Morningstar Runs the Numbers

We take a numerical look through this week's Morningstar research. Plus, our most popular articles and videos for the week ended May 5.

Inspired by Harper's Index (with a tip of the hat to FiveThirtyEight's Significant Digits blog), Morningstar Runs the Numbers uses a numbers-based approach to highlight recent Morningstar research, along with some outside news stories.

50.8 million Apple reported sales of 50.8 million iPhones in its second quarter. Overall, the company reported solid fiscal results and provided investors with a third-quarter forecast that was relatively in line with director of technology, media, and telecom equity research Brian Colello's expectations, and points to decent ongoing demand for Apple's products and services. /p>

"Services revenue grew nicely, which we think still bodes well for customer stickiness around the iOS ecosystem, which is the backbone of our narrow moat rating for the firm. Further, Apple issued a healthy raise to its capital return program, boosting its quarterly dividend by 10.5% and adding $35 billion to its share repurchase authorization. We will maintain our $138 fair value estimate for Apple and shares appear fairly valued today."

211,000 The Labor Department said the United States added 211,000 jobs in April, ahead of expectations. The unemployment rate also inched down to 4.4%, the lowest rate in a decade. Despite the cheery headline number, director of economic analysis Bob Johnson views the report as mixed, though he says we in "very stable territory."

10 Value stocks have underperformed their growth counterparts over the past 10 years, though not by nearly the same margin as they did during the tech bubble: Over the trailing 10 years ended April 30, the Morningstar US Growth Index has outpaced its Value counterpart by over 3 percentage points. This invites the question, are there bargains to be found?

"We examined the nearly 500 constituents of the Morningstar US Value Index. First we removed companies that our analysts do not cover. Then we focused only on firms that have economic moats of wide or narrow, which means our analysts think the company has a durable competitive advantage that will allow it maintain its profitability over the long term. (This step helps avoid value traps.) Finally, we sorted the stocks that passed our screen by lowest and highest price/fair value to find the 10 cheapest value stocks, and the 10 most expensive."

4 The threats to bottom-up active equity management are real, and it is the rare stock-fund jockey who has not at least attempted to harness technology to refine and streamline his investment process, says Dan Culloton, director of equity strategies for Morningstar's manager research group. But there remain managers whose main competitive advantage is still good, old-fashioned research and stock-picking. Culloton gives four examples of medalist-rated funds that have been successful with plying a decidedly low-tech active management approach.

$250 billion Speaking of Apple, Dow Jones reported ahead of the company's earnings release that its stockpile of cash has likely topped a quarter of a trillion dollars. What's more, the company has doubled its cash pile in just over 4 1/2 years; in the last three months of 2016, it racked up new cash at a rate of about $3.6 million an hour, Dow Jones said.

"[This is] an unrivaled corporate hoard that is greater than the market value of both Wal-Mart Stores Inc. and Procter & Gamble Co. and exceeds the combined foreign-currency reserves held by the U.K. and Canada combined."

4X The Securities and Exchange Commission this week approved a request to list ForceShares Daily 4X US Market Futures Long Fund (proposed ticker UP), and ForceShares Daily 4X US Market Futures Short Fund (proposed ticker DOWN). As you probably inferred from its name, the long fund is designed to deliver 400% of the daily performance of S&P 500 stock index futures, while the short fund will aim to deliver four times the inverse daily return. Many market participants expressed concern that these risky instruments could cause investors to lose money very rapidly; one trader interviewed by CNBC called them "market crack."

"This is an innovation for people who are going to run the game, sit behind the table and deal the cards, and it's going to be a really bad innovation for those who think they can buy it and juice up some of their returns," said Sal Arnuk, a principal at Themis Trading. "This is market crack, and it concerns me."

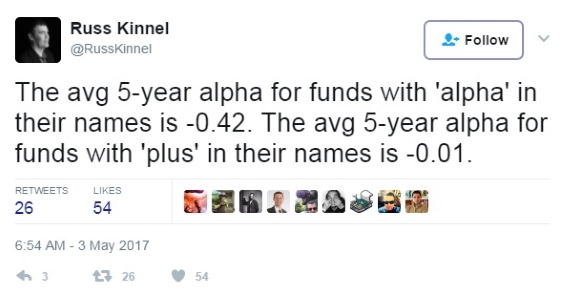

-0.42, -0.01 Finally, director of manager research Russ Kinnel tweeted this interesting observation:

Most Popular Articles, Videos, and Securities

Most Popular Articles

- 10 Solid Value Stocks at Great Prices (and 10 to Pass Up)

- Funds That Buy Like Buffett, 2017

- How Much Cash Do You Really Need?

- 10 Funds That Beat the Market Over 15 Years

- Jack Bogle: It's Easier to Serve One Master Than Two

Most Popular Videos

- A Buffett-Like Small-Company Fund on Our Radar

- Why Active Bond Managers Are Succeeding

- Service Complaints Aside, Investors See Value at Vanguard

- Tail Risks That Keep a Bond Manager Up at Night

- As Retirement Nears, Customize Your Plan

Most Requested Stock Quotes Apple Amazon Berkshire Hathaway Facebook AT&T

Most Requested Stock Analyses

Cameco

Apple

Vornado Realty Trust

Amazon.com

Hanesbrands

Most Requested Fund Quotes Vanguard 500 Index

Most Requested Fund Analyses

Vanguard High-Yield Tax-Exempt

Fidelity New Markets Income

T. Rowe Price High Yield

Fidelity Contrafund

PRIMECAP Odyssey Growth

Most Requested ETF Quotes SPDR S&P 500 ETF Vanguard Total Stock Market ETF PowerShares QQQ ETF Vanguard S&P 500 ETF Vanguard REIT ETF

Most Requested ETF Analyses

Vanguard Total Stock Market ETF

Vanguard Dividend Appreciation ETF

Vanguard FTSE Emerging Markets ETF

Vanguard High Dividend Yield ETF

Vanguard REIT ETF

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)