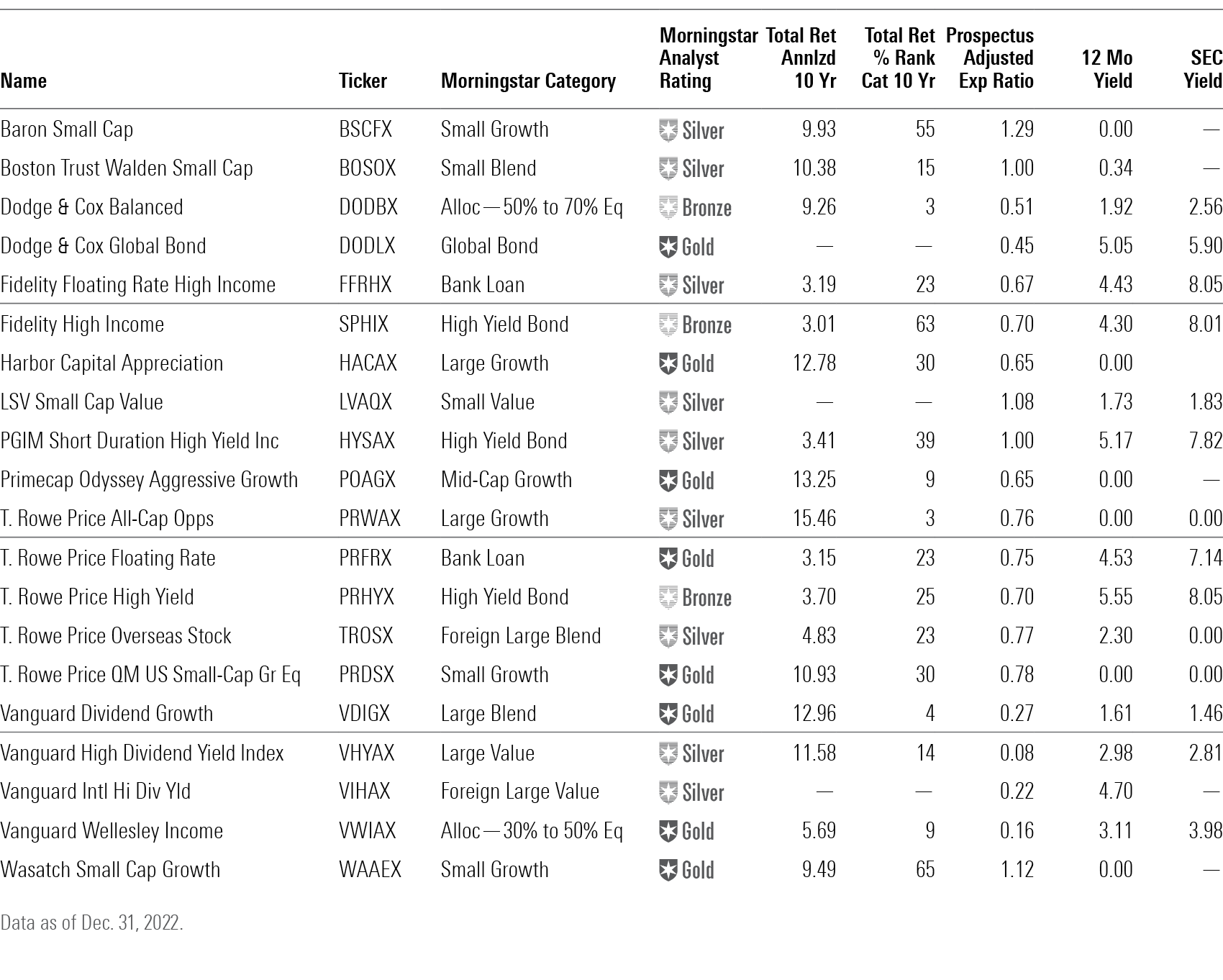

20 Funds for Investors to Consider in 2023

These funds have long-term appeal.

The market gave us a lot of red numbers in 2022. It was one of the tougher years for stocks and bonds alike. But now I feel pretty good about investing for the long term.

To be sure, 2023 seems dicey, with more Federal Reserve rate hikes and a possible recession looming. But stocks appear cheap, and equity and bond yields are quite robust. A couple of years of sideways markets wouldn’t be so bad if fund investors can continue to bank yields of 2% to 8%, depending on the fund.

Our equity analysts estimate the fair value price of every stock they cover. At the start of 2022, they had the U.S. market at a 6% premium. Today, it’s at a 15% discount. In 2020, a similar discount would have been a good time to buy as the rebound came quickly, but in 2008, there was a lot more pain to come. (You can track the discount/premium here.)

By market cap, small caps are trading at a 23% discount, mid-caps at a 16% discount, and large caps at a 14% discount. If we look at returns by index or fund category, we see value beating growth for one and three years, but growth modestly ahead over the longer time periods. So, the returns are suggesting that the prospects for value and growth are roughly similar, while the discount to fair value indicates that in large caps, at least, growth has greater potential.

I’m grouping my picks for 2023 and beyond into three buckets: bargains based on price/fair value, income, and special opportunities. As always, these picks look particularly attractive now but are meant as long-term investments. I’m not predicting short-term results.

Cheap Parts of the Morningstar Style Box

I’ve chosen three very different small-growth funds. T. Rowe Price QM U.S. Small-Cap Growth Equity PRDSX, which has a Morningstar Analyst Rating of Gold, is a great wide-ranging fund based on quantitative models. The models look at valuation, profitability, earnings quality, and price momentum to build a diversified portfolio. If small growth really is cheap, then this fund ought to be a winner.

Wasatch reopened several funds in September as investors pulled out money amid the bear market. I selected Wasatch Small Cap Growth WAAEX for its combination of a Gold rating and poor recent performance. The names in its portfolio, after all, would appear to have gotten much cheaper. Manager J.B. Taylor has a great track record despite 2022′s poor showing. He looks for well-run companies that can double earnings in five years’ time. It’s an aggressive strategy, which is why it got pummeled in 2022 but soared in 2020.

Baron Small Cap BSCFX is a Silver-rated fund plying the house strategy of finding companies with steady earnings growth, good management, and a good position in the market. It’s a fine strategy, though it, too, has endured a rough year.

In small blend, I offer you Boston Trust Walden Small Cap BOSOX, a Silver-rated hidden gem. The team looks for companies with durable earnings and strong returns on capital, but it places a greater emphasis on valuation than the funds above. Likewise, the team is cautious about risking too much on one stock and limits position sizes to 2.5% of assets. This caution worked nicely in 2022 as a modest 9% loss topped nearly every small-blend fund. The fund’s long-term record likewise shows it losing less in downturns and staying competitive in rallies. With that ticker, I’m guessing they won’t be getting any Yankees fans to invest.

In small value, I’ve selected Silver-rated LSV Small Cap Value LVAQX. The fund’s models look for very cheap stocks that are out of favor or have the fundamentals to suggest a rebound. The fund lost less than its peers in 2022, and it has beaten benchmark and peers since the 2013 inception. With only $417 million in assets, the fund certainly has the flexibility to make the most of its models.

Now, I have two picks for large growth.

Old favorite Harbor Capital Appreciation HACAX is very much a classic growth fund with many investments in the big technology and healthcare names you know. The growth team at subadvisor Jennison is seasoned with a strong track record. Top holdings at this Gold-rated fund include Tesla TSLA, Apple AAPL, Amazon.com AMZN, and Eli Lilly LLY.

Silver-rated T. Rowe Price All-Cap Opportunities PRWAX has been an appealing fund since Justin White took over in 2016. White has nimbly moved among growth names to produce solid returns. He’s also one of the few T. Rowe Price growth managers to outperform in 2022. He mixes secular growth stories with more opportunistic plays, and it has worked nicely. The fund no longer has an explicit growth mandate but still lands squarely in the growth section of our style box.

Income

Yes, yields are back. You can finally get decent income without taking wild risks. So, I’m going to go in reverse order of SEC yield. The SEC yield is a 30-day yield as opposed to the 12-month yield, which tells you what a fund paid the past year. Because rates have spiked, the 30-day is more indicative of the portfolio yield today.

Bank loans adjust as interest rates do, and that means their yields are soaring. Silver-rated Fidelity Floating Rate High Income FFRHX has a big 8.05% yield, and Gold-rated T. Rowe Price Floating Rate PRFRX has a 7.14% yield. Bank loans pack both credit and liquidity risk, so please don’t treat them like a core bond fund. But Fidelity and T. Rowe Price have assembled strong teams to do the needed research and have managers who can find the right mix of aggression and caution.

I also like the high-yield teams at Fidelity and T. Rowe Price. Bronze-rated funds T. Rowe Price High Yield PRHYX and Fidelity High Income SPHIX have yields around 8%, but as their 11% to 12% losses in 2022 showed, the category isn’t risk-free. The next year will be challenging for them as we flirt with a recession, but, for a change, you are getting well compensated for that risk.

If you want high-yield with less interest-rate risk, consider PGIM Short Duration High Yield Income HYSAX, which we rate Silver. Despite a duration of just three years, the fund still has a yield of 7.8%—nearly matching those of the longer-term high-yield funds above. This fund’s 5.9% loss in 2022 was half the above funds’, so it’s not a bad deal. PGIM has a strong high-yield team that is comparable to those at T. Rowe Price and Fidelity.

Dodge & Cox Global Bond DODLX sticks to investment-grade fare, so its yield is a more modest 5.9%, but that’s still pretty nice for a largely investment-grade fund. As with Dodge & Cox’s domestic bond fund, this one mostly sticks to corporate bonds, government bonds, and mortgage-backed securities. We rate it Gold.

Another angle on income is Gold-rated Vanguard Wellesley Income VWIAX, which combines a big bond portfolio with a smaller dividend-oriented equity portfolio. The fund charges just 0.16% and has a yield of about 4%. This is one of those funds that’s easy to own.

I’m also a fan of Bronze-rated Dodge & Cox Balanced DODBX, which invests 60% or more in equities, thus giving it more risk and more return than Vanguard Wellesley Income. Dodge & Cox is one of the unusual boutiques to excel at both stock and bond investing, so a balanced fund makes sense.

Finally, I have a couple of equity funds that are worth a look. Vanguard High Dividend Yield Index VHYAX is a Silver-rated fund that aims for stocks with robust yields but is well-constructed to avoid those with the highest risk. Also, Vanguard Dividend Growth VDIGX emphasizes the potential for dividend hikes, so it looks for companies with clean balance sheets and growth potential. That leads to a lower yield, but it also means a solid portfolio of high-quality companies that can withstand economic turmoil.

A Few Opportunities

I’m a big fan of buying when a fund reopens to new investors. Reopening is often a contrarian signal in that it can mean performance-chasers are fleeing when solid investment opportunities are out there. Thus, Gold-rated Primecap Odyssey Aggressive Growth POAGX is intriguing. The fund’s pedestrian three- and five-year returns likely spurred the exodus. But the fund’s longer-term record remains strong, and Primecap’s team is excellent.

I’m also interested in the potential for foreign currencies to rebound against the dollar. An aggressive Fed has caused the dollar to appreciate, thus adding to the losses suffered by foreign equity funds, most of which don’t hedge exposure to currencies and thus are subject to the whims of their movements. And, of course, foreign equities are having their own winter sale event, so you can get them at fairly cheap prices.

Two favorites that stand out are T. Rowe Price Overseas Stock TROSX and Vanguard International High Dividend Yield VIHAX. Both funds have Silver ratings. T. Rowe Price manager Ray Mills is a seasoned vet who is simply very good at fundamental research. The Vanguard option is a well-designed index fund with one of the bigger yields you can find in an equity fund.

There are plenty of good choices for your money in 2023. Investors who can buy in a bear market and tolerate short-term pain are often rewarded handsomely in future years.

This article first appeared in the January issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting this website.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/fcc1768d-a037-447d-8b7d-b44a20e0fcf2.jpg)