5 Stocks That Crushed Earnings in Q1 2023

Citigroup and DoorDash are among those that are still cheap despite impressive earnings beats.

Despite a negative earnings picture in the first quarter, U.S. companies are beating estimates at the best rate since the first quarter of 2022.

When combining results for the companies in the Morningstar US Large-Mid Index that have reported earnings with the analyst expectations for those still yet to publish, earnings are on track to decline 0.4% from the first quarter of 2022.

Among those that reported as of May 23, more than half of the U.S.-listed stocks covered by Morningstar analysts have beat FactSet consensus estimates by 5% or more. Better yet for investors looking to put money to work, Morningstar analysts believe a number of these companies’ stock prices remain undervalued relative to their fair value estimates.

To highlight these opportunities for the long-term investor, we ran a screen for undervalued stocks that crushed both earnings and revenue expectations for the first quarter of 2023.

More details on our screen, along with comments on the stocks from Morningstar analysts, can be found later in this article.

5 Undervalued Earnings Crushers

How Do First-Quarter Earnings Stack Up?

As of writing, roughly 90% of the 850 U.S.-listed stocks covered by Morningstar analysts have reported earnings. Of those, 55% beat the FactSet mean estimates for their earnings by 5% or more—the largest share since the first quarter of 2022. About 16% missed earnings estimates by 5% or more—the lowest share since the fourth quarter of 2021.

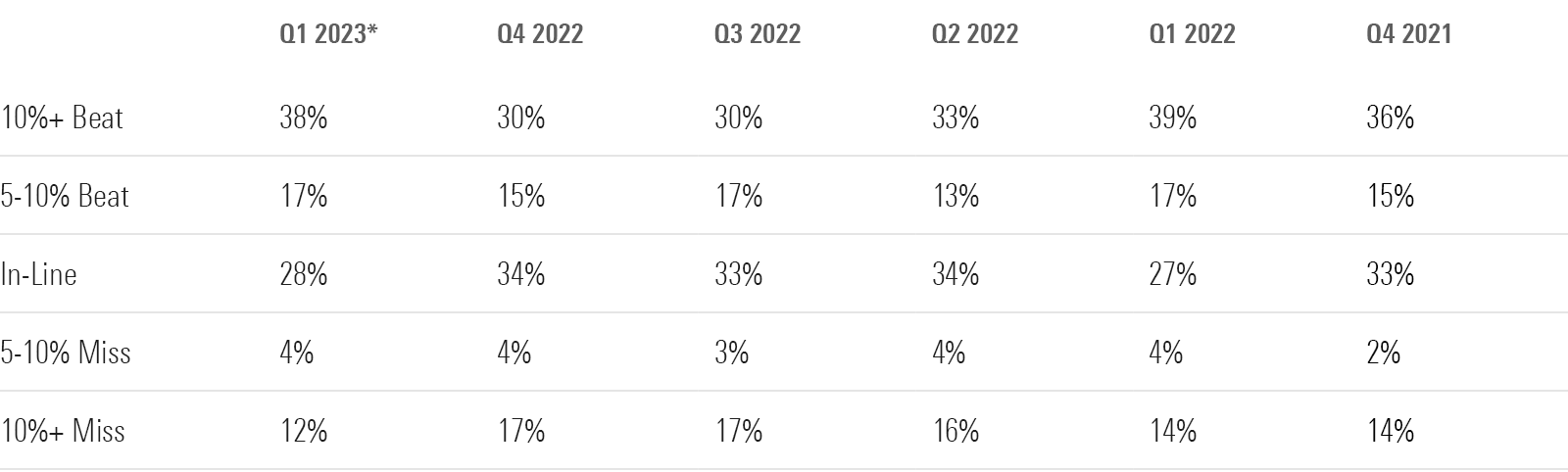

Quarterly Results for U.S.-Listed Stocks Covered by Morningstar

Digging deeper, the largest shift in this earnings season from the fourth quarter was that more companies beat estimates by a larger factor. Roughly 38% of reported companies beat estimates by 10% or more, versus 30% in the fourth quarter. About 17% surpassed expectations by 5% to 10%, which was a slight uptick from 15% in the fourth quarter.

There were fewer significant misses as well, with only 12% of companies reporting earnings 10% or more below FactSet estimates—down from 17% in the fourth quarter and the lowest share since the third quarter of 2021, when it was also 12%.

How We Did Our Stock Screen

While Morningstar stock analysts pay close attention to earnings, they focus on long-term results and valuations. One quarter doesn’t usually lead to a change in the long-term assumptions behind the assessment of a stock’s fair value estimate, unless a company also comes out with new material information that affects those assumptions. For example, there could be new data on a drug that raises the probability of its approval, or pricing gains on a key product line could affect an analyst’s long-term thinking.

Still, looking at quarterly earnings against the valuation backdrop can help long-term investors identify opportunities.

We screened for stocks that beat earnings expectations by 10% or more but remained undervalued to help investors capitalize on new investment opportunities.

To help keep the focus on companies that had truly strong results and did not beat on earnings through accounting gimmicks or one-time factors, we also screened for revenue beats of 5% or more. Of those results, we filtered for stocks with a Morningstar Rating of 5 stars.

Of the 850 U.S.-listed stocks covered by Morningstar analysts, only five companies met our criteria. We’ve highlighted what Morningstar analysts had to say about their earnings results below.

5 Undervalued Stocks That Beat Earnings Expectations

DoorDash

- Earnings Per Share: Loss of $0.41 versus the consensus estimate of $0.58.

- Revenue: $2.04 billion versus the consensus estimate of $1.93 billion.

- Morningstar Rating: 5 Stars

- Discount: 58%

“A solid network effect continued to propel narrow-moat DoorDash during the first quarter, with gross order value, or GOV, increasing 27% from the prior year (17% adjusted for the Wolt acquisition) to $15.9 billion, stronger than the $15.1 billion-$15.5 billion target that management set in mid-February. Management also increased its GOV forecast for the full year to $63 billion-$64.5 billion from $60 billion-$63 billion, implying growth of 19% at the midpoint versus 15% previously. The firm continues to post steady gains in the core U.S. restaurant category while pushing rapidly into a variety of new categories and markets. We are maintaining our $155 fair value estimate and believe the shares remain attractive.

“DoorDash also generated $428 million of free cash flow during the quarter versus $252 million last year and $604 million for all of 2022. The firm has completed $500 million of its $750 million share repurchase authorization, which it expects will limit share dilution to 1% for the full year.”

—Ali Mogharabi, senior equity analyst.

Farfetch

- Earnings Per Share: Loss of $0.16 versus the consensus estimate of $0.40.

- Revenue: $556 million versus the consensus estimate of $513 million.

- Morningstar Rating: 5 Stars

- Discount: 56%

“We are maintaining our fair value estimate for no-moat Farfetch at $12.20 per share after the company reported improved revenue growth in the first quarter. The shares still look cheap in our view.

“Growth was driven not by the core digital platform, where performance remains sluggish (digital platform gross merchandise value was up 1.9% at constant exchange rates), but by the brand platform (which includes the acquired New Guards business), which was up 15.4% at constant currencies, and in-store revenue, which was up by 10% at constant currencies, partly thanks to store openings.

“The first quarter was still affected by discontinued business in Russia (comparison gets easier from March 2022), continued but improving declines in China, and declines in the United States as the company reduced marketing investment in a promotional market. Demand in Europe, the Middle East, and Africa was solid with low-double-digit improvement, if business in Russia is excluded from the comparison base.”

—Jelena Sokolova, senior equity analyst.

Park Hotels & Resorts

- Earnings Per Share: Loss of $0.42 versus the consensus estimate of $0.33.

- Revenue: $648 million versus the consensus estimate of $617 million.

- Morningstar Rating: 5 Stars

- Discount: 50%

“First-quarter results for no-moat Park Hotels & Resorts were slightly better than we anticipated, leading us to reaffirm our $26.50 fair value estimate. Occupancy improved to 65.0% in the first quarter from 50.8% in the first quarter of 2022. Average daily rate was up 6.6% year over year. As a result, revenue per available room improved by 36.5% in the first quarter, in line with our estimate of 37.6% growth.

“Revenue from the group business segment continues to show steady improvement. During the pandemic, group business saw a dramatic decline, with many organizations unwilling to commit to booking hotel rooms because of the uncertainty surrounding COVID-19. As a result, group business fell to just 7.2% of Park’s revenue mix in the first quarter of 2021, significantly down from the 35.0% level Park reported in the first quarter of 2019. Since then, group business has rebounded, representing 32.7% of Park’s revenue in the first quarter of 2023.

“As of the end of March, group bookings for the rest of the year equaled 79% of the group booking Park saw at the end of March 2019 for the rest of that year. Additionally, planned group revenue is 82% of the 2019 level. We expect that the number of bookings will continue to improve over the next few quarters and that Park should return to 2019 levels by 2025.”

—Kevin Brown, senior equity analyst

Malibu Boats

- Earnings Per Share: Loss of $2.59 versus the consensus estimate of $2.34.

- Revenue: $375 million versus the consensus estimate of $343 million.

- Morningstar Rating: 5 Stars

- Discount: 44%

“We don’t plan to alter our $96 fair value estimate for narrow-moat Malibu Boats after digesting better-than-expected third-quarter results, and we view shares as attractive. Sales of $375 million handily surpassed our $344 million estimate, as shipments of Cobalt and saltwater units grew 5% and 30%, respectively.

“With the firm nudging its fiscal 2023 sales outlook up to around 10%, we still expect sales to decline around 10% in the fourth quarter, lapping 28% growth and facing nearly restored dealer inventory levels (except for saltwater units). But in the longer term, we think the prognosis for growth is stellar.

“To start, the firm opened its tooling design center, a facility that accelerates Malibu’s journey to build most of its tooling across brands. This helps in both quality control and avoiding supply chain issues, allowing for faster turns at retail and wholesale that better matches retail. Also, it acquired a property in Tennessee to facilitate further unit growth, signaling a potential launch into pontoons or another adjacent category soon. These factors, along with Malibu’s appetite for acquisitions, give us confidence in our 8% average annual sales growth estimate through 2027.”

—Jaime M. Katz, senior equity analyst

Citigroup

- Earnings Per Share: Loss of $2.19 versus the consensus estimate of $1.65.

- Revenue: $21.45 billion versus the consensus estimate of $20.02 billion.

- Morningstar Rating: 5 Stars

- Discount: 37%

“No-moat-rated Citigroup was our top pick at the start of 2022 and remains one of the more undervalued banks under our coverage in 2023. First-quarter results supported our multistep thesis for the company as the overall revenue and expense outlooks remained unchanged, the bank sold off additional business units, and first-quarter results were even better than we expected … The primary difference with our own estimate was a 4% beat on net interest income, or NII, and a 4% beat on expenses.

“The bank’s core (excluding legacy) operations showed slight growth in NII, solid overall performance within the ICG services group, and expenses that are just beginning to approach run rates that we hope the bank can hold the line on. We think the bank will need a turnaround in several of its key fee categories to meet medium-term revenue growth targets, and we also have some worries about how ICG services revenue will respond if rates are eventually cut, but otherwise most other targets seem on track for now.”

—Eric Compton, sector strategist

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)