Software Stocks Sink, the Bond Market Barely Treads Water, and Biodiversity Risk Shifts Into Focus

We’ll review the top stocks, funds, and exchange-traded funds this week as well as updates you can make to your portfolio.

What You Missed

This week, software stocks look cheap, bonds are trending down, and asset managers are paying closer attention to biodiversity risk. We name the top stocks from our Ultimate Stock-Pickers and discuss women changing the fund industry. Christine Benz shares portfolio withdrawal strategies, Amy Arnott talks industry wealth destroyers, and Dave Sekera keeps us up to date on Twitter.

Chart of the Week

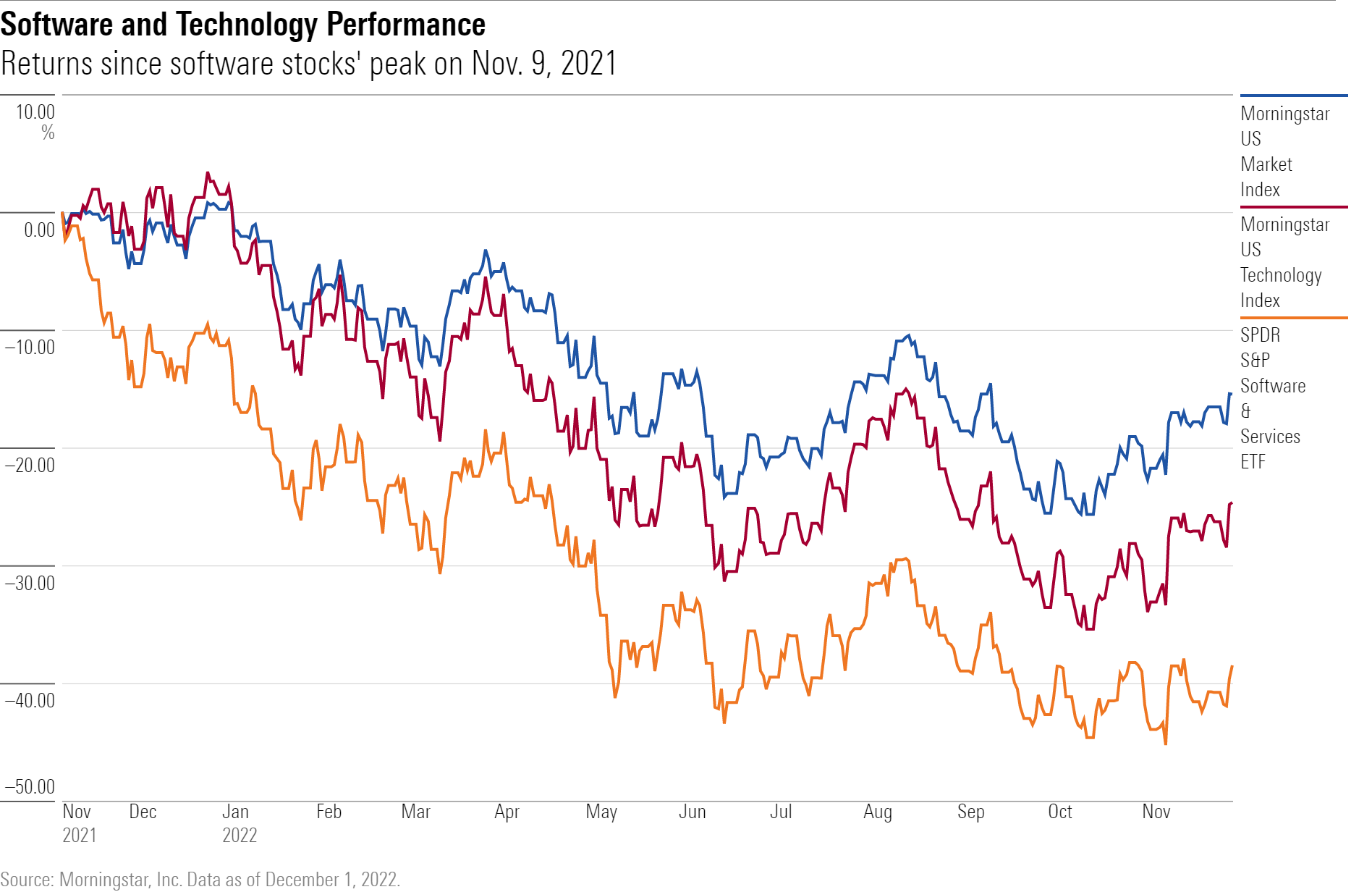

Software Stocks Are Cheap, but Is It a Safe Time to Buy?

Stocks like MongoDB, Snowflake, and ServiceNow are at big discounts, but a murky revenue outlook clouds the picture.

Glossary Term of the Week

Interest Rate

An interest rate is a percentage that will be charged, per interest period, on a principal amount that a lender lent to a borrower.

At a Glance

- An interest rate is a percentage of a loaned amount that is added to the total money owed to a lender per interest period.

- Interest rates can increase the payout of investments where investors loan out money.

- Interest rates can also hurt investors who borrow money to invest.

See Morningstar’s Investing Definitions and Financial Terms for the full definition.

What to Watch

5 Strategies for Portfolio Withdrawals in 2022

With both stocks and bonds underwater, here’s how retirees can manage portfolio withdrawals this year.

Articles We Love

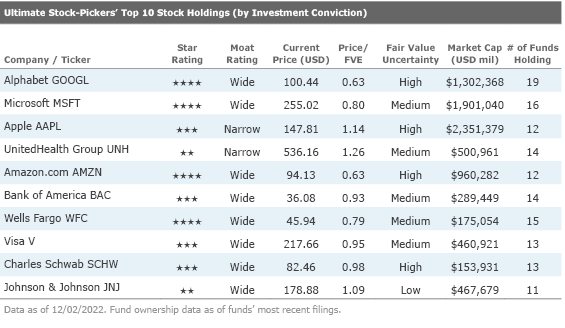

Top 10 Buys and Sells From Our Ultimate Stock-Pickers

Funds see value in a diverse range of sectors.

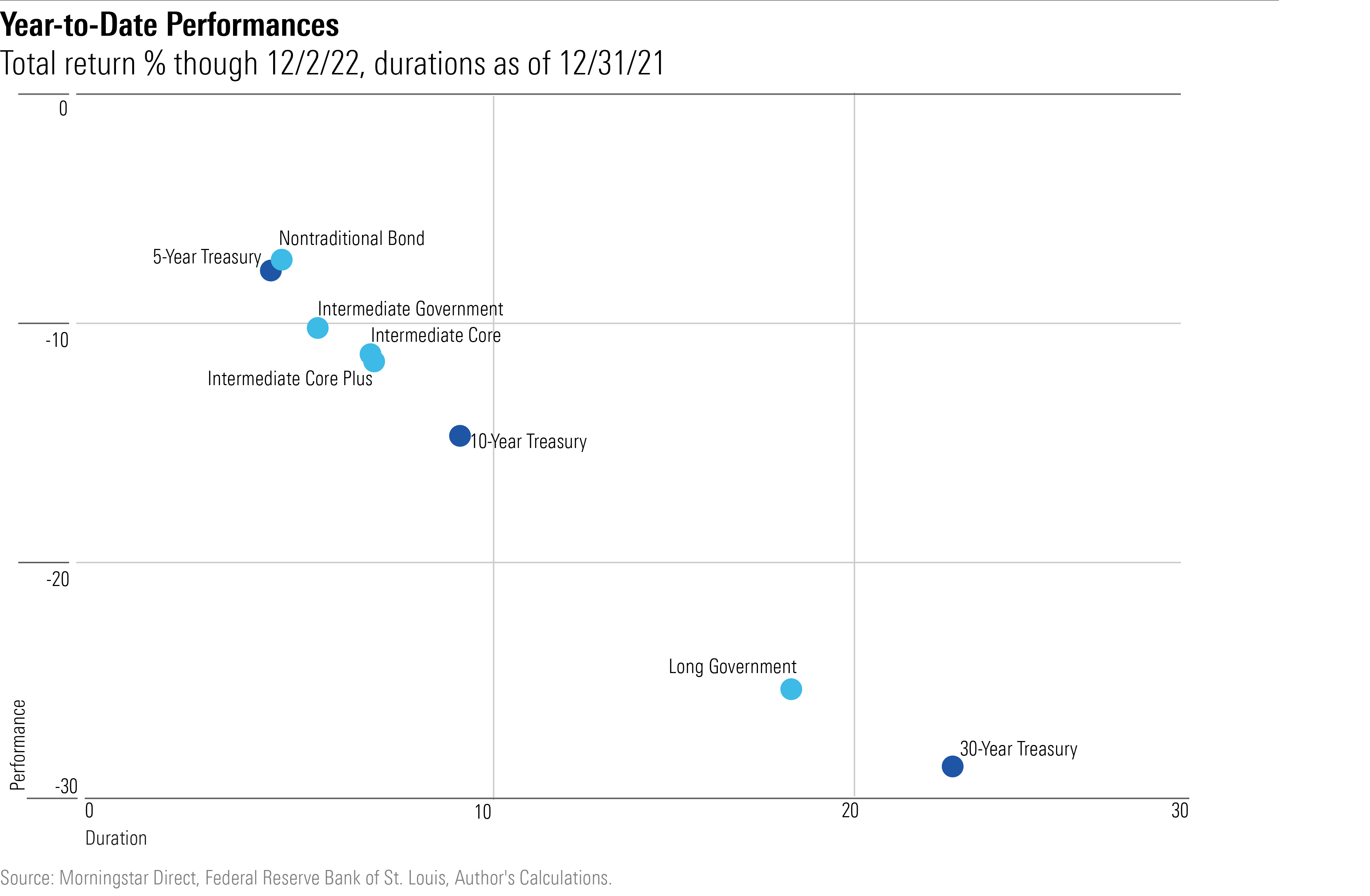

Today’s Market: Bonds vs. Bond Funds

Has there been a meaningful difference?

The following exhibit provides the results. It plots the returns of the three Treasury securities and five mutual fund categories against their December 2021 durations—that is, against the amount of interest-rate risk that each has assumed. As 2022′s bond losses have been overwhelmingly correlated with interest-rate exposure, the durations are required for understanding whether the assessed investments have surpassed, met, or muffed their expectations.

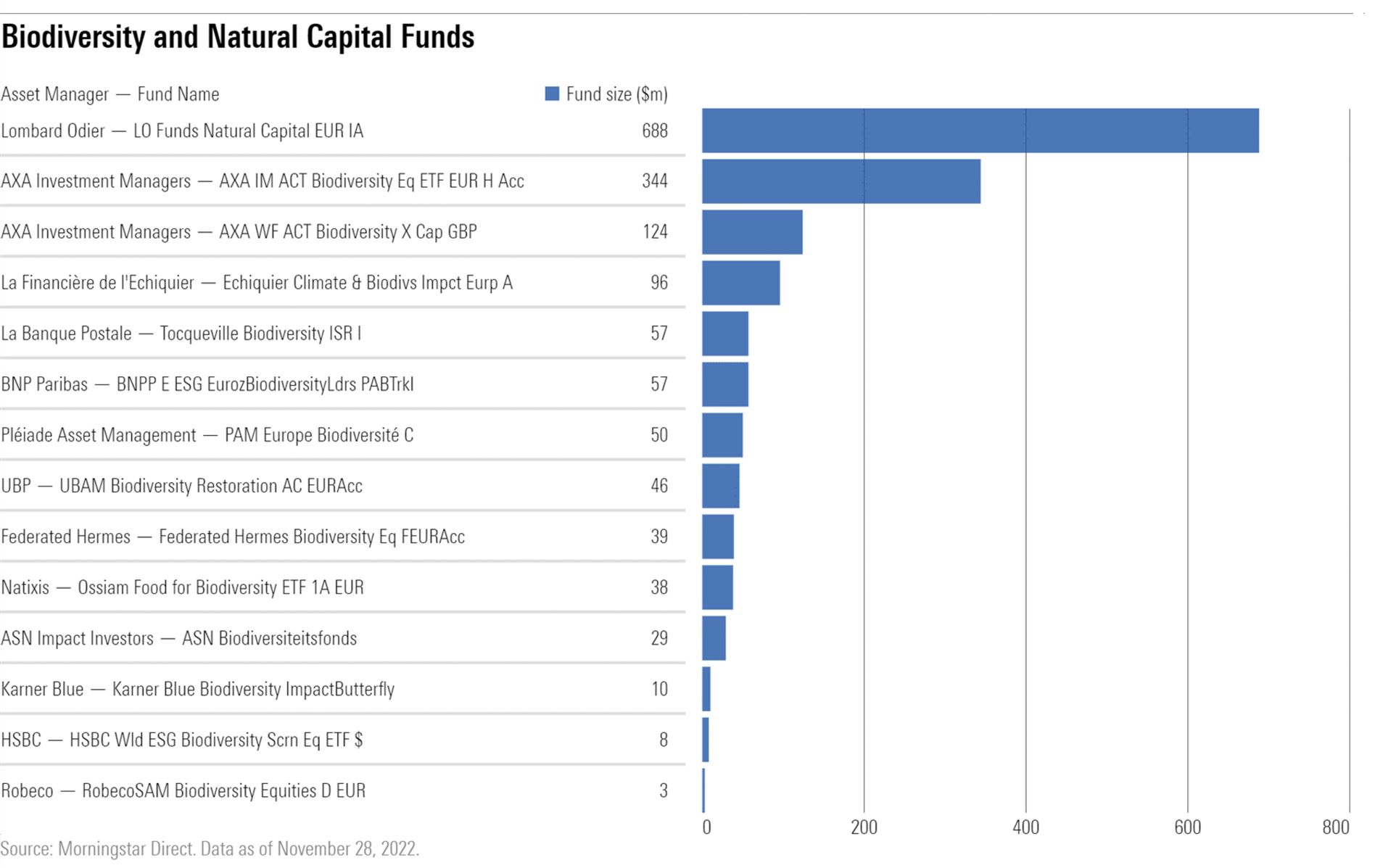

Asset Managers Start Adopting Policies Around Biodiversity

Expect to see more as the U.N. Biodiversity Conference focuses minds on the importance of nature.

Humankind depends on the natural world for everything—including food, water, energy, and healthcare. Biodiversity describes the variety of life on earth. Its value is enormous, as several studies have shown. The World Economic Forum estimates that USD 44 trillion of economic value generation, over half of the world’s total gross domestic product, is “moderately or highly dependent” on nature and its services. Meanwhile, the Organisation for Economic Co-operation and Development estimates the total global value of the benefits we derive from nature is USD 125 trillion to USD 140 trillion per year.

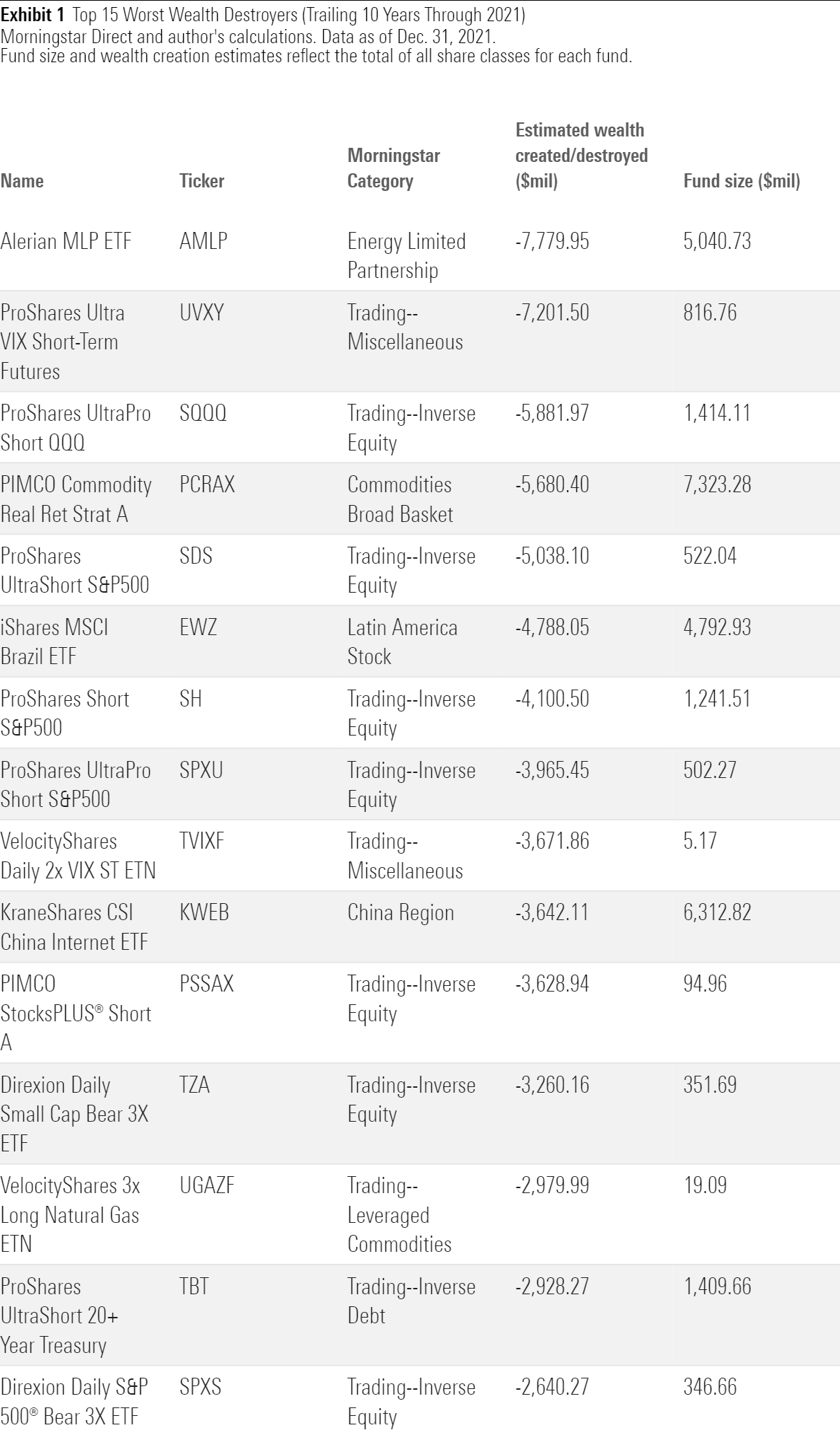

15 Funds That Have Destroyed the Most Wealth Over the Past Decade

These funds managed to lose value for shareholders even during a generally bullish market.

Last week, I wrote about the 15 mutual funds and exchange-traded funds that created the most value for shareholders in dollar terms over the trailing 10-year period ended in 2021. To come up with the list, I ranked Morningstar’s database of U.S.-based mutual funds and ETFs, focusing on those that had the biggest increase in asset size over the 10-year period ended in 2021 after subtracting out total inflows and outflows over the same period. The resulting number reflects how much growth a fund has created from market appreciation in dollars. This week, I’ll look at this from the opposite perspective, focusing on funds that have lost value for shareholders over the same period.

3 Women Who Are Changing the Financial Industry

Marci Bair, Nicole Casperson, and Georgia Stewart forge their own paths.

At September’s impressive Future Proof conference, I met three women who are changing the financial industry—each a woman who blazed her own trail in the male-dominated financial field and each found ways to make her mark to benefit others.

Stocks, Funds, and Exchange-Traded Funds

The Best Funds for Rebalancing in 2023

For many investors, reviewing the asset allocations of their portfolios sounds about as appealing as a visit to the dentist.

But after a tough year for U.S. stocks, U.S. bonds, and international stocks in 2022, is rebalancing a must-do heading into 2023?

“If you’re in your 30s or 40s and you think you have at least 20, 25 years until retirement, you probably don’t need to do a lot of shifting around in terms of your portfolio’s asset class exposures,” says Morningstar director of personal finance and retirement planning Christine Benz.

However, if you’re nearing retirement—someone older than 50 and getting within 10 to 15 years of retirement—Benz suggests taking a hard look at your asset mix, especially if you haven’t rebalanced in several years.

Do Multifactor Funds Deliver on Their Objective?

Multifactor funds rose to popularity in the mid-2010s, and they controlled more than $250 billion of investors’ money by the end of September 2022. These strategies attempt to diversify their portfolios across two or more risk factors, or characteristics shared by a group of stocks, such as low price multiples (value) or strong recent performance (momentum). The appeal of these characteristics ties back to their potential for better long-term risk-adjusted performance than the market.

Small-Cap Stocks Are Really Cheap

While many investors are wondering whether it’s safe to start buying those mega-size companies that led the last bull market, it’s actually small-cap stocks that may be the biggest bargains.

For smaller-company stocks, price/earnings ratios—a widely used measure for determining the value of a stock relative to its earnings—have reached their lowest levels in two decades. Lower ratios generally represent more attractive values and with a greater potential for price gains.

Missed Us?

Check out our investing specialists on Twitter:

#Stock market giving back some of its recent gains, but for long-term investors that can weather the turbulence, equities remain undervalued. Here is where we still see value and what to watch for in the months ahead. https://t.co/q1je8gUqed - Dave Sekera @MstarMarkets

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)