Getting Ahead of Inflation Changes in 2023

With so much uncertainty, there’s value in preparing for different scenarios.

The year 2022 caught investors off guard, with persistently high inflation and aggressive responses from central banks worldwide. Could 2023 be more of the same? Potentially. There are also reasonable arguments to be made for an environment where inflation is declining. Yet another, worse, potential outcome is stagflation, where economic growth stalls but inflation remains high.

With the full spectrum of possibilities in mind, Morningstar Investment Management looks to position portfolios to weather a range of inflationary environments in 2023.

2023′s Inflationary Environment Is Uncertain

Inflation remains a challenge for much of the developed world, from the United Kingdom, to Europe, to the United States. This is no small concern. Beyond the pressure that inflation applies to consumers’ wallets, it’s also a destructive force on investments. That is, inflation demands a higher return hurdle to meet investor goals while simultaneously making returns harder to come by, reducing the value of bond income payments and eating away at company earnings.

The Bank of England, the European Central Bank, and the Federal Reserve have each taken steps to curb inflation, aiming to cool demand and reinforce price stability in their respective economies. The central bank response to inflation has had an equal, or perhaps even more costly, impact on asset prices as inflation itself. With interest rates moving higher, bonds have been particularly hard-hit—U.S. Treasuries suffered double-digit declines in 2022, which is among the largest in history.

The paths ahead for inflation and interest rates are arguably two of the most critical variables for 2023 market outcomes. Should inflation surprise to the upside, central banks may very well continue to push rates higher, economies could teeter further into recessions, and asset prices could continue to decline. But higher inflation isn’t the only risk in 2023. If inflation is not as quick to dissipate as consensus thinks, central banks may maintain a tightening posture for longer. Stubborn inflation and higher interest rates could mean that the easy above-average equity and bond returns of the last decade are a thing of the past, at least for now.

Our View of Inflation in 2023 and Beyond

Of course, no outcome is preordained. In the U.S., inflation hawks can point to any number of persuasive arguments for a bleak inflation outlook, but the market itself is pricing in moderate levels of U.S. inflation over the next five years, with falling rates from the Federal Reserve by the end of 2023. Under those conditions, it’s not a stretch to imagine U.S. markets bouncing back in short order, rewarding investors who have stayed invested.

Easing inflation and rates in the U.S. bodes well for emerging markets, too, particularly those with debt denominated in U.S. dollars. However, inflation rates in the U.K. and Europe are less contingent on U.S. outcomes. Nuanced issues exist in these markets, with the debt challenges in the U.K., the continuing European energy crisis, and uncertain geopolitical outcomes. Given this dynamic, it’s hard to imagine a quick resolution to inflationary concerns in those markets.

Yet even in the U.K. and Europe, five-year inflation expectations are only slightly above long-term inflation targets—and well below current levels—underscoring that, over the long run, the momentum for inflation is generally to the downside.

Our own inflation outlook leans benign. As long-term investors with valuation models focused on the coming 10 years, not the coming 10 months, our inflation and interest-rate expectations are not herculean. But building portfolios for a range of time horizons and investment goals requires outlooks that don’t just focus on the next 10 years but also on the journey markets take to get there.

With that in mind, we recognize that in today’s uncertain climate, the range of outcomes in the near term is particularly wide. Moreover, the market, while typically quite good at pricing in possibilities, has been consistently off the mark on inflation—and interest rates—over the past year.

Positioning Our Portfolios for a Range of Scenarios

As we consider the allocation of our portfolios, we size asset classes not just based on their valuation but also on their behavior in a range of inflation and economic-growth environments. For example, because of markedly higher valuations, we reduced our energy exposure over the course of 2022. However, we have retained exposure to master limited partnerships and European energy, both of which are relatively cheaper in our eyes than broad U.S. energy and may prove resilient should inflation remain persistent.

We’ve also maintained exposure to U.S. Treasury Inflation-Protected Securities, which have sold off over the course of the past year as real rates have risen. These now appeal to us, not just because of their better valuations but also because they offer portfolios a measure of protection against negative inflation surprises. In fact, our analysis suggests both energy and U.S. TIPS could prove effective even in a stagflationary environment, when growth disappoints but high levels of inflation persist.

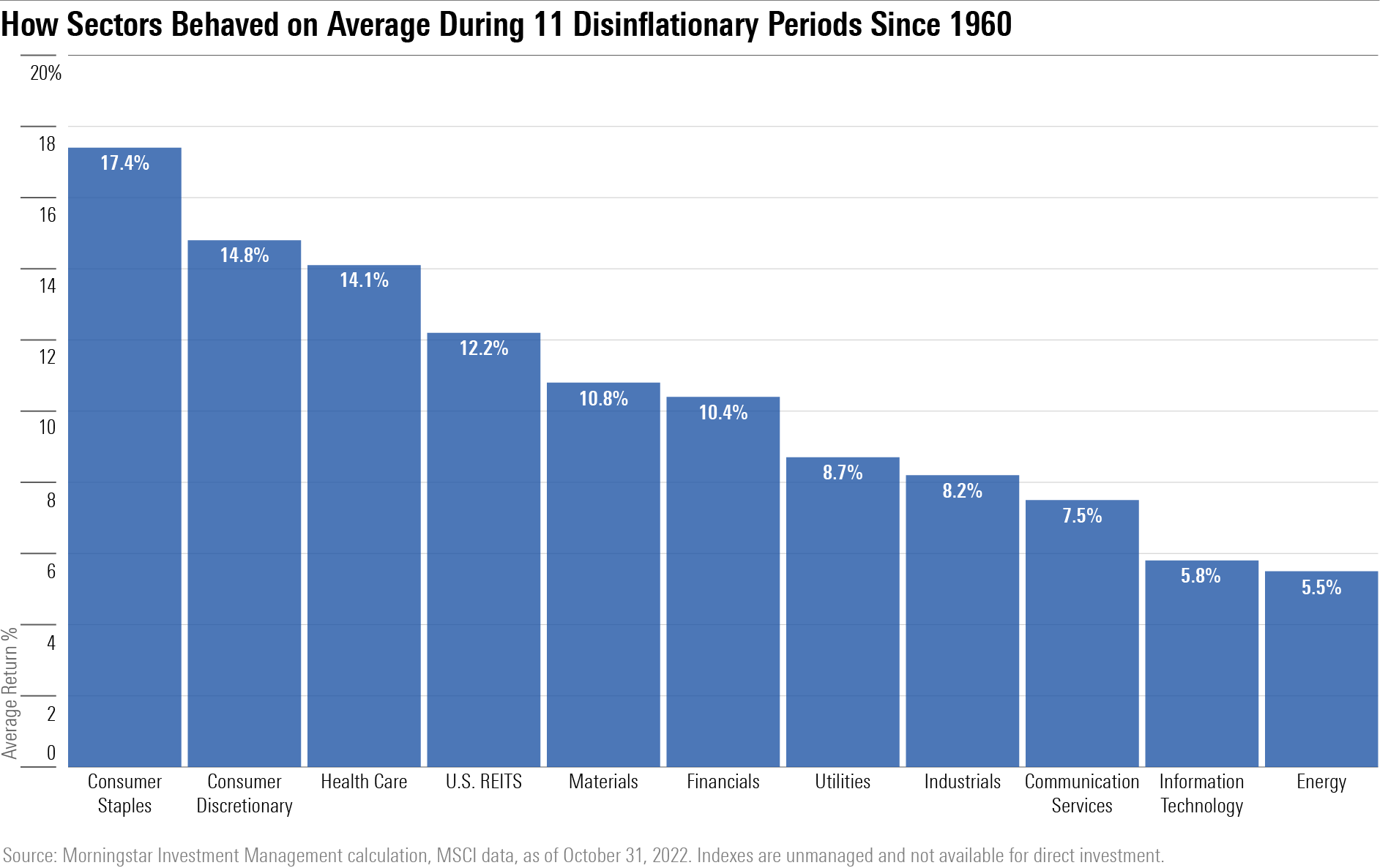

While we’ve considered portfolio outcomes in the event that inflation and interest rates remain high, we’re also cognizant of how portfolios could behave if we enter a disinflationary environment, which is characterized by positive but slowing rates of inflation. Under those conditions, our analysis of history suggests higher-duration fixed income could outperform. An increased level of fixed-income exposure may therefore do well in that environment. Within equities, our analysis suggests that defensive sectors are also attractive in the event of disinflation.

Overall, it’s not an inflation forecast or rate expectation that dictates portfolio positioning. In fact, we think forecasts of that variety are largely a fruitless exercise, especially when they matter most. Investors and economists have learned that lesson the hard way over the past year. To our mind, it is far more critical to acknowledge the full spectrum of possibilities and position portfolios to weather the range of them.

From deflation to inflation to stagflation and beyond, we enter 2023 considering each outcome, weighing market expectations against the price. It’s this emphasis on planning over prediction that we believe will allow for good client outcomes over the long run.

This article was adapted from the Morningstar Investment Management 2023 Outlook, published December 2022. Download the full report here.

Morningstar Investment Management LLC is a Registered Investment Advisor and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. Opinions expressed are as of the date indicated; such opinions are subject to change without notice. Morningstar Investment Management and its affiliates shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1bb3b7d2-89c3-40c6-ad6d-01d4f0004f7a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/XLSY65MOPVF3FIKU6E2FHF4GXE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1bb3b7d2-89c3-40c6-ad6d-01d4f0004f7a.jpg)