What’s Driving Cryptocurrency Investors?

A look at what’s led people to invest in this risky asset.

The rise of cryptocurrency has taken the industry by storm. According to Morningstar’s 2022 Cryptocurrency Landscape, over the past seven years alone, cryptocurrencies have skyrocketed from about $5.2 billion in market capitalization for the top 100 coins to nearly $1.7 trillion as of January 2022. Along with this rise in assets, social-media feeds and investing trends have pushed cryptocurrencies to the masses, getting the attention of both longtime investors and newer entrants.

As with any investable asset, there’s much to consider regarding cryptocurrency, and there are plenty of resources on this site to help investors through that decision. In our current research, we instead endeavored to better understand cryptocurrency investors and, moreover, dive into how they are thinking about cryptocurrency.

Who Has Invested in Cryptocurrency?

In our research, we asked a nationally representative sample about their investing behaviors regarding cryptocurrency. In our sample, about 28% of participants were invested in a cryptocurrency at the time of the study (November 2021). In agreement with past research, we found that a vast majority of these investors were men, with men making up about 70% of total cryptocurrency investors in our sample. We also found that cryptocurrency investors tend to have higher incomes than those who do not invest in cryptocurrency, probably owing to the need for discretionary income to use for investing.

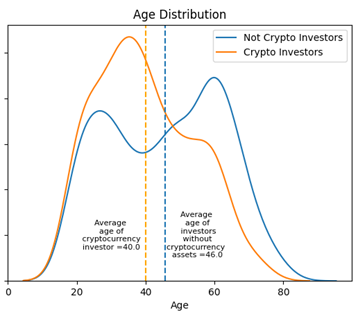

We also found that cryptocurrency investors tend to be younger, but they all aren’t just bored college students. As the exhibit below shows, there is actually a wide distribution of ages for both groups. The distribution of cryptocurrency investors, shown in orange, is more skewed toward younger investors; however, there are also plenty of cryptocurrency investors well into their 60s.

What’s Motivating Cryptocurrency Investors?

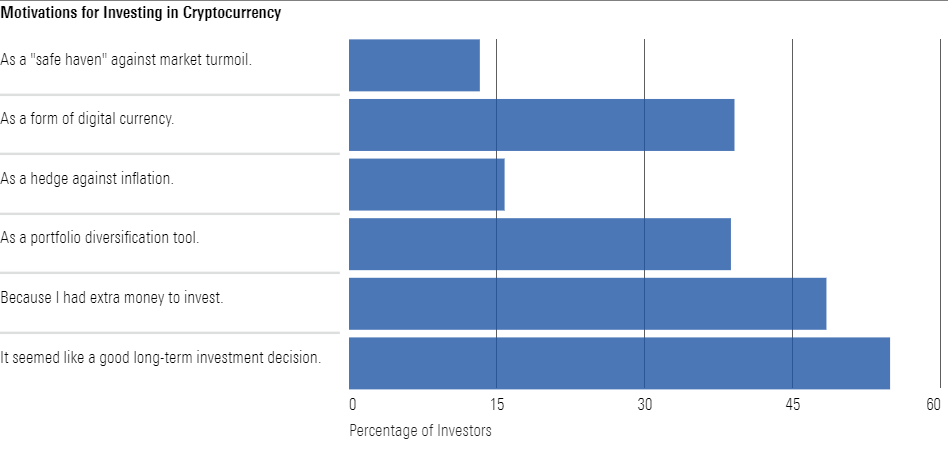

In our survey, we also asked investors why they chose to invest in cryptocurrency. Our goal here was to better understand the motivations of cryptocurrency investors. The exhibit below shows that a vast majority believe that cryptocurrency seems like a good long-term investment decision and that it can be a way to diversify their existing portfolios. At the same time, there are plenty of people who invested because they had extra money on hand and were curious about the potential of crypto. We also included a write-in option on our survey, where individuals could extrapolate about their motivations. Here, we also saw a range of responses, where some individuals invested out of curiosity or fun, some simply did not want to miss out on the action, and others saw it as the way of the future. Thus, not all cryptocurrency investors are seeking some speculative gain; instead, they are in it for the long term.

What Does This Mean for Financial Advisors?

As the financial industry grapples with cryptocurrency, it is important to remember that investors are struggling along with us. However, given the volatile nature of the asset and the high stakes involved for some individual investors, financial professionals must do their part in helping inventors carefully consider cryptocurrency opportunities. Also, as our study shows, interest in crypto is not confined to any one specific demographic. With this in mind, it may be a good idea to talk to your clients about their interest in crypto and/or be ready for any future conversations that come your way.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2TT3THVKOJAKBFGHCCRTVPNEQ4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03cab4a-e7c3-42c6-b111-b1fc0cafc84d.jpg)