Mistakes to Avoid When Selecting a Large-Growth Fund

Go beyond total returns and dig into the nuances of the category.

Let’s say you’re fed up with a large-growth mutual fund you’ve held for umpteen years. You’re sick of watching it trail its peers during a fantastic market for growth stocks, and you’ve finally decided to pull the plug. How will you go about choosing a new fund?

You could just look at trailing returns and pick one of the best-performing funds of the past year or five years, but that’s a lazy and ineffective method, as you surely know (top performers from a recent past period often revert to the mean and underperform in the future).

Another approach might be to select from among funds that receive a Morningstar Analyst Rating of Gold or Silver. This approach has more merit. The Morningstar Analyst Rating is a forward-looking rating reflecting our analysts' assessments of a fund’s ability to outperform in the future, and it has shown to be a good predictor of future success (and the updated version of the ratings system introduced this past fall promises to supply even greater reliability).

But deciding on a group of Morningstar Medalists will only get you so far. How does one choose from among a lengthy list of Gold- and Silver-rated funds? What are the salient characteristics and differences among them that would determine the best fit for your portfolio? What are the most important factors and metrics to examine?

In this article, I will attempt to tackle these questions, but my larger aim is twofold: 1) to clarify some of the nuances of the large-growth Morningstar Category, providing context for making your fund selections; and 2) to provide some insight into what we might call “manager selection thinking,” or the analytical process that professional managers and selectors use, as a way to help enlighten and improve your own process. This should benefit you whether you are looking to replace a fund or build a portfolio from scratch. In the future, I intend to write similar pieces covering different categories and asset classes.

Caveats Before I jump full bore into the discussion, there are a few caveats and assumptions to put on the table. First, it is important to acknowledge that fund selection falls at the top of the pyramid of investor priorities that Christine Benz helpfully lays out. In the end, choosing the best managers will have less impact on your financial success than steps such as saving the right amount or setting an appropriate asset allocation. That said, as a reader of Morningstar.com, you likely have a greater interest in and capacity for the intricacies of fund selection than the typical investor.

In addition, my focus here is on actively managed funds. As I’ve noted in the past, selecting a passive fund is almost always a reasonable option. The considerations are somewhat different, though, but I will still consider active funds relative to an index in the discussion that follows. These kinds of deliberations are also pertinent if you are mixing passive and active funds, as many investors do.

Finally, I want to make clear that this column is not intended to serve as a list of what I consider the “best” large-growth funds (which is, in any case, too vague a designation to be meaningful). I will be mentioning specific Medalist funds, and by virtue of their ratings you can expect that they are high-quality, but I am using them as examples, not as recommendations per se.

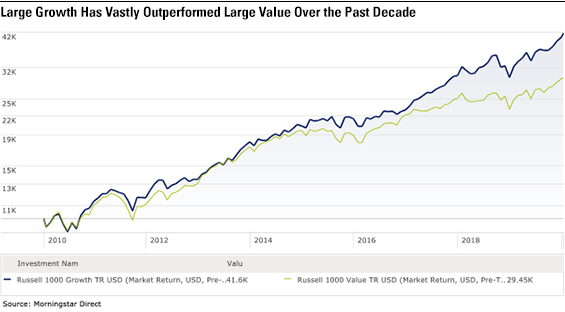

Putting Your Growth Allocation in Context Although it's not the primary focus of this article, as an investor a first question you may want to ask yourself is how heavily you want to load up on growth funds. It's been quite a run for large-growth stocks, and the divergence between growth and value along with potential causes was explored in detail in a series of Morningstar.com articles last fall. A simpler illustration of the divide between large growth and large value appears in Exhibit 1. The Russell 1000 Growth Index gained more than 33% in excess of the Russell 1000 Value Index over the past decade.

Exhibit 1

All of which may signal caution. It’s unlikely that such a historic disparity will remain in place indefinitely, and from a somewhat crude valuation standpoint, large growth is certainly far dearer than large value (with a trailing 12-month price/earnings ratio of 28.6 versus 18.3 for the value index). Still, that’s not to say that growth can’t continue its run for longer. The best option for most investors is probably to stick with your strategic allocation to growth and not overweight it. Most people will have seen their growth allocation rise out of line with their target weight, so now might be a good time to rebalance toward that target if you haven’t already. It may also be cause to consider approaches to growth investing that have been less in favor but that may do better in more-challenging future markets (more on that below).

Finally, you should consider your overall risk tolerance level, as well as growth exposures in other parts of your portfolio. As I’ll discuss, the style nuances of large-growth funds can lead to pronounced differences in their portfolio composition, risk characteristics, and performance patterns, so it’s important not to select a fund in a vacuum.

Key Considerations in Selecting Large-Growth Funds

Style of Growth Investing A common way of distinguishing growth investing styles is between fast/accelerating growers (think Netflix NFLX), sustainable or durable growers (firms with strong consumer brands like McDonald's MCD come to mind), and cyclical growth firms. Each of these will have different traits--fast growers tend to have high valuations along with their high growth rates and can be susceptible to sharp reversals, for example, while cyclical growers may outperform only during certain phases of the economic cycle. And some fund managers may choose to focus only on the most aggressive growth stocks, increasing the risk of their offerings, while others may seek more-diversified sources of growth in an effort to produce a smoother ride for investors.

There are various ways to suss out a fund’s style, including reviewing the Morningstar Analyst Report, reading management’s letters to investors, or examining the fund’s valuation metrics or Morningstar Style Box placement. I’ll get into more detail on some of these points below, as there tends to be overlap between different characteristics.

Concentration Level Some managers may choose to focus on 25-70 of their best ideas, increasing potential alpha but also the chance of idiosyncratic holding risk (a single stock blowup can really damage the portfolio); others may choose to diversify across hundreds of holdings, significantly reducing such risk. A broad portfolio does not necessarily mean low risk, however, if the manager focuses on the most aggressive growth areas. Concentration levels can be discerned from a fund's percentage of holdings in the top 10 and by total number of holdings.

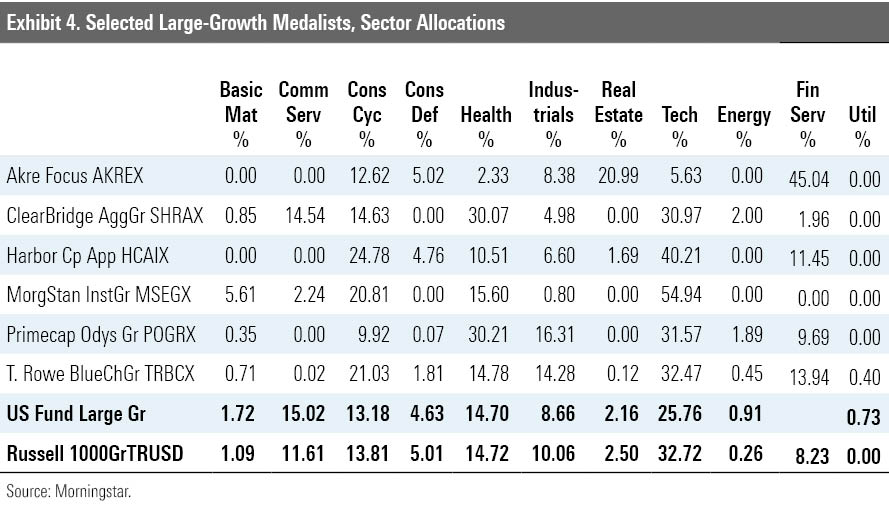

Sector Weightings A companion to overall concentration risk is sector concentration. Large-growth managers tend naturally to invest more heavily in certain sectors, such as technology, healthcare, and consumer cyclicals. But some managers choose to up the ante by significant overweighting or underweighting a given sector. Such deviations from the index may be a source of the fund's success but can also lead to periods of investor discomfort if those sectors are out of favor or the manager struggles with stock selection. It is worth examining a fund's sector weightings relative to the index and the large-growth category averages to understand where those biases lie, and then assess your own comfort with the positioning.

Domestic vs. International Exposure Most U.S. large-cap growth funds invest predominantly in the United States. (The category average is 92%.) Some managers look farther afield for growth, though, and deploy as much as one fourth of their assets in foreign companies. As an investor, you should ask yourself whether this makes a difference to you. Some might say that it's a distinction without a difference, since many U.S.-domiciled firms generate significant revenues abroad and a good manager should look for growth wherever it can be found. Others might feel that international investing should be limited to a dedicated portion of their portfolio. At the very least, you'll want to account for the overseas exposure when looking at your total portfolio allocations.

Style-Box Positioning The Morningstar Style Box is a useful guide to how strictly a manager keeps within the bounds of the large-growth area of the style box. Pure fealty to the style-box constraints is neither typical nor desired, but in selecting a manager you'll want to know if the style leans starkly to the growth end or is more diversified, sprinkling in more core-type holdings (which could be slower growth firms or out-of-favor stocks with lower valuations). Similarly, you should have a sense of whether the manager has boosted returns from a generous sampling of smaller-cap firms. There's nothing wrong with such an approach, but as an investor you'll want to make sure you are still in line with your overall targets for smaller- and larger-cap stocks, as well as have an understanding of the sources of performance. We have often seen cases where a manager amassed a strong long-term record generated in part from smaller-cap stocks, but as the fund got larger and the manager was forced to invest in larger, more liquid stocks, that historical edge dissipated. (Although I lack the space to cover it in this article, risk-factor analysis is a useful companion piece to style-box analysis.)

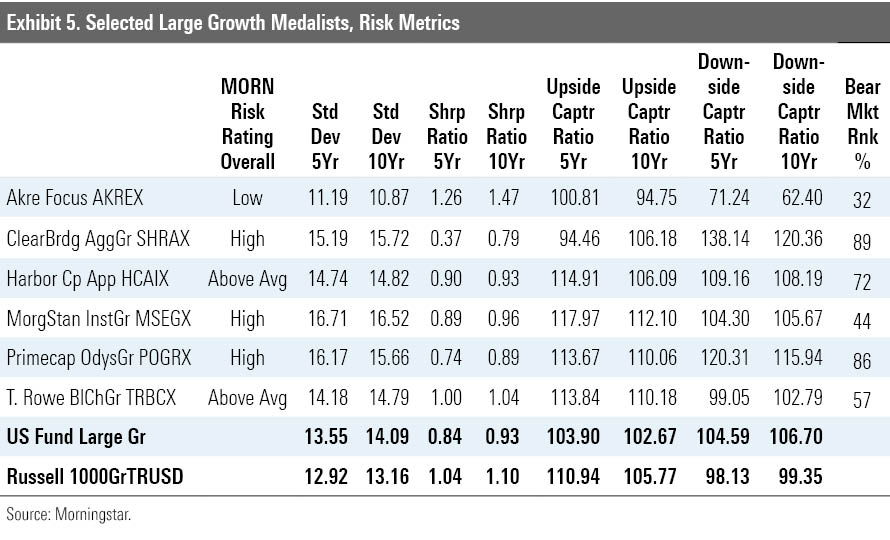

Risk Characteristics The above items will convey the fundamental basis for a fund's performance patterns, but it's also helpful to consult calculated risk metrics for another view of the fund's risk and risk-adjusted performance. Growth funds on average exhibit higher volatility than core or value funds, so be sure to look at risk stats on a relative basis and don't cherry-pick stats in isolation. It's better to take a mosaic view. Volatility of returns as expressed in standard deviation can give you an idea of how bumpy a ride you might experience, but it doesn't necessarily convey how deep your losses might be. Risk-adjusted measures like Morningstar Risk and the Sharpe ratio are more inclusive, but with the Sharpe ratio be careful to observe whether the numerator (returns) or denominator (risk) is the bigger driver of the result. Similarly useful are downside and upside capture ratios, which can convey magnitude of potential gains and losses, but ultimately you must match those numbers to your preferences: Are you more interested in a fund that can gain big on the upside but may lose similar amounts on the downside, or can you be happy with a more moderate balance? Of course, funds that consistently gain more on the upside than the downside are what we aim for.

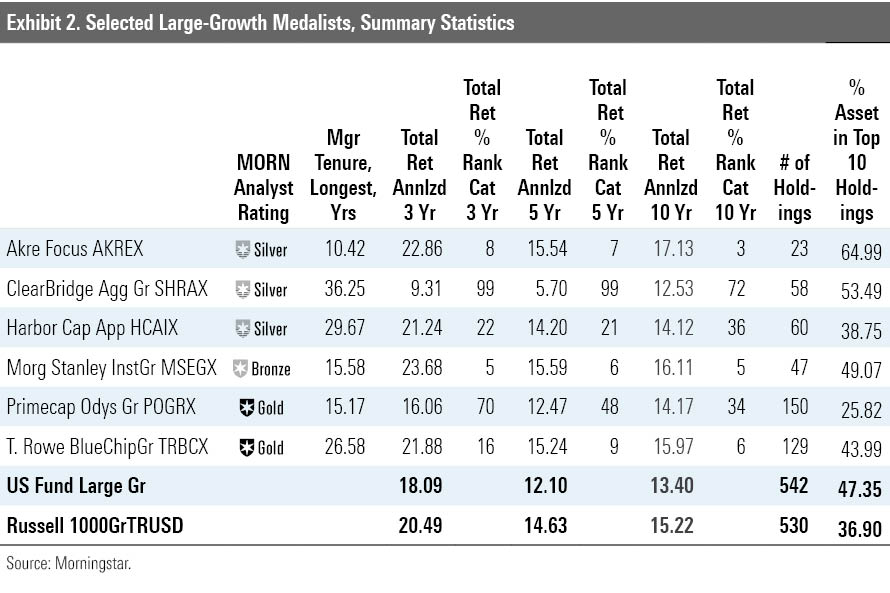

Case Studies To illustrate some of the intricacies of the large-growth category, I've selected six Morningstar Medalist large-growth strategies, each with experienced management known for its stock-picking prowess, strong conviction from Morningstar analysts, and significant popularity in terms of overall assets. My point here is to reflect how, even among funds well-rated by our analysts, significant distinctions emerge.

From a total-return perspective, all of these funds rank in the top third or better versus peers over the trailing 10 years, with the exception of Silver-rated ClearBridge Aggressive Growth SHRAX (see Exhibit 2). Yet, how they have achieved those returns differs markedly. From a concentration perspective, they range from the extremely focused Silver-rated Akre Focus AKREX, with only 23 holdings, to the still-concentrated (50-60 stocks) Clearbridge, Silver-rated Harbor Capital Appreciation HCAIX (subadvised by Jennison Associates), and Bronze-rated Morgan Stanley Institutional Growth MSEGX portfolios, to the far more diversified (and Gold-rated) Primecap Odyssey Growth POGRX and T. Rowe Price Blue Chip Growth RRBGX.

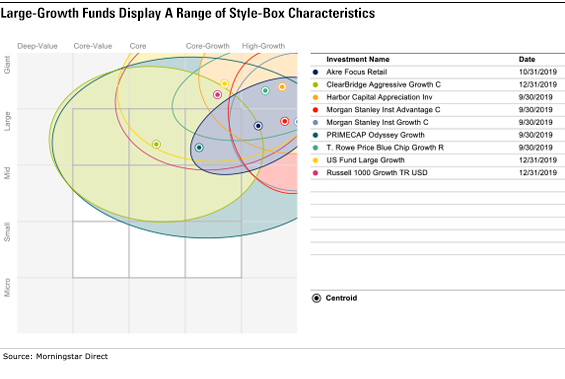

As seen in the style map (Exhibit 3), the funds differ widely in terms of their growth-value and size spectrums. Whereas the Morgan Stanley and Harbor funds restrict their investments primarily to the upper-right area of the style box (very growthy and very large), Primecap and Clearbridge both exhibit more flexibility, with a mix of core and even value-priced investments as well as a willingness to dip into mid- and small caps.

Exhibit 3

From a sector perspective (Exhibit 4), you wouldn’t expect these vehicles to hug the benchmarks because these fund managers emphasize their stock-selection capabilities. Indeed, significant deviations from the benchmark and high sector concentration levels are the norm for many of these funds. Morgan Stanley Institutional Growth, for instance, with Dennis Lynch’s focus on “disruptors,” devotes 55% of assets to technology, more than double the category average. The Primecap team, unafraid to let its high-conviction approach lead to significant sector overweights, splits 60% of assets between tech and healthcare, the latter 30% allocation double the benchmark’s weight. Richie Freeman of ClearBridge invests similarly in healthcare and tech to Primecap but adds on a 15% weight in communication services, which, while on par with the benchmark, is an area the other funds on this list avoid.

Akre Focus, the most concentrated fund on the list, is also one of the most unconventional, with 45% of assets in financial services (much of which is in consumer-oriented firms like Visa V and Mastercard MA) and 21% in real estate (mainly a play on two cell-tower leasing companies). Such an approach can be highly binary, with the potential for long dry spells if sectors or large positions fall out of favor, but Chuck Akre has largely pulled it off. T. Rowe Price Blue Chip, by contrast, generally does not make big sector bets, aiming instead for superior security selection within sectors, and, with the backing of the firm’s large analyst team, has generally been successful in that effort.

The risk metrics on these funds provide some interesting insights, at times consistent with my previous observations but in other cases less intuitively so (Exhibit 5). For example, several of the more concentrated funds (by holdings or sector), such as Morgan Stanley and Primecap, exhibit High Morningstar Risk, well-above-average volatility levels, and high upside/downside capture ratios. Notably, Primecap’s more-diversified portfolio in terms of number of holdings may lessen but does not fully counter the other risks of its approach. By contrast, Akre Focus’ concentrated approach has counterintuitively led to less downside volatility than others on this list and indeed to the best 10-year Sharpe ratio among all large-growth Medalists. This most likely is a function of management’s emphasis on high-quality firms with sustainable earnings, along with its tendency to carry a cash cushion (recently around 20%). Still, investors should not ignore the fact that there are intrinsic risks to the fund’s concentration and unconventionality.

The fund here that has struggled most in recent years is ClearBridge Aggressive Growth, indicated in both its relative returns and its weaker risk metrics (its 10-year Sharpe ratio and upside/downside capture ratio are the poorest of the group). Much of this is structural--the managers are conscious about valuations, leading them to invest less in the growthiest stocks that have led the market, and overweightings in healthcare and energy (long-standing preferences) have also hurt. Given the fund’s 30-plus-year history of success, though, this is not a strategy you’d want to quickly count out. T. Rowe Price Blue Chip’s appealing risk numbers reflect its somewhat less-charged, more diversified approach. It has managed to capture much of the upside of bull markets without falling too sharply during down markets. Its Sharpe ratio is second-highest in this group as a result.

To reiterate, my aim here has been to provide a way to think through issues when it comes to selecting a large-growth fund, not to give you a list of my favorite offerings. If anything, I hope I have emphasized both the variety of approaches and performance patterns that exist and the corresponding need to select funds that fit well within your portfolio and investment objectives. And I’ve hardly covered everything here. I haven’t addressed fees, for one, as I assume that cost should always be a central consideration (and some of the Medalists covered in this article are higher-cost). But let this be a starting point toward deeper, more-nuanced thinking about this category.

/s3.amazonaws.com/arc-authors/morningstar/2e13370a-bbfe-4142-bc61-d08beec5fd8c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/2e13370a-bbfe-4142-bc61-d08beec5fd8c.jpg)