What a Bitcoin ETF Would Mean for Investors

A BlackRock ETF would broaden the bitcoin market, which would have both benefits and drawbacks.

Several mutual fund titans have made a splash recently by seeking SEC approval to offer “spot” bitcoin exchange-traded funds. To this point, the SEC hasn’t permitted spot bitcoin ETFs, which would invest directly in the digital asset. (The bitcoin ETFs available to this point invest in bitcoin futures contracts or the stocks of firms thought to offer exposure to the asset, not bitcoin itself.)

BlackRock filed for approval on June 15, with Fidelity, Invesco, VanEck, WisdomTree, and others swiftly following.

The chief benefit of a spot bitcoin ETF is that it would allow investors to buy and sell bitcoin without having to set up an account on a cryptocurrency exchange. Given the legal hot water many of those exchanges now find themselves in, an ETF could reduce investors’ exposure to fraud or legal enforcement. It would also spare them the hassle of setting up a separate wallet to store their digital assets, so they could manage their bitcoin exposure alongside the rest of their portfolio.

What’s in it for BlackRock? The ETF would arguably widen the market, attracting investors who have been put off by the complexity and hassle of investing in bitcoin through an exchange or other means. It also might be seen as legitimizing bitcoin, as ETFs are a popular and proven investing vehicle and have attracted an immense following.

But why now? The SEC has repeatedly turned away other managers who have tried to register spot bitcoin ETFs.

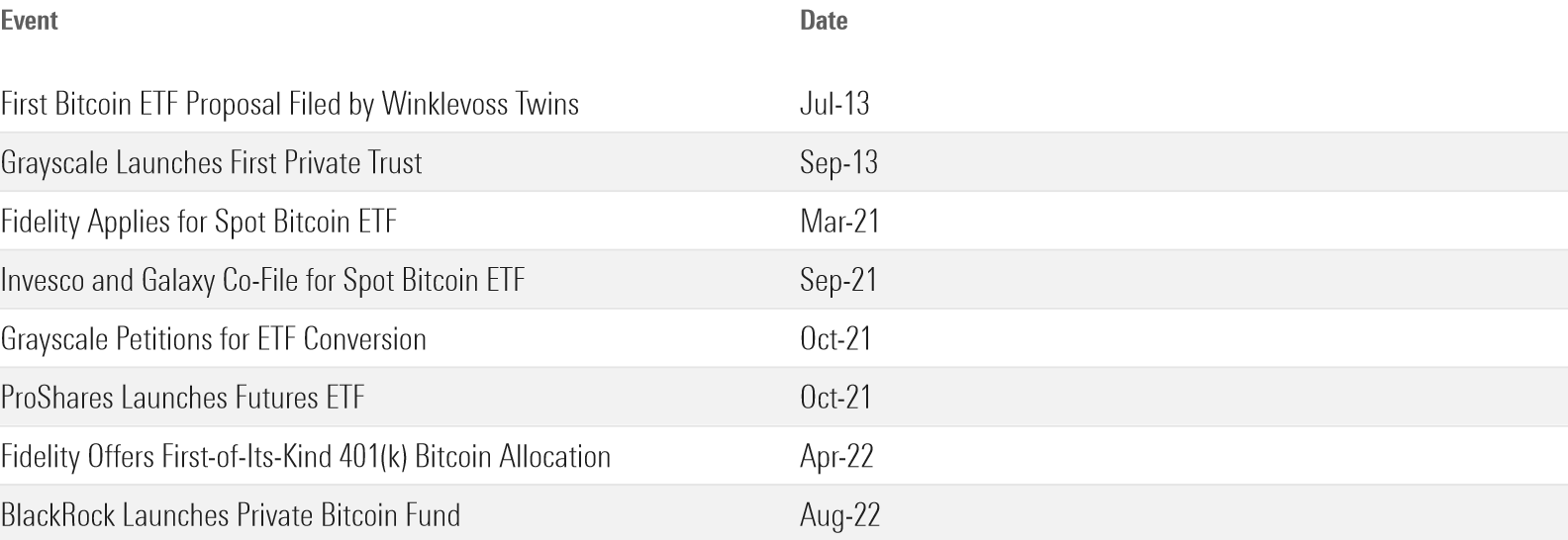

Putting aside the economic justification for trying to enter a new market, it’s important to remember that these firms are no strangers to asking the SEC for clearance in cryptocurrency. BlackRock already offers a private bitcoin trust, and Fidelity unsuccessfully petitioned for an ETF in 2021. So in a sense, these new filings build on prior efforts and experience, experience that might have imparted lessons about what the SEC will or will not accept.

History of Bitcoin Investment Vehicles

What might these firms have learned? The SEC’s rationale for previously turning down Fidelity, Grayscale, and others was that none of the proposals boasted a robust mechanism for surveilling bitcoin transactions, so as to prevent price manipulation. No surveillance in the spot market, no bitcoin ETF, or so the SEC seemed to be saying in rejecting the previous applications.

Surveillance is typically conducted when a listing exchange taps another exchange to conduct analyses of the trading activity on its platform, and the two compare notes. Previously, applicants have attempted to argue that futures markets, run by either CBOE or CME, could serve as their listing exchange’s surveillance mechanism. But the SEC rejected that for lack of evidence that a futures market can detect all price manipulation when people trade bitcoin directly.

There’s precedent for the SEC to hold out in this manner. For instance, it wasn’t until CBOE Group’s bitcoin futures market had been live for four years that ProShares got the ok from the SEC to launch the first U.S.-domiciled bitcoin futures ETF. Asset managers seeking to launch ETFs investing in physical gold bullion went through a similarly arduous process in the early 2000s.

What made BlackRock’s proposal novel is that the ETF’s listing exchange, Nasdaq, announced that it would pursue two surveillance systems: one in the futures market, overseen by CME, and another in the spot market, represented by Coinbase. Coinbase can access confidential information on transactions between buyers and sellers of bitcoin in a way that a futures exchange like CME could not. Nasdaq has experience with surveillance-sharing agreements that Coinbase does not. What results is a “belt-and-suspenders” approach: By linking CME to Coinbase through Nasdaq, the thinking goes that it may be easier to detect fraud than either partnership could on its own.

Will It Succeed?

For my part, I’m not sure that Nasdaq’s involvement will be enough to convince the SEC when it’s not clear exactly how high the regulator’s barriers are. The closest the SEC has come to articulating its standard—”A comprehensive surveillance-sharing agreement with a regulated market of significant size related to the underlying or reference assets”—leaves plenty of room for interpretation. For instance, while Nasdaq’s partnership with Coinbase certainly counts as a “surveillance-sharing agreement,” the SEC has not specified how it will evaluate metrics like market depth, which leaves wide latitude to rebuff this proposal.

There are also questions surrounding Coinbase itself. The SEC has already alleged that Coinbase is insufficiently regulated. This saber-rattling could cause customers to leave and make it more difficult to meet the threshold of “significant size.”

None of this is new information. The SEC’s misgivings and concerns with cryptocurrency exchanges have been well documented. That’s led some to wonder aloud why BlackRock has decided to enter the fray at this stage, speculating whether it may have an inside scoop that gives it confidence its proposal will succeed where the others failed. It could be that BlackRock’s name alone is enough to set regulators’ minds at ease.

On the other hand, if BlackRock’s petition is approved, it would open the floodgates to similar proposals from other asset managers mimicking BlackRock. Already many of the firms with outstanding petitions have amended their filings to include similar surveillance-sharing agreements. In their review process, the SEC would have to treat these proposals equally, which makes the substance of the surveillance-sharing agreement more important than the BlackRock name itself. Considering the surveillance-sharing agreement on its merits alone, does it do enough to win the SEC’s approval? I’m skeptical.

Will It Succeed for Investors?

Putting aside the question of whether the SEC will approve the spot bitcoin ETF proposals put before it, there’s the matter of whether an ETF will be beneficial to investors at all. On that, I have a mixed view.

An ETF would enlarge the market for bitcoin investing by making it easier for people to buy and sell bitcoin in their investment accounts. Currently, investors can’t buy bitcoin directly unless they use Robinhood or a few other select brokers. While an ETF boasts convenience and would likely lower transaction costs over time, greater access isn’t unilaterally a good thing. Compared with other investments, Bitcoin is a massive outlier in terms of its volatility. Investors who haven’t dabbled in cryptocurrency before may not fully grasp just how risky bitcoin is and set up a suboptimal allocation that overwhelms traditional sources of returns.

That said, it’s not impossible, after the events of the past year, that the SEC would be willing to try something new. ETF disclosures could go a long way toward enlightening investors on the risks presented by cryptocurrency, and traditional asset managers have experience with custody and risk management that cryptocurrency exchanges do not. For investors that already own digital assets, an ETF would be a welcome enhancement.

A note on the disclaimer below: Most digital assets, including the cryptocurrencies mentioned in this article, are not currently classified as shares of registered securities by the SEC and therefore do not fall under Morningstar’s editorial policies. However, in the interest of full disclosure, the author of this article does own digital assets mentioned in this article.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_29c382728cbc4bf2aaef646d1589a188_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)