Bank Blowups Trigger Portfolio Changes

Funds scaled back exposure to financials, especially regional banks, in 2023′s first quarter.

The U.S. stock market’s rally since mid-March may make it seem like a distant memory, but little more than three months ago, markets were plunging as investors feared that runs on Silicon Valley Bank, Signature Bank, and First Republic would spread to other regional banks, larger lenders, and the broader economy. IShares U.S. Regional Banks ETF IAT lost 29% in March compared with Vanguard Financials ETF’s VFH 10% decline. The trouble led portfolio managers to reassess the durability of all their regional bank holdings on concerns that small banks would lose deposits to the industry’s biggest players and have a harder time dealing with potential new regulations.

Since mutual funds don’t have to disclose their portfolios and trades in real time, Morningstar and investors had to rely on anecdotal evidence to determine how active managers were responding to the crisis. Now that most equity funds have disclosed their portfolios through the end of March, by comparing data from the December 2022 and March 2023 portfolios we can see which funds fled from long-held regional bank positions and which funds used the turmoil as an opportunity to buy surviving banks that had been thrown out with the bathwater.

Overall, diversified U.S. funds across the nine Morningstar Style Box categories pulled back from regional banks during the first-quarter tumult, reducing exposure by 14%. Equity mutual funds reduced their financials stake by 7%, or roughly $40 billion, adjusted for funds’ cash inflows and outflows. Sales of regional and diversified banks accounted for half the decline. Managers sold all of their SVB, First Republic, and Signature Bank positions during the quarter. Interestingly, a few Fidelity funds were net buyers of Signature Bank in the first quarter before the implosion. For example, Fidelity Growth Discovery FDSVX, Fidelity Capital Appreciation FDCAX, and Fidelity Mid Cap Value FSMVX bought shares in the beleaguered company between the end of February and the end of March; the FDIC took over the bank on March 10.

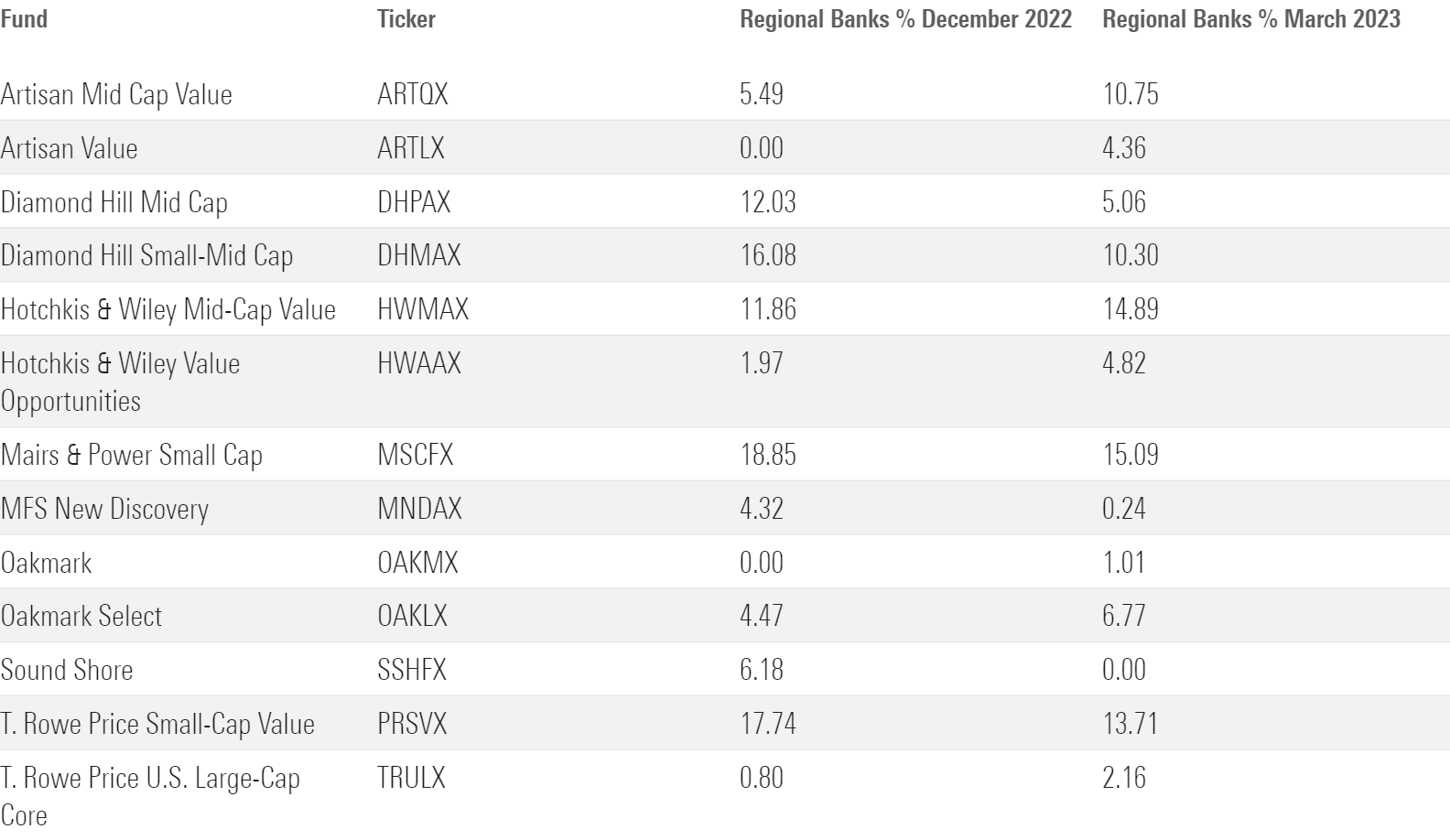

Below we’ll examine fund-level trends during the quarter, including which regional-bank stocks managers embraced and shunned. Mutual fund flows may have affected decision-making and accounted for some of the changes, so the numbers are estimates.

Assessing the Damage

The wipeouts took the bank stakes of the owners of the failed institutions down naturally. The panic bruised Diamond Hill Mid Cap DHPAX more than most strategies on Morningstar analysts’ coverage lists. Its 5.4% SVB and First Republic stake at the start of the quarter evaporated by the end of it because of depreciation and sales. Manager Chris Welch also sold a small position in BankUnited BKU, which fell harder than more than 90% of other regional banks in 2023′s first half. Diamond Hill Mid Cap’s helping of the industry shrank to 5% from 12%. It still owned three regional banks at quarter-end, though the portfolio’s overweight in the industry relative to the Morningstar US Mid Cap Broad Value Index narrowed. The managers haven’t shunned financials, though, picking up capital markets company Stifel Financial SF during the quarter.

The overall regional bank exposure of Diamond Hill Small-Mid Cap DHMAX, which owned two banks that went bust, dropped to 10% from 16%. The fund had trimmed but still held six other regional banks at the end of March, though the managers did buy more shares of Live Oak Bancshares LOB.

Sound Shore’s SSHFX regional-bank stake dropped to zero from 6% during the quarter. The managers reduced exposure to its two holdings, SVB and First Republic, which ultimately failed. The concentrated value-leaning fund hadn’t invested in any other regional banks during the past decade, typically sticking with bigger diversified banks, including Wells Fargo WFC, its sole bank holding at quarter-end.

Marginal Changes

MFS New Discovery MNDAX did not own any of the big losers, but its managers sold three of its five other regional banks during the quarter, taking its exposure down to near zero. The small growth fund’s remaining financials holdings were three asset-management companies.

T. Rowe Price Small-Cap Value PRSVX, a broadly diversified portfolio, owned small positions in 40 regional banks at the beginning of the quarter. The fund lost its small stake in SVB but still owned most of the rest at quarter-end. It scaled back on some longtime holdings, including Western Alliance Bancorp WAL and Glacier Bancorp GBCI, while adding to a handful of others, including Eastern Bankshares EBC and Columbia Banking System COLB.

Mairs & Power Small Cap’s MSCFX 19% regional-bank stake was well above its small-blend peers’ at the start of the quarter and more than twice the Morningstar US Small Cap Extended Index’s. It hung on to the seven banks it owned, trimming First Interstate BancSystem FIBK and adding to Wintrust Financial WTFC, its biggest position in the industry.

Finding Value

Some managers, especially value-oriented ones, saw buying opportunities. Artisan Mid Cap Value ARTQX nearly doubled its regional-bank stake to 10.8% from 5.5% during the quarter. It bought Fifth Third FITB and Comerica CMA but also added to three other banks it already owned. Artisan Value ARTLX, run by the same team, ended the quarter with 4.4% in regional banks, up from zero. It used the selloff to buy PNC Financial PNC and U.S. Bank USB, bigger regional banks that fell during the panic, and it also added to Bank of America BAC.

Deep-value fund Hotchkis & Wiley Mid-Cap Value HWMAX is always on the hunt for bargains. It upped its stake in regional banks by 3 percentage points during the quarter to nearly 15%—well above the Morningstar US Mid Cap Broad Value’s 3.8%. The team scooped up First Horizon FHN, KeyCorp KEY, and Comerica and added to the three others it already owned. Sibling Hotchkis & Wiley Value Opportunities HWAAX, a more wide-ranging strategy, had a smaller overall quarter-end stake at 4.8% but also leaned into the panic, buying First Horizon and Citizens Financial Group CFG.

Oakmark Select OAKLX, a value-conscious concentrated fund, increased its regional-bank stake by 2 percentage points via First Citizens BancShares FCNCA. It also added to other financials like Wells Fargo and Charles Schwab SCHW. More diversified sibling Oakmark OAKMX bought Truist Financial TFC during the quarter.

T. Rowe Price U.S. Large-Cap Core TRULX and T. Rowe Price Value’s TRVLX exposure to regional banks stood about a percentage point higher at quarter-end as they scooped up PNC. Other funds that marginally added to regional banks included Fidelity Value Discovery FVDFX, Tweedy, Browne Value TWEBX, American Beacon Large Cap Value AAGPX, and ClearBridge Large Cap Value SINAX.

Changing Regional-Bank Stakes

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/7528c6c6-0184-4151-a5ce-274ce6ae0589.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/7528c6c6-0184-4151-a5ce-274ce6ae0589.jpg)