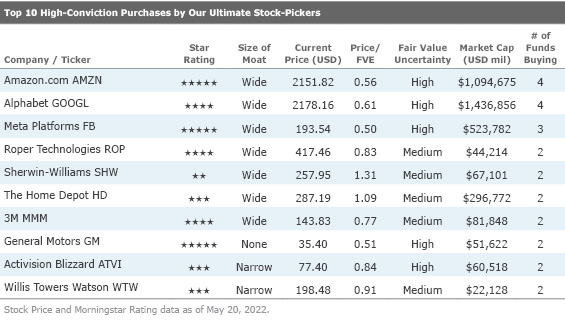

Our Ultimate Stock-Pickers' Top 10 High-Conviction Purchases

Several funds see value in industrials, communication services, and consumer cyclical.

While looking at our Ultimate Stock-Pickers’ buying activity, we concentrate on high-conviction purchases and new-money buys. We think of high-conviction purchases as occasions when managers have made meaningful additions to their portfolios, as defined by the size of the purchase in relation to the portfolio’s size. We define a new-money buy strictly as an instance where a manager purchases a stock that did not exist in the portfolio in the prior period. New-money buys may be done either with or without conviction, depending on the size of the purchase, and a conviction buy can be a new-money purchase if the holding is new to the portfolio.

We recognize that our Ultimate Stock-Pickers' decisions to purchase shares of any of the securities highlighted in this article could have been made as early as the start of February, so the prices paid by our managers could be substantially different from today's trading levels. Therefore, we believe it is always important for investors to assess for themselves the current attractiveness of any security mentioned here based on a multitude of factors, including our valuation estimates along with our moat, stewardship, and uncertainty ratings.

Since 2020, headwinds created by the pandemic hampered the markets and sidelined a multitude of industries as governments across the globe instituted lockdowns and imposed restrictions. And just as the market was looking to slowly recover as pandemic restrictions were lifted and a return to normality began, the Russian invasion of Ukraine threw another wrench into the global economy, elevating energy prices and creating inflationary pressures that have impacted food and energy markets. The first quarter of 2022 has been defined by a tumultuous market, as selloffs in tech have reflected a depression in the aggregate market and fears of a potential recession linger. The Fed has already raised rates by 0.75 of a percentage point since March, from near-zero levels that had been in place since the early days of the pandemic. But despite market headwinds, Ultimate Stock-Pickers still looks to find value in individual stocks during a period of volatility and uncertainty. These stocks are in a wide range of sectors, such as industrials, communication services, and consumer cyclical.

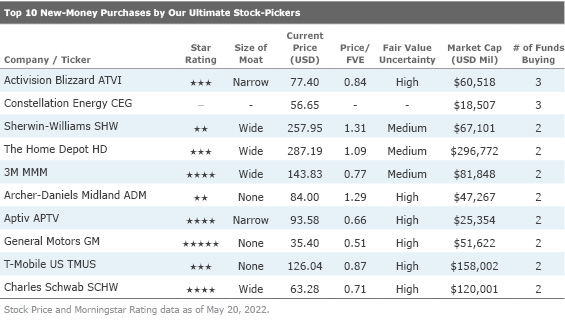

The buying activity in the top 10 high-conviction purchases list was distributed among a multitude of sectors, including industrials, basic materials, communication services, and consumer cyclical. Nine out of 10 companies on the high-conviction purchases list, and six out of the 10 companies on our new-money purchases list, received at least a narrow economic moat rating from Morningstar analysts, keeping in line with trends we have witnessed over the past few years. The three names we find most interesting on the high-conviction purchases and new-money lists are wide-moat-rated Sherwin-Williams SHW, no-moat-rated T-Mobile TMUS, and wide-moat-rated Home Depot HD.

There was a moderate amount of crossover between our two top 10 lists this period, with a few names appearing on both lists. This quarter, both Amazon AMZN and Alphabet GOOGL received four high-conviction purchases from our manager list, with Meta FB receiving three. All three of these companies have wide economic moats and are trading at heavy discounts to their fair value estimates, which indicates that money managers place an emphasis toward blue-chip stocks such as these in a period of uncertainty. The remainder of the list was populated by names from a multitude of industries, including basic materials and industrials.

Sherwin-Williams

One name that stood out for us was wide-moat Sherwin-Williams, which attracted two high-conviction purchases during the first quarter of 2022. The name currently trades at about $258, a significant premium to Morningstar analyst Spencer Lieberman’s fair value estimate of $197. It is the only name on our top 10 high-conviction purchases list trading below 3 stars.

Sherwin-Williams is the largest provider of architectural paint in the United States. The company has approximately 4,800 stores and sells premium paint at higher price points than most competitors. It also sells paint-related products in big-box stores and provides coatings for original equipment manufacturers.

Lieberman notes that in Sherwin's largest segment, the Americas group, it has maintained strong growth, even in developed markets, as it rolls out nearly 100 new stores each year throughout the Americas. Its strategic focus on building this segment has created a strong value proposition for contractors. Job-site delivery, in-app ordering, and a capacity for high-volume orders saves time for customers and allows for premium product pricing. Roughly 90% of sales in the Americas group are to professional painters with the remaining 10% to do-it-yourself, DIY, consumers.

The consumer brands segment markets Sherwin's paint brands through retail channels, such as Menards, and is the exclusive provider of coating products to Lowe's LOW. It owns a variety of widely known brands such as Valspar, Purdy, Minwax, Krylon, Thompson's Waterseal, and Dutch Boy. Its performance coatings business produces a diverse product mix and accounts for much of the firm’s global exposure. The segment sells everything from marine paints to airplane and fire-resistant coatings, many of which are custom formulated to suit client needs.

Lieberman assigns the firm a wide moat rating, believing that Sherwin-Williams benefits from durable competitive advantages that should support economic profits for at least the next 20 years. For Lieberman, the moat advantage stems primarily from intangible assets. He notes that the Americas and consumer brands segments (accounting for more than 80% of segment EBIT) enjoy strong brand equity, which has supported durable pricing power. While the performance coatings segment benefits from switching costs, we give it a narrow moat as we do not think its pricing power is as durable as the firm’s other segments. The segment does not represent a large enough percentage of the consolidated portfolio to warrant extending the switching cost moat source to the firm. That said, Sherwin's wide-moat segments (the Americas and consumer brands) account for most of its profits, leading to Lieberman’s wide moat rating for the firm.

T-Mobile US

Two of our money managers made high-conviction new-money purchases of T-Mobile USA, a no-moat company currently trading at a discount to Morningstar analyst Michael Hodel’s fair value estimate of $145.

Hodel notes that since Deutsche Telekom merged its T-Mobile USA unit with prepaid specialist MetroPCS in 2013, T-Mobile USA has provided nationwide service in major markets but spottier coverage elsewhere. T-Mobile spent aggressively on low-frequency spectrum, well suited to broad coverage, and has substantially expanded its geographic footprint. This expansion, coupled with aggressive marketing and innovative offerings, produced rapid customer growth. With the Sprint acquisition, Hodel notes that the firm’s scale now roughly matches its larger rivals: T-Mobile now serves 70 million postpaid and 21 million prepaid phone customers, equal to nearly 30% of the U.S. retail wireless market. In addition, the firm provides wholesale service to resellers.

Hodel expects the T-Mobile network to match up well with its rivals’ over the long term, thanks to the massive amount of spectrum the firm now controls. Its midband spectrum holdings, which will likely provide the bulk of wireless network capacity well into the future, are massive and largely unused, a position that allowed it to avoid matching Verizon VZ and AT&T’s T egregious spending in the C-band spectrum auction in 2021. Efficiently and effectively deploying this resource, something Sprint failed to do on its own, is now the firm’s primary objective.

But Hodel argues that T-Mobile’s network isn’t perfect. The firm doesn’t own significant fixed-line assets, which will be increasingly important as wireless networks become denser. He expects the firm will have access to third-party networks on reasonable terms, but this remains a risk. T-Mobile also leases many of its spectrum licenses and will need to renew leases or purchase licenses outright in the coming years.

In the race to deploy 5G, each U.S. carrier has taken a different course, emphasizing different assets, spectrum bands, and technical elements. Hodel believes Verizon is attempting to set the bar for the industry through aggressive investment in fiber-optics, with AT&T racing to follow suit. T-Mobile has primarily deployed 5G as an extension of its existing network, adding capacity but without the same extreme download speeds Verizon has seen in the limited areas its strongest 5G networks can reach. T-Mobile could be forced to make difficult choices between increased investment in spectrum and network equipment or risk falling behind customer expectations.

Home Depot

Our Ultimate Stock-Pickers also made two high-conviction purchases in wide-moat Home Depot, the world’s largest home improvement specialty retailer. Home Depot currently trades at a slight premium to Morningstar analyst Jaime Katz’s fair value estimate of $264.

Home Depot is the world's largest home improvement retailer, and Katz believes the firm is on track to deliver $156 billion in revenue in 2022. In her view, it continues to benefit from a healthy level of housing turnover along with perpetual improvements in its merchandising and distribution network. She assigns it a wide economic moat rating because of its economies of scale and brand equity. While Home Depot has produced strong historical returns as a result of its scale, operational excellence and concise merchandising remain key tenets underlying our modest margin expansion forecast. Its flexible distribution network will help elevate the firm's brand intangible asset, with faster time to delivery improving the do-it-yourself experience and market delivery centers catering to the pro business. Katz believes that the success of ongoing initiatives should allow for flat operating margin performance in 2022, despite significant inflationary pressures.

According to Katz, Home Depot should continue to capture sales growth, bolstered by an aging housing stock, a shortage in home inventory, and rising home prices, even when lapping robust COVID-19 demand. Other internal catalysts for top-line growth could come from the firm’s efficient supply chain, improved merchandising technology, and penetration of adjacent customer product segments (bolstered by the acquisition of HD Supply). Expansion of newer (like textiles from the Company Store acquisition) as well as existing (such as appliances) categories could also drive demand.

In her opinion, perpetual improvements in the omnichannel experience should support the firm's competitive position, even if existing-home sales and turnover become more volatile. The commitment to better merchandising and an efficient supply chain has led the firm to achieve operating margins and adjusted returns on invested capital, including goodwill, of 15.2% and 35%, respectively, in 2021 (both quantitative peaks). Additionally, Home Depot's focus on cross-selling products in both its DIY and its maintenance, repair, and operations channels should support stable pricing and volatility in the sales base, helping achieve further operating margin lift, with the metric remaining above 15% consistently over the next decade.

Disclosure: Eden Alemayehu, Justin Pan, and Eric Compton have no ownership interests in any of the securities mentioned above. It should also be noted that Morningstar's Institutional Equity Research Service offers research and analyst access to institutional asset managers. Through this service, Morningstar may have a business relationship with fund companies discussed in this report. Our business relationships in no way influence the funds or stocks discussed here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e03383eb-3d0b-4b25-96ab-00a6aa2121de.jpg)