Which Funds Have Recently Bought or Sold Netflix?

The streaming giant’s poor performance this year stirred trading activity.

Some bargain-hunting equity managers scooped up Netflix’s NFLX stock when it dropped nearly 63% from January to July 2022, as the firm said it lost subscribers for the first time ever; others ran for the exits. Here’s a look at which funds recently bought or sold the stock, and those that have the largest exposure to Netflix.

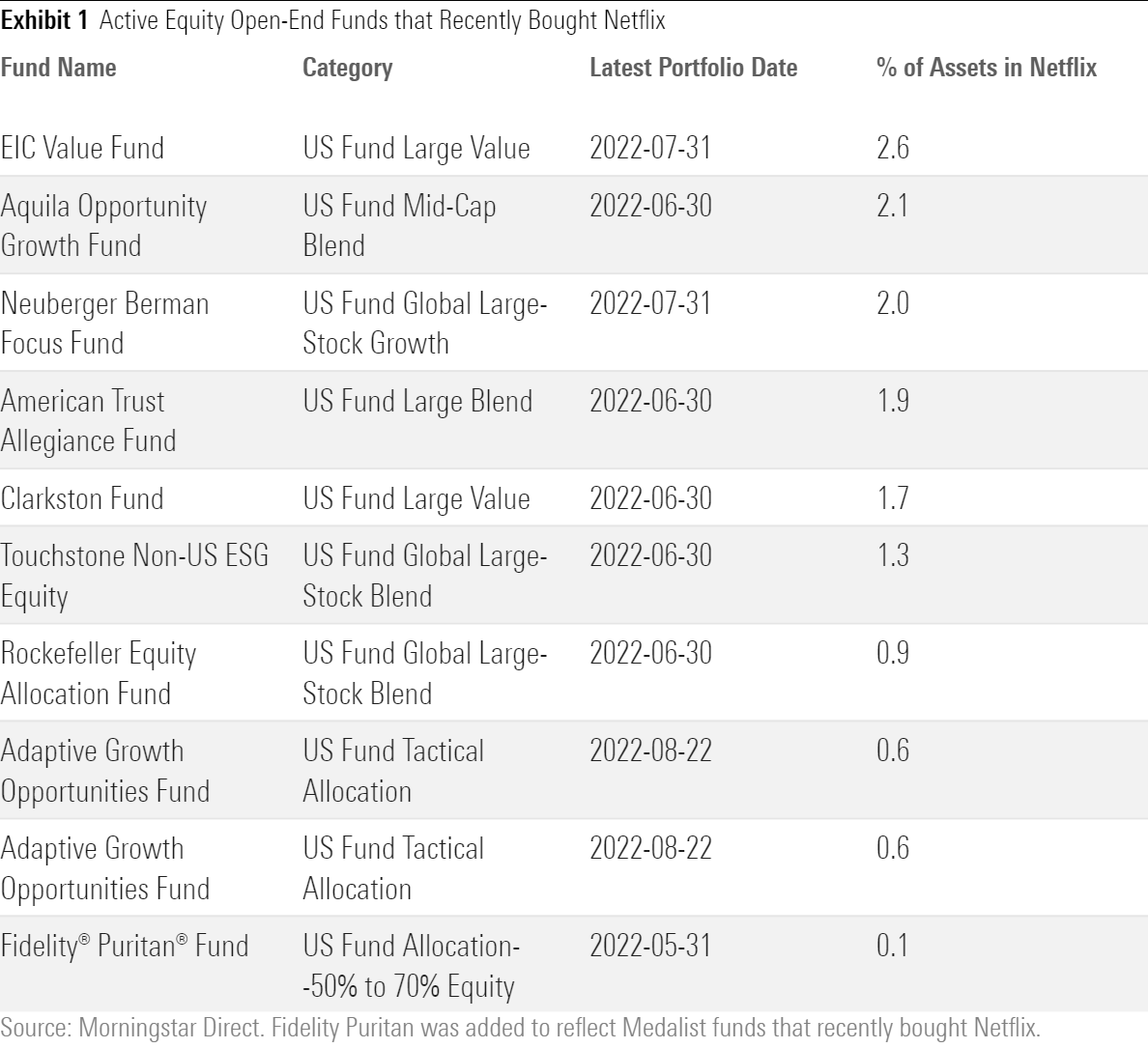

Which Funds Recently Bought Netflix?

Many buyers were value- and blend-oriented and tactical-allocation funds. This implies these strategies saw Netflix’s poor performance as an opportunity to invest in the stock at a low entry point. Another reason less-growth-oriented strategies may buy Netflix stock is because the Russell 1000 Value recently added it as a constituent, as of June 24. Buying shares would help keep the risk of not owning Netflix in check.

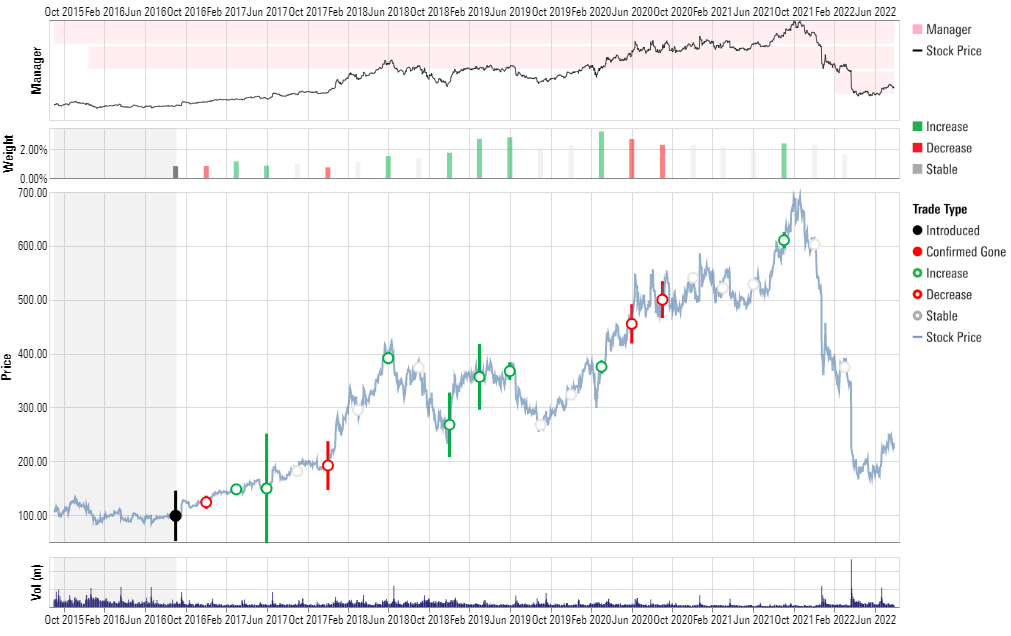

Fidelity Puritan FPURX

This Bronze-rated balanced fund allocates about 60% of assets toward stocks, and the remaining 40% or so to a mix of fixed income and cash. Lead portfolio manager Dan Kelley established a modest position in the streaming giant at 0.13% in May 2022, but this isn’t the first time he has bought the stock. Kelley bought Netflix in February 2020 but sold it in November of that year. He rebought the position in August 2021 and then sold it six months later. Here’s a look at his Netflix trading activity, using Morningstar Direct’s Individual Trade Analysis notebook.

Touchstone Non-U.S. Equity TROCX

Portfolio managers David Harris and Michael Seo run this Bronze-rated strategy. They use a patient, long-term approach that seeks to capitalize on short-term dislocations in stock prices. Harris and Seo also look for companies that are cyclically and permanently impaired. The streaming giant’s prospects don’t look nearly as bright given its subscriber-loss news, but this gave the managers an opportunity to capitalize on the market’s less-optimistic viewpoint.

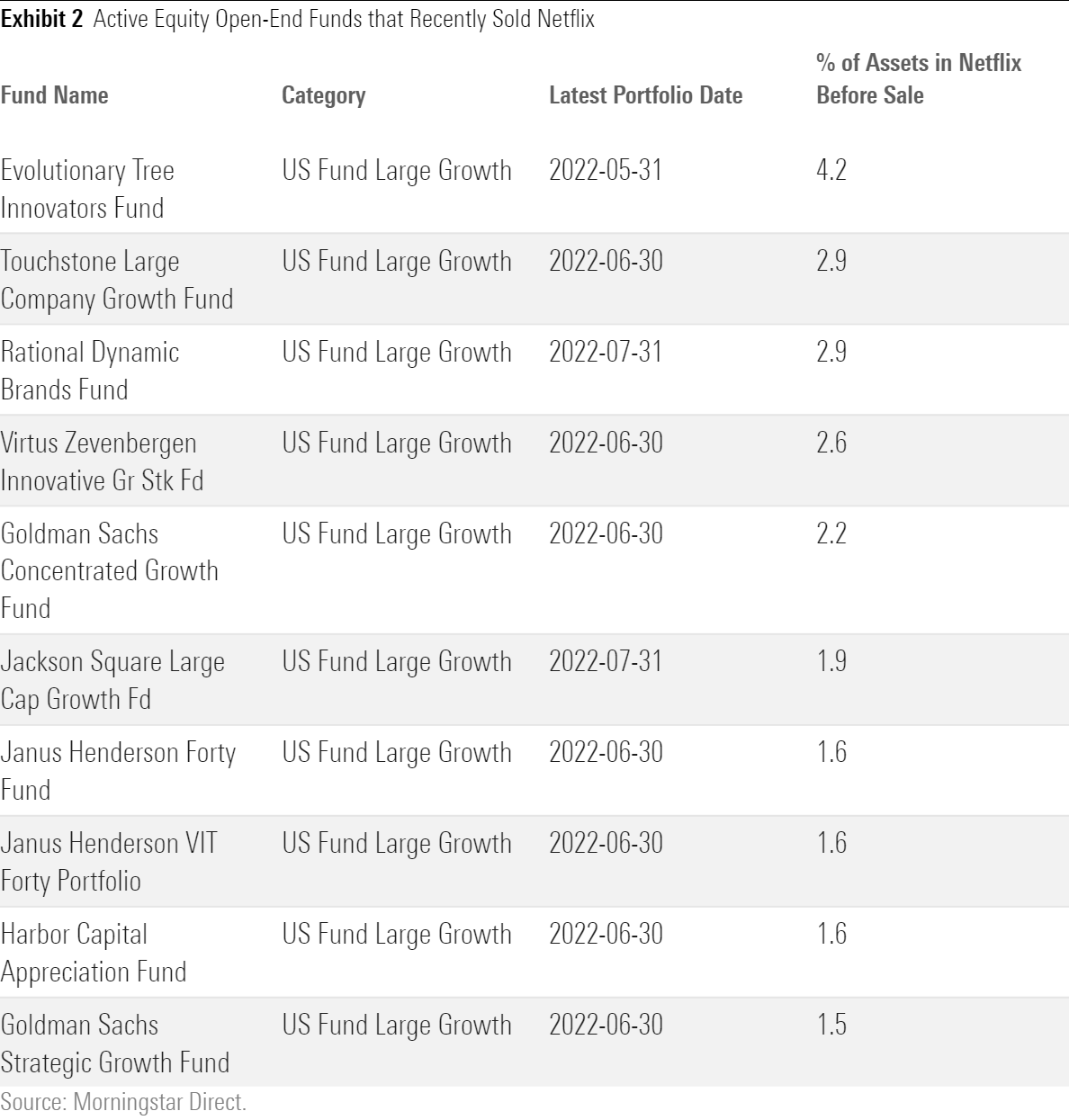

Which Funds Recently Sold Netflix?

The top 10 funds that had the highest exposure to Netflix before its final sale are all from the U.S. large-cap growth Morningstar Category. These sales make sense as Netflix’s share in the Russell 1000 Growth Index plummeted, given its poor performance this year to date. As of Jan. 3, the stock composed 1.1% of the index compared with 0.2% as of August 26. There’s less incentive to own such a small index constituent.

Harbor Capital Appreciation HACAX

A six-person management team from subadvisor Jennison leads this large-cap growth fund, which earns a Gold rating. The team sold its 1.63% position in June but regularly trimmed its stake since 2014—though the Jennison team’s final sale could have been better timed. In March 2022, the team decreased its Netflix position by almost 46%—after the stock had already fallen nearly 37%. The stock tumbled another approximately 33% before they sold it completely, as shown by the Individual Trade Analysis notebook.

Janus Henderson Forty JCAPX

Lead manager Doug Rao, who runs this Bronze-Rated aggressive-growth fund with comanager Nick Schommer, first bought Netflix in 2016. As for many managers who bought the stock then, it proved to be a good choice. Netflix’s stock price increased by 102% annualized before he added to the position in September 2021. Since then, however, the stock has burned this strategy as it has tanked. Rao sold the entire position in June, after the stock dropped nearly 71% since he added shares nine months earlier. The below chart summarizes the fund’s Netflix trading activity.

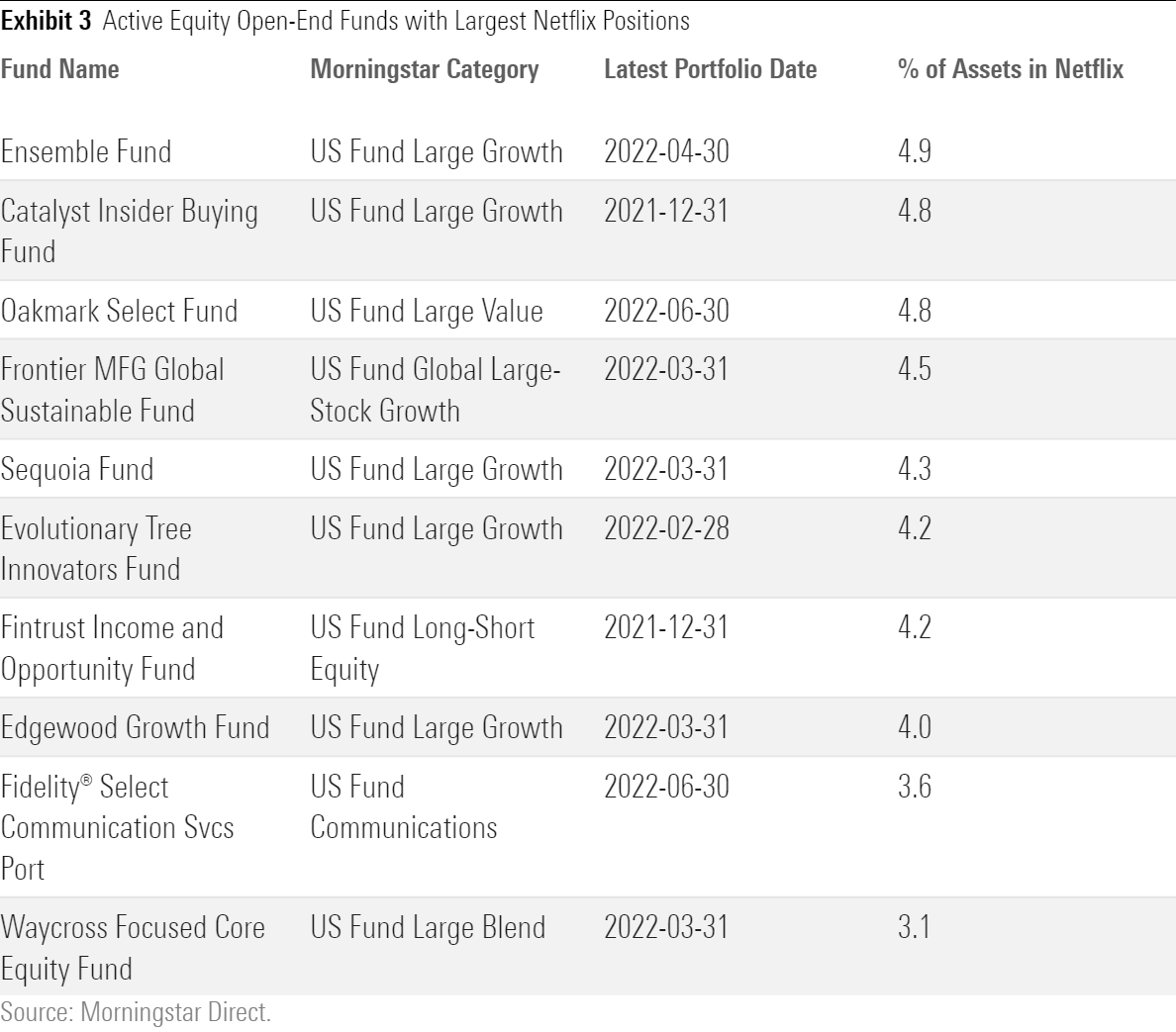

Largest Owners of Netflix

The strategies listed here are generally growth funds or those with growth tilts in their respective Morningstar Categories. These funds are also concentrated, explaining their relatively high Netflix stakes. For example, the top five strategies here all own 30 or fewer stocks. They also have big overweights in Netflix’s sector, communication services.

Oakmark Select OAKLX

Veteran manager Bill Nygren runs this Silver-rated strategy, which has among the highest exposures to Netflix among actively managed equity funds. Oakmark Select has 4.8% of assets in the stock, more than double than its more-diversified sibling, Oakmark OAKMX, as of June 30. In his second quarter-end commentary, Nygren explained that he lowered his estimate of Netflix’s business value to adjust for softer near-term guidance but still likes the stock. He believes the company’s lead in the streaming industry remains intact and that future operating margins will be substantially higher. Nygren also likes Netflix’s potential to enhance revenue growth through advertising and monetizing password-sharing. For the year to date through June, Nygren increased his Netflix position to 4.8% from 4.5%. The chart below summarizes how Oakmark Select has traded the stock.

Sequoia SEQUX

Neutral-rated Sequoia also has among the highest exposure to Netflix compared with other actively managed equity funds. As of March 2022, the most recent portfolio, it had 4.3% of assets in the stock. The investment committee behind this strategy looks for companies with strong franchises, differentiated business models, and effective capital allocation. Despite being a top detractor, the team still likes Netflix considering its unmatched scale, attractive growth characteristics outside the United States, and more-attractive valuation.

/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)