Discounts Largely Intact in Consumer Cyclical as Economic Uncertainty Feeds Investors’ Pessimism

Apparel and travel and leisure top our list of the most undervalued sectors.

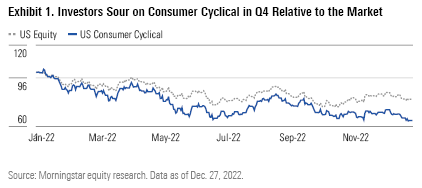

The Morningstar US Consumer Cyclical Index plummeted 7.62% in the fourth quarter, lagging the 6.91% increase the market chalked up, as of Dec. 27, 2022 (Exhibit 1).

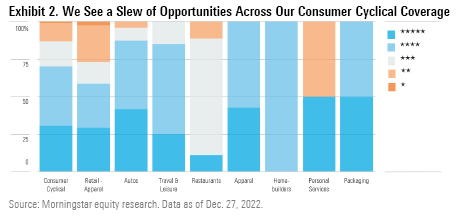

As such, the median stock valuation within the consumer cyclical sector trades at a 21% discount to our fair value estimates, with 61% of our coverage trading in 4- or 5-star territory (Exhibit 2). Apparel and travel and leisure top our list of the most undervalued sectors, trading at 39% and 31% respective discounts to our intrinsic valuations. We suspect investors are overweighting near-term concerns regarding persistent inflation, rising interest rates, dollar appreciation, diminishing personal savings, and the likelihood of a recession. While these headwinds continue to challenge companies’ profitability, we believe this has disproportionately affected share prices, and anticipated relief has yet to be fully recognized.

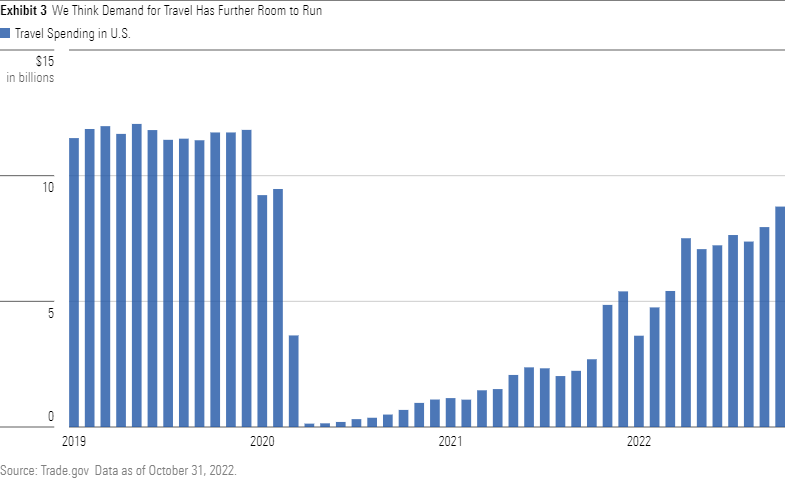

U.S. travel spending fell off a cliff in 2020 when COVID-19 induced mobility restrictions and halted international travel. Despite navigating headwinds in 2022 (including inflation and restrictions in China), pent-up demand catalyzed a surge in the travel industry during the second half of calendar 2022 (Exhibit 3). Still shy of a full recovery, we don’t posit consumers’ penchant to travel has waned, and we expect overall spending to shift more to services than goods over the next few quarters. We also surmise remote-work flexibility will serve as another tailwind for travel-industry growth.

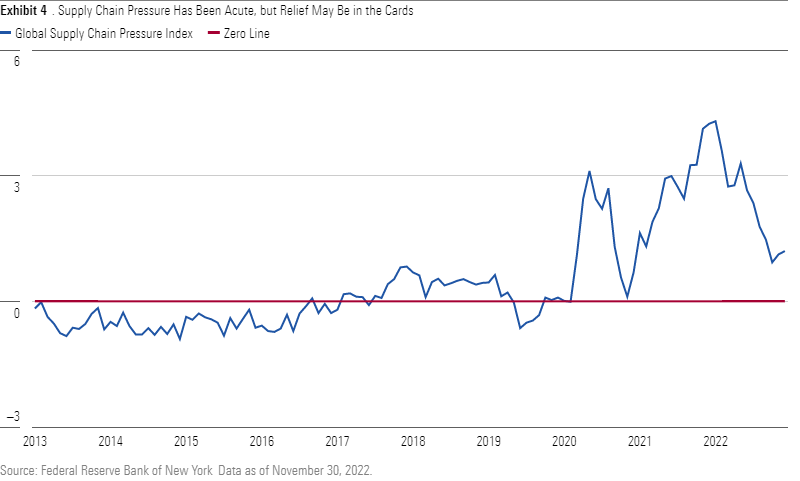

In addition, we think heightened spending on services (as opposed to goods) combined with enhanced capacity levels are serving to ease the pressure that has strained supply chains for the better part of the past few years.

This is evidenced in the Global Supply Chain Pressure Index (Exhibit 4), which while still elevated, has come off its peak at the beginning of calendar year 2022. We think that damped demand from cash-constrained consumers could further alleviate supply chain angst. Even if trepidations around a snarled supply chain re-emerge, we believe moaty firms are best equipped to navigate such challenges, given the stout resources and brand standing they tout.

See our analysts’ Top Picks in the Consumer Cyclical sector.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)