How to Talk to Your Client About Alternative Investments

Advisors can steer clients in the right direction by learning how they think about alts.

Crypto, private equity, REITs, sneakers. Alternative asset classes are nothing new, and investors have long treated them as trends (tulip mania, anyone?). But the number of alternative asset classes available to investors is ever-expanding thanks to advances in tech, and with social media, trendy assets can grow hotter and faster than ever before.

This isn’t to say that there is anything inherently wrong with alternative asset classes. They can provide a variety of benefits—such as diversification, liquidity, or tax benefits—to the right investor. But are investors carefully considering the benefits of these asset classes, or are they getting caught up in the excitement like so many investors before them?

To find out, our recent report examines how investors are thinking about investing in trendy alternative assets.

How Do Investors Think About Alternative Asset Classes?

We surveyed 948 investors about their knowledge of and reasons for investing in nine different trendy asset classes such as commodities, crypto, private equity, and REITs.

Overall, investors did not think they knew much about alternative asset classes. At least half of investors reported they did not think they could even identify a definition for every asset class except crypto and commodities. This indicates that, in general, there is a massive opportunity to educate investors on alts.

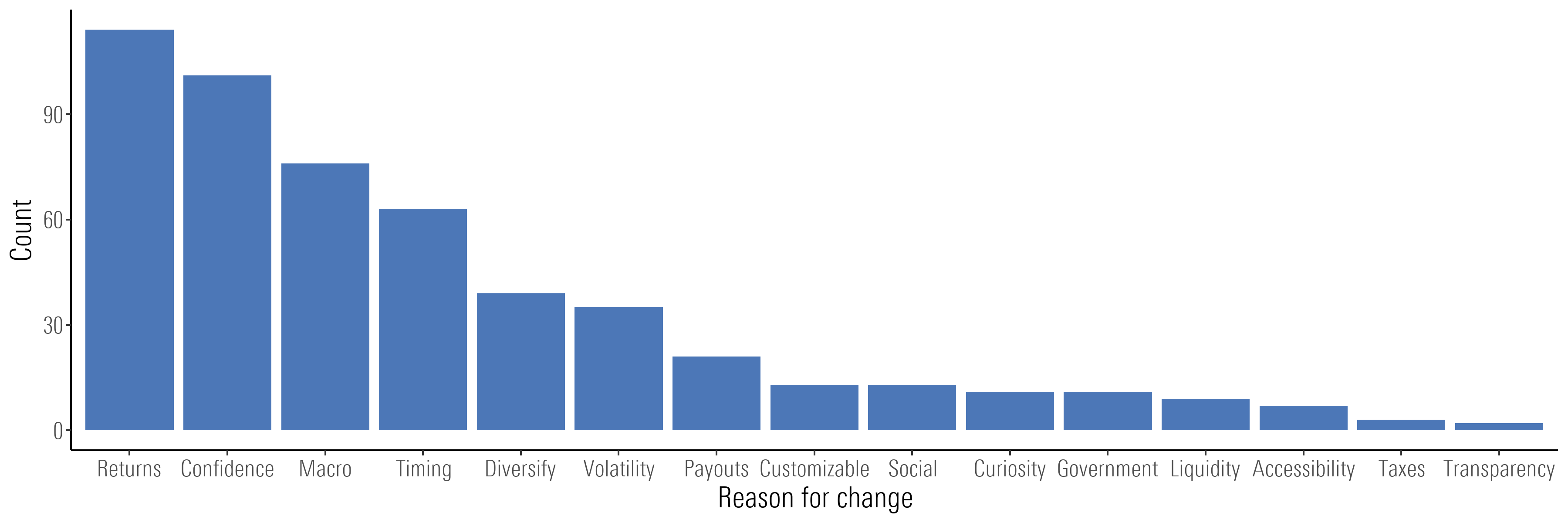

We also asked investors who wanted to change their holdings in each asset why they wanted to do so. Their responses were mired by the behavioral biases of short-term thinking and overconfidence. The two most common reasons investors gave for wanting to change their investments were that they were chasing returns or felt confident (often without any tangible evidence) about the long-term viability of the investment. This suggests that investors may be getting swept away by trends and missing out on strategically using alternative assets to benefit their long-term goals.

Most Common Reasons for Changing Investments in Alts

Advisors to the Rescue?

So far, the image doesn’t look too great: Investors don’t know too much about alts and aren’t establishing viable long-term motivations for investing in a given asset. However, we do find some signs that advisors may play an important role in helping investors invest in alts.

For one, investors who have an advisor were more likely to own one of these assets. Further, people tended to own assets they understood, indicating advisors may be helping bridge the gap of investors’ knowledge.

Second, investors with an advisor were less likely to cite macroeconomic events as a reason for changing their investment in alts. Given most investors are working with a long time horizon, adjusting to macroeconomic events can be more harmful than helpful. This suggests investors with an advisor may be better at ignoring the everyday noise and staying the course with their investments.

How to Be the Hero Your Clients Need

Based on our findings, there are several things advisors can do to help guide their clients toward a better working relationship with alternative assets.

- Talk with your clients about alts. Given that so many alts are now being directly advertised to investors, your clients may already be thinking about alternative investments. Broach the topic with them to see what is on their mind. What are they curious about? Ensure that you provide good explanations of the assets they are interested in. In our report, we provide steps for practicing your communication about these topics with clients.

- Discuss their motives for investing in alts. Many people were letting short-term thinking or overconfidence guide their investment decisions. Check in with your clients about what is driving their interest and address where their motives might need recalibration by bringing the conversation back to their goals. Those meaningful goals can help recenter clients by reminding them the true reason they got started (which probably wasn’t to chase down the hottest investment).

- Help them find the right outlet for their alt interests. After bringing clients back to their long-term goals, you might be able to redirect their interest in alts. Perhaps you think there is a different investment that might better fit their time horizon, risk tolerance, and so on. Bring it to their attention and discuss how it can get them to where they want to be. On the other hand, you may find some clients are steadfastly interested in an alt that you don’t necessarily think is appropriate. If so, you may consider creating a small sleeve for this investment in their portfolio—that is, treat their investments in alts as a small portion of their overall portfolio that they’re having fun with.

The alts of today are not necessarily the alts of tomorrow, but the lessons learned here can be applied to whatever tomorrow brings. When new things catch investors’ attention, advisors can help them learn more about these investments and ensure they are motivated by the right reasons.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/57c62327-64fd-443e-8cd7-e0a2807bc566.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KWYKRGOPCBCE3PJQ5D4VRUVZNM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TZEZ6FJNTZEZRC3FBWCWXTXVOQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/57c62327-64fd-443e-8cd7-e0a2807bc566.jpg)