Brisk Morningstar Analyst Ratings Activity Heading Into Fall

Thirty-eight ratings debuted in September.

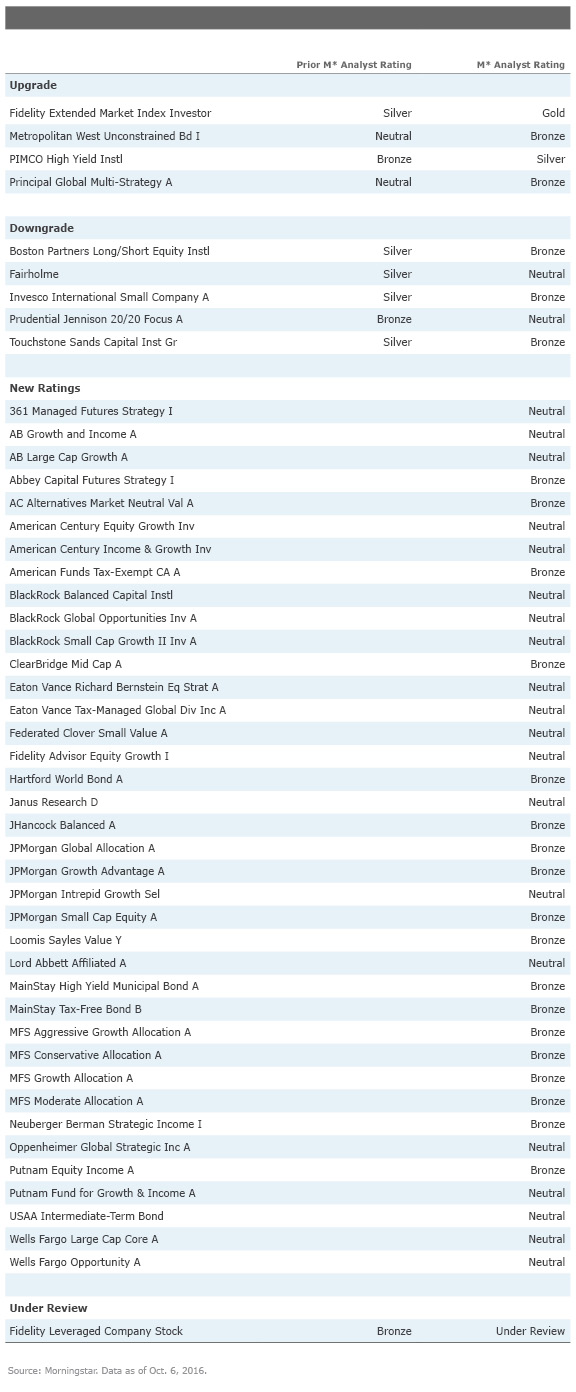

In September, Morningstar manager research analysts downgraded the Morningstar Analyst Ratings of five funds, upgraded four funds, moved one rating to under review, and assigned new ratings to 38 funds. Highlights of the ratings activity can be found below as well as a full list of ratings activity for the month.

Downgrades

Fairholme FAIRX: Neutral from Silver

On pace for its third consecutive bottom-decile calendar-year finish and after nearly $5 billion in three-year net outflows, Fairholme faces serious liquidity risks. These risks and poor results lead to a cut in the fund's rating to Neutral from Silver. The fund has endured outflows in every month since March 2011, a total of nearly $15.7 billion. During that time, manager Bruce Berkowitz raised cash mostly by selling liquid stocks like

Boston Partners Long/Short Equity BPLSX: Bronze from Silver

This closed fund’s diversified and generally contrarian equity long-short strategy has been a standout since Bob Jones took it over in June 2004. But an increase in its already high annual net expense ratio has led to a downgrade of its rating to Bronze from Silver. The institutional shares now cost 5 basis points more than they did the previous year, and the fund's gross expense ratio ranks near the top of its category. The investor shares’ price tag rose by 6 basis points compared with the previous year. A typical fund in the long-short Morningstar Category charges 2.00%, which is less than the 2.47% levy on this fund's institutional shares. Such high fees could temper future returns.

Upgrades

PIMCO High Yield PHIYX: Silver from Bronze

PIMCO High Yield has largely performed as expected through various market environments. Its deft navigation of the recent energy-sector troubles, along with a deep team and inexpensive price tag, support an upgrade of the fund’s rating to Silver from Bronze. Since Andrew Jessop took over management of the fund in January 2010, the fund’s 7.2% annualized return through August 2016 was in the top third of the high-yield Morningstar Category on both an absolute and risk-adjusted basis (as measured by Sharpe ratio). More recently, the team was early to spot trouble in the energy and commodity sectors and outperformed its peer group during the commodity sell-off that plagued many high-yield bond funds. The fund’s 2.6% decline during that period (Dec. 1, 2014-Feb. 29, 2016) was better than 80% of its peer group.

Principal Global Multi-Strategy PMSAX: Bronze from Neutral

Principal launched this multistrategy alternative fund in 2011 with the aid of hedge fund consultant Cliffwater LLC, which has continued to support this fund with ongoing manager due diligence. Originally, Principal had little in the way of experience researching hedge fund managers or building alternative-allocation funds, though the firm had ample expertise selecting and allocating among external subadvisors. In 2015, Principal created a four-person team focused on hedge fund manager research. Going forward, that extra support rounds out what was already a solid asset-allocation team. The fund’s conservative approach has served investors well so far, and the new internal group increases our confidence in the overall team running the strategy, driving the rating upgrade to Bronze from Neutral.

New Ratings JPMorgan Growth Advantage VHIAX: Bronze

This best-ideas equity fund successfully leverages the resources of the larger JPMorgan growth team to curate the highest conviction holdings from its small-, mid-, and large-cap growth portfolios. Its proven manager, 30-year JPMorgan veteran Timothy Parton, relies on the efforts of an experienced analyst team to buy stocks across a wide range of capitalization sizes, employing consistent fundamental analysis. Through August 2016, the fund had returned 8.8% annually over 15 years and outperforms its benchmark and typical peer in the categories it invests across. Its appeal is somewhat dented by relatively high fees on certain share classes, but the fund still earns a Bronze rating.

Hartford World Bond HWDAX: Bronze

This world-bond fund’s risk-aware process, engineered and executed by subadvisor Wellington Management Company's talented investment team, sidesteps the pitfalls present in today's global-bond markets. Manager Mark Sullivan and team disregard global-bond benchmarks, which are skewed toward the most-indebted, lowest-yielding sovereign-debt issuers. Instead, they aim to construct a portfolio centered on a core group of countries selected for their stable-to-improving fundamentals, compelling valuations, and highly liquid debt markets. The fund’s one competitive weakness--above-average fees--caps its rating at Bronze.

/s3.amazonaws.com/arc-authors/morningstar/bdf88cbd-d3d8-4661-b946-d09f9ffe196b.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/bdf88cbd-d3d8-4661-b946-d09f9ffe196b.jpg)