Hot Inflation May Mean an Even More Aggressive Fed

Factors driving high food and energy costs should ease, but timing remains uncertain.

Inflation continued to run hot in May, with rising price pressures again hitting consumers where it hurts: at the fuel pump and at the grocery store.

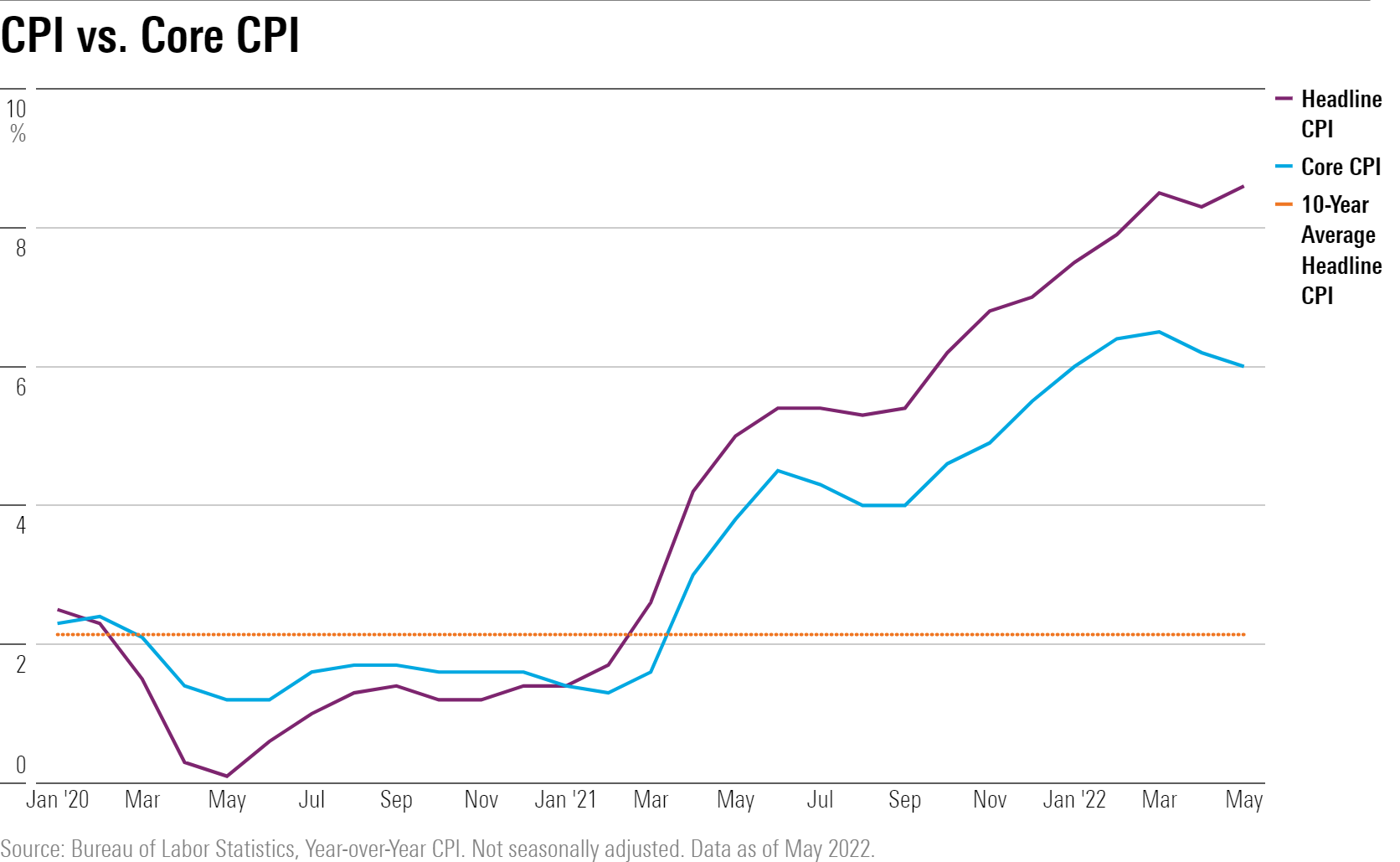

While overall inflation pressures should still cool off in the second half of 2022, for now, rising gas and food prices remain a primary driver behind inflation remaining at 40-year highs. The latest data suggest the Federal Reserve will need to remain on course for frequent and large increases in interest rates in the months to come, if not move even more aggressively than has been expected.

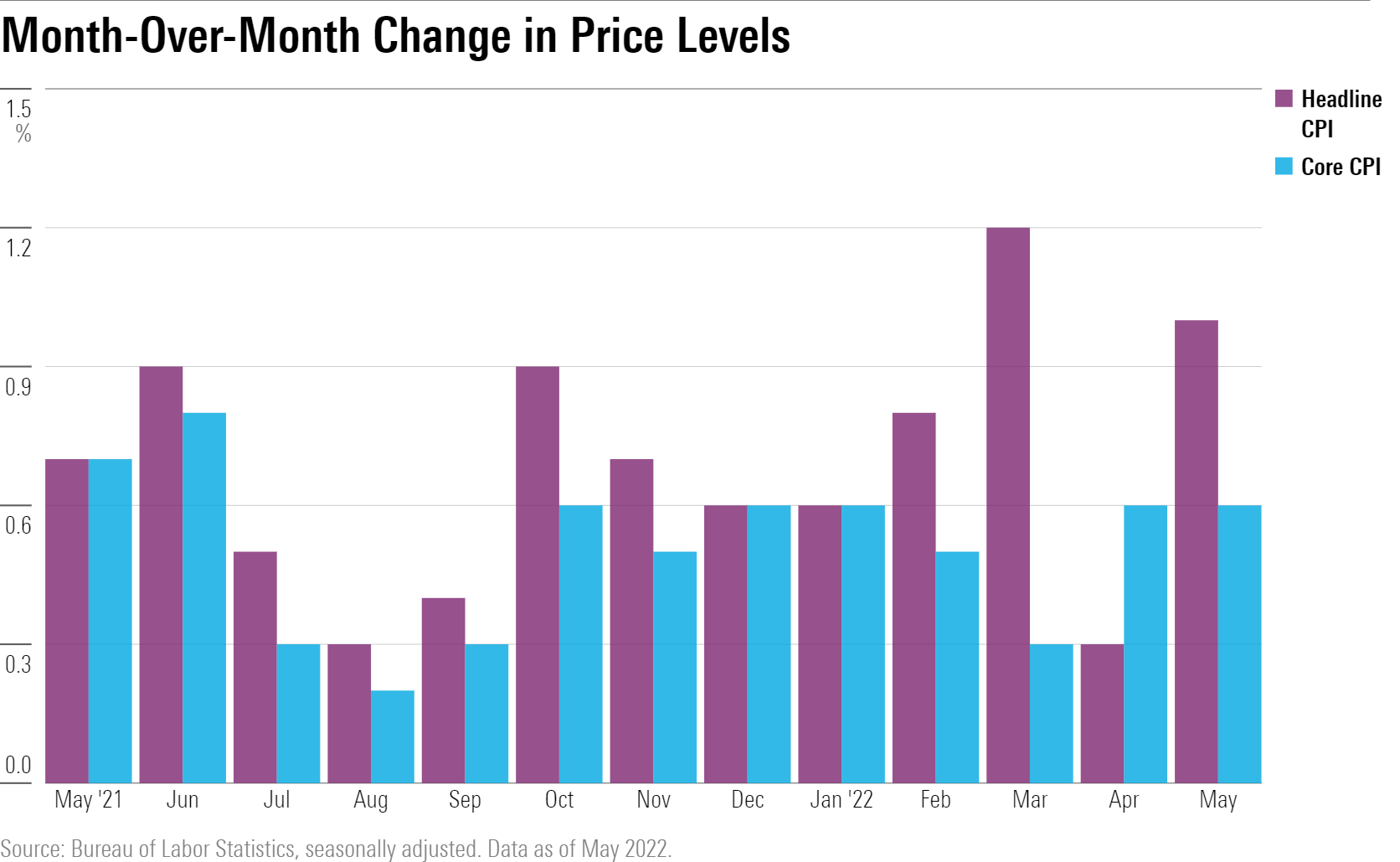

The Bureau of Labor Statistics reported the Consumer Price Index rose 1.0% in May from April, a significant acceleration from the 0.3% increase in April and a larger rise than economists had predicted. On an annual basis, the CPI rose 8.6%, the largest 12-month increase since December 1981. The increase in May was broad-based, the BLS said, with the indexes for shelter, gasoline, and food being the largest drivers.

Even excluding food and energy prices, which tend to be volatile on a monthly basis, the rest of the index also rose more than expected in May. The so-called "core CPI" rose 0.6% in May, the same rise as posted in April.

“While inflation continues to be driven by temporary issues, such as the Ukraine War, aggressive Fed tightening will probably be needed to ensure that high inflation doesn't become embedded in the economy,” says Preston Caldwell, chief U.S. economist at Morningstar.

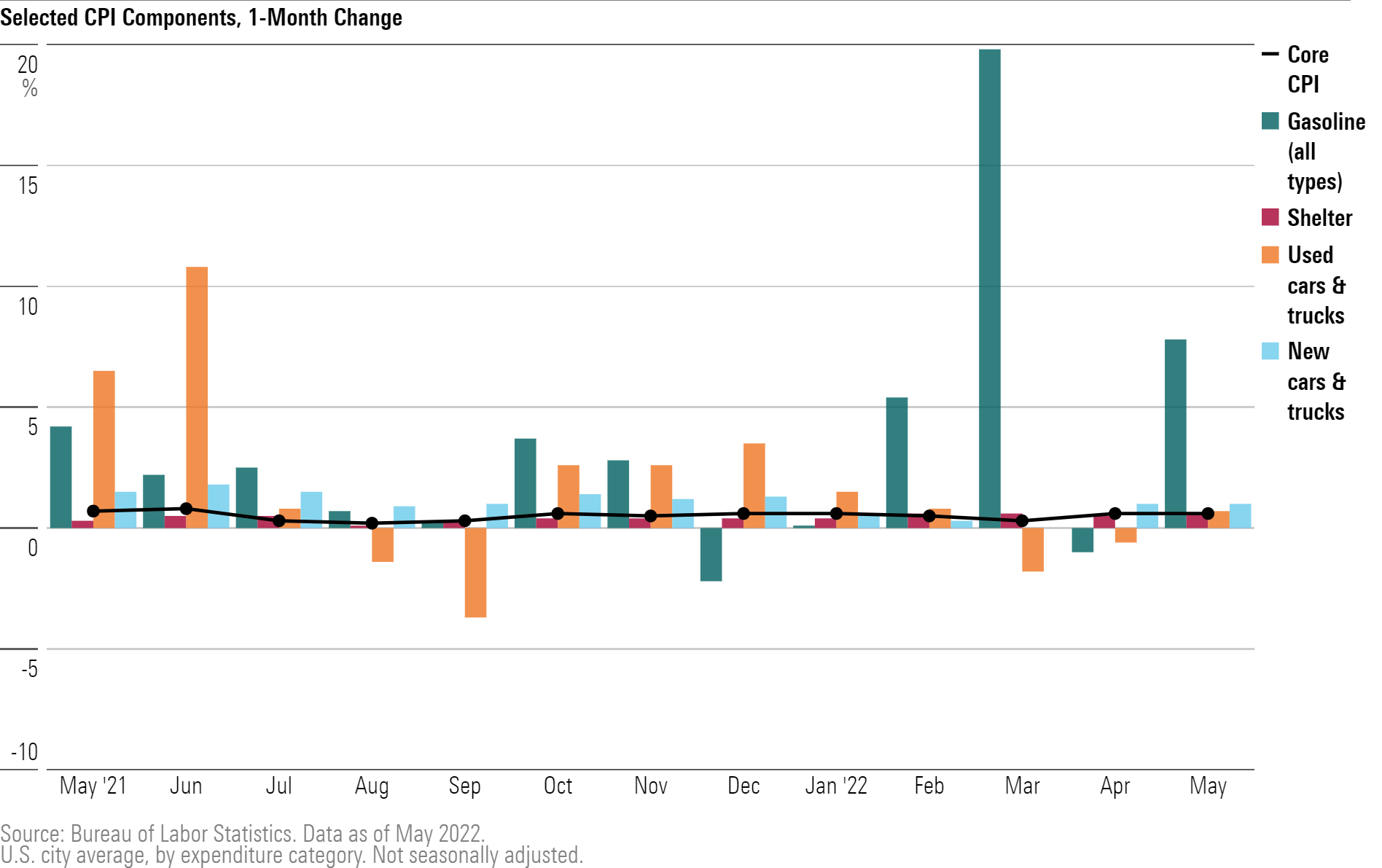

“We still expect that the main contributors of high inflation since the start of the pandemic—energy, food, and autos—will eventually reverse in impact,” he says. For example, Morningstar expects oil prices to fall from their current level of around $120 per barrel to $55 per barrel by 2025, as oil producers adjust to make up for the loss in Russian supply. “Supply for vehicles and other goods should also loosen, helping to cool off high prices,” he says.

“The main issue is timing, which is highly uncertain,” Caldwell says. “If these supply issues take too long to resolve, inflationary momentum could become embedded in the economy. For now, we don’t see large signs of that happening; for example, wage growth has been decelerating over the last several months.”

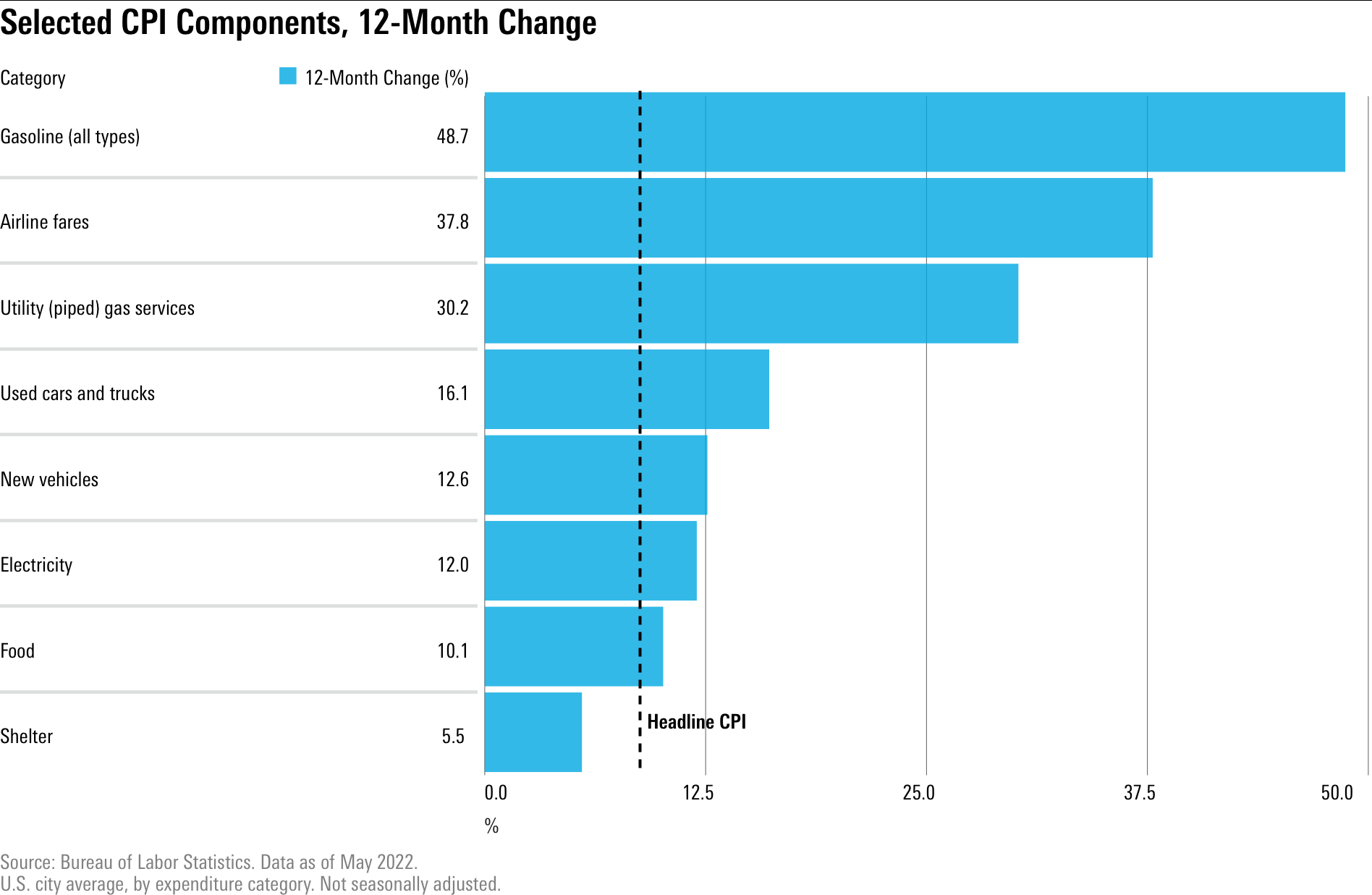

Across the spectrum of energy costs for consumers, year-over-price increases were meaningful. Gasoline prices rose 48.7% from May 2021, natural gas posted its largest increase since October 2005 with an 8.0% jump, electricity rose 12.0%, the biggest rise in August 2006, and fuel oil prices more than doubled with a 106.7% increase, the largest increase since the government began keeping track in 1935.

Food prices, meanwhile, rose 1.2% in May from April and rose 11.9% from a year ago, the largest 12-month increase since the period ended April 1979. All six major growth store-food group indexes rose in the month, and the index for food away from home posted a 7.4% jump from a year ago, the biggest increase since November 1981.

“The largest driver of the fast pace of inflation in May was ongoing impact from the war in Ukraine, which has propelled food and energy prices higher,” Caldwell says. “The direct effect on consumers' food and energy costs caused the wedge between headline and core inflation. But there were also indirect effects on core inflation, where energy is used as an input. Notably, air travel prices increased 13% month over month thanks greatly to higher jet fuel costs. The prices of all manner of goods are impacted by higher trucking costs via higher fuel costs.”

Caldwell notes that beyond the ripples from higher gas and food prices, other factors were at play in the big May CPI jump. “We also saw a 0.9% uptick in vehicles prices, indicating that resolution of supply chain issues isn't yet providing relief from high prices,” he says. “Shelter prices increased 0.6%, modestly ahead of its prepandemic average of 0.3%.”

Taken together, the May CPI report shows the difficulties that consumers are facing especially when income is viewed on a “real” basis – adjusting for inflation. “Given that wage growth has been decelerating as inflation has remained hot, consumers are now getting squeezed by falling real wages,” says Caldwell. “The personal income data shows that consumers have compensated in the near-term by dipping into savings which were greatly boosted during the pandemic. This dynamic can't last forever, and we expect real wages to improve as high energy and food prices cool off.”

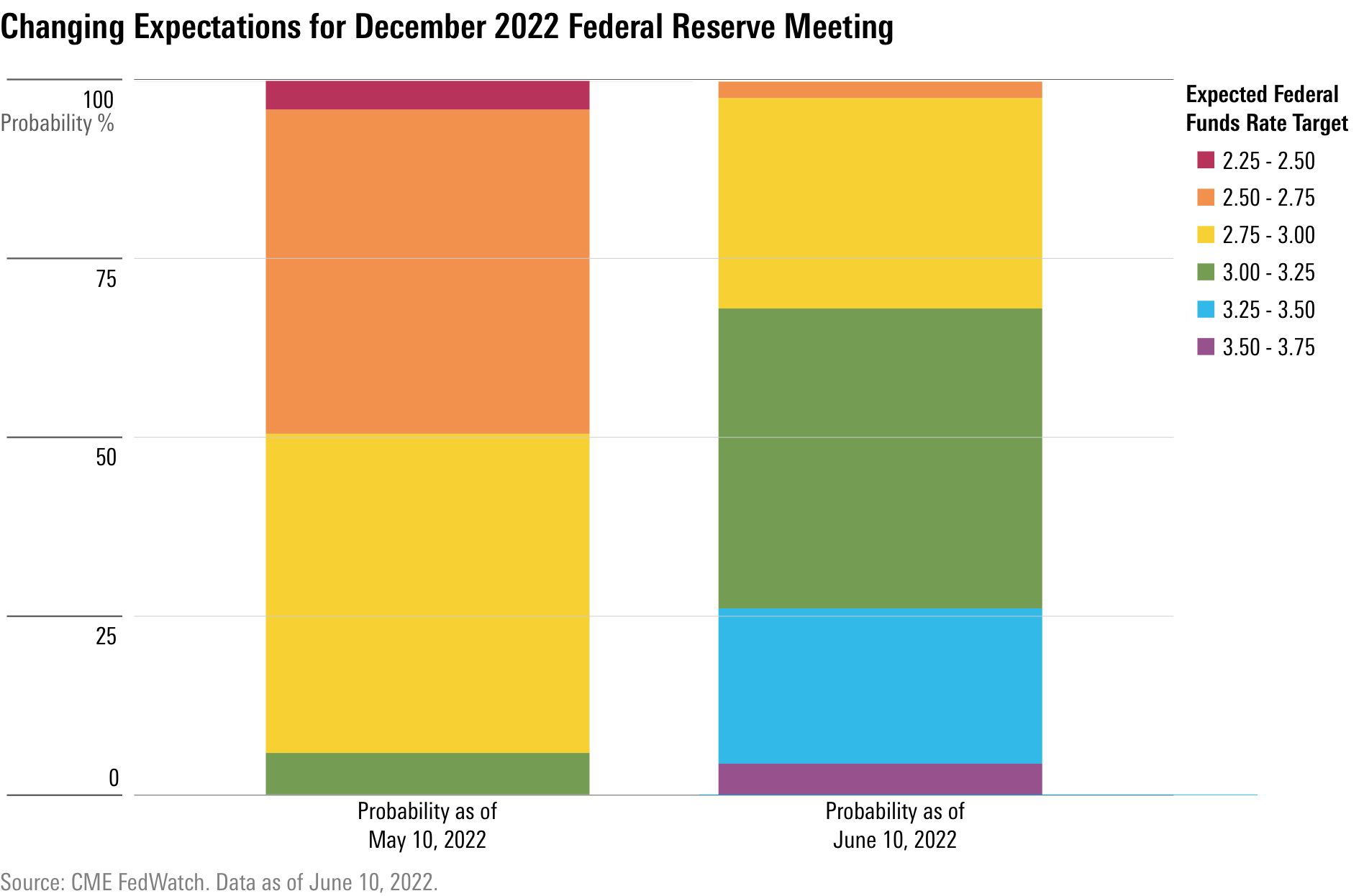

For the Fed, financial markets are interpreting the CPI as suggesting the central bank will, if anything, have to be even more aggressive about raising interest rates. In the bond futures markets, expectations are rising that by year-end, the Fed will lift the federal-funds rate to above 3% from its current level of 0.75%.

Fed policymakers are meeting on June 14 and 15. Markets have been expecting the Fed to raise the funds rate by a half percentage point at both the June meeting and in July. “In next week's FOMC meeting, we could see the Fed adopt a more aggressive approach by hiking the federal-funds rate by 0.75% instead of the planned 0.5%,” says Caldwell.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/010b102c-b598-40b8-9642-c4f9552b403a.jpg)