Going Into Earnings, Is Home Depot Stock a Buy, a Sell, or Fairly Valued?

With slow housing turnover, here’s what we think of Home Depot’s stock.

Home Depot HD is set to release its fourth-quarter earnings report on Feb. 20 before the market opens. Here’s Morningstar’s take on Home Depot’s stock.

Key Morningstar Metrics for Home Depot

- Fair Value Estimate: $263.00

- Morningstar Rating: 2 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

What to Watch for In Home Depot’s Q4 Earnings

- Given the still-slow housing turnover, we’ll be interested in hearing about customer engagement in home improvement projects, as seen in customer transactions (particularly growth in big-ticket items above $1,000) and average ticket size (in dollar terms). We’ll specifically look at management commentary around any shifts in consumer behavior during the quarter, their expectations for the overall market in fiscal 2024, and the implications for Home Depot’s business.

- Any commentary around the strength of pro customers (roughly half of total sales) and their backlog would help gauge the health of the firm’s home improvement demand amidst the current macro backdrop.

- Of particular interest is how much the 3.1% sales decline we expect has impacted the company’s margins, and whether the business could close its books with the 33%-34% full-year gross margin it has historically maintained, leveraging the promotional tactics and scale that underpin its cost advantage.

The Home Depot Stock Price

Fair Value Estimate for Home Depot

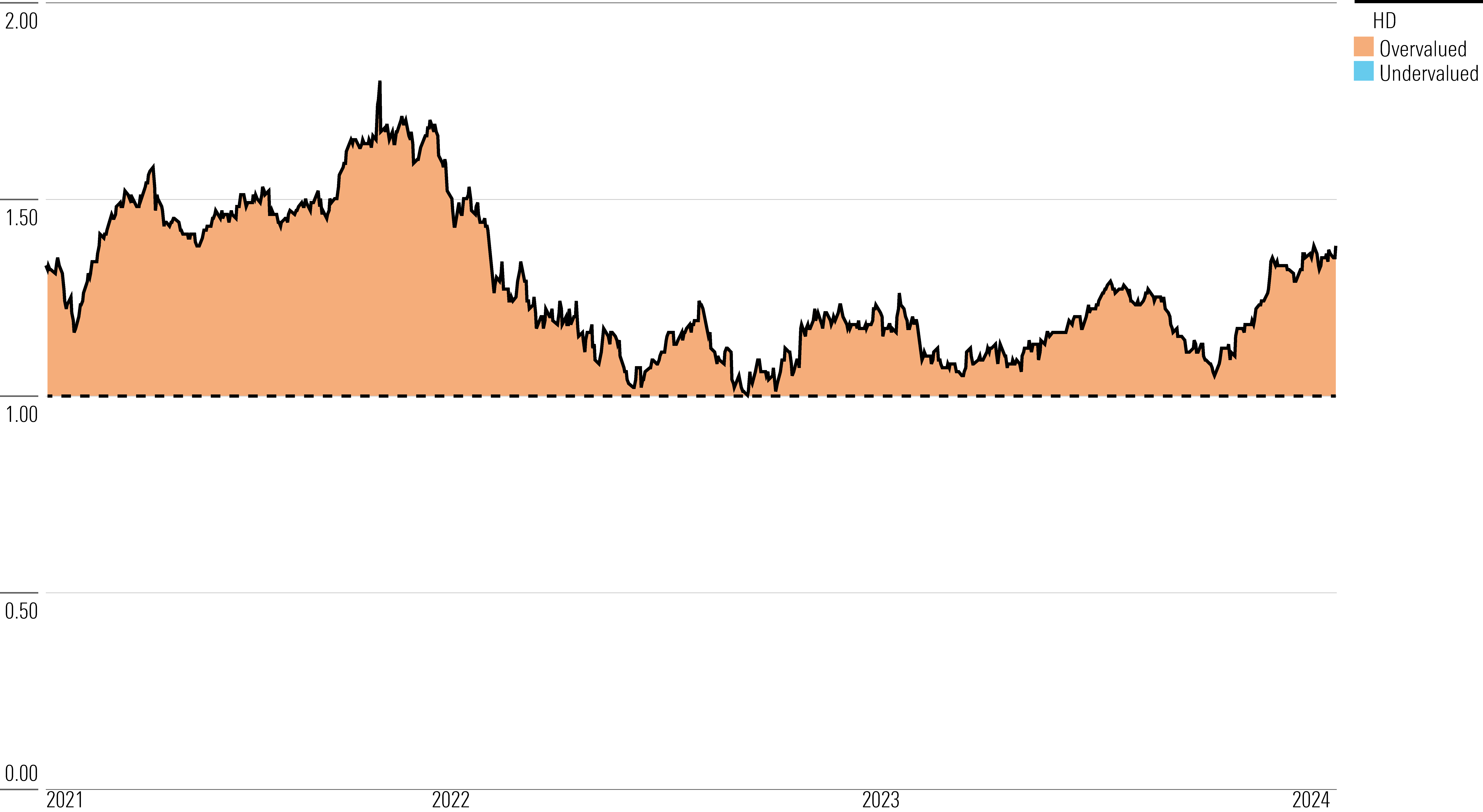

With its 2-star rating, we believe Home Depot’s stock is overvalued compared with our long-term fair value estimate.

Given the maturity of the domestic home improvement industry, we expect demand to largely depend on changes in the real estate market, driven by prices, interest rates, turnover, and lending standards. We project 2.4% average sales growth over the next five years, supported by 1.9% average same-store sales increases and helped by offerings like buy online/pick up in-store and better merchandising, which drives market share gains. In the longer term, we forecast gross margins to hold steady over the next decade (ending 2032 at around 2022 levels or 33.5%) while the selling, general, and administrative expenses ratio remains flat (around 17%) as the firm capitalizes on its scale and supply chain improvement initiatives while investing to protect its market leadership perspective. This leads to a terminal operating margin of 15.4%, a touch above the 15.3% peak achieved in 2022.

Home Depot’s operating margins and returns on invested capital could improve as the firm focuses on the efficiency of its supply chain and opportunities to better penetrate the pro business with market delivery centers that leverage its delivery capabilities. Additionally, we think Home Depot still has other opportunities to expand. It can capitalize on product lines with weak market share leaders, as it has previously done in appliances while Sears faltered. Also, having deeper product lines to cross-sell (with brands like Company Store offering exposure to textiles and HD Supply reaching the maintenance, repair, and operations consumer) could add incremental revenue potential. The service business backed by a major national brand, as well as the commercial business coming from Interline and HD Supply, could build brand loyalty and keep consumers returning to a trusted source, something that could be hard to duplicate for a new entrant.

Read more about Home Depot’s fair value estimate.

Home Depot Price/Fair Value Chart

Economic Moat Rating

We assign Home Depot a wide moat. As the largest global home improvement retailer, we believe the firm possesses a competitive edge owing to its brand intangible asset and cost advantage. Over the past 10 years, the company’s sales growth has outpaced its industry’s average growth of 6.2% by 160 basis points annually, an indication of its ongoing relevance. We surmise Home Depot’s strong brand equity and extensive scale should enable incremental share gains in the highly fragmented $950 billion North American home improvement market, on top of the high-teens market share it has amassed thus far (given roughly $157 billion in sales in 2022).

In our opinion, it would be difficult for another retailer to enter the market and threaten Home Depot’s position. Smaller retailers would have a hard time building vendor relationships strong enough to undermine the company’s pricing prowess. While manufacturers creating their own networks could jeopardize the availability of products in Home Depot’s retail channel, we doubt such an endeavor would be successful in the long term. In our opinion, manufacturers would be best poised to move more products by maintaining a beneficial relationship with a wholesale network like Home Depot. We are thus confident that the firm’s competitive position will persist, indicated by our forward ROIC metrics remaining north of our 8% weighted average cost of capital over the next two decades (with ROICs forecast to ultimately reach 38% in 2032).

Read more about Home Depot’s moat rating.

Risk and Uncertainty

We give Home Depot a Medium Uncertainty Rating owing to its strong brand recognition, which has helped stabilize sales through the cycle. Its sales are largely driven by greater consumer willingness to spend on category goods, with stable existing-home price growth and decent turnover. The MRO business (Interline Brands and HD Supply) could make pro revenue less cyclical, as that maintenance side can prove more consistent.

In uncertain economic times, consumers remain in their homes, embarking on improvement projects and boosting do-it-yourself revenue. Alternatively, when home prices rise, the wealth effect generates a psychological boost to consumers, reinvigorating professional sales thanks to a higher willingness to spend on big projects. A diverse consumer base helps normalize revenue even in uneven times. Currently, about half of sales are in the do-it-yourself arena, while the rest are generated by pro customers.

In our opinion, Home Depot has minimal environmental, social, and governance risks. Product sourcing, potential data theft, and consumers’ shift in preferences to sustainable product offerings are relevant, but Home Depot should be able to adapt. We do not see any material financial impact from these factors.

We believe the biggest risk is a slowdown in the real estate market, signaled by increased home inventories for sale, slower price growth, or higher mortgage rates (up about 450 basis points over the last two years).

Read more about Home Depot’s risk and uncertainty.

HD Bulls Say

- Home Depot’s continued investments in its supply chain and merchandising should improve productivity and support its market leadership position in the home improvement market.

- The company has returned $70 billion to shareholders through dividends and share buybacks over the past five years, above 20% of its market cap. In our outlook, we forecast that Home Depot will return nearly $80 billion to shareholders over the next five years.

- The addressable MRO market is around $100 billion, and Interline and HD Supply make up a low-double-digit share, leaving meaningful upside up for grabs.

HD Bears Say

- Weak consumer spending, higher interest rates, or an economic downturn could hinder sales for home improvement projects and affect Home Depot’s growth.

- IT and supply chain improvement gains could prove challenging, as simpler efforts have already borne fruit. Further productivity efforts could face some implementation risks, creating inconsistent profitability.

- As home improvement demand continues to normalize, consumers could still shift discretionary spending away from home improvements and back into other discretionary categories.

This article was compiled by Frank Lee.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/3559e02b-f74d-4a72-a821-b50f61ba05e9.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/3559e02b-f74d-4a72-a821-b50f61ba05e9.jpg)