Ahead of Earnings, Is Home Depot Stock a Buy, a Sell, or Fairly Valued?

Watching for weather impact on sales, backlogs for the retailer’s professional client base.

Home Depot HD is scheduled to release its first-quarter earnings report on May 16, before the start of trading. Here’s Morningstar’s take on what to watch for in earnings and Home Depot’s stock.

Home Depot Stock at a Glance

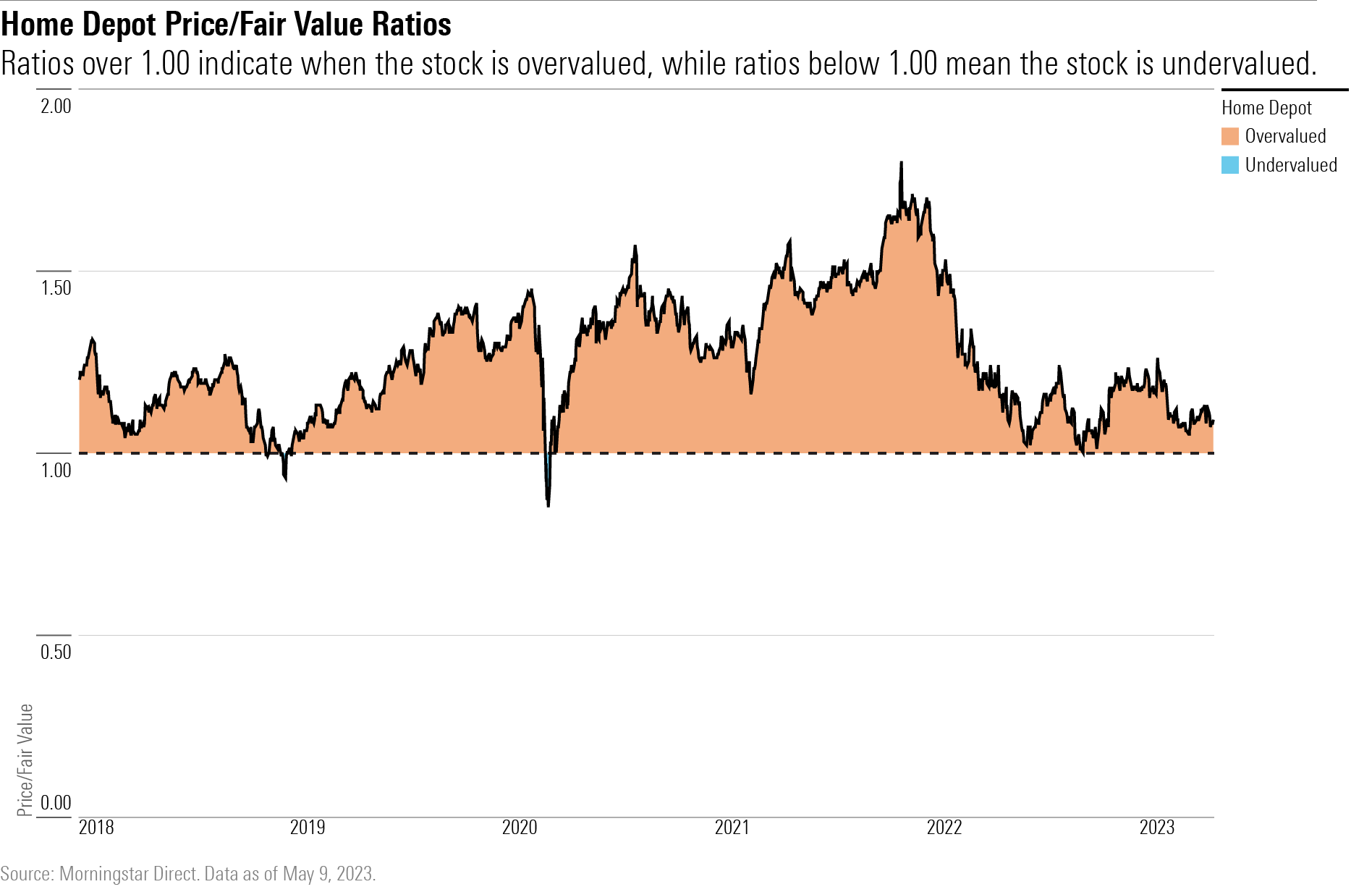

- Fair Value Estimate: $267

- Morningstar Rating: 3 stars

- Morningstar Uncertainty Rating: Medium

- Morningstar Economic Moat Rating: Wide

What to Watch for in Home Depot’s Q1 Earnings

- Was Home Depot able to defend against a colder start to spring (a factor that had an impact on first-quarter sales at Malibu Boats MBUU and Tractor Supply TSCO)? This is relevant for the sizable outdoor garden category Home Depot caters to.

- How have the backlogs for the professional contractor client base changed? Have they started to work down with rising interest rates and macro concerns?

- Is the sales mix still trending toward premium products?

Fair Value Estimate for Home Depot

We recently lowered our Home Depot fair value estimate to $267 per share from $270 to account for both a slowing top line and operating margin compression, as the firm invests in the employee base. We contend that such an investment is imperative to elevate the customer and employee experience, in turn generating goodwill from both parties, which will support the brand intangible asset. Under an updated store team structure, new career paths that provide pay upside could help retain employees, allowing for continuity of knowledge at the store level.

Home Depot’s operating margins and returns on invested capital could improve as the firm focuses on the efficiency of the supply chain and the opportunity to better penetrate the pro business with market delivery centers that leverage its delivery capabilities.

Read more about Home Depot’s fair value estimate.

Economic Moat Rating

We assign Home Depot a wide moat rating. As the largest global home improvement retailer, the company possesses a competitive edge owing to its brand intangible asset and cost advantage. For one thing, we believe its extensive product offerings and services have fostered brand loyalty. To continue to engage its consumers and keep up with changing customer demand (for localization and personalization, for instance), Home Depot leverages consumer data, collaborates with suppliers, and conducts periodic merchandising resets to refine its assortments. Additionally, Home Depot’s value-added services (including tools and trucks rental, installation, and remodeling) allow its wide range of customers to easily undertake their projects, which in our view further elevates the customer experience. An important aspect of Home Depot’s brand intangible asset lies in its omnichannel capabilities, which we think protect the firm’s competitive position and prevent customer attrition by enabling them to buy what they want and how they want it.

In our opinion, it would be difficult for another retailer to enter the market and threaten Home Depot’s position, as smaller retailers would have a hard time building vendor relationships strong enough to undermine Home Depot’s pricing prowess.

Read more about Home Depot’s moat rating.

Risk and Uncertainty

We give the company a Medium Uncertainty Rating based on its strong brand recognition, which has helped stabilize sales through the cycle. Home Depot’s sales are largely driven by greater consumer willingness to spend on category goods, with stable existing-home price growth and decent turnover. Thanks to the maintenance, repair, and operations, or MRO, business (Interline Brands and HD Supply), pro revenue could be less cyclical, as the maintenance side of the business can prove more consistent.

In our opinion, Home Depot has minimal environmental, social, and governance risk.

We believe the biggest risk is a slowdown in the real estate market, signaled by increased home inventories for sale, slower price growth, or higher mortgage rates (up about 100 basis points in the last six months).

Read more about Home Depot’s risk and uncertainty.

HD Bulls Say

- Home Depot’s focus on distribution and merchandising should increase productivity and grow domestic share in a stable housing market, helping to stimulate sales and protect margins.

- The company has returned $70 billion to its shareholders through dividends and share buybacks over the past five years—above 20% of its market cap. In our outlook, we forecast Home Depot returning another $80 billion to shareholders over the next five years.

- The addressable MRO market is around $100 billion, and Interline and HD Supply make up a low-double-digit share, leaving meaningful upside available.

HD Bears Say

- Weak consumer spending, higher interest rates, or an economic downturn could hinder sales for home improvement projects and affect Home Depot’s growth.

- IT and supply chain improvement gains could prove more challenging to achieve, as simpler efforts have already borne fruit. Further productivity efforts could face some implementation risks, creating inconsistent profitability.

- As home improvement demand normalizes, consumers could continue to shift discretionary spending away from home improvement into other discretionary categories, like leisure and restaurants.

This article was compiled by Muskaan Hemrajani.

Get access to full Morningstar stock analyst reports, along with data and tools to manage your portfolio through Morningstar Investor. Learn more and start a seven-day free trial today.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/3559e02b-f74d-4a72-a821-b50f61ba05e9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5GAX4GUZGFDARNXQRA7HR2YET4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/U746MWXQHFFZPLSMTEJSUD7HLY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KPHQX3TJC5FC7OEC653JZXLIVY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3559e02b-f74d-4a72-a821-b50f61ba05e9.jpg)