15 Top Wealth Creators in the Fund Industry

These mutual funds and ETFs have generated the most value for shareholders in dollar terms.

If you want to know how a fund has performed, total returns are the first place to look. But performance is less meaningful if few shareholders are around to benefit from it.

To get a better sense of which funds have created the most value in dollar terms, wealth creation is a better measure. To home in on this, I ranked Morningstar’s database of U.S.-based mutual funds and exchange-traded funds, focusing on those that had the biggest increase in asset size over the 10-year period ending in 2021 after subtracting out total inflows and outflows over the same period. The resulting number reflects how much growth a fund has created from market appreciation in dollars.

The Results

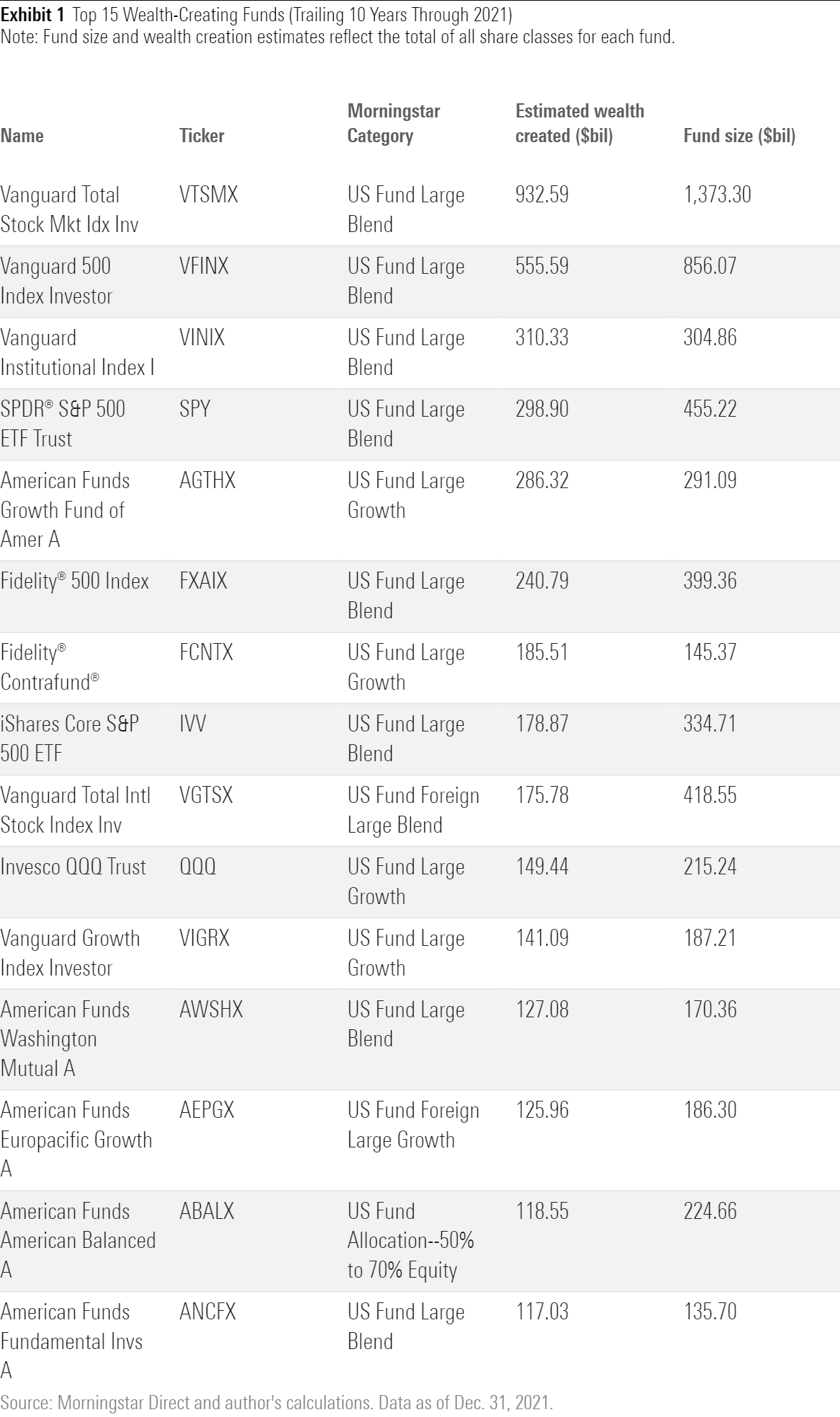

To some extent, this is a chicken-and-egg exercise. By definition, the biggest funds will create or destroy more value in dollar terms. And money tends to flow to the funds that have been successful in the past, so the big generally get bigger.

As the table below illustrates, the 15 funds that created the most wealth are all large, well-established names. And all but three of the 15 are also among the biggest funds in the industry ranked by asset size.

Not surprisingly, eight of the 15 funds are low-cost passively managed funds that track broad market indexes. Because few active managers have been able to consistently add value, buying the market and keeping costs low has been a winning strategy. Fidelity Contrafund, managed by Will Danoff for the past 32 years, has been an exception. During its glory days in the 1990s, the fund racked up billions of asset growth. While performance has been less spectacular lately, Contrafund has continued to create significant value for shareholders in dollar terms.

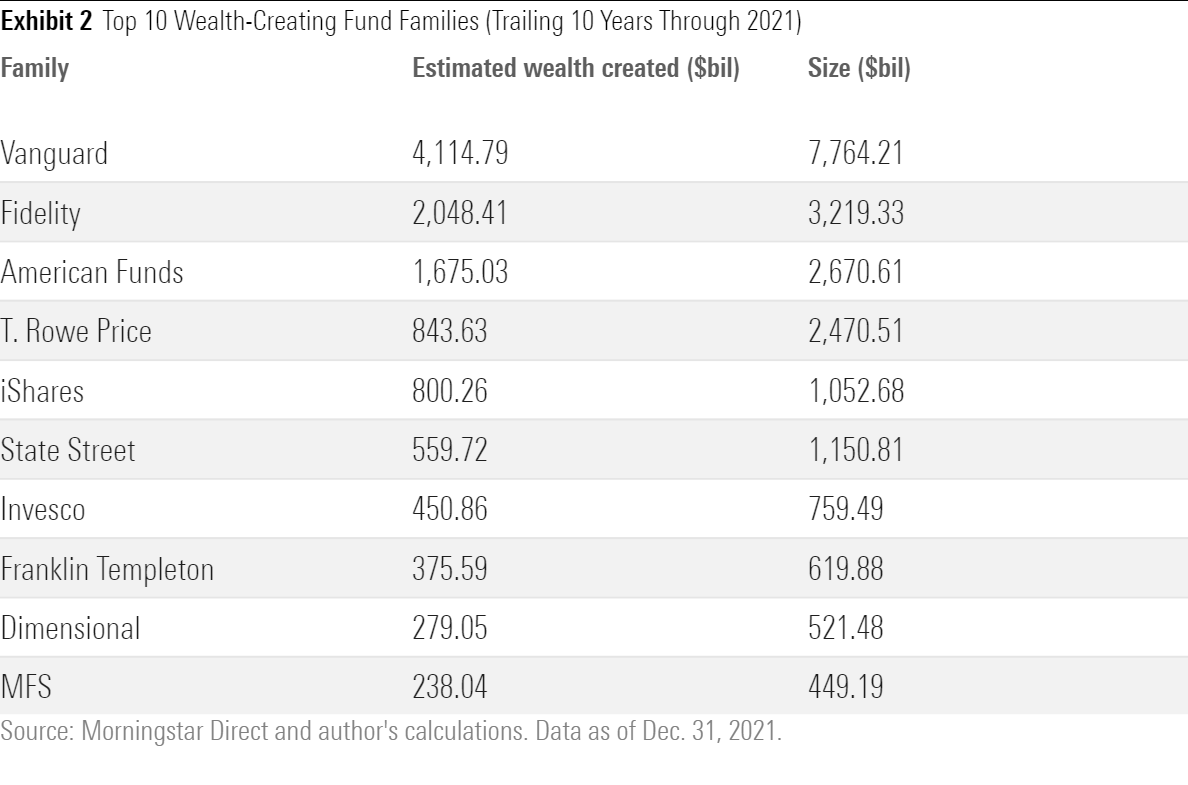

On the other side of the country, Los Angeles-based American Funds has also created billions in shareholder value with its measured, multimanager approach. The funds are actively managed but tend toward the conservative side, with broadly diversified portfolios that avoid big bets and rapid-fire trading. As the table below shows, American Funds has created an estimated $1.7 trillion in shareholder value over the trailing 10-year period. (Note: This figure doesn’t include the impact of sales commissions, which would reduce the benefit to shareholders.)

Vanguard tops the list, with a stunning $4.1 trillion in estimated value creation, compared with about $2 trillion for Fidelity. Index powerhouses iShares and State Street also rank in the top 10 fund families based on wealth created, along with broker-sold houses including American Funds, Franklin Templeton, and MFS. (As noted above, my calculations don’t include the effect of brokerage commissions, which would reduce shareholders’ actual results.) T. Rowe Price ranks as the sixth-largest fund company based on total assets but punches above its weight with shareholder value creation, ranking fourth on the list based on estimated value created over the trailing 10-year period.

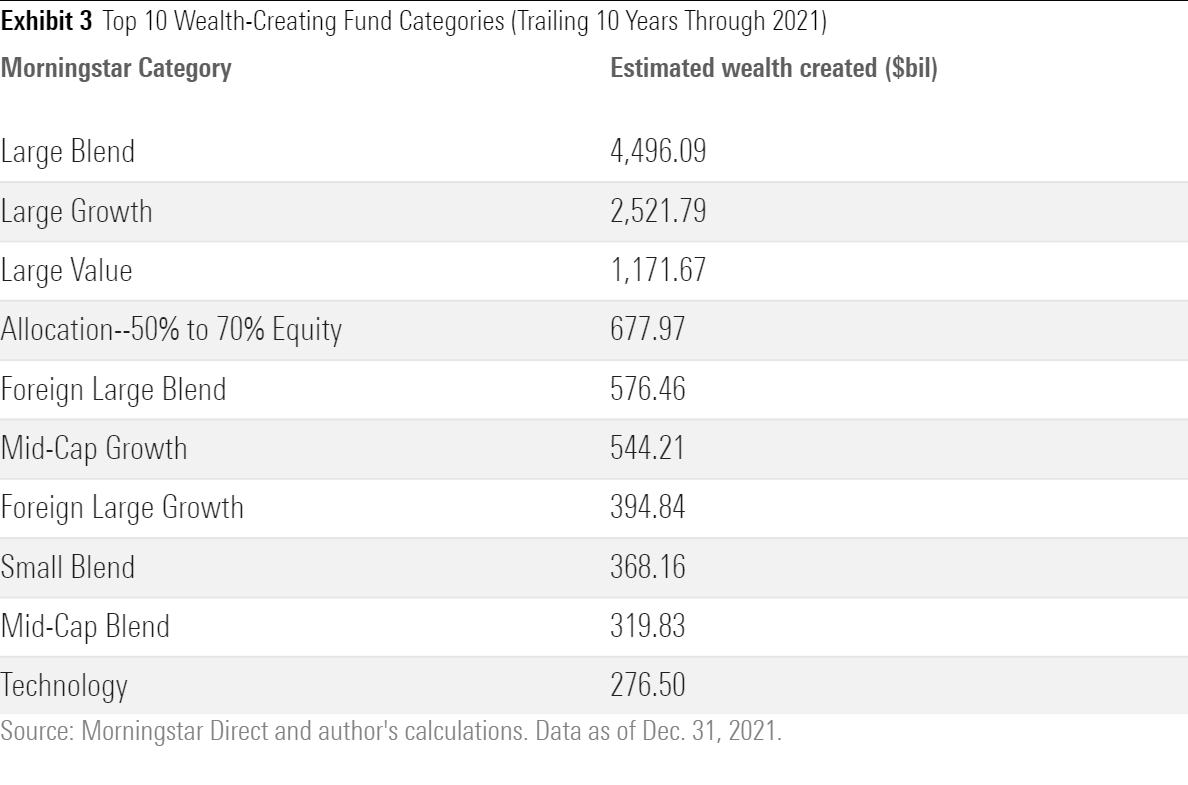

Looking at the results by Morningstar Category, basic was definitely better. The large-blend category, which ranks as the single largest fund category based on assets as of Dec. 31, 2021, sits at the top of the list with an estimated $4.5 trillion in shareholder value created. This category is also home to eight of the top 15 funds shown in the first exhibit above. Investors have done well in large-blend funds because they typically get broadly diversified exposure to the mega-cap stocks that dominate the market, as well as some exposure to mid-cap names.

Most of the top wealth creators by category also happen to be among the largest categories based on asset size (again, the chicken-and-egg issue). But bond funds are notably absent, even though they posted decent returns over the trailing 10-year period ending in 2021. Even though bond-fund returns got a boost from steadily declining interest rates over most of the period, asset growth from market appreciation has been less robust than on the equity side.

Three of the top 10 categories land on the growth side of the Morningstar Style Box. The best growth funds benefited from dominant market trends during most of the 10-year period, when growth-oriented stocks outperformed their value counterparts by more than 5 percentage points per year, on average.

Technology-stock funds fared better than might be expected, creating an estimated $276.5 billion over the 10-year period. Before their recent collapse, tech stocks were by far the best-performing sector over the 10 years spanning 2012 through 2021, with annualized returns outperforming the broader market by about 4 percentage points per year. This performance advantage means shareholders were well rewarded, even though sector funds tend to be difficult to use effectively in a portfolio.

Conclusion

The biggest players in the fund industry are often vilified as having too much power and failing to act in the best interests of their shareholders. But as the results above show, the largest funds and fund families have created significant value where it counts: by increasing dollar value for shareholders.

In my next article, I’ll take a look at some of the biggest value destroyers over the same period.

Correction: The asset figures included in the exhibits and text have been revised to include some share classes that were inadvertently excluded.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)