3 Lessons for Investors From the Third Quarter

Why you shouldn’t fight the Fed, expect a V-shaped bounce, or throw in the towel.

What a long, strange trip the third quarter turned out to be.

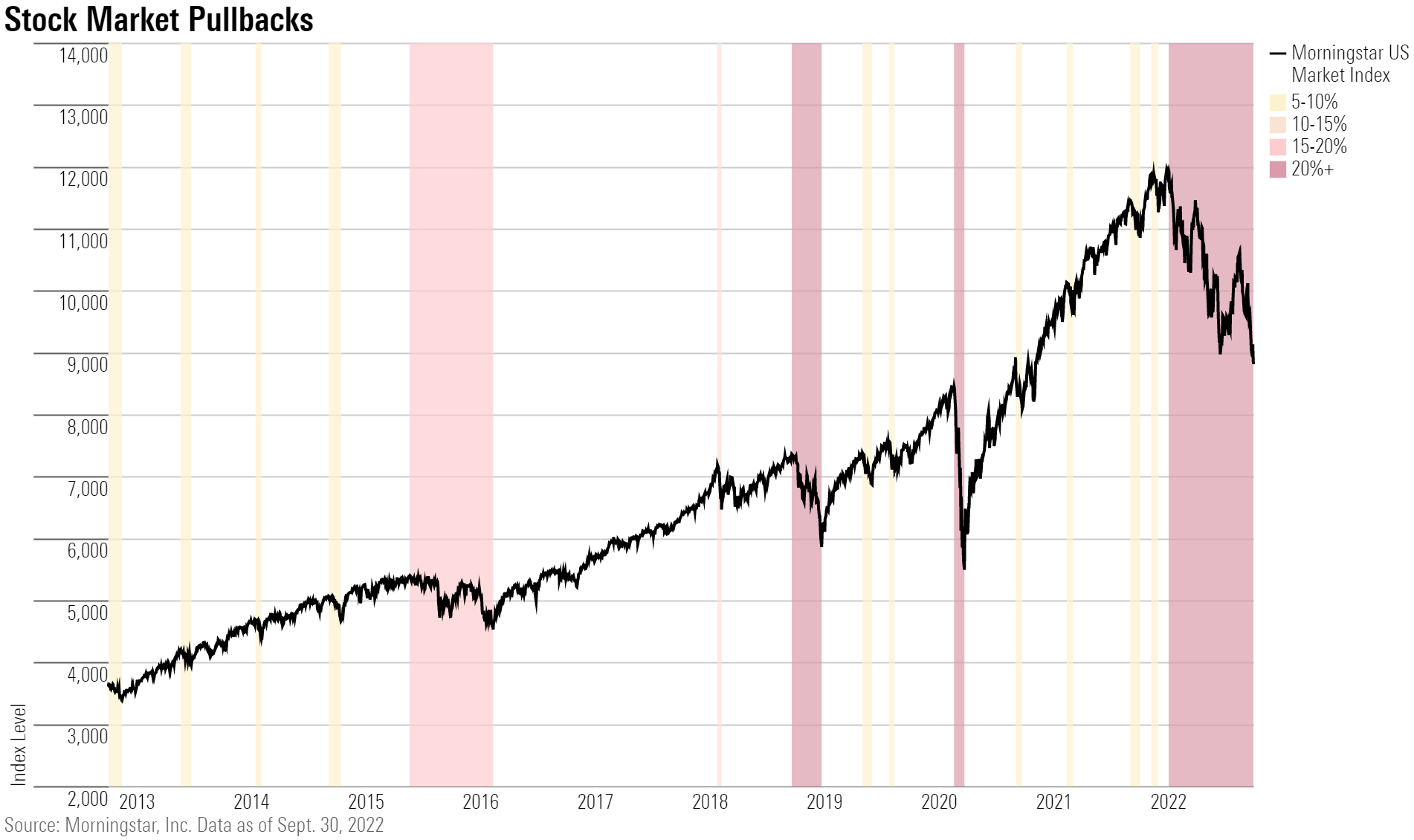

The Morningstar US Market Index took a dizzying round trip journey by rising 13% from July 1 through Aug. 16 before giving back those gains and more, falling nearly 17% since then through quarter-end. For the year, the index is off 24.9%.

By Sept. 30, the optimism that kicked off a monthslong summer rally from the June 16 low on hopes that inflation had peaked and the Federal Reserve would begin to let up on the pace of interest-rate hikes was a distant memory. Exuberance gave way to deep pessimism, driven by weakening corporate profits, concerns about slowing consumer demand, and the potential for recession as the Fed redoubled its commitment to bring inflation down. Stocks sunk to new lows in the final days of the quarter.

Inflation has remained stubbornly high. Far from pivoting, the Fed moved full steam ahead and boosted rates by 0.75 percentage points for a third straight time in late September, and the central bank vowed to keep at it. The ongoing war in Ukraine has continued to wreak havoc on global supply chains and energy supplies. China, which represents close to 19% of global gross domestic product, is struggling with a sharp economic slowdown. Earnings warnings from high-profile companies such as FedEx FDX and Ford F, among others, have spooked investors. And the U.S. dollar continues to rise against other currencies, pressuring corporate earnings but also raising concerns about the potential for a liquidity crisis.

There are lessons to be learned from the recent investment dynamics and volatility, many old saws that bear repeating but freshened with insights specific to the current times. Chief among them:

'Don’t Fight the Fed'

It’s one of the most common bits of market wisdom you’ll hear, but there’s a reason for it: It’s true. And investors ignore it at their own peril.

“Don’t fight the Fed—it works on the way up and it works on the way down,” says Steve Sosnick, chief strategist at Interactive Brokers. “Fed liquidity is like the tide for the market. If the tide is flowing in that moves stocks higher … and if the tide is moving out, that direction brings stocks down, and you don’t want to fight that either."

Right now, the tide is definitely moving out in the form of multiple aggressive interest-rate increases and messaging from Fed Chair Jerome Powell that the central bank won’t relent until price stability is achieved.

“Trust what the Fed is saying and what they are doing,” says Andy Kapyrin, co-chief investment officer at RegentAtlantic, a Morristown, New Jersey-based Registered Investment Advisor with $6 billion under management.

“The biggest lesson we learned: The Fed is serious about getting inflation under control,” Kapyrin says. “They have been unequivocal about getting inflation down. There’s been damage to the bond market from the rise in rates, and they are comfortable with that. There’s been damage to the housing market, and they are comfortable with that. There’s damage to the stock market, and they are comfortable with that. Don’t expect them to ease until the weakness in the economy demands action. It’s too early to talk about easing.”

So, Forget About That 'V-Shaped' Bounce

Years of interest-rate easing—first in response to the 2007-09 financial crisis and then following the COVID-19 pandemic lockdowns—and near-zero interest rates led investors to assume the Fed would continue to come to the rescue at the least hint of trouble in the markets. That has led to investors becoming accustomed to “V-Shaped” bounces in the stock market (so-called because of how they look on a chart.)

This time around, it didn’t help that initially the Fed said it believed inflation would be “transitory,” but that was before Russia’s war against Ukraine.

Yet, investors continued to expect them to back off. Among the reasons for the bounce in stocks was the belief that the Fed would be quick to pause or substantially slow down the pace of interest rate hikes, especially with the stock market down more than 20%.

“The Fed isn’t going to pivot on market reaction,” says Jim Masturzo, partner and chief investment officer of multi-asset strategies at Newport Beach, California-based Research Affiliates. “They have a target and they’re going there.”

That doesn’t mean that the stock market won’t see more rallies in coming months, but as long as the Fed remains in aggressive tightening mode, investors should keep in mind the bear market could be lingering.

“One of the lessons of the third quarter is that the Fed is not coming to the rescue of the stock market,” agrees Sosnick. “And another lesson is that bear market rallies are short, sharp, and ferocious.”

Against that backdrop, Sosnick cautions that “buy the dips” will be a treacherous strategy in the short term. “When there is not this flow of money (from the Fed and other central banks) coming into the market, buy the dips becomes much trickier.”

Stay Invested and Stay Diversified

It’s easy for investors to become disillusioned when markets put a big dent in a financial plan.

That’s especially the case in a year like this one in which most asset classes suffered pullbacks, making it hard to find cover anywhere. Most notably, bond investments haven’t lived up to their traditional role of providing a safe haven from a stock market downdraft. In fact, during the third quarter, many parts of the bond market posted bigger declines than stocks.

But by maintaining a diversified portfolio of different asset classes, sectors, regions, and style characteristics, investors can lighten their losses and position themselves to benefit as conditions shift.

“Diversification continues to be important,” says RegentAtlantic’s Kapyrin.

And certainly, now is not the time to pull out of the market. Just make sure to consider your investment strategy, time horizon, and market conditions.

“Trust in the fundamental value of your investments and look through the volatility,” says Scott Clemons, chief investment strategist for Brown Brothers Harriman’s private banking division. “If you’re comfortable with your strategic asset allocation then buckle down and ride it through. For long-term investors, buying on the dip makes sense.”

With that in mind, many market strategists are seeing value for long-term investors in the bond market, even though they could be vulnerable to losses in the near term.

Now that yields on 10-year Treasuries are approaching 4%, “long bonds are something every investor should start thinking about,” says Research Affiliate’s Masturzo.

RegentAtlantic’s Kapyrin is focused on the fixed-income market as well.

“For the first time in a generation, there is a very good rate of return in fixed-income products,” he says. “Investors have options.”

At the same time, the experience of the last three months shows that sometimes market rules of thumb—such as bonds will move in the opposite direction of stocks—is a sign that for some portfolios, a broader definition of diversification may be needed.

The lesson of diversification from this time period, says Masturzo, comes with a twist.

“Portfolios of U.S. stocks and bonds are not enough diversification,” he says. Investors, he suggests, need to add commodities, Treasury Inflation-Protected Securities, real estate, and non-U.S. assets.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/LDGHWJAL2NFZJBVDHSFFNEULHE.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed88495a-f0ba-4a6a-9a05-52796711ffb1.jpg)