The Strategic-Beta ETF Market Has Matured, but That Doesn’t Mean the Party’s Over

These products have settled into the new phase of their evolution, but demand remains intact.

Strategic beta, also called smart beta, is a form of systematic active management. Strategic-beta exchange-traded funds are tied to indexes that make active bets of various shapes, degrees, and magnitudes against broad market-cap-weighted indexes that serve as their starting points. These wagers are embedded in the funds’ index methodologies. These blueprints can’t be revised, though. Unlike discretionary active managers, strategic-beta strategies can’t reroute once they’re off and running.

In September 2014, Morningstar introduced its naming convention and taxonomy for the fast-growing universe of strategic-beta exchange-traded products, or ETPs. Our latest report, A Global Guide to Strategic-Beta Exchange-Traded Products, provides a comprehensive update on the state of the global strategic-beta ETP landscape. It’s framed with our latest strategic-beta and index attributes, which were launched in Morningstar’s database in late 2018 and routinely refreshed since then.

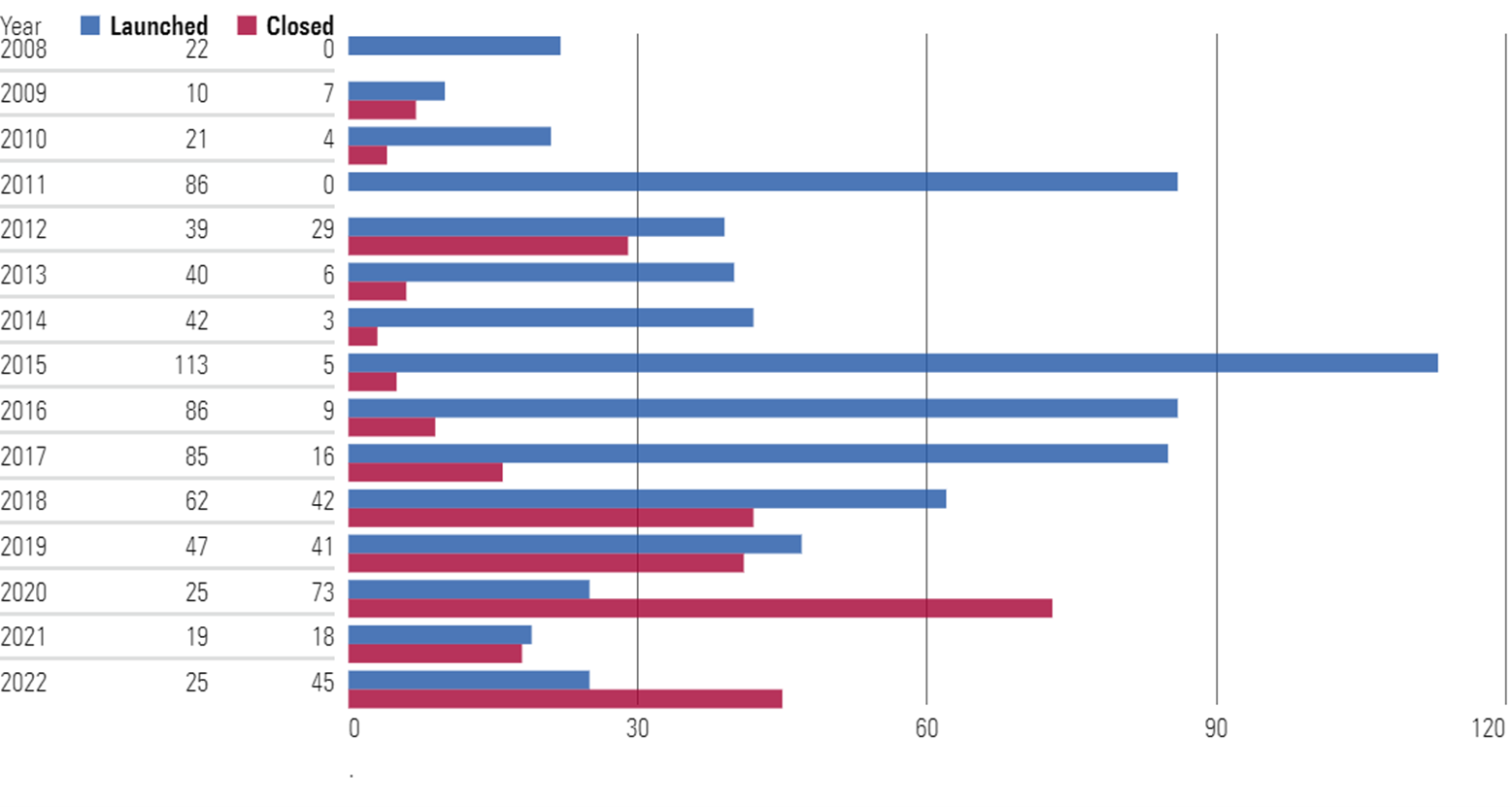

Global strategic-beta ETPs have settled into their niche. After a flurry of new products debuted in the 2010s, ETP providers have curbed strategic-beta product launches over the past couple of years. The number of listed strategic-beta ETPs grew 1.8% worldwide in 2022, primarily owing to growth in the younger Asia-Pacific regional market. In the United States, the number of closures (45) outstripped launches (22) in 2022, a testament to the market’s saturation. New product ranges like actively managed ETFs, covered call strategies, and defined outcome funds have displaced strategic beta from the limelight.

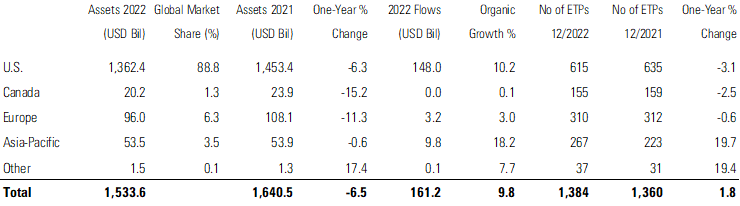

The Global Strategic-Beta ETP Landscape in 2022

Yet the strategic-beta ETP treasure chest has deepened even as it has refined. Investors poured $161.2 billion into the funds in 2022, translating into an organic growth rate of 9.8%. Annual net flows set a record for the second straight year. The shape and trajectory of the global strategic-beta market looks different from it did a few years ago, but these ETPs proved their firm footing in 2022.

United States: Dividend ETFs Climb the Ranks

The U.S. hosts the largest and most diverse stable of strategic-beta ETPs. This comes as little surprise given the size and maturity of the U.S. financial services industry. The U.S. market accounts for 44% of the total number of strategic-beta ETPs, which compose 89% of global assets. After a record $148 billion net inflow in 2022, U.S. strategic-beta ETPs held about $1.36 trillion. The roster has dwindled, though. The U.S. market listed 615 strategic-beta ETPs at the end of 2022—a 10% net reduction since the count peaked in 2019.

U.S. Number of Strategic-Beta ETP Launches and Closures by Year

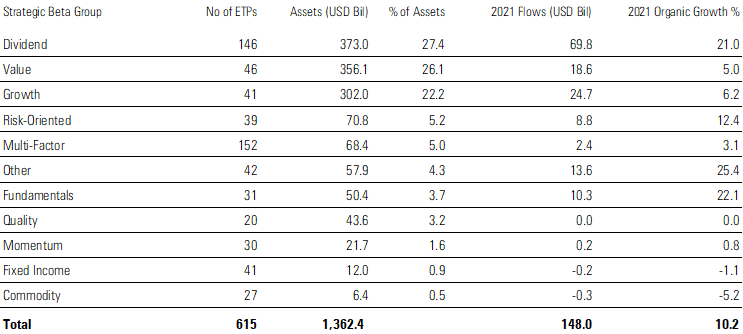

Three fourths of U.S. strategic-beta ETP assets are invested across three groups: Dividend, Value, and Growth. As they did in the global marketplace, Dividend ETPs ruled the roost in the U.S. in 2022. The nearly $70 billion these strategies hauled in grew their U.S. strategic-beta ETP market share to 27% and catapulted them to the largest strategic-beta group after entering the year behind Value and Growth.

U.S. Ranking of Strategic-Beta ETPs by Strategic-Beta Group

There was no such shakeup atop the list of top strategic-beta ETP providers. IShares and Vanguard account for just 15% of the total number of strategic-beta ETPs but have amassed nearly 64% of the total assets. Invesco occupied the third spot, a post it solidified after acquiring the ETF ranges of Guggenheim and Oppenheimer in the late 2010s. Schwab and its ascendant ETF lineup were far behind thanks to a blend of low-cost, no-frills strategies and fundamentally weighted funds.

3 Takeaways From the Global Strategic-Beta ETP Landscape

1) The global market for strategic-beta ETPs has matured

As of Dec. 31, 2022, 1,384 strategic-beta ETPs held roughly $1.53 trillion of assets worldwide. For most of the decade-plus, strategic-beta ETPs made inroads against their peers that are benchmarked to more-traditional indexes.

Recently, the global market has matured. To be sure, the strategic-beta ETP market takes different shapes in different parts of the world. In Asia-Pacific, for example, net flows and product launches broadly increased in 2022. But in the U.S. and Europe, which jointly constitute about 95% of the market, strategic-beta ETPs’ market-share gains have stalled.

Product closures outnumbered launches in the U.S. and Europe in 2022, perhaps the clearest indication that a once-burgeoning market segment has reached a shakeout. The number of listed strategic-beta ETPs slid by 3.1% in the U.S. and 0.6% in Europe last year. A difficult year in the markets may have made fund providers keener to cut bait on the strategies that had yet to resonate with investors.

Unrelenting fee competition is another sign that the space has grown up. Novelty and differentiation gave strategic-beta strategies more pricing leeway for years, but those days have drawn to a close. In the U.S., the asset-weighted average strategic-beta expense ratio was 0.19%—only a hair pricier than conventional ETPs’ 0.16% clip and 5 basis points cheaper than the 2018 asset-weighted average. Fee-conscious investors have squeezed out most strategic-beta ETPs for which there are alternatives.

2) Market forces shaped asset flows between strategic-beta groups in 2022

ETPs listed in the Morningstar’s Dividend strategic-beta group dominated the flowscape in 2022. These strategies gathered $85 billion of net new money globally in 2022, accounting for 52% of global net flows into all strategic-beta products. In most regional markets, the Dividend strategic-beta grouping is the largest in terms of total assets. Still, the Dividend cohort exceeded 20% organic growth in the U.S., Europe, and Asia-Pacific markets, reflecting strong investor demand in both absolute and relative terms.

The market backdrop in 2022 helped power Dividend funds’ commercial outburst. As inflationary pressure sparked a series of global interest-rate hikes, investors flocked to Dividend ETPs because they tend to favor stable companies and exhibit relatively low sensitivity to interest-rate changes.

Last year’s bear market breathed life into the Risk-Oriented strategic-beta group. After pulling about $30 billion from these products as markets cruised in 2020-21, investors piled a fresh $9.6 billion into them in 2022.

3) Strategic-beta and sustainability are not symbiotic

ETPs may qualify as both strategic-beta and sustainable; the two descriptions aren’t mutually exclusive. For example, Nuveen ESG Large-Cap Value ETF NULV targets stocks with strong ESG metrics and sits within the Value strategic-beta group. The rise of environmental, social, and governance investing figured to be a new avenue for strategic beta to grow, especially after sustainable-fund providers already applied ESG tints to conventional investment strategies.

So far, combining sustainable and strategic beta has not emerged as a trend. In Europe, the largest market for sustainable investing, assets in sustainable strategic-beta ETPs accounted for 8.5% of the strategic-beta ETP market—notably smaller than sustainable funds’ 20% share of all European fund assets as of end-2022. [1] Products that combine the philosophies haven’t caught on in the U.S., either. The 15 U.S. strategic-beta ETPs labeled as sustainable tallied only $3.1 billion, or less than 0.2% of the U.S. strategic-beta market.

Conclusion

The global strategic-beta ETP market has evolved. Once an upstart pocket of the fund universe, most of these strategies have seen their menus shrink and their market share plateau. That doesn’t mean these products have fallen off the map. Dividend funds led a record-setting year of inflows in 2022, and the Risk-Oriented group saw a resurgence of its own. Strategic-beta ETPs no longer look like rising stars, but they have solidified their spot in the global investment solar system.

[1] Bioy, H, et al. 2023. “Global Sustainable Fund Flows—Q4 2022.” Morningstar. https://research.morningstar.com/articles/1133348/global-sustainable-fund-flows-q4-2022-in-review

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_29c382728cbc4bf2aaef646d1589a188_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)