The Threat of a Recession Has Subsided. Are Your Clients Prepared for the Next One?

The recession scare may have prompted your clients to act rashly without you knowing.

There’s a saying in theater: “Bad dress rehearsal, good opening night.”

In many ways, we just had a dress rehearsal for a recession.

Though investor sentiment has since turned around, new research from Morningstar found that investors came into the year expecting a recession and, in many cases, were already preparing for it—and not always in a smart way.

But now that the imminent threat of a recession has subsided, it’s a good chance for advisors to learn from what investors did when they were worried. By getting familiar with what these decisions looked like, advisors can work better with clients to achieve their investing goals amid inevitable market downturns. After all, opening night is only better than the dress rehearsal if the actors have learned from it.

The results of the study suggest there are two major things advisors can do now: 1) play catch-up and 2) get ready to go on the offensive.

Catch Up on Clients’ Financial Actions

In the face of a recessionary threat, 87% of investors took at least one action to prepare for a recession. For about half of all investors, that included touching their investments.

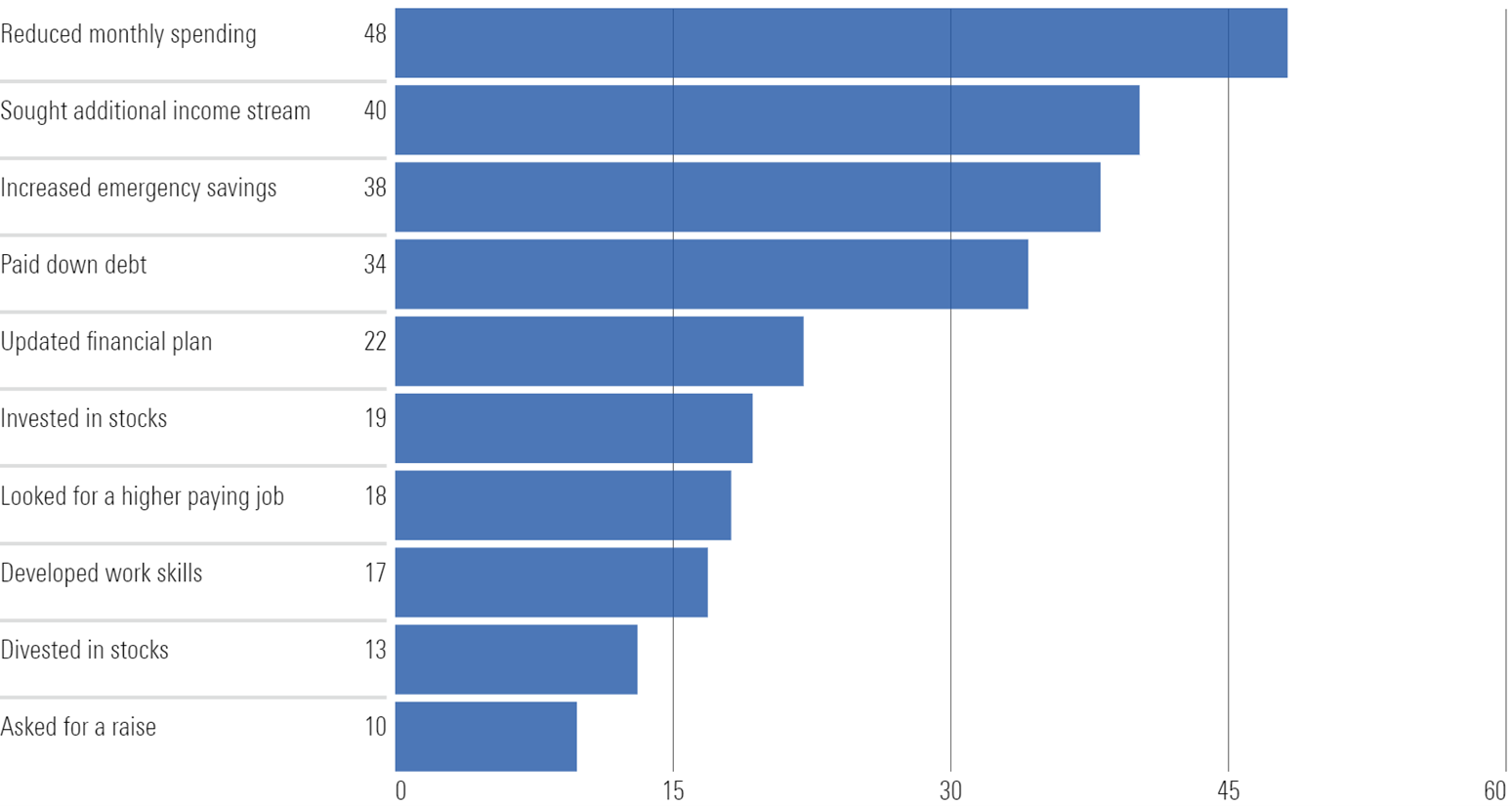

Top 10 Actions Investors Took to Prepare for a Recession (by % of Investors)

Given the sheer number of actions being taken by investors, it’s no wonder that 38% of investors took at least one imprudent action (such as pulling money out of stocks when the market was down). Overall, the results indicate that investors changed how they were handling their finances because of the threat of a recession, so their situation may look different than it did a year ago.

Moreover, financial advisors may not even know the full extent to which their own clients responded to the threat of a recession. We saw that 38% of investors with advisors did not consult their advisor before touching their investments, and investors reported consulting their advisor before making imprudent decisions only about a fourth of the time.

With fears of recession fading into the background, it’s a prime opportunity for advisors to regroup with clients. There may be changes to clients’ finances to be dealt with, and if they made an imprudent decision, it’s better to catch it now than let the effects compound over time.

Get Ready to Demonstrate Your Value

Investors were largely not making decisions on their own: They reported seeking advice from external sources 61% of the time before they acted. Though no one source dominated investors’ attention, financial advisors only captured a small percentage (8%) of the advice space during this time, falling behind family and friends (24%), websites (23%), and social media (11%).

In many ways, the finding that people tend to seek out financial advice before preparing for a recession is a silver lining. It offers new inroads to demonstrate the value of financial planning, both for those who don’t currently work with an advisor and those who may be typically more disengaged.

However, advisors must be ready to meet investors where they are in times of market uncertainty. Advisors can take this reprieve to build trustworthy content (newsletters, blog posts, and so on) to make available to investors the next time there is volatility.

3 Takeaways to Help Clients Prepare for a Recession

- Perception is reality. When investors perceive a threat to their financial security, like an impending recession, they will often try to mitigate this threat. In this way, just the threat of a recession can impact people’s finances (even if it does not materialize). In our study, we found most investors had already adjusted both their personal finances and investments to account for an expected recession. Therefore, advisors should keep in mind that proactively checking in with clients when there is a recession buzz can help them guide clients into taking the best actions for their situation.

- Check in with clients about changes spurred by the threat of a recession. Although investors with advisors tended to consult their advisors before changing their investments, they still did not consult their advisors about 40% of the time. Investors consulted their advisors even less often when making changes to their personal finances, like seeking additional income. The break in recession talk gives advisors the opportunity to touch base with clients, address their reactions to the threat of a recession, and if necessary, get them back on track.

- Be prepared for next time. Investors began seeking advice for a recession, but not always from advisors. As such, advisors can prepare now to be a go-to source for advice the next time investors feel the threat of a recession. In our report, we provide a guide for advisors to create resources for clients and investors during times of uncertainty, and action plans for engaging with clients when recession fears are heightened. Advisors who are proactive in their preparation for the next recession scare will be more equipped to head off client missteps.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/57c62327-64fd-443e-8cd7-e0a2807bc566.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/2TT3THVKOJAKBFGHCCRTVPNEQ4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/57c62327-64fd-443e-8cd7-e0a2807bc566.jpg)