Reddit Posts Show Investors Care About Climate Change, Renewable Energy, and EVs

How you talk about ESG with clients may need to change.

ESG has it all, and for financial advisors, that can be a problem. Environmental, social, and governance investing has become a widely discussed subject in the financial industry. But new Morningstar research finds that for investors, “ESG” isn’t really a thing. Instead, investors prefer to use more-exact terms related to the topic, such as “climate change.” This points to the importance of stepping away from such industry jargon when talking to clients.

Advisors are already challenged with developing financial plans that reflect their clients’ financial goals, risk tolerance, time horizon, and more. So, the topic of ESG can be overwhelming, adding three large considerations (environmental, social, and governance factors) to an already full plate all at once.

But maybe there is a different way to approach ESG with clients.

To find out, our recent report examined how investors talked about ESG online. Our approach using social media (in this case, Reddit) served as a valuable source of knowledge as interest in the topic on the site not only reflected interest as seen through fund flows but also allowed us to examine how people talk about the topic unbound by institutional norms surrounding it.

Investors’ ESG Conversations Are Very Different From the Industry’s

We collected a sample of 26,784 posts and comments from 2015-22 related to ESG from finance-related subreddits (communities organized around specific topics) such as r/personalfinance and r/investing (the more speculative subreddits like r/WallStreetBets were not included). We conducted natural language processing to extract common terms and topics as well as the sentiment reflected in posts, which yielded some important insights into how investors think and talk about the topic.

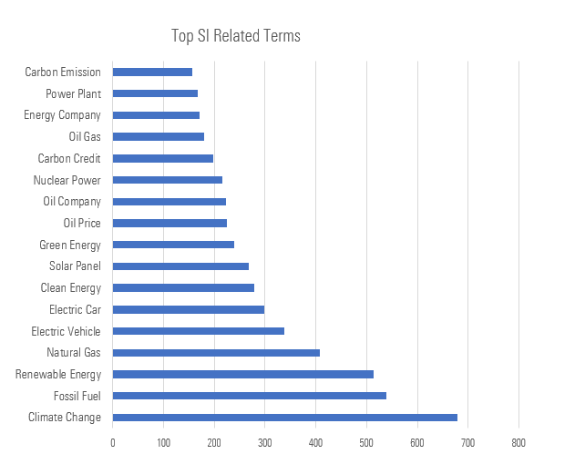

- “ESG” isn’t really a thing. Overall, investors did not talk about ESG using industry terms. Neither “ESG” nor any of its other industry correlates such as “socially responsible investing” came to the surface as common phrases in investor conversations. Instead, investors used more-exact terms related to the topic at hand, such as “climate change” (see Exhibit 1). This points to the importance of stepping away from such industry jargon when talking to clients.

- ESG wasn’t the sole focus. Common topics in the industry surrounding ESG such as ESG risk or ESG impact did not come up as focal topics in investors’ conversations. Instead, ESG factors were incorporated into broader conversations related to investing, such as considering the viability of an industry given ESG concerns. This again points to a divergence between investors and industry—investors are approaching ESG as part of the puzzle, not the whole puzzle itself.

- ESG was not so polarized. Contrary to what one might expect about conversations about ESG (especially conversations on the internet, of all places), posts and comments about ESG were overwhelmingly neutral in sentiment. This neutrality was reflected throughout time; even after the popularity of the topic online exploded in 2020, the conversations largely remained neutral. This, too, indicates industry conversations differ from investors’ conversations.

Most Common ESG-Related Terms by Count

Talk About ESG With Clients

These findings present important information for advisors about how many clients will likely think about ESG that should affect future conversations about the topic.

So, what should advisors do given the insights from this study?

- Don’t approach clients with “ESG.” Our findings (and findings from others) show “ESG” largely remains industry jargon, which can annoy and alienate clients. Instead, when the topic comes up, use language that already carries meaning for clients. One way to do this is by asking clients about what causes they care about and establishing common ground for the rest of the conversation based on their responses.

- ESG should be in service of clients’ goals. Investors generally weren’t putting ESG as the focal point; instead, ESG considerations were in service of other financial goals. Remember: Goals should always come first, and values-based investing can be incorporated to serve those goals. Help clients identify both their surface and deeper goals (that is, life goals) first and foremost. Doing so will help you find a place to naturally incorporate a component of ESG investing when clients want it.

- Don’t be afraid when ESG comes up. As we saw, the polarization around ESG is far more a creation of the industry than actual investors. When it comes up, your clients likely are coming from a place more of curiosity than dogma. Instead, see it as an opportunity to get clients to be further engaged in the financial planning process. By finding issues that are animating to clients, you can better craft a meaningful financial plan that clients will feel motivated to stick to.

Our findings suggest a different approach to conversations about ESG than what has been the norm for the past several years in the industry. In doing so, it opens doors to have more flexible conversations that bring ESG in (without fear) to work with not only a client’s values but also their goals.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/57c62327-64fd-443e-8cd7-e0a2807bc566.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/57c62327-64fd-443e-8cd7-e0a2807bc566.jpg)