Why Do Investors Keep Their Financial Advisors Around?

By focusing on returns, you may be missing out on opportunities to earn your keep.

It can feel like a marathon getting a client from the prospect phase to implementing a financial plan, so advisors may understandably see their work with existing clients as a chance for respite. Yet, like the Greek runners of yore, it’s important not to rest on your laurels.

The work of maintaining a client doesn’t always receive as much attention as getting hired or fired by one, but it is still vital to the arc of the advisor-client relationship. Focusing on how you maintain clients can ensure they are both engaged and happy—and happy people don’t fire their advisors.

We might think the main reason that clients keep their advisor is that they are pleased with their returns—we know investors can be overly focused on them. However, our previous research on why investors hire and fire their advisors suggest that returns may not be the dominating factor in how clients think about the advisor-client relationship.

As such, in our latest research, we examined why clients keep their advisors to help you understand how to earn your keep.

Top Reasons Clients Keep Their Advisors

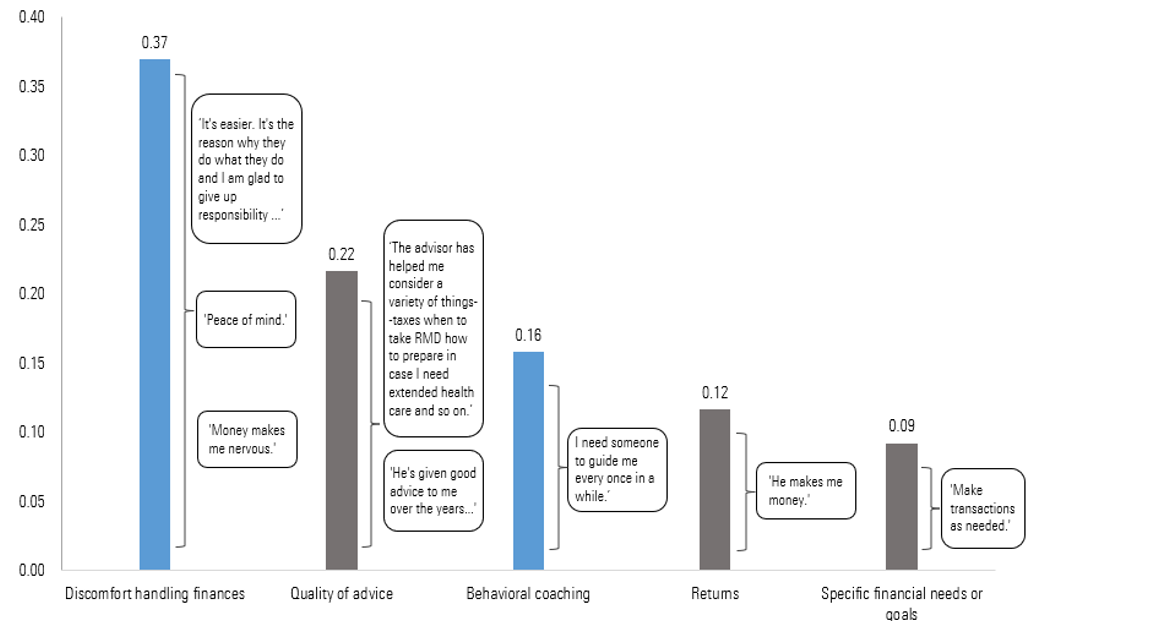

We asked 620 advisor clients to tell us some of the reasons they continue to work with their advisors, and we found three common reasons.

- Discomfort handling their own finances (37% of responses)

- Quality of financial advice (22% of responses)

- Behavioral coaching (16% of responses)

Most Common Reasons for Keeping a Financial Advisor

Clients also mentioned returns (12%) and their specific financial needs (9%) as reasons for keeping their advisors. Although returns showed up, they didn’t account for enough of clients’ rationale to be the sole focus of advisors’ efforts to maintain clients. In fact, 59% of the time, clients are keeping their advisors for emotional reasons instead of financial ones.

Are You Earning Your Keep?

Advisors must do more than generate good returns to keep their clients happy. Instead, advisors must fulfill clients’ numerous needs to build and sustain a base of those who will champion their practice. Based on the most common reasons clients keep their advisor, here are some ways to meet those needs.

1. To create comfort, foster trust.

By far the most common reason investors gave for keeping their advisor was that they didn’t feel comfortable enough, interested enough, or knowledgeable enough to do the work of managing their finances themselves. As such, clients are looking for an advisor they feel comfortable handing these issues off to, so it’s important to garner each client’s trust on that front. Our previous research indicates trust can be built on the foundation of a strong relationship in which an advisor cares about the client’s future, acts in line with the client’s best interest, and expresses similar values. Such a relationship requires having more-productive conversations with clients. Although this can be daunting, using frameworks and ready-made guides for discussions can foster these deeper relationships.

2. To demonstrate your value, focus on goal-based communication.

In looking at how clients talked about their advisor, we saw clients tended to talk about why the advice they got from their advisor was good. In short, clients are not just looking for good advice in a vacuum but good advice for them. This means it’s important for advisors to spend time helping clients articulate meaningful financial goals. But it’s also important to tie subsequent communication (such as communication about their portfolio’s construction and progress) back to those goals to help clients connect the dots between your advice and their goals.

3. To instill confidence in decisions, provide behavioral guidance.

Clients don’t often throw around terms like “behavioral coaching.” However, even without using the terminology, many clients identified key components of behavioral coaching in their rationale for keeping their advisor, like scaffolding decision-making. Clients want to feel confident in the decisions they make, but they may not ask directly for the behavioral coaching they need to get there. Fortunately, advisors can be proactive about providing the behavioral support clients need to feel good about their choices. A good place to start is by acting as a financial educator to clients and helping them prepare for times of stress, when making good decisions can be even harder than normal.

In the end, clients like working with advisors who provide reassurance, guidance, and advice tailored to their goals. Although an advisor’s work is certainly not done once a client is fully onboarded, the work of maintaining strong, positive relationships with clients has both extrinsic rewards for your business and intrinsic rewards for you.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/57c62327-64fd-443e-8cd7-e0a2807bc566.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KWYKRGOPCBCE3PJQ5D4VRUVZNM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TZEZ6FJNTZEZRC3FBWCWXTXVOQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/57c62327-64fd-443e-8cd7-e0a2807bc566.jpg)