Consumer Defensive Stock Outlook: We Pluck Discounted Tyson Foods From the Flock

Albertsons and Kraft-Heinz are also names to put on your shopping list.

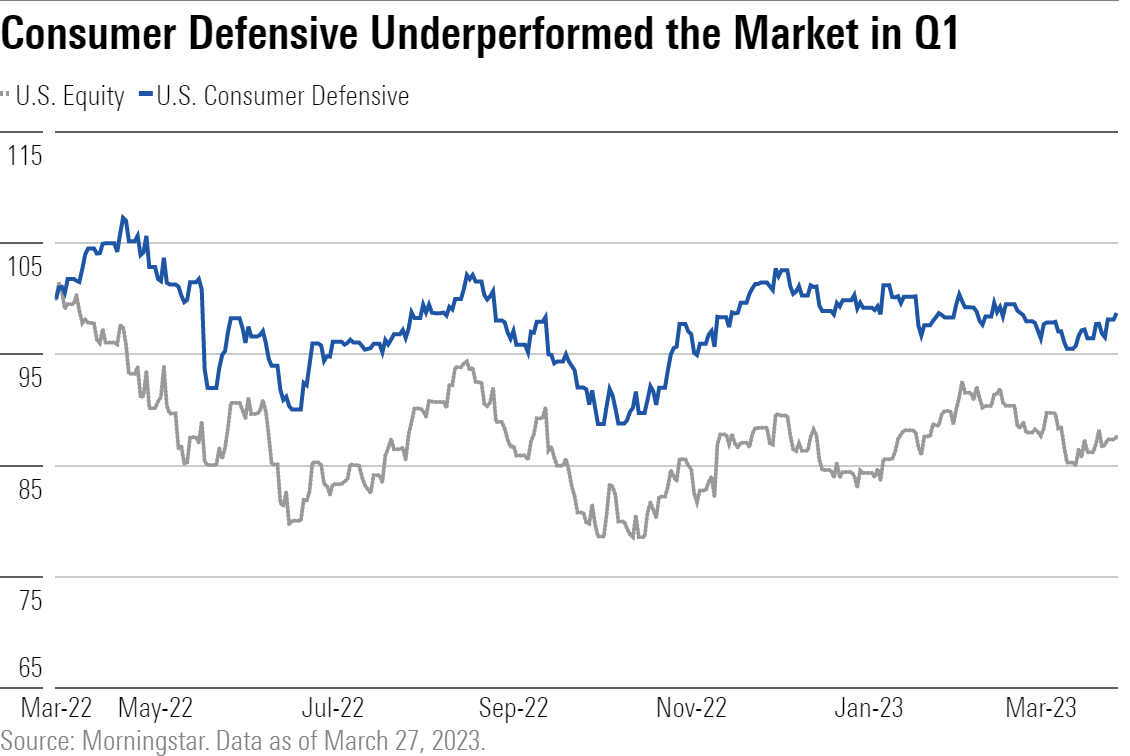

The Morningstar US Consumer Defensive Index retreated 0.49% in the first quarter, underperforming the overall market’s 3.83% gain, as of March 27. Despite the downdraft, the median consumer defensive stock appears fairly valued, in our view, trading near our fair value estimates. Still, we continue to see compelling investment opportunities in the consumer packaged goods and alcoholic beverage spaces. We suspect the market’s concerns around inflation and macro uncertainties are overshadowing the product innovation and brand prowess that bolster pricing power in the sector.

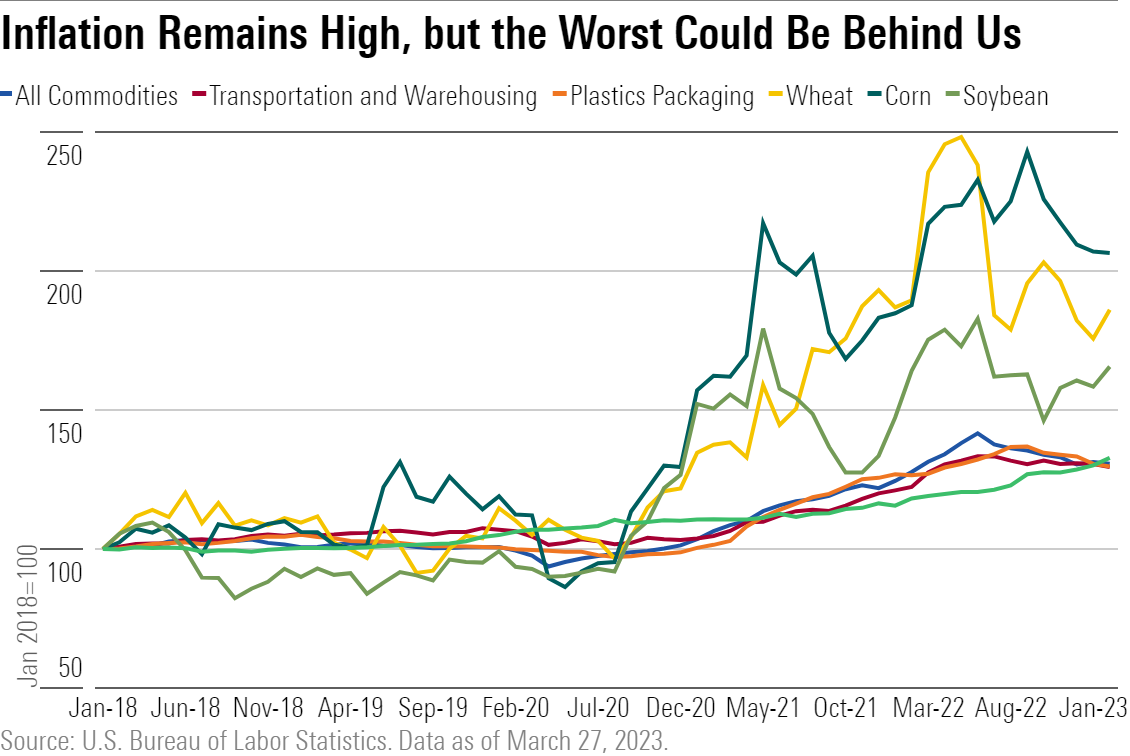

One factor that has hindered profitability in the consumer defensive space has been surging costs (across commodities, transportation, and labor). And although some commodities (including wheat, corn, and soybean) appear to be coming off recent highs, we don’t expect cost pressures to completely subside in the near term. Our contention is anchored in the fact that supply chains remain fragile and geopolitical uncertainty persists. As such, we think it will behoove operators to employ multiple levers (cost containment, stock keeping unit rationalization, and products offerings in various pack sizes) to damp the drain.

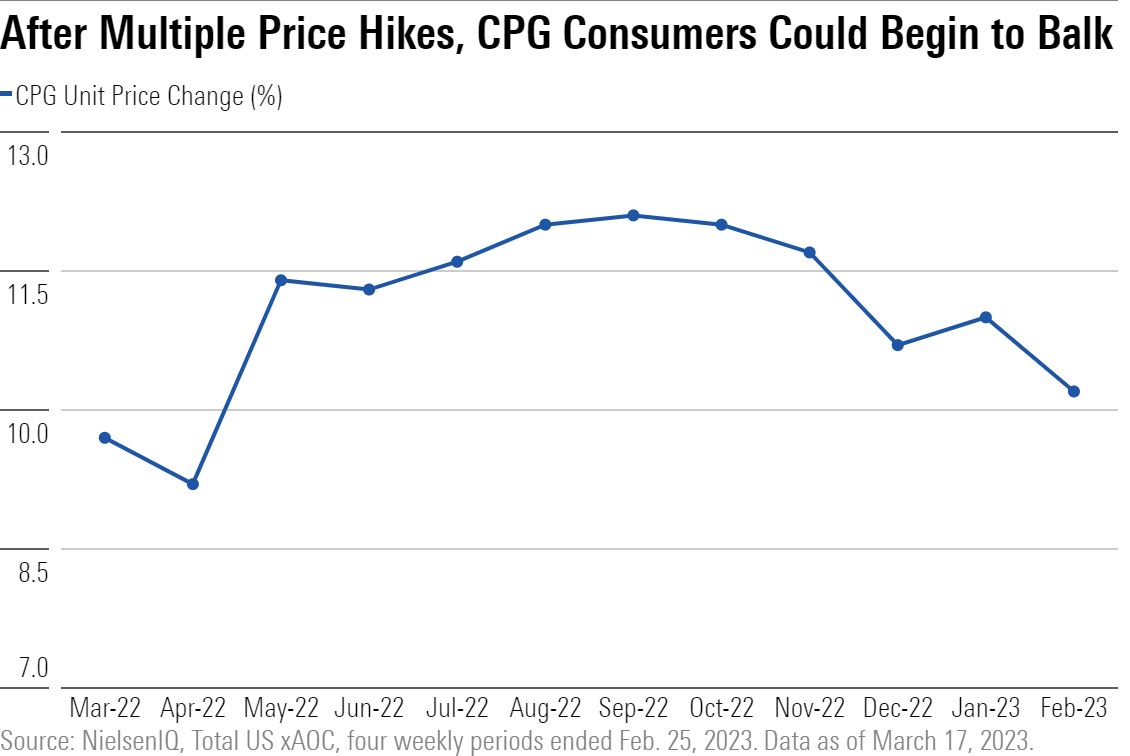

Beyond these avenues, most firms have hiked prices multiple times over the past couple of years, amounting to a low-teens rate on average over the past 12 months, with February’s 10.2% increase marking the slowest pace since April 2022. This, however, drove a 2% drop in unit sales in nonfood categories and a 4% decline in food aisles. From our vantage point, further step-ups in pricing could be met with resistance (from both retailers and consumers seeking value in these tough economic times).

In this context, we anticipate consumers could increasingly opt to purchase larger pack sizes (that carry lower per unit prices) or smaller offerings (which boast lower price points). However, to thwart trade down, we anticipate leading branded operators will keep funneling resources toward research, development, and marketing to tout the value their products offer and ultimately support their brand intangible assets and pricing power.

Top Consumer Defensive Sector Stock Picks

Tyson Foods TSN

- Fair Value Estimate: $103.00

- Star Rating: 5 stars

- Uncertainty Rating: Medium

- Economic Moat Rating: None

Tyson’s stock is on sale, trading at a 43% discount to our $103 fair value estimate. Stout inflationary headwinds have been degrading margins and impairing demand, with cash-constrained consumers increasingly opting for less expensive cuts of meat. And while we’re skeptical the firm will hit its sales targets (due to increased chicken and pork supply, which stands to cap prices), we’re encouraged that Tyson has recently prioritized productivity efforts and investments in wages and benefits as well as automation, which should enhance long-term efficiency. As such, we think Tyson’s stock will gravitate toward our valuation in time.

Albertsons Companies ACI

- Fair Value Estimate: $29.00

- Star Rating: 5 stars

- Uncertainty Rating: Medium

- Economic Moat Rating: None

Albertsons trades at a 34% discount to our $29 fair value estimate. We think the market fails to fully appreciate Albertsons’ ability to outperform subscale rivals and improve its private label and omnichannel capabilities independent of Kroger (our valuation is on a standalone basis). Indeed, competition is rife in the grocery sector, with multiple incumbents fighting to lower prices and meet high customer expectations while incurring high fulfillment costs (particularly delivery). Still, we expect Albertsons to post roughly 5% long-term adjusted EBITDA margins, on average, as cost leverage offsets some of the competitive strain.

Kraft Heinz KHC

- Fair Value Estimate: $52.00

- Star Rating: 4 stars

- Uncertainty Rating: Medium

- Economic Moat Rating: None

Kraft Heinz trades 27% below our $52 fair value estimate, while boasting a 4% dividend yield. We suspect its shares are beleaguered by the supply chain disruptions and broad-based inflationary headwinds, which are expected to drag margins by a high-single-digit rate in fiscal 2023 (on top of double-digit hits the past two years). Nonetheless, we contend the firm’s efforts to elevate its brand (marketing and innovation), enhance capabilities (category management and e-commerce), and unearth cost savings warrant investors’ attention; these should prove valuable for enhancing the long-term health of the business.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IRAS2PNXWNDGRPQXLGHV6T7QWE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6A6R4SGLDNGMXHAH3K2CIQTF3Q.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)