New 401(k) Lawsuits Go Too Far

If successful, performance-chasing could be the hot new trend in 401(k) lineups.

Plan sponsors of 401(k) defined-contribution plans aren't strangers to litigation over investment options, but a new set of lawsuits focused on past performance could lead to chasing top-performing funds.

In recent years, there have been numerous lawsuits accusing plan sponsors of including target-date strategies that charge excessive fees. These lawsuits have helped push some plan sponsors to select cheaper target-date series to limit the risk of litigation. In Morningstar's 2022 Target Date Landscape, for example, we highlighted how $59 billion of net inflows went to target-date mutual fund share classes in the cheapest quintile, while the second-cheapest quintile gathered $3 billion. The three more-expensive quintiles in aggregate shed more than $38 billion. Choosing lower-cost funds over those with higher fees has consistently tilted the odds in investors' favor, so this tack has merit.

But with most plan sponsors now focused on fees, aggressive and opportunistic law firms have found a new target: past performance. Ten companies, typically those with more than $500 million in assets in their 401(k) plans, face allegations that they violated their fiduciary duty by only focusing on selecting a low-cost option over better-performing peers. However, these allegations are made with the benefit of hindsight. The argument hinges on whether the sponsors should have swapped to a top-performing target-date series in the past without knowing whether previous performance trends would persist.

These lawsuits can lead to changes in plan sponsors' behavior as they seek to avoid legal trouble. In this instance, questioning if a plan sponsor fulfilled its fiduciary responsibilities based largely on past performance can incite frequent swapping of investment options when they aren't top performers to avoid similar lawsuits in the future.

Under Fire

The series currently in the hot seat is BlackRock LifePath Index. It earns a Morningstar Analyst Rating of Gold for its cheapest share classes, which cost 0.09% and 0.14%, and Silver for its more expensive share classes, both ringing in at 0.39%.

The lawsuits compared BlackRock LifePath Index's trailing performance starting in 2016 with the five other series with the most assets as of the end of 2021: Vanguard Target Retirement, T. Rowe Price Retirement, American Funds Target Date Retirement, Fidelity Freedom, and Fidelity Freedom Index. Those five series' cheapest share classes are Morningstar Medalists: American Funds Target Date Retirement and T. Rowe Price Retirement both earn Analyst Ratings of Gold, and the other three are rated Silver.

BlackRock LifePath Index's cheapest share class topped 73% and 76% of peers when averaging its percentile rankings across every vintage over the three- and five-year time periods through July 2022. Notably, it outperformed Vanguard and both of Fidelity's series. For performance comparisons we used the cheapest share class for each series.

Although plan sponsors had the option to select any of these six series in 2016, they also could have picked any of the 54 other target-date mutual fund series available at the time. Limiting the peer group to only a select few, including two that had the best track records as of the end of 2021, sets an unrealistically high bar for sponsors choosing investment options for their plans.

There's More to Picking a Target-Date Strategy Than Past Performance

A plan sponsor's fiduciary duty is to select an option that will best serve its employees over the long term. One of the biggest choices a plan sponsor must make when picking a target-date fund is whether to use a "to" glide path, which stops lowering stock exposure at the target retirement date, or a "through" glide path, which continues to lower stock exposure for 10 to 15 years after the retirement date. The key difference between these approaches is typically the amount of stocks they own at the target retirement date. At the end of 2021, the median "to" glide path had a 35% allocation to stocks at retirement, and the median "through" glide path had a 52% allocation to stocks.

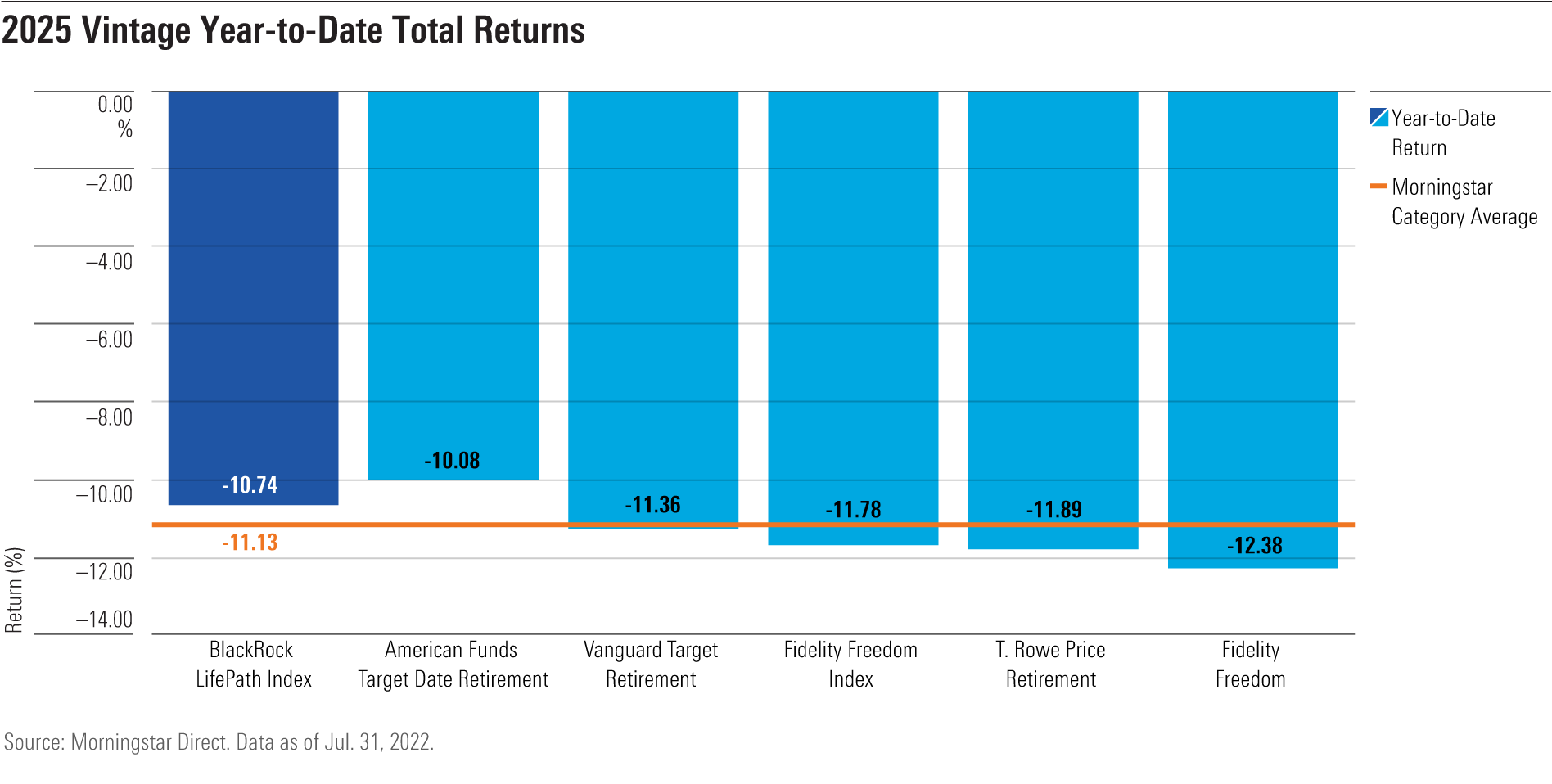

One of the arguments in the lawsuits is that the underperformance of BlackRock LifePath Index's 2025 vintage compared with the limited peer group should have triggered a change. Although BlackRock's 2025 vintage has underperformed those peers, it's because it follows a "to" approach, which means it has less equity exposure as it gets closer to the target-retirement date. The other hand-picked peers all follow "through" approaches and have a higher exposure to equities close to retirement.

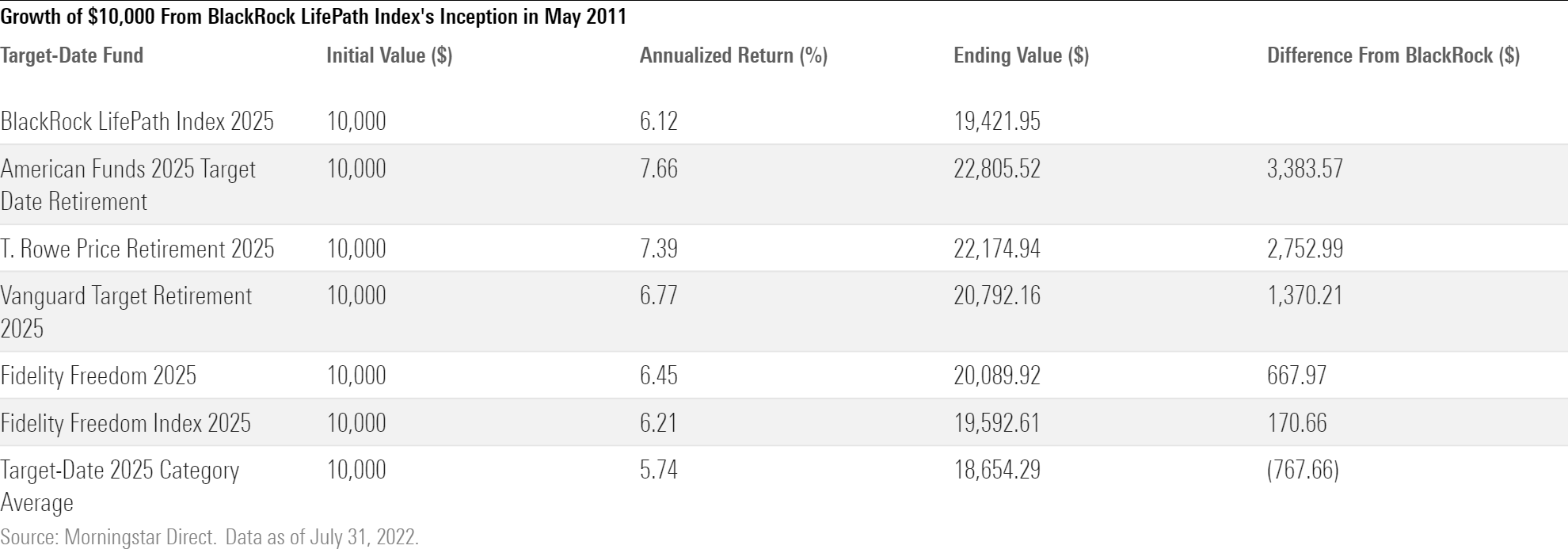

Exhibit 1 illustrates the growth of $10,000 for the cheapest share class of the six series' 2025 vintage and the Morningstar Category average from May 2011, when BlackRock LifePath Index was launched, through July 2022.

BlackRock's underperformance versus the five peers can largely be attributed to its lower allocation to stocks; it also previously had a large overweight in global real estate investment trusts that dragged on returns, but that was a smaller detractor. It was able to top the category average over the same time frame.

Wouldn't We All Love to Predict the Future?

Over the past decade, more-aggressive target-date series have been rewarded as stocks and other risk assets have generally gone up. But without knowing that ahead of time, it's not fair to fault a plan sponsor for selecting a series with a more conservative approach near retirement. That's when savings are at the most risk because participants are about to transition from making contributions to making withdrawals in retirement. If plan participants can't stick with a series during more volatile periods, they won’t be able to benefit from the long-term results. In 2020, investors closest to retirement were less likely to stay the course during the first quarter's bear market than those furthest from retirement.

In 2022, BlackRock's more conservative approach has benefited shareholders. It and American Funds were the only series out of the six to deliver shallower losses compared with the average category peer through July.

Trust the Process

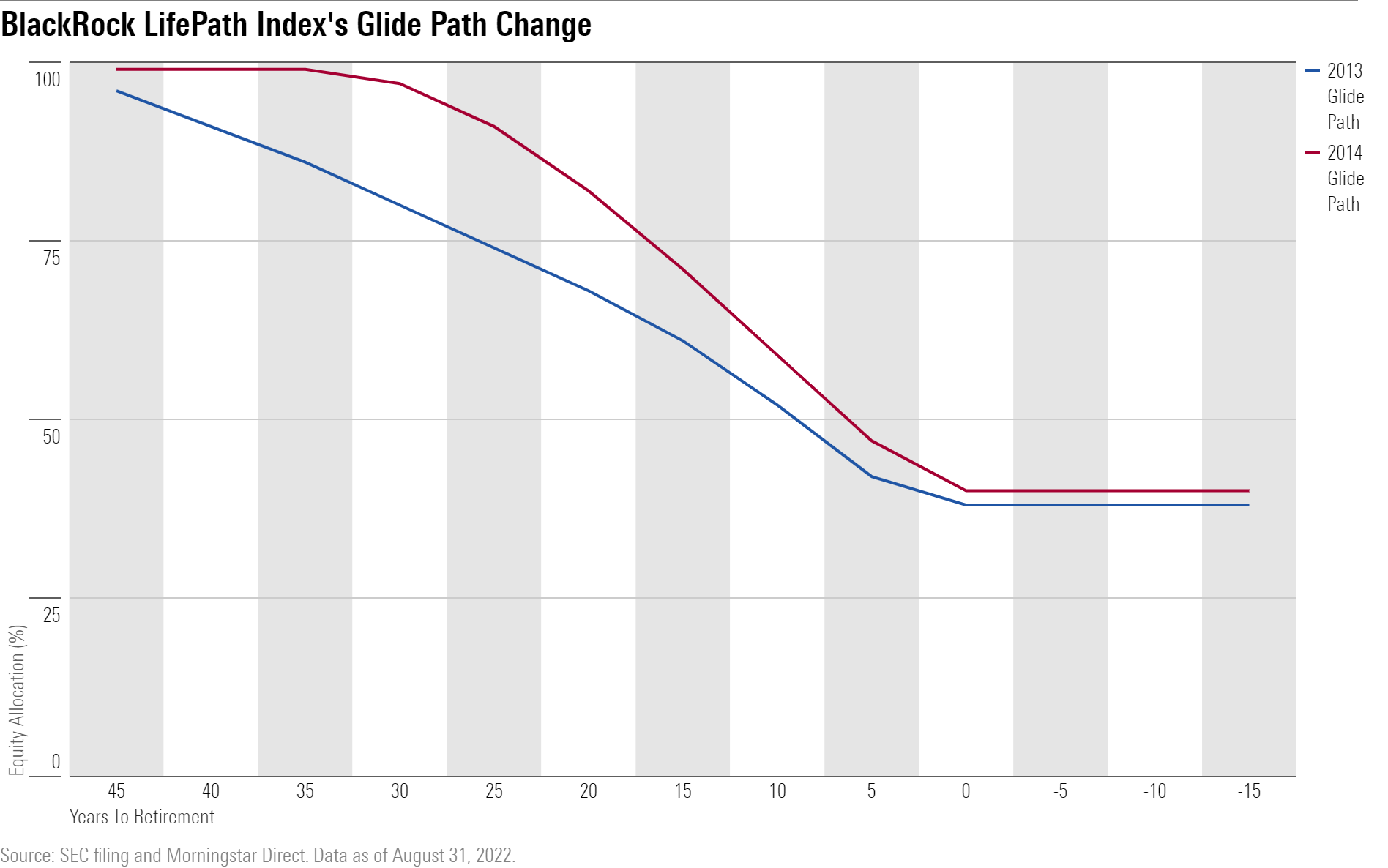

Many of the 10 lawsuits call out plan sponsors for not swapping out BlackRock LifePath Index for an alternative based on three- and five-year total-return numbers as of June 2016 and for each subsequent quarter. The best target-date teams are regularly making improvements and enhancements to their series as part of their processes, though. For example, in 2014, BlackRock was one of the first firms to increase the equity allocation early in the glide path. Exhibit 3 shows the series' glide path in 2013 and 2014.

The glide path change made any performance comparisons prior to 2014 less meaningful. Any investor making decisions based on the old glide path's returns and not what they expect going forward from the new glide path wouldn't be doing a very good job of due diligence. The changes have benefited younger savers. In 2020, T. Rowe Price changed its Retirement series' glide path to be more like BlackRock's for younger investors, showing the merit of such an approach.

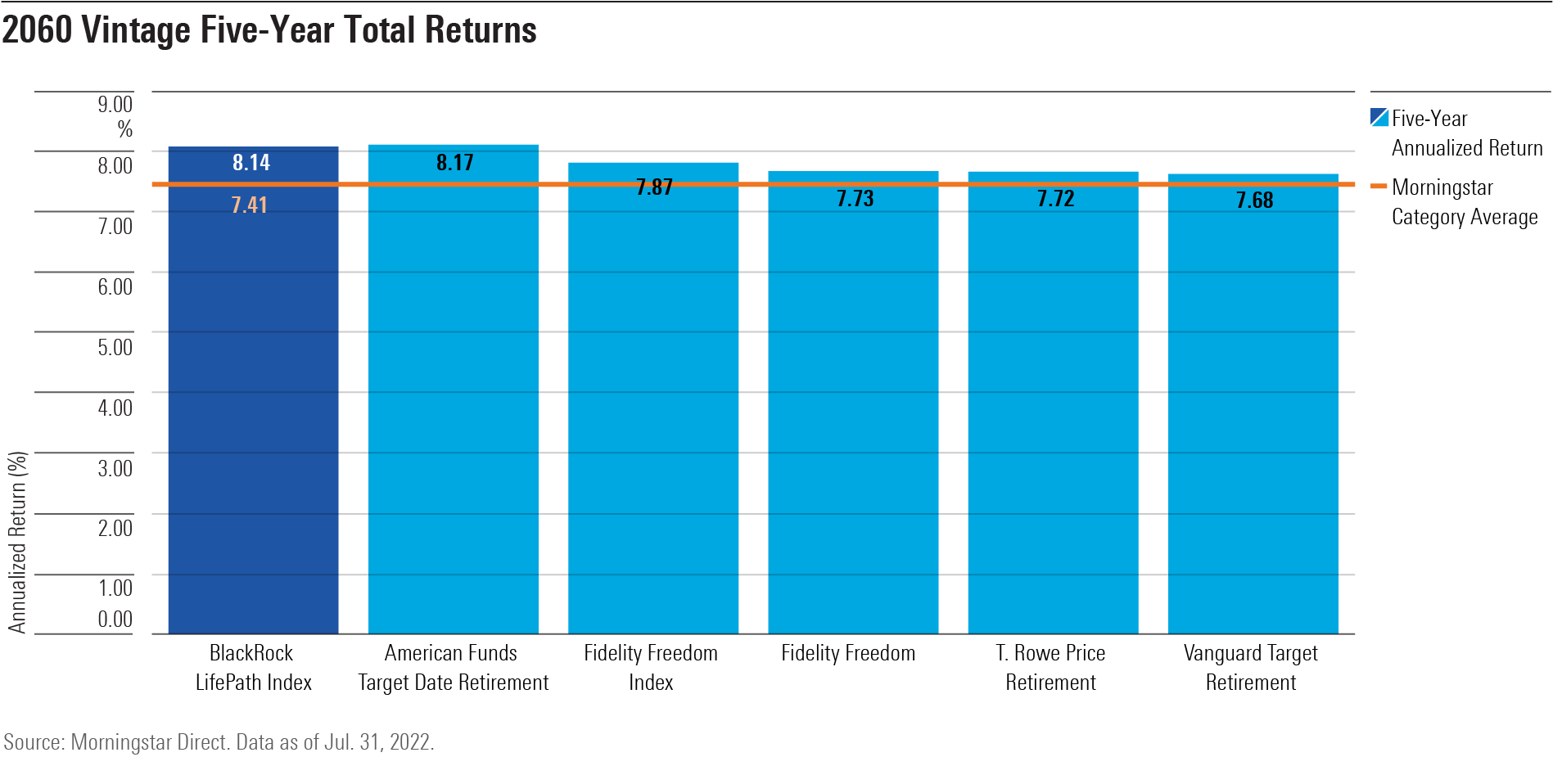

Looking at the past five years, if a plan sponsor switched target-date series to one of the proposed series, younger investors, for the most part, would have been worse off. American Funds and BlackRock's performance were toe-to-toe, with BlackRock trailing by 0.03 percentage points. BlackRock's larger equity allocation further from retirement helped boost returns.

Fiduciary Responsibility vs. Fortune-Telling

The lawsuits' primary focus on past returns versus a hand-picked group of peers could set a dangerous precedent for plan sponsors. If plan sponsors have to worry that they will face a lawsuit for periods when a series isn't a top performer, it can potentially lead them to performance-chasing and swapping out the target-date funds more often than they should. Swapping an underperforming fund for a top-performing fund has rarely led to good results. If the lawsuits are successful, this can lead plan sponsors facing similar questions on every fund offered in their 401(k) lineups.

/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/532c09c7-c679-4cfa-bfb6-578ca1149ef7.jpg)