Top Funds Whose Managers Are Hitting Their Stride

After five years on Medalist funds, these managers merit some interest.

The markets have packed in quite a lot in just the past five years. In 2020, the coronavirus slammed on the brakes of the economy as joblessness soared, prices plummeted, and a handful of working-from-home stocks soared. Then in 2021, job creation surged, markets rallied, and there were signs of reflation. Next came Russia’s invasion of Ukraine and a second wave of inflation followed by aggressive rate hikes and a growth-stock selloff. Now the rate hikes are coming to an end, and stocks are rallying once again.

As a result, fund managers who passed the five-year mark on their funds have certainly been tested. Now that they’ve reached that milestone, I thought I’d take a look at some funds with Gold, Silver, or Bronze Morningstar Medalist Ratings where the longest-tenured managers have five-year track records through Oct. 31, 2023. They might have seemed too inexperienced when you looked a couple of years ago, but now they merit some interest.

Allocation

Fidelity Puritan’s FPURX Dan Kelley started on the fund in July 2018, and he’s built a strong top-decile record with 7.9% annualized returns. Kelley picks stocks and sets the asset allocation for the fund. He has a growth bias within equity and an equity bias in allocation, and those things have worked nicely except for 2022. He’s kept stocks between 60% and 70% of the fund and was at 62% at the end of May 2023. This year, the fund is in the top decile thanks to Big Tech winners like Nvidia NVDA and Meta Platforms META, which have more than doubled. Despite the strong results, the fund has been in steady outflows in recent years. With a big $26 billion asset base, I don’t expect returns will be harmed.

Vanguard Global Wellesley Income VGYAX and Vanguard Global Wellington VGWAX have lived up to expectations since they were launched in November 2017, though their relative performance has diverged. Bond-heavy Global Wellesley Income has five-year returns in line with its Morningstar Category average, while Global Wellington is in the top 2%. However, that’s because Global Wellesley Income has far more in income than its peers, while Global Wellington is modestly overweight equities. Vanguard Global Wellesley Income is set at about 35% equities versus 60% for the category, while Vanguard Global Wellington has 65% equities.

The allocation levels are set, so I won’t give credit or blame for that. The appeal here is good issue selection by the teams and low fees courtesy of Vanguard. The funds have most of their managers overlapping, but Nataliya Kofman runs Vanguard Global Wellington’s equity sleeve, and Andre Desautels runs Vanguard Global Wellesley Income’s equity sleeve. Loren Moran runs both funds’ bond sleeves with an emphasis on corporate credit. We rate both funds Silver.

Equities

Artisan Global Discovery APFDX boasts a five-year return of 8.8%—good enough for the top decile in its category. Artisan launched the fund in August 2017, and four of its five managers have been listed as managers from the beginning. Jason White is the lead here, but it’s clearly a collaborative effort.

The focus is on fast-growing companies. Management moderates risk a bit by avoiding big bets on individual stocks. Even so, this fund always seems to be swinging between feast and famine. In 2023, the fund boasts top-quartile returns thanks to German medical packaging company Gerresheimer AG GXI and Dutch biotech stock Argenx ARGX. On the downside, the fund owned First Republic Bank.

Artisan International Small-Mid ARTJX manager Rezo Kanovich is more established than most on this list as he had a good six-year run at Oppenheimer before setting up his own boutique within Artisan. However, success doesn’t always translate when a manager changes firms, so I think the five-year mark is still noteworthy. He now has the support of four analysts—two came along from Oppenheimer and two joined from Artisan. He seeks out disruptive companies that can grab market share from more established firms. Many growth managers want the same thing, but Kanovich seems to be better at researching and buying the winners. The fund is closed to new investors, but recent outflows suggest there may be another chance to get in.

Fidelity Capital Appreciation FDCAX shows that Fido can learn new tricks. Fidelity was long the home of the star manager, but this fund is run by an equal pair in Asher Anolic and Jason Weiner. The two were experienced before taking over the fund in October 2018, but we wanted to see how they would work together. So far, the pairing has worked well as returns are ahead of peers but behind the S&P 500 benchmark. The fund unusually focuses on the growth side of that core index, making it a fund with one foot in blend and one in growth. Given that growth has beaten blend the past five years, those results are really pretty good.

Fidelity OTC FOCPX manager Chris Lin was named a manager in September 2017 and sole manager in October 2019. The results at his first diversified fund (he ran technology funds before that) have been encouraging. Lin seeks companies with durable growth prospects within the limits of an 80% Nasdaq constraint. Given that requirement, the fund’s five-year returns of 14% annualized have been stellar. Tech giants like Alphabet GOOG, Microsoft MSFT, and Apple AAPL have led results. Lin has diverged from predecessor Gavin Baker in terms of the number of stocks—he’s pared the portfolio from 230 stocks to fewer than 150—but otherwise, the fund doesn’t look too different than it did under Baker.

Harbor International HAINX hired Marathon Asset Management to run this fund in August 2018. Despite some recent departures, five of the managers who took over at that time remain. The fund has outperformed its benchmark and peers since then. The team seeks companies with strong pricing power that operate within industries that are in favorable stages of their capital cycles. The portfolio leans heavily on industrials and is pretty light on technology. On a country basis, the fund has big overweights in the United Kingdom and Japan and not much in emerging markets. This year, European names like Novo Nordisk NVO and UniCredit UCG have been offset by losing European names like Glencore GLEN and Roche Holding ROG. Despite management’s success, the fund has had a steady trickle of outflows, though those have steadily declined.

At MFS Massachusetts Investors Trust MITTX, lead manager Ted Maloney stepped down in May 2023, turning the fund over to Alison O’Neill and Jude Jason, who became named managers in 2018 and 2021, respectively. Weak tech stock picks have prevented the fund from outperforming of late, but we think the skilled managers and analysts behind it will improve results.

Bonds

Many of Vanguard’s actively managed bond funds are unusual in that they are barely active. Vanguard has such low fees that it can run fairly passive strategies and still outperform most peers. Some recent additions are more venturesome, but others still stay broadly diversified and severely limit what management can do.

The latter applies to two Vanguard corporate-bond funds: Vanguard Short-Term Investment-Grade VFSUX and Vanguard Intermediate-Term Investment-Grade VFIDX. It’s not that management has wowed us, but it has shown it can do a fine job within very narrow confines. Thus, our People ratings are Average, but both funds earn Bronze ratings for their Admiral shares because you won’t find many cheaper ways to invest in investment-grade corporates. Daniel Shaykevich and Arvind Narayanan have been at the helm since April 2018 and November 2019, respectively. Both funds have been reliable and comfortably ahead of their benchmarks and peers.

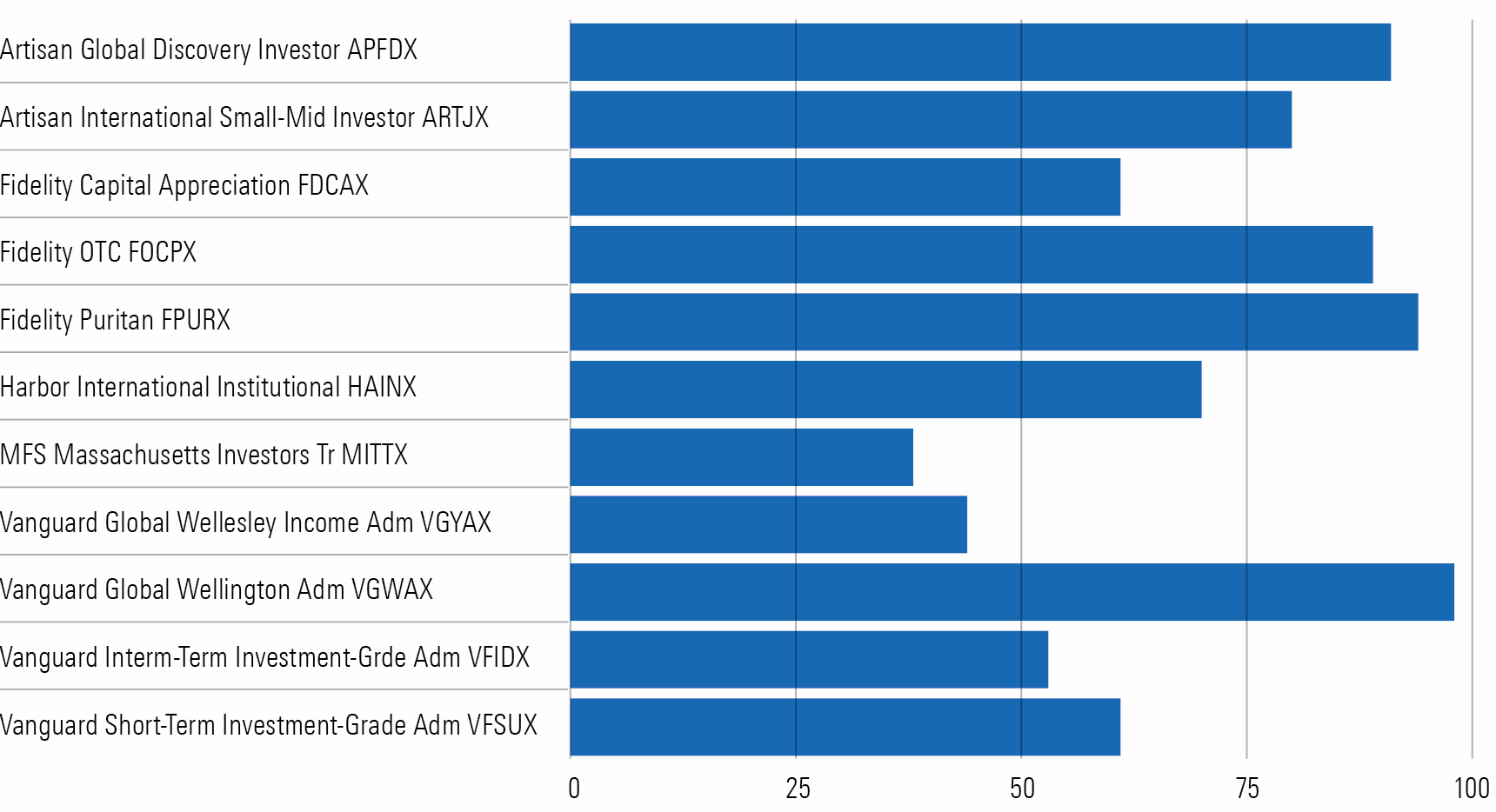

5-Year Relative Performance

Conclusion

Five years are not as telling as 10 or 15 years, but it is a meaningful record that makes these funds worth watching. It’s a good idea to have some funds that are in the early stages of a manager’s career to balance those that are near the end.

This article first appeared in the November 2023 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting this website.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)