July CPI Forecasts Predict Continued Slowing Inflation

The U.S. economy is strong, and upward pressure on prices is easing.

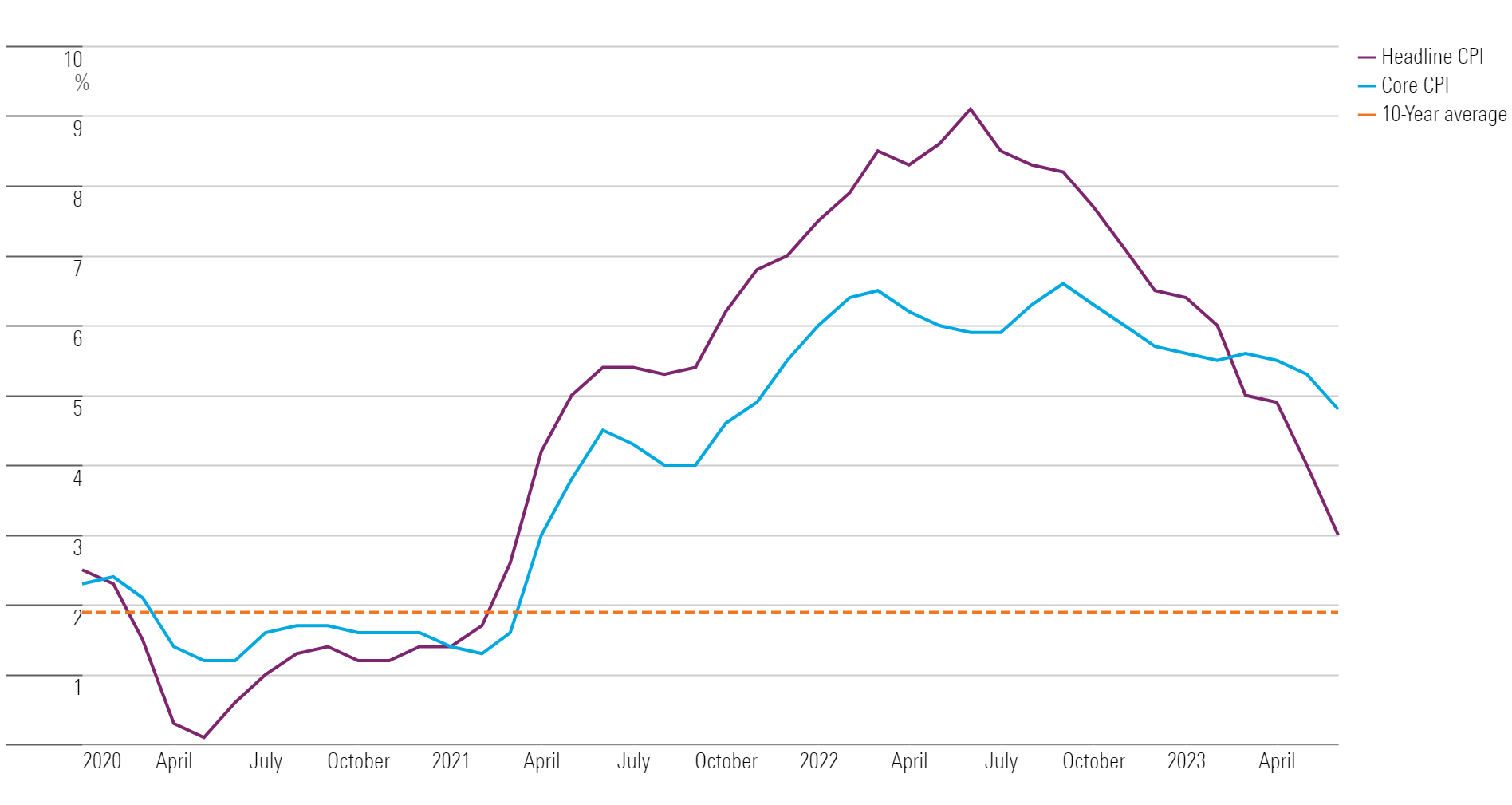

Inflation has started to meaningfully slow, even with the economy still creating plenty of new jobs for Americans. If this trend continues, the economic outcome could be even better than the Federal Reserve is hoping for.

Economists are expecting another month of slowing inflation in July. “The underlying rate of inflation is coming down such that inflation will stay down for good,” says Preston Caldwell, chief U.S. economist at Morningstar.

Scott Clemons, chief investment strategist at Brown Brothers Harriman, echoes that sentiment: “Inflation is really, really coming down. We can see that objectively in the figures.”

The July Consumer Price Index report is expected to show a 3.3% increase in inflation from year-ago levels, according to the FactSet consensus forecast. That’s well below last July’s reading of 8.5%, though a hair above last month’s reading.

For July, the headline CPI is forecast to rise 0.2% from month-ago levels, while core CPI (which excludes volatile food and energy costs) is also expected to rise 0.2%. The June CPI report showed the overall CPI rising by 0.2% as well, which was an uptick from May’s 0.1% rise.

“In the July CPI report, the headline number won’t be as informative as the details,” says Clemons. “The one detail that really warrants attention is the cost of shelter. It makes up 28% of the overall picture, and it’s been stubbornly persistent.” He says the cost of shelter is starting to fall, and that he’s looking for the number to fall further in July.

CPI vs. Core CPI

July CPI Report Forecasts

Forecasts for the July CPI report show a continuation of last month’s trend, according to FactSet consensus estimates.

- The CPI is forecast to rise 0.2% in July after rising by the same amount in June.

- Core CPI is forecast to rise 0.2% for the second consecutive month in July.

- The CPI, year over year, is forecast to rise 3.3% in July after rising 3.0% in June.

- Core CPI, year over year, is forecast to rise 4.8% in July for the second month in a row.

Caldwell also expects July’s inflation to be similar to June on a month-by-month basis. “A few deflationary contributors from a month ago won’t repeat this time, such as airlines and lodging, but we’re likely to see a large deflationary impulse from used cars,” he says.

The year-over-year inflation numbers are largely set in stone, according to Caldwell. He says, “A decrease in energy prices compared to where they were a year ago is the biggest factor pushing down the headline year-over-year figures.”

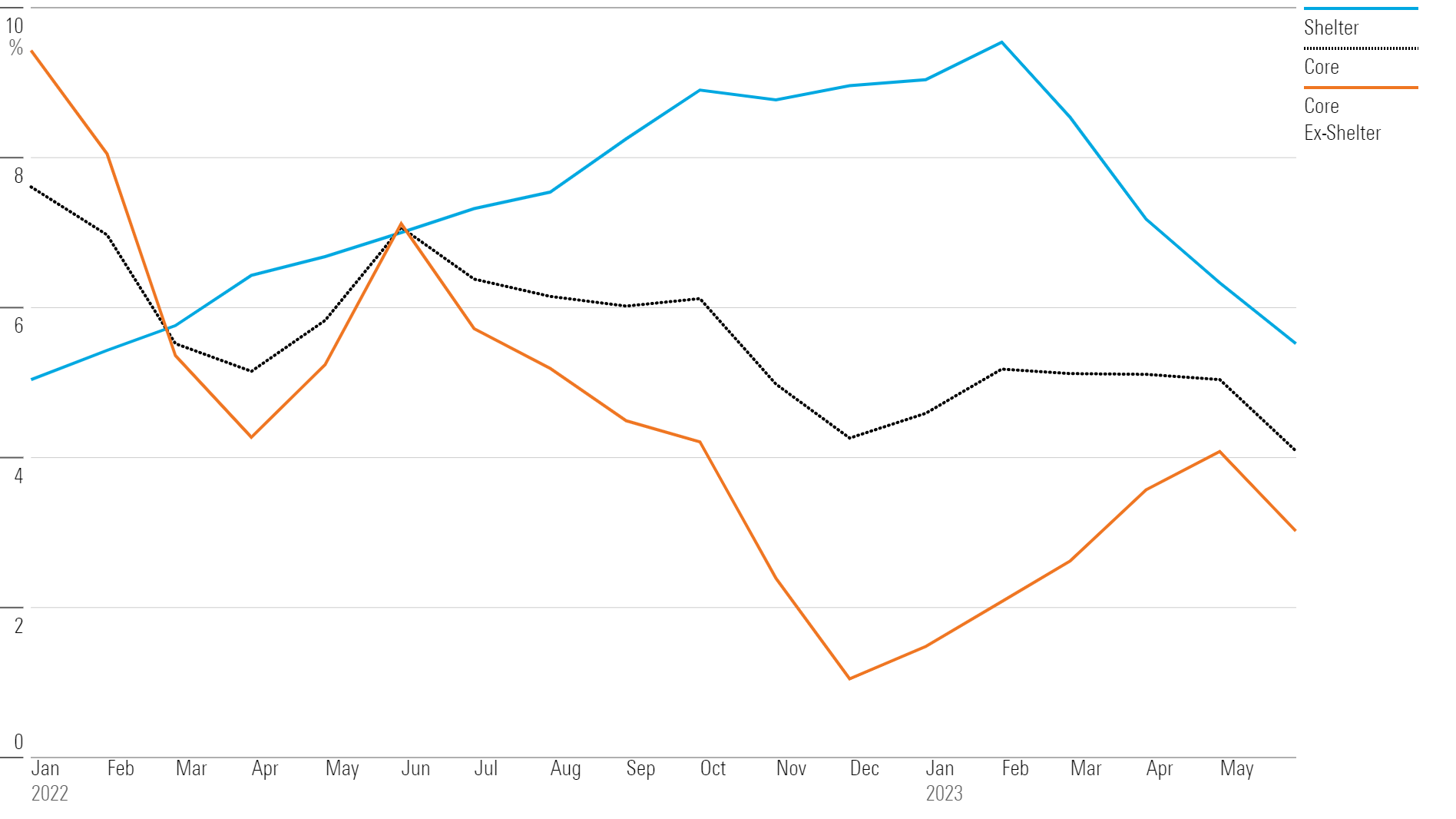

Shelter Costs Are Key

“Shelter costs (rents) are a really important core part of inflation that is proving to be quite sticky,” says Clemons. “The Fed isn’t willing to declare victory on inflation until they begin to see some substantial improvement in shelter numbers in particular.”

Inflation for shelter prices peaked at 8.1% year over year in April, according to Clemons, and it’s already started to fall. Even so, shelter has been the largest contributor to rising prices over the past few months, accounting for over 70% of the total CPI increase in June.

“It’s happening now, and I’d love to see shelter numbers come down further,” Clemons says. “If it goes down to 7.6%, that’s a step in the right direction.”

Part of the reason shelter prices have been stubborn, Clemons explains, is that they lag most other portions of the CPI: “The prices of eggs can go up and down every week, but for rent prices, you sign a lease once a year and those prices are locked in.” Clemons says that the Fed is aware of this lag, but it wants to see the numbers fall further before its work is done.

Impact of Shelter on Core CPI

A Best-Case Scenario?

“A best case is that economic growth doesn’t slow (meaning it would remain at about 2%), but inflation falls to 2% anyways,” says Caldwell. “Whether this occurs hinges on the extent of further supply-side improvement.”

Caldwell’s base case projection is for price pressures to swing from inflationary to deflationary in 2023 and the following years, due largely to the resolution of supply chain constraints in areas like durable goods and energy. “This will make the Fed’s job of curtailing inflation much easier,” he writes. “In fact, we think the Fed will overshoot its goal, with inflation averaging 1.8% over 2024-27.”

Upcoming CPI Reports Will Impact Fed Policy

“If core CPI averages below a 3% annualized growth rate for the three months ending in August—which I believe it will—this would demonstrate substantial progress in bringing core inflation down, and I believe the Fed would refrain from hiking in September,” Caldwell says.

Most futures market participants anticipate that the Fed won’t hike its target rate at its September meeting. According to the CME FedWatch Tool, 86.5% of respondents foresee the target rate holding steady at its current range of 5.25%-5.50%. Just 13.5% expect the Fed to raise rates to a range of 5.50%-5.75%.

Clemons takes a different view. “I’m not terribly convinced that the Fed’s work is done,” he says. “Given how healthy economic activity is, we aren’t seeing any real negative effects of rising rates on the economy. That may give the Fed the luxury of making sure there’s truly a cap on inflation. One more 0.25% hike likely won’t do much to slow down the economy, but it will help slow inflation.” Clemons says he wouldn’t be surprised if the Fed hikes rates again between now and the end of the calendar year.

Overall, he says, “The next two CPI reports, as well as the jobs report, are going to give us really good insight into the direction of inflation, and therefore the direction of near-term Fed policy.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MQJKJ522P5CVPNC75GULVF7UCE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/S7NJ3ZTJORFVLCRFS2S4LRN3QE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)