these companies lose money in the short term. But it’s an incredible opportunity.

Kinnel: Who are the biggest potential losers to the value-based movement you’re talking about?

Yoon: Providers with high fixed costs, such as hospitals. Their largest cost is wages and benefits, and more doctors and nurses are retiring. We’re seeing some nurses’ strikes reflecting that pressure.

A version of this article was published in the October 2022 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/s3.amazonaws.com/arc-authors/morningstar/5dd7882e-0413-4eb1-b7f0-3d3ed94328e7.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/5dd7882e-0413-4eb1-b7f0-3d3ed94328e7.jpg)