What Does Tesla's Stock Split Mean for Investors?

It will mark the second stock split for the electric vehicle maker in the past two years.

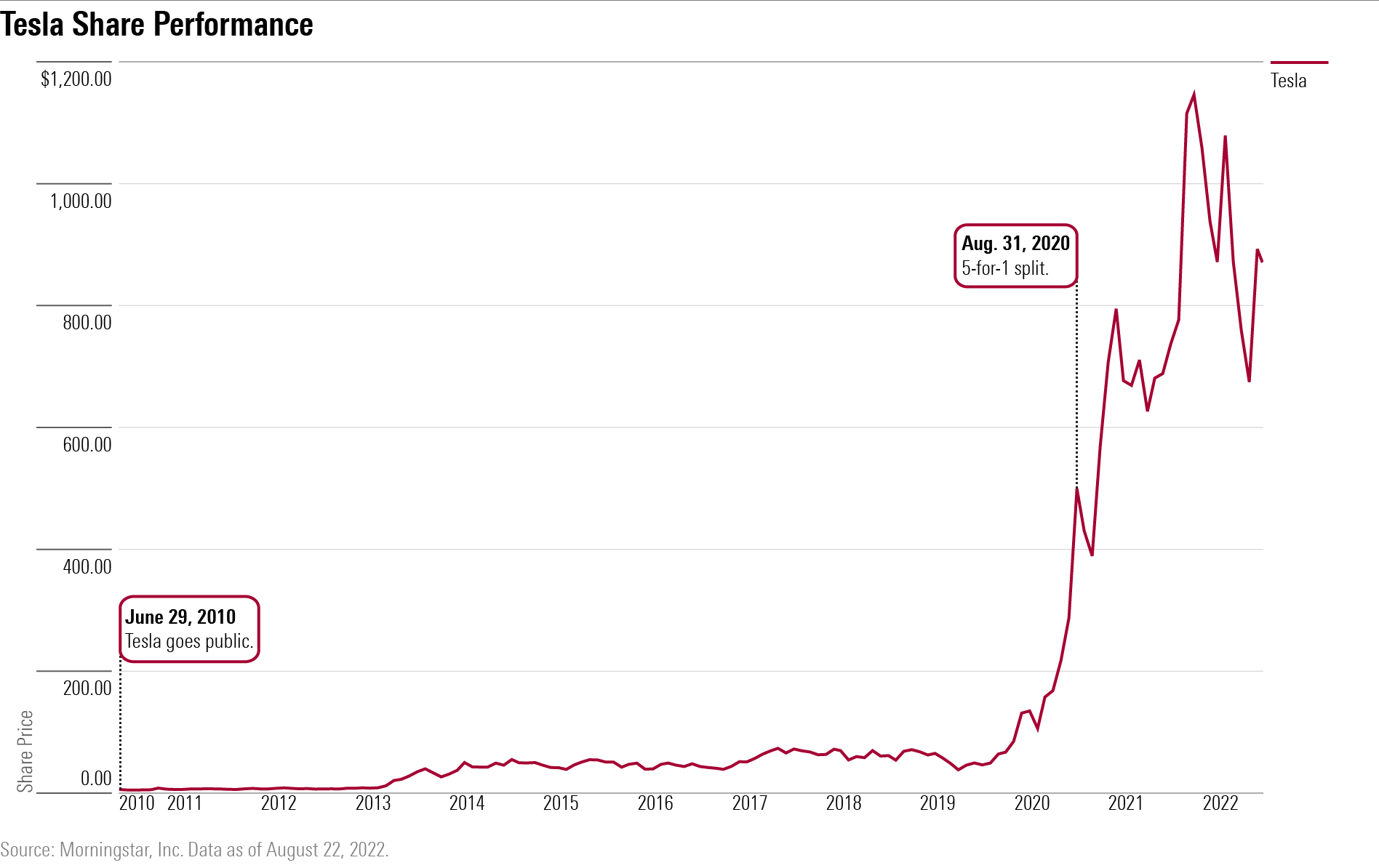

Tesla TSLA shares are set to split for the second time in the past two years. The electric vehicle maker had been proposing a possible split since early this year, which was approved by shareholders during the company's annual meeting on Aug. 4, 2022.

The shares are to be split on a 3-for-1 basis, meaning investors will receive an additional two shares for each one they already own. The company's last stock split was on a 5-for-1 basis in August 2020.

Tesla Stock Split Date

The Tesla stock split is set to take place after the market's close on Aug. 24.

Tesla's Stock Split and What It Means

The split won't affect Morningstar's view on the company, which equity strategist Seth Goldstein values at $760 per share. After the split, the company's fair value estimate will be adjusted to about $255 per share to account for the increase in the company's outstanding share count, according to Goldstein.

The company's Morningstar Economic Moat Rating of narrow, which means it has a competitive advantage versus their rivals, will be unaffected by the split.

Tesla's stock will also keep a Morningstar Rating of 3 stars following the split, but at a slight premium of 14% as of Aug. 23, which is still within a range that Goldstein views as fairly valued.

The company's shares rallied in the past few weeks on news that an agreement was reached to pass the Inflation Reduction Act, which was signed into law by President Joe Biden on Aug. 16.

However, trading became volatile in recent weeks as investors weighed whether or not Tesla would benefit from the bill's passage.

In an analyst note on Aug. 8, Goldstein pointed to two reasons why the company would not get a tailwind from the measure.

The act ``would offer a $7,500 tax credit for EVs, if those vehicles and the consumer purchasing the vehicles meet certain conditions," Goldstein wrote. "However, we think most Tesla vehicles would likely not qualify for the tax credit." The credit would not apply to sedans that cost above $55,000 or SUVs above $80,000, leaving many of Tesla's vehicles, such as the Model S, Model X, and Performance Model 3s, excluded.

Second, Goldstein points out that the act would require a growing percentage of ``critical materials'' used to build EVs be extracted or processed domestically, or in those countries where the United States has a free trade agreement. The legislation sets a threshold of 40%, which rises to 80% by 2027. Tesla's 2021 impact report shows most of the company's materials come from Argentina, China, and the Democratic Republic of Congo.

``Tesla could work with suppliers to incentivize the buildout of processing plants in the U.S., but this would likely take years before the company could secure enough battery materials for the majority of its vehicles to qualify,'' Goldstein says.

Other Stock Splits

Tesla is one of several tech and consumer companies that have set out to split their shares this year. Market leaders Amazon.com AMZN and Alphabet GOOG GOOGL have already split their shares in the past few months. Cybersecurity firm Palo Alto Networks PANW will split its stock on Sept. 14 on a 3-for-1 basis.

/d10o6nnig0wrdw.cloudfront.net/05-09-2024/t_fab10267147f40fb93a1deb8a0b6553b_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/E3DSJ6NJLFA5DOKMPQRAH5STMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)