Consumer Defensive: Lofty Valuations Persist, but a Handful of Bargains Remain

At home and abroad, consumer defensive firms look to offset muted growth prospects by boosting their brand intangible assets and cost edge.

- Trading about 2% above our fair value estimate, we view the consumer defensive space as a bit overvalued.

- Consumer product manufacturers haven't been immune to the slowdown in emerging markets, particularly with broad weakness in Latin America and Asia. Despite the near-term hit, we still contend that firms offering brands that resonate with local consumers will be the best positioned to capture outsize growth in these regions longer term.

- In light of challenges to reignite top-line gains, firms throughout the space are likely to remain laser-focused on extracting excess costs to bolster earnings growth.

- Defensive retailers are also taking steps to expand their store bases and move to more of an omni-channel presence (such as e-commerce) to offset intense competition and slowing growth prospects.

Valuations within the consumer defensive space have continued to appreciate and now trade at around a 2% premium to our fair value estimate. We think this premium reflects a rotation into higher-quality names amid global macroeconomic uncertainty, investors' appetite for yield and the strong shareholder returns found in the sector, as well as renewed optimism for merger and acquisition activity in the space.

Despite this, we still contend that investment opportunities remain, but many of the stocks we consider the most undervalued are seeing pronounced foreign currency headwinds from the strong U.S. dollar (including top pick

NSRGY), as well as threats to growth from slowing international consumer spending (to which most global players have not been immune) that may constrain near-term revenue and earnings gains (although we maintain that longer-term prospects appear more favorable).

Even though the consumer staples space tends to be fairly defensive in a market downturn, we remain cautious of global consumer spending, particularly in emerging markets. For one, we believe China is entering a period of normalized GDP growth in the low- to mid-single-digits range as it transitions away from being a government- and export-driven economy. However, we do not believe consumption trends will permanently decline as economic growth decelerates. Further, while the yuan devaluation and equity market volatility has triggered a pullback in spending--particularly among higher-end consumers and corporations--we believe the slowing pace of consumption has more to with consumer sentiment and less to do with the inability to spend.

Despite recent challenges, we expect the pace of emerging-markets growth to exceed more developed markets longer term given favorable demographic and disposable income trends. From our vantage point, firms best positioned to capitalize on emerging-markets growth possess solid competitive advantages in the form of a strong brand intangible asset and expansive global scale (such as

In light of the persistent pressure to accelerate top-line growth, most firms in the consumer defensive industry are maintaining a stringent focus on driving efficiencies. As a result, companies have implemented zero-based budgeting strategies, and many have adopted multiyear strategies to improve margins. However, cost-reduction efforts have not always proved beneficial--for instance

The challenges resulting from competitive pressures amid a slowing global growth landscape aren't limited to consumer product manufacturers, however. Defensive retailers are also facing muted growth prospects, and in this light, operators pursued multiple avenues to ignite sales, which have included efforts to increase store counts. Although concerns have surfaced surrounding the impact these new stores could have on sales within a retailer's existing store base, what matters in the long run, from our perspective, is structural overstoring: This occurs when new entrants/channels (think e-commerce, discounters, dollar stores) render a material portion of existing firms' square footage/assets obsolete.

This is precisely what ultimately challenged the traditional U.K. grocers; Aldi and Lidl, convenience stores, and e-commerce players came in with new value propositions that left a not unsubstantial percentage of traditional retail square footage (especially big box stores) less profitable. And while online grocery represents less than 5% of total grocery sales, it is growing fast in many parts of the world and will continue doing so in the U.S. That said, we believe that online grocery is a particularly costly model, and we think that ship-from-store and click-and-collect offerings will continue to have a cost advantage over pure-play online grocers (especially in rural markets) for quite some time.

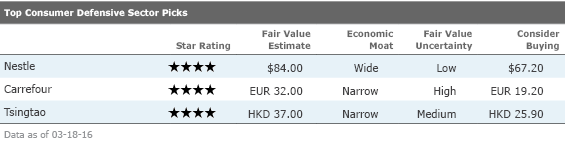

Nestle

NSRGY

Given its expansive global distribution platform and focus on driving cost savings, we expect Nestle will continue generating solid returns for shareholders over the longer term, supporting our wide moat rating. While competitive pressures amid a slowing global growth environment have hindered the firm's top-line performance, Nestle's broad product portfolio of leading brands and strong cash flows (it converted more than 11% of sales to free cash flow in 2015, at the high end of its peer group) give it an entrenched position in the supply chain of its customers and an ability to react to new entrants. As such, we believe the shares look undervalued at current levels, and for investors wishing to gain broad exposure to the consumer staples industry, Nestle may be an appropriate holding.

Carrefour

(CA)

As the largest retailer in Europe and the second-largest retailer on the planet, Carrefour boasts economies of scale and attractive properties that are worthy of a narrow economic moat. Further, we believe that its recent initiatives--including efforts to drive higher private brand penetration, incremental price investments, and more decentralized merchandise decisions--are poised to stabilize sales and margins in France. From our vantage point, Carrefour is also well positioned to capitalize on urbanization trends and growing middle class incomes in emerging-markets regions over time. We contend investors are pricing in lackluster sales growth and margin contraction over the long term, a view that does not give Carrefour full credit for its cost advantages. For patient investors, we believe Carrefour is a decent way to gain exposure to emerging-markets defensive retail as well.

Tsingtao

(

)

We view narrow-moat Tsingtao as one of the most strongly positioned domestic Chinese brewers, and we expect its brand premium, coupled with strong financial health, to help it wade through current challenges. In our view, robust wealth creation will prompt rising demand for premium branded goods among Chinese consumers, allowing companies, like Tsingtao, that possess a superior brand image and product quality to further expand market share and support future growth. In addition, we think that with its remarkable brand premium and operating efficiency, Tsingtao is well positioned to benefit from further consolidation and premiumization opportunities in the industry. Overall, we contend Tsingtao looks attractive for investors looking to gain exposure to the space.

More Quarter-End Insights

Stock Market Outlook: Stocks Start to Look More Attractive

Credit: Corporate Bond Markets Recuperate

Basic Materials: The Recent Commodity Rally Shouldn't Give Investors Hope

Consumer Cyclical: China Growth Concerns Present Buying Opportunities

Energy: Don't Expect a Quick Recovery for Crude Prices

Financial Services: Global Bank Rout Is Overdone

Healthcare: Drug Reform Worries Are Overblown

Industrials: An Uneven Start to 2016, but Compelling Values Remain

Real Estate: Companies With Enduring Demand Will Persevere

Tech, Telecom & Media: Long-Term Opportunities Amid Software's Storm

Utilities: Dividends Still Attractive, but Headwinds Remain

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)