P&G Stands to Pamper Investors by Shoring Up Its Wide Moat

We think the market is undervaluing this household and personal care giant's advantages.

We don't believe the market fully appreciates

Unwieldy Brand Set Has Hampered P&G's Competitive Edge Lackluster innovation and an attempt to overextend its geographic reach plagued P&G's financial performance, and ultimately its competitive positioning, over the past several years. While brands can be a significant advantage for consumer product firms and a strong defense against some industry pressures, owners of strong brands should be able to consistently pass inflationary pressures to customers. However, this has proved elusive for P&G and household and personal care peer Church & Dwight, as both have struggled to generate price/mix at or above inflation, as measured by the consumer price index.

We believe that in assessing a firm's intangible asset moat source, the strength of its relationships with retailers is also important; we think building and maintaining a reputation as a critical supplier helps some consumer packaged goods manufacturers carve out sustainable competitive advantages. All else equal, retailers would rather do business with an established vendor with whom they have had a long-term relationship in an effort to avoid costly out-of-stocks and subsequently drive down costs. By operating as a leading household and personal care manufacturer (market share of more than 30% in baby care, 65% in blades and razors, more than 30% in feminine protection, and in excess of 30% in fabric care), P&G is a valued partner for retailers, in our view, supporting the firm's intangible asset moat source.

We don't believe Church & Dwight is viewed in the same light. For example, Church & Dwight controls just north of 10% of the domestic laundry detergent aisle, which pales in comparison with the 60% share P&G maintains. As such, we suspect that Church & Dwight's exposure to dominant retailers such as Wal-Mart, which represents 25% of its annual sales, could strain the firm's bargaining position, particularly because the reallocation of product lines has become more commonplace at major distribution outlets; in this vein, Church & Dwight management has said that retailers have not hesitated to reward shelf space to lower-priced private-label offerings at the expense of Church & Dwight's products.

In our view, this isn't limited to the traditional store channel. About three years ago, P&G integrated itself with Amazon by sharing warehouse space with the leading e-commerce retailer, which now includes at least seven P&G distribution centers worldwide. We don't believe smaller manufacturers like Church & Dwight will be able to embed themselves in the supply chains of leading e-commerce operators, given the lack of product breadth and resources they maintain. As such, we believe that relative to the industry giant, Church & Dwight will continue to lack in regards to scale and financial muscle to defend itself from impending competitive blows, supporting our no-moat rating. In this context, we view the market's expectations surrounding Church & Dwight's competitive positioning and prospects as aggressive.

Customer Acquisition Costs Another Challenge for CPG Manufacturers Beyond examining the degree to which a firm's intangible assets are a source of competitive edge, we contend that the magnitude of customer acquisition costs also creates a barrier to entry, and the ability to fund those costs can be a competitive advantage over new entrants with limited budgets. We've stripped out customer acquisition costs (research and development, advertising expenses, and some other discretionary costs) to compare the go-to-market cost structures of companies across the consumer staples industry. On that basis, while P&G operates with a vast network over which to leverage its fixed costs, when adjusted for expenses not directly linked to the production and distribution process, its profitability and costs per employee lag other household and personal care operators.

From our perspective, P&G's inferior cost position probably reflects diseconomies of scale due to the broad scope and the operational complexity inherent in its far-reaching portfolio, exacerbated by the proliferation of new stock-keeping units necessitated by brand line extensions and greater varieties of pack sizes to tailor its offerings to penetrate alternative channels. In that vein, we think the current portfolio pruning at P&G may have been prompted by a desire to reduce complexity and restore focus to a broad and unwieldy portfolio. We forecast that profits will be boosted longer term (including around 200 basis points of gross margin improvement, relative to the average over the past five years, to more than 51% and 400 basis points of operating margin expansion to 24% over the next 10 years) by efficiency gains and the mix shift to a focus on more profitable offerings.

While we recognize that most operators will attain enhanced profitability over the next several years, we think P&G has the most to gain. In that context, we incorporated our fiscal 2020 sales and profit projections for P&G into our cost analysis model to assess the degree of cost improvement P&G stands to realize by rationalizing its brand mix and driving further efficiencies. Relative to its household and personal care peers, our forecast calls for P&G to move into the top tier of the industry, which highlights the firm's economies of scale and the cost edge that should result from its current strategic efforts to slim down.

Past Stumbles Aside, P&G Is Steering a New Course Despite its slow response to external headwinds and internal missteps, P&G appears to be taking prudent actions to improve the long-term health of the business. The most dramatic effort, announced in August 2014, is the plan to halve its brand portfolio (by extracting around 100 brands that in the aggregate represented around 10% of sales and 5% of consolidated profits but posted a 3% sales decline and a 16% profit reduction the past three years) as a means to better focus its resources--financial and personnel--on the highest-return opportunities. We view this as a wise course that should make P&G a more nimble and responsive operator to consumer trends. We believe that even as a more narrowly focused manufacturer, P&G will still operate with a portfolio of leading brands across household and personal care, making it a crucial partner for retailers looking to drive traffic in their stores. In that light, we think these actions stand to enhance P&G's competitive positioning. The market seems reluctant to buy in to P&G's ability to accelerate top-line performance, but with a more focused portfolio, P&G should be able to better tailor its fare to meet evolving consumer trends and drive sales gains longer term.

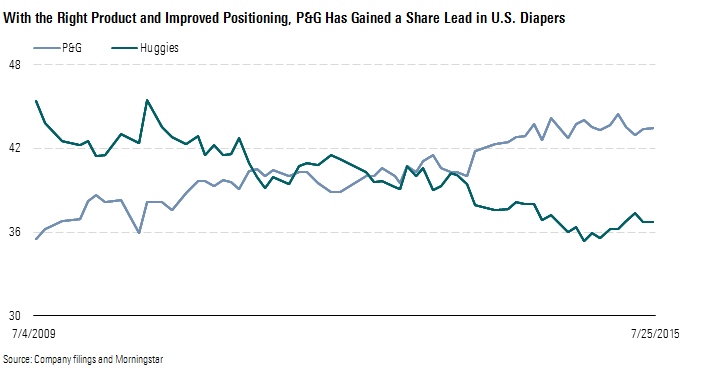

The benefits from its stepped-up focus are evident in recent market share gains in two of P&G's largest businesses, diapers and laundry, which account for more than one third of consolidated sales. P&G had operated as the number-two player in the U.S. diaper market over most of the past 20 years. However, as a result of new product launches and efforts to get in front of new moms early on with increased sampling in hospitals, Pampers (P&G's largest brand with about $10 billion in annual sales) overtook Huggies (a Kimberly-Clark KMB brand) and now controls more than 40% of the U.S. diaper market, above its leading competitor. We think recent share gains are proving sustainable, as P&G's share lead, which stands at 700 basis points above Kimberly-Clark, has continued to expand over the past year, up from just 300 basis points.

The success of P&G's recent innovation has been particularly evident in the Swaddlers product line, which now is sold in sizes 1-6, up from just 1-3 previously; it accounts for nearly $800 million in annual sales, up from around $600 million the previous year and $200 million 10 years ago, equating to a 10% value share of the category. We think this highlights the gains that can be realized when product innovation aligns with consumer trends, which in this case was offering an alternative to training pants for older children.

P&G is also realizing an improved share position in the U.S. laundry category; it now controls about 62% of the market, up from less than 60% in the past several years. Tide, P&G's second-largest brand with sales around $9 billion each year (including international counterpart Ariel), has been a beneficiary, garnering 42% of the market, up from less than 40% over the past few years.

We think this reflects the success of the company's tilt toward innovation to build brand loyalty, as crafted through the launch of a single-dose laundry pod in 2012. Single-dose laundry now makes up about 12% of the overall U.S. laundry market, with P&G maintaining 75% of this niche (accounting for north of $750 million in annual sales). Management has said single-dose laundry is even winning with dollar store consumers despite selling at a 20% premium to base Tide, given the convenience it affords--it is easier to take a pod or two to the laundromat than a jug of liquid detergent. This provides further evidence to us that consumers are willing to pay up for a product when they perceive added value.

We don't believe the benefits from this innovation are limited to the laundry aisle. The fact that this technology can be extended to other parts of the firm's product set (like dishwashing liquids) suggests further leverage can be realized from on-trend, value-added new products. We ultimately think the company will be able to bring products to market in a more timely manner to better respond to evolving consumer trends as its focuses on its core product categories, which should drive low- to mid-single-digit sales growth over our 10-year explicit forecast, an expectation the market fails to share.

Enhanced Focus Should Drive More Balanced Top-line Gains for P&G As P&G wraps up its product rationalization efforts over the next year, we think the benefits of its more focused investments (and hence an ability to more effectively tap into and respond to evolving consumer trends) should yield improvements across its product mix, including in grooming, hair care, adult incontinence, and feminine care, driving accelerating sales and volume growth and subsequently aiding the brand intangible asset source of its wide moat. Our forecast for annual sales growth amounts to around 4% longer term, with just less than two thirds of annual growth resulting from higher volume and the remainder from increased prices and improved mix, which runs in contrast to the firm's historical performance that was almost entirely driven by volume gains. We expect foreign currencies to continue to hinder sales growth in fiscal 2016, but we don't incorporate foreign currency impacts beyond our current-year outlook.

While sales growth in the United States and Europe may remain tepid, at low single digits annually over our explicit forecast, P&G's underlying sales in developing markets are growing at a mid- to high-single-digit rate each year. And we still believe the firm has growth opportunities for its brands in many overseas markets, beyond the favorable demographic and disposable income trends we anticipate that will support emerging-market growth longer term. For one, we think P&G has an opportunity to trade consumers up to more value-added products in the bulk of its emerging-market regions. As an example, P&G historically hasn't sold liquid laundry detergent in emerging markets (in China, its second-largest market accounting for around 8% of total sales or $6 billion annually, its mix only included powdered detergent), which creates the potential for price and volume gains. Further, the company recently began selling diaper pants in a handful of emerging markets, which despite the higher-price tag is a preferred product, even for newborn children. In addition, we believe there is the potential for increased diaper use among developing-market consumers, who only use about one diaper per day, trailing the five diapers the average developed-market consumer uses daily. In combination, we think these factors support our expectations for around 4% consolidated sales growth over our 10-year explicit forecast.

On the other hand, we think Church & Dwight's top line will be driven entirely by higher volume and lower prices (given its lack of pricing power and negotiating leverage with retailers), in line with recent history. We fail to see how the firm will bolster its pricing in the face of an intensely competitive environment and a recharged peer set and suspect that if the firm attempts to raise prices, its volume growth could languish. We think Church & Dwight lacks the scale and resources of its peers, which will hamper the firm's ability to entrench itself in retailer supply chains and build brand goodwill with local consumers.

P&G's Avenues for Improvement Go Beyond Sales Line We think P&G's efforts to slim down also stand to reduce the complexity that has plagued its cost structure. This is evidenced by the margin expansion realized when P&G restated fiscal 2015 results to exclude the 43 beauty brands that Coty is poised to acquire (a deal that is to be sealed in the second half of calendar 2016, which is the first half of P&G's fiscal 2017). Between fiscal 2012 and 2014, P&G's beauty segment earnings before taxes approximated 17% of sales annually, but when the planned divestiture is taken into account, the fiscal 2015 segment margin jumps to 23%, up from less than 19% when P&G initially reported fiscal 2015 results.

In addition to the margin bump we anticipate from the firm's mix shift to more-profitable fare and the benefit from reduced manufacturing and distribution complexity as it slims down, we expect savings from the $10 billion cost-cutting initiative, launched in February 2012, which aims to reduce overhead, lower material costs from product design and formulation efficiencies, and increase manufacturing and marketing productivity. At the time it was announced, the targeted savings equated to around 15% of P&G's cost of goods sold and operating expenses excluding depreciation and amortization expense. While this might seem aggressive, we think taking an ax to costs was warranted, given the firm's bloated structure relative to its peer set.

As part of these efforts, P&G has been extending common manufacturing platforms globally. This is proving advantageous for its diaper business--a product that had been manufactured in a disparate form using different materials around the world, inherently limiting its negotiating leverage over suppliers. Streamlining manufacturing and using the same inputs on a global basis should enable P&G to exploit its purchasing leverage and ultimately enhance its cost edge. The firm is implementing these opportunities throughout a number of its other large businesses, including blades and razors, which we estimate accounts for more than 10% of P&G's total sales.

P&G is also working to improve the efficiency of its North American manufacturing and distribution network, by more effectively routing deliveries and automating more of its manufacturing processes, as well as to reduce unnecessary spending, which includes consolidating the number of advertising agencies it works with. Partly because of these efforts, over the past three years, the firm has realized around 500 basis points of selling, general, and administrative leverage and around 250 basis points of operating margin expansion to nearly 20% in fiscal 2015. We forecast gross margins (which have been constrained the past two years by unfavorable foreign exchange movements) to expand to 51% over the next five years, about 200 basis points above the average gross margin over the past five years, and operating margins to increase another 400 basis points to 23%.

However, we don't expect P&G will boost its profits by ratcheting back brand spending; rather, we think a portion of these savings will provide the fuel for brand reinvestment, which could further prop up the intangible asset source of its wide economic moat, particularly its retailer relationships, as retailers depend on leading brands to bring value-added new products to market to drive traffic in their stores. We forecast research and development spending to tick up to 3% of sales (versus around 2.5% historically) and marketing expense to approximate 11.5% of sales annually (compared with 11% in the past) over our 10-year forecast horizon. Whether this level of spending will ultimately be sufficient to offset competitive pressures and ensure P&G's products win with consumers is debatable. However, a comparison of the percentage of sales we expect P&G to allocate toward cost of goods sold, SG&A, marketing, and R&D over our 10-year explicit forecast with a group of its industry peers supports our contention that P&G is driving efficiency improvements at the cost of goods sold and operating expense lines while beefing up its spending behind marketing and R&D to support its brand mix, tailor its offerings to evolving consumer preferences, and deepen its relationships with retailers.

Opportunity for Long-Term Investors to Stock Up The market doesn't share our belief that P&G's strategic efforts to rightsize its brand mix stand to enhance the firm's competitive prowess and reignite its top-line trajectory, potentially to the detriment of peers like Church & Dwight. P&G trades as if it has failed to amass a competitive edge, which is particularly striking given that no-moat Church & Dwight is priced as if it has garnered a sustainable competitive advantage. P&G's current market price implies just 2% annual sales growth and operating margins holding relatively flat at 21%, while Church & Dwight's stock price implies more than 5% annual sales growth and operating margins exceeding 25% over our 10-year explicit forecast. Given the lack of pricing power and muted resources at Church & Dwight relative to its larger, deep-pocketed peers, we think the market's expectations will prove quite lofty. On the other hand, we believe P&G's strategic efforts position the firm to bolster its wide economic moat and, in turn, its sales and profit growth more than the market foresees.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)