Today’s Market: Bonds vs. Bond Funds

Has there been a meaningful difference?

At Long Last

I must be the only investment blogger in this country who has not yet discussed the difference between owning bonds directly, and possessing them through bond funds. The people who work for brokerage firms do it, those at financial publications do it, individual investors do it, and other Morningstar columnists do it. Not to mention the birds, the bees, and the educated fleas. They all do it.

But now is surely the moment, given that 2022′s fixed-income marketplace has been, to cite myself, the “worst ever.” If ever the distinction between those two investment methods mattered, that time would seem to be now.

This column addresses the topic from three perspectives: 1) total returns, 2) yield, and 3) convenience.

Total Returns

For this study, I have skipped low-quality credits because it is foolish to buy a single junk bond, given the risk that its issuer will implode. And in the unlikely event that a retail investor buys a basket of high-yield bonds, (s)he will have effectively created a personalized mutual fund, thereby rendering the test moot.

This article’s comparison therefore consists of the returns for three Treasury securities versus the returns for five investment-grade mutual fund categories.

The Treasury securities are: 1) 30-year bonds, 2) 10-year notes, and 3) five-year notes. To compute their total returns, I assumed the investor purchased a newly issued version of each Treasury at the close of business on Dec. 31, 2021, and held it through Friday, Dec. 2, 2022. I calculated those securities’ current prices with this online tool (I could have built my own, but why?), then computed the total returns by adding their reinvested and accrued yields.

The mutual fund performances were easier to obtain; I located the category-average results in Morningstar Direct. The categories evaluated were: 1) intermediate core funds, 2) intermediate core-plus funds (akin to the previous group, but with a sprinkling of esoteric investments), 3) intermediate-government funds, 4) long-government funds, and 5) nontraditional bond funds. The latter are not strictly comparable to Treasuries, as they are invested flexibly instead of consistently, but I was curious to see how they have fared, given that they were created to withstand an environment of rising interest rates.

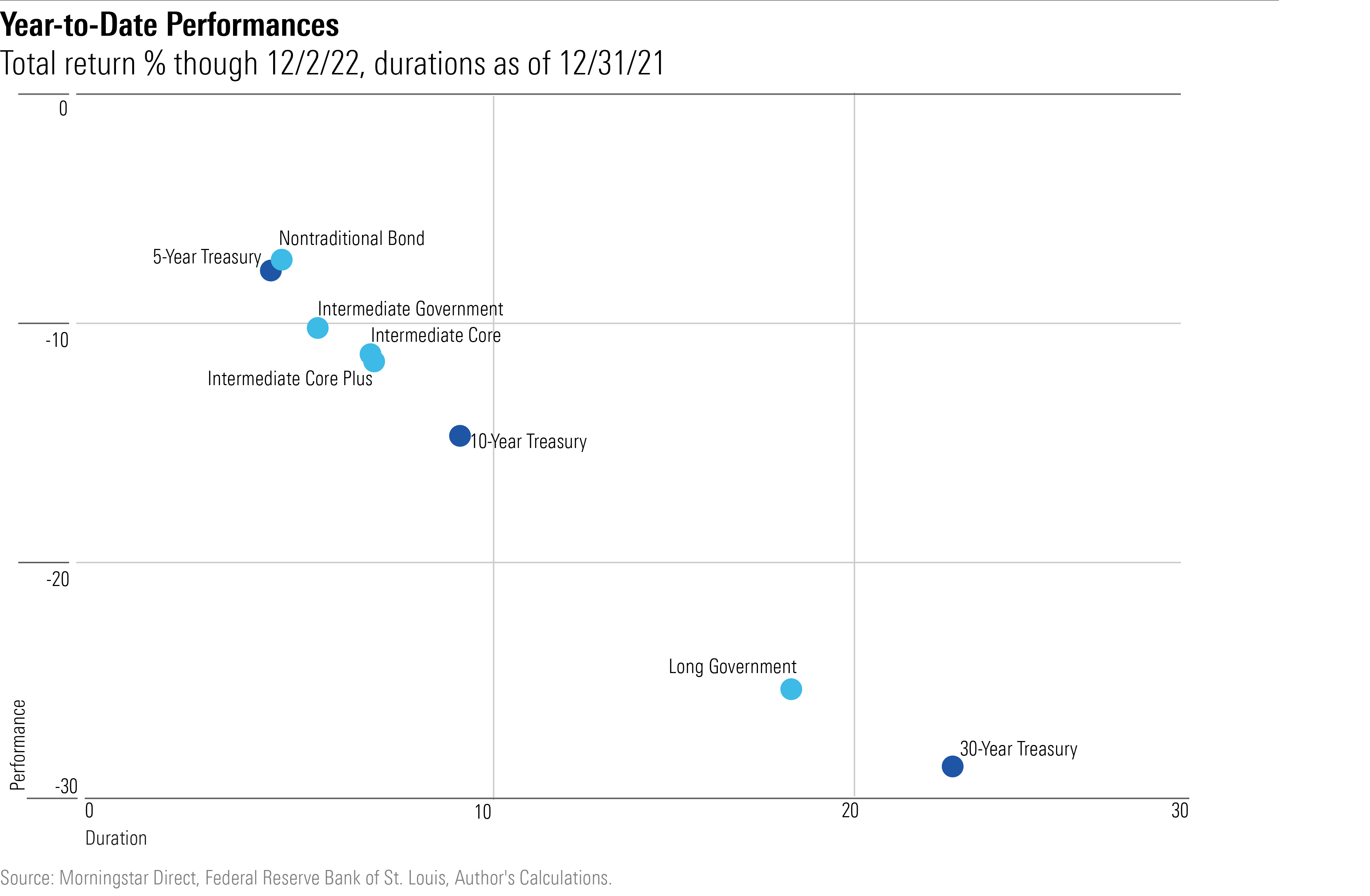

The following exhibit provides the results. It plots the returns of the three Treasury securities and five mutual fund categories against their December 2021 durations—that is, against the amount of interest-rate risk that each has assumed. As 2022′s bond losses have been overwhelmingly correlated with interest-rate exposure, the durations are required for understanding whether the assessed investments have surpassed, met, or muffed their expectations.

Mutual funds have tracked Treasuries, and vice versa. With only slight wobbles, the dots place on a straight line, save for nontraditional bond funds, which have performed 1 percentage point better this year than their durations suggested. (Two percentage points before expenses; such funds are expensive!) That was no surprise, as nontraditional bond funds were designed to respond to market shifts.

Yield

With the yield test, I jettisoned the 30-year Treasury bond, 10-year Treasury note, and long-government fund category, as it became too messy to evaluate Treasury versus fund payouts over three maturity schedules. Instead, I simplified the analysis, showing the difference in net yields (that is, after expenses are considered) for the four intermediate-term fund categories (counting nontraditional bond funds), when compared against five-year Treasuries.

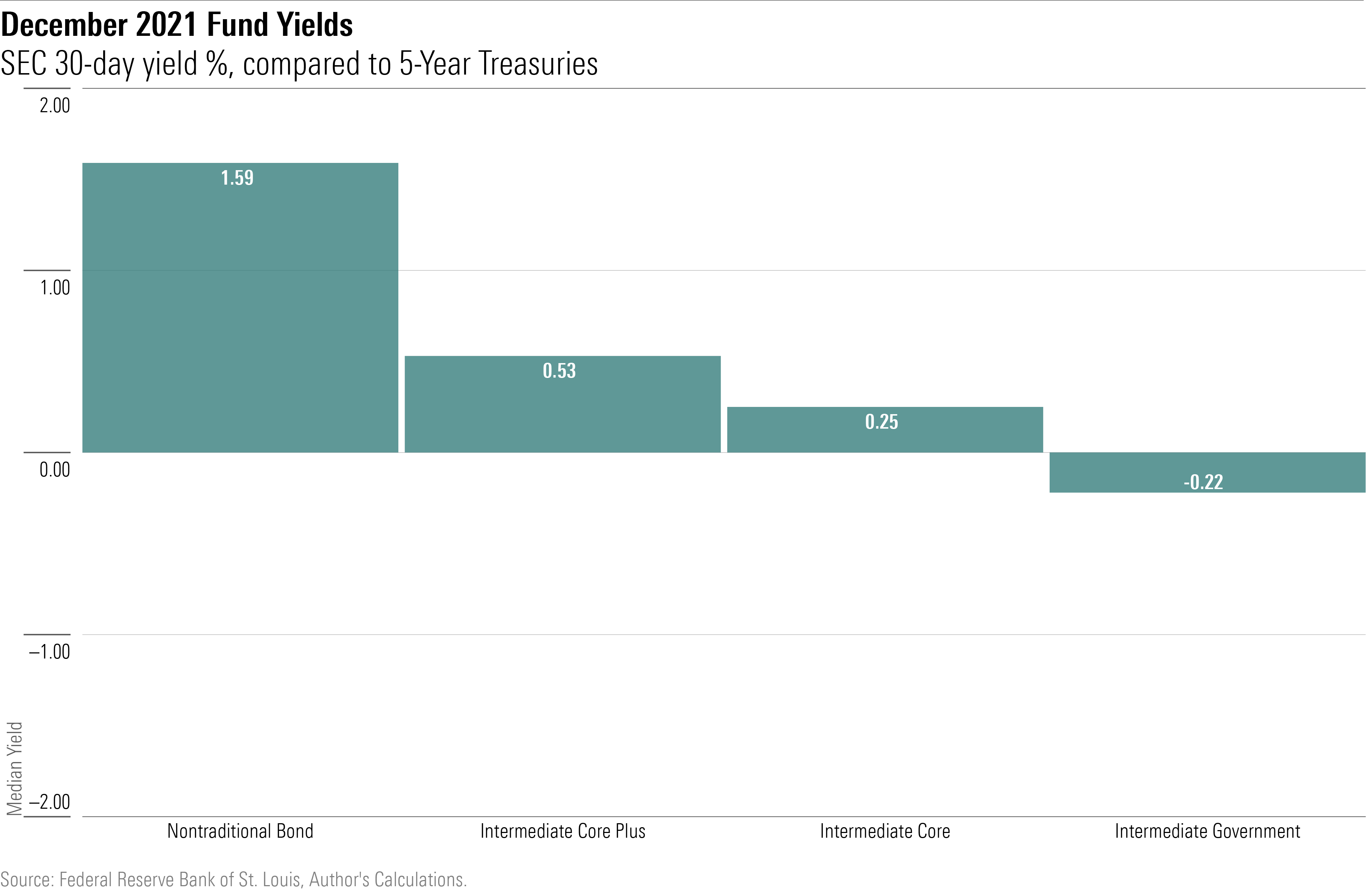

Entering this year, the funds had a decided yield advantage. Nontraditional bond funds yielded much more than did five-year Treasuries, and the core and core-plus categories somewhat more. Only intermediate-term government funds trailed.

The average fund yield was higher than the five-year Treasury yield for three reasons. First, as Treasuries offer the lowest available payouts, and most investment-grade bond funds buy other securities besides Treasuries, funds always possess a pre-cost income advantage. Second, bond-fund expenses have dropped sharply in recent years, so their offsetting handicap has been reduced. Third, until recently the yield curve was positive, thereby aiding the funds, since they have somewhat longer durations than do five-year Treasuries.

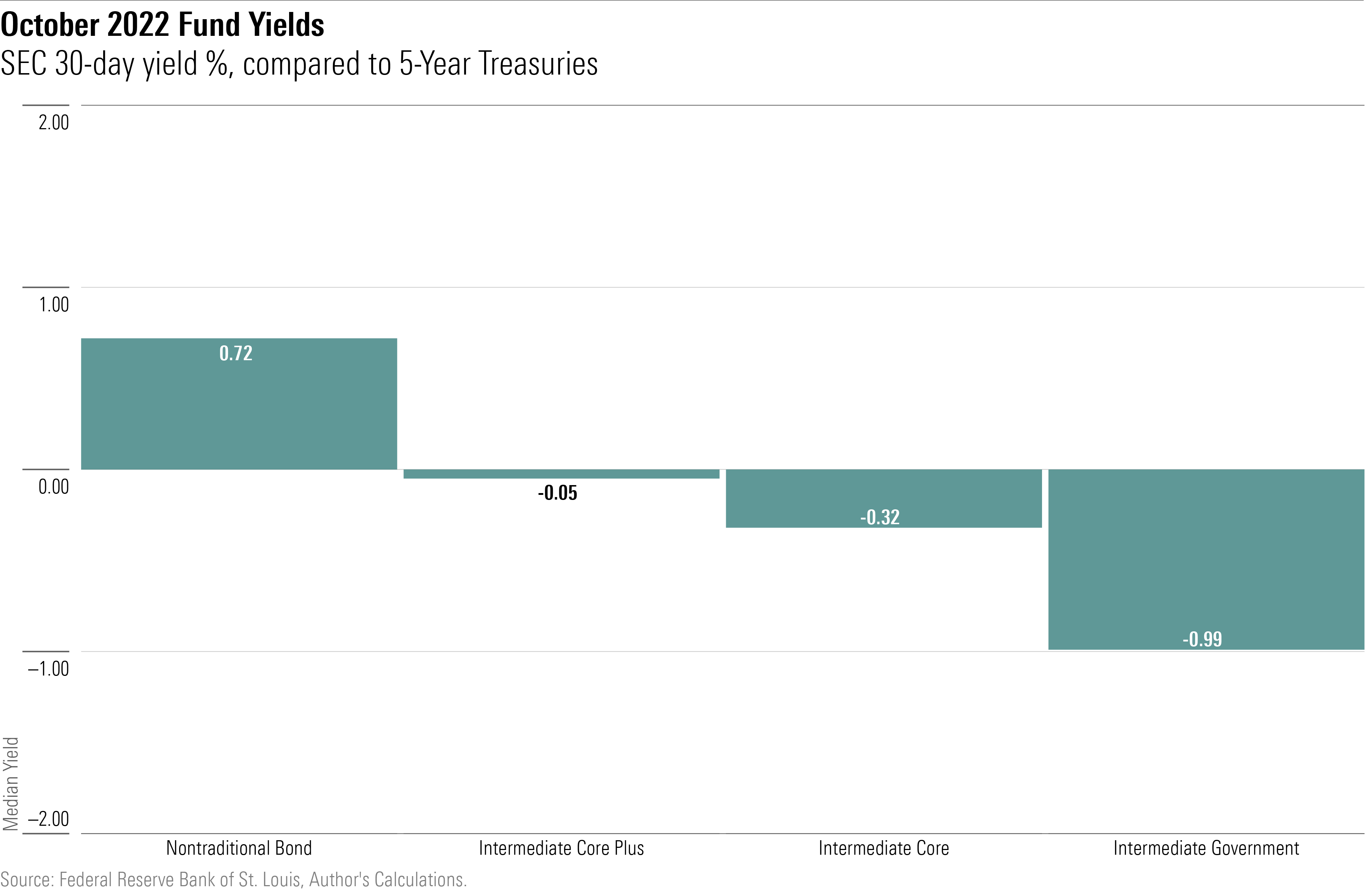

Since the year began, though, the funds have shed about 50 basis points of relative yield to five-year Treasuries. Nontraditional bond funds continue to show higher 30-day yields, but the other fund categories have slipped modestly behind.

A small victory for the directly held securities. Their triumph, however, owes mostly to circumstances. As the yield curve inverted during 2022, funds became penalized for having somewhat longer maturities. Had the yield curve steepened rather than inverted, then funds likely would have gained more yield.

Convenience

Regrettably, the above discussion misses a very large point. Those yields are theoretical, not actual. They are based on yields to maturity, which consider not just a bond’s payout, but also its future price change, as the security moves toward its par value. If the bond sells at a premium, meaning that its payout exceeds the current market rate, it will have income to burn. However, if the bond sells at a discount, it will generate less cash than its stated yield. That is not necessarily a bad thing—it does not harm total returns—but it does affect how much money the bond distributes.

Funds that hold discount bonds can partially cover the gap by trading for bonds that have higher current yields. In some cases (such as zero-coupon bonds), they are also permitted to reclassify the capital growth of a discount security as “income,” distributing that amount. However, those who own bonds directly are permitted no such tricks.

As a result, actual payouts—as opposed to yield-to-maturity calculations—have increased for funds, whereas they have not for directly held Treasuries that have not matured. That is, a 10-year Treasury note that paid 1.52% entering this year on a $10,000 investment, meaning $152 annually, still distributes that same yearly amount of $152. The note’s yield-to-maturity has risen as its price has declined, but it does not disburse more cash.

Whether that condition proves to be troublesome or trivially unimportant depends upon the investor’s situation. Those who live on their income will aver the former, while those who reinvest their distributions will believe the latter. Once again, this situation is circumstantial. Had interest rates fallen instead of rising, directly held bonds would boast higher dollar payouts than bond funds.

Summary

There is far more to be said about owning bonds directly versus holding them in bond funds than I have addressed. Previous writers have discussed, among other items, the benefits that bonds confer in having fixed-income streams, predictable maturity dates, and controllable cost bases. For their part, bond funds provide better diversification and access to institutional pricing.

Thus, this article is scarcely the final word on the topic. It does, however, differ from its predecessors in discussing how each strategy has performed when facing the most severe of investment tests. The answer is, quite similarly, with bond funds possessing some advantage for those who seek higher current payouts, without making a trade.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)