What's in Store for the Future of Cryptocurrency?

Cryptocurrencies are prone to a gold-rush mentality, but there's reason to believe in more durable growth of the asset.

In recent months, casual awareness of cryptocurrencies has reached an all-time high—just as valuations have dipped by 35%.

Responding to the upswelling of interest that cryptocurrencies witnessed throughout 2021, Morningstar published its inaugural Cryptocurrency Landscape in April 2022. The paper focuses on the trends that have led to this inflection point in cryptocurrencies' history, but we also spent some time taking stock of where the market may lead us next.

While we can't predict the future, we believe two main factors will dictate crypto's growth: how long speculative interest persists and whether consumers adopt blockchain technology en masse.

Investor Loyalty and Popularity Are Key Drivers of the Cryptocurrency Market

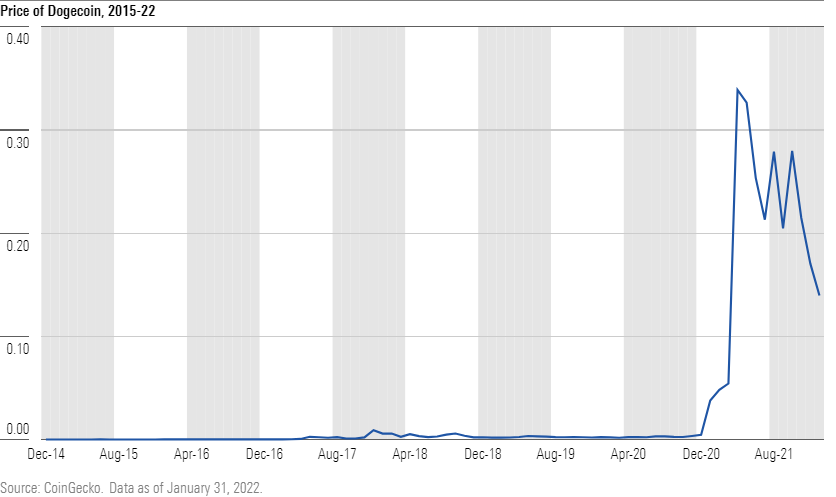

Even a cursory glance at the return charts of cryptocurrencies unearths a litany of highly speculative boom-and-bust narratives. These narratives often emerge from optimism around new applications for a particular blockchain (the technology that underlies cryptocurrency) but sometimes rely on nothing beyond a stray tweet from Elon Musk. The chart below shows just how substantially the price of dogecoin has surged and fallen in response to that brand of tweets.

Narratives like these aren't just blips. They shape the returns of the cryptocurrency market in aggregate.

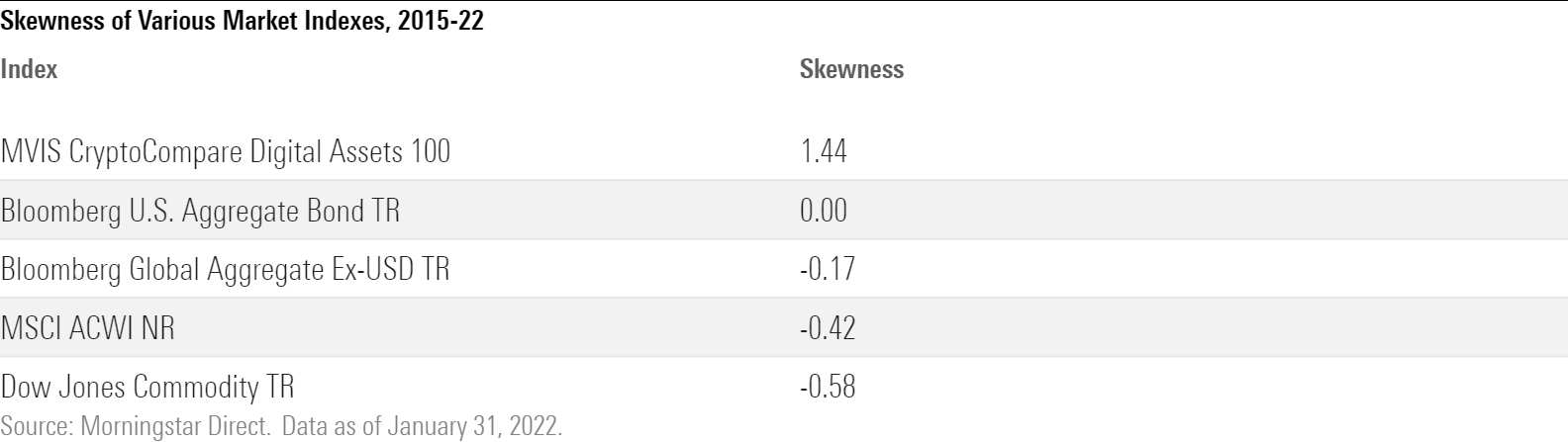

Generally, market indexes' returns have a negative skew, which means that above-average returns happen more often than below-average returns, but those below-average returns are more extreme and drag down the total return over the entire period.

Cryptocurrency market returns are the other way around, as shown on the table below. The fact that the MVIS CryptoCompare Digital Assets 100 Index skews positive—the opposite of the other highlighted market indexes—indicates that it experiences more below-average returns than above-average returns, but the positive outliers are more extreme and pull up the cumulative return over the period.

Because these periods when investors pile on and drive up the prices of a particular coin have more influence than steady adoption of blockchain technology, we classify cryptocurrencies as a speculative asset.

What does that mean for investors? As the saying goes, it's better to be lucky than good.

If current conditions hold, the returns from buying a popular coin will outpace any returns from spotting an under-the-radar cryptocurrency that has technological merit. That's one of the key drivers of speculative interest: the way in which people come together and form collectives that support a particular token.

And that means that mind-boggling losses are a fact of life for these crypto investors: The January 2022 crash alone wiped out more value than the Black Tuesday market crash of 1929 did, even after adjusting for inflation.

That said, the largest cryptocurrencies in the market (bitcoin and ethereum, especially) have devoted followings, and it's this loyalty that spares the coin from failure during these periods of underperformance.

That reliance on loyalists will likely decide the fates of individual cryptocurrencies, so we'll continue to monitor whether other coins exhibit signs of accumulating the types of followings enjoyed by bitcoin and ether, and what sort of durability they provide.

Blockchain, Keep Us Together

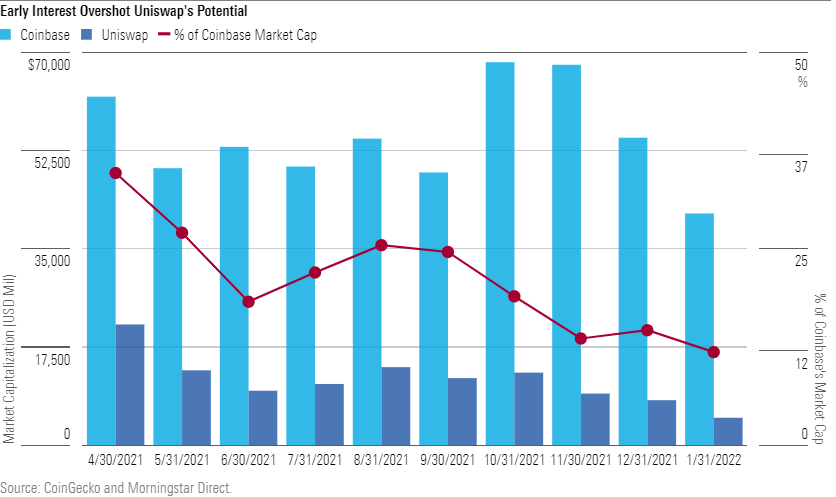

These communities don't hold all the answers, though. In our view, runups spurred by a spirited fandom generally overshoot the future adoption of public blockchains that support a native token—especially in areas where compelling centralized alternatives exist. Below we've laid out a few examples that support this theory.

The Promise and Shortcomings of Decentralized Exchanges

Today's investors can trade cryptocurrencies in several ways. In addition to using a centralized service run by a company like Coinbase COIN or Kraken, or by purchasing them through a handful of retail brokerage platforms like Robinhood HOOD, investors have also recently gained the ability to trade on a decentralized exchange.

These exchanges advance the philosophy of decentralization by stripping out a centralized market maker. Instead, they rely on smart contracts (contracts that include terms of agreement that automatically execute when the terms are met) to link buyers and sellers.

Uniswap is the most popular of these decentralized exchanges. On May 13, 2021, when enthusiasm for decentralized exchanges hit its peak, Uniswap traded at a market capitalization of $22.6 billion, or 40.9% of rival Coinbase's $55.3 billion market cap. The chart below shows that it has since plummeted to $4.9 billion, compared with Coinbase's $41.2 billion—still a remarkable gamble on the promise shown by decentralized exchanges.

These decentralized exchanges meet more of the original aims of cryptocurrencies than centralized services like Coinbase do. But exchanges like Coinbase still command far more market share. Why? Because centralization has well-known advantages for exchanges, including lower transaction fees and user-friendly interfaces.

In our view, crypto investors often overlook how much more these aspects of Coinbase's user experience matter to consumers than the principles of decentralization.

In the future, centralization could allow Coinbase to amass network effects and economies of scale that lower costs and boost liquidity—assuming the crypto market does not continue to fluctuate significantly from quarter to quarter and the major coins continue to intrigue investors (bitcoin and ether trades made up 56% of Coinbase's trading volume in 2020).

Legal Ownership Issues May Slow Adoption of Nonfungible Tokens

Nonfungible tokens, or NFTs, which are digital assets that securely record ownership of unique digital files on a blockchain, could also spur increased adoption of blockchain technology. Still, we believe the market overestimates how quickly this could happen.

For example, in their current state, NFTs do not grant legal ownership rights to the item they link to. That means that an artist (or thief) could theoretically mint multiple NFTs of the same artwork or collectible on different blockchains. Today, if there was an NFT minted on the ethereum blockchain and another one of the same file minted on the solana blockchain, there wouldn't be a way to determine which one is the original.

Legislative intervention could resolve this issue, but there's currently less demand for this type of action in NFTs compared with other parts of the crypto market. Plus, property rights vary significantly by jurisdiction. In the United States, for example, property rights are defined at the state level, which makes coordinated adoption of such legislation unlikely.

That hasn't stopped investors from speculating on NFTs, and crypto providers have taken note. Several communities associated with prominent NFTs, like Bored Ape Yacht Club and Metapurse (which owns 20 highly sought-after NFTs, including the B20 token), have issued tokens that aim to capitalize on pent-up demand.

These tokens cost much less than the NFTs themselves, but the benefits of membership are slim. As a result, these tokens typically skyrocket immediately after launch before taking a sudden nosedive as investors confront the shortcomings of the token. The chart below shows the pace of changing expectations before, during, and after the inflated sale of a Beeple NFT not tied to the B20 token.

Where to Find Durable Future Growth in Cryptocurrencies

These peaks and valleys are a symptom of the gold-rush mentality exhibited by many investors that engage with cryptocurrencies today. Usually, the first projections wildly overestimate the asset's potential.

That said, the returns from increased adoption of cryptocurrencies are not zero. Bitcoin shows that an asset can outgrow its speculative narratives and continue to thrive. So, where could durable future growth in cryptocurrencies come from?

We anticipate that over time, cryptocurrencies will converge with existing players rather than unseat them. Bitcoin, for instance, was partly able to shake off its initial skeptics via partnerships with companies like Microsoft MSFT and countries like El Salvador. These relationships have cemented its legitimacy and bolstered its use cases.

Also consider Visa V, which partnered with Coinbase to offer a debit card that allows consumers to make purchases using their Coinbase account. Just like centralized exchanges, Visa sacrificed the principles of decentralization for convenience; during the transaction, Visa converts cryptocurrency into the consumer's home fiat currency for the merchant. Nevertheless, the partnership reached $2.5 billion in transactions in the fiscal first quarter of 2022. Tellingly, transaction volume has continued to grow despite the significant volatility in the cryptocurrency markets in the second half of 2021. We expect more partnerships between crypto-native, centralized companies seeking credibility and incumbents that want to preserve their market share.

Clear regulation could speed this process along. One notable slice of the financial-services sector has vigorously resisted cryptocurrency partnerships: banks. There's a good reason for this: The stakes for cryptocurrency brokerage accounts and people's life savings are starkly different. But in many cases, banks have expressed the desire to meet consumer demand for cryptocurrency services, if not for the absence of regulation that could clarify banks' roles in facilitating these services. Whether accommodative or combative, we anticipate numerous regulatory developments in the next several years that will determine the adoption rates of cryptocurrency as a form of payment.

The fact remains that today, cryptocurrencies' decentralized infrastructure is difficult to integrate with real-world use cases. As applications on trustless blockchains proliferate, we will closely watch how the user experience, network bridging, and everyday relevance transform. We expect that integration with legacy systems across financial services and other sectors is likely to determine future adoption rates in the space. If that potential path unfolds, cryptocurrency's opportunities will increase at a rate matched only by the potential risks.

/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HTLB322SBJCLTLWYSDCTESUQZI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TAIQTNFTKRDL7JUP4N4CX7SDKI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)