Why 'Free' Robo-Advisors Aren't Really Free

Hidden costs, cross-selling, and misleading marketing can be a problem.

The advent and growth of the robo-investing industry holds considerable promise for investors, including those of modest means. Whereas traditional advisors have historically underserved them, smaller investors can now easily be matched with curated, diversified portfolios run by computer algorithms after filling out a risk-tolerance questionnaire and detailing their investment goals, all for a fraction of what they might otherwise pay.

There are potential disadvantages, though, especially with nominally "free" services. Hefty cash allocations that generate revenue for the robo-advisor while suppressing long-term investment returns are one problem. Cross-selling and misleading marketing of pricey and proprietary products are others. Here, we'll draw on the research of Morningstar's recent Robo-Advisor landscape report to illustrate these problems using three leading robo-advisors as examples.

The Costs of Holding Cash

Whether conservative, moderate, or aggressive, robo-advisor portfolios typically allocate 3% of assets or less to cash. Ally Invest and Schwab Intelligent Portfolios stand out for their higher cash allocations, however, which preserve wealth in down markets but otherwise constrain its growth or even shrink it in inflationary environments.

Ally’s portfolios come in two types: Market Focused or Cash Enhanced. Whereas Market Focused portfolios allocate 2% to cash and have a 0.30% annual advisory fee, Cash Enhanced portfolios allocate 30% to cash but have no advisory fee. The Cash Enhanced portfolios primarily target Ally’s risk-averse customers who already have most of their assets at the bank and for no extra charge can be nudged into higher-return potential investments in the remaining 70% of the portfolio. It is problematic, however, that cash-heavy portfolios are the service’s default option. The cash may earn a competitive rate relative to other high-yield savings accounts, but it won’t keep up with inflation. Investors might do better in an ultrashort-term-bond fund like Vanguard Ultra-Short Bond ETF VUSB even after a modest advisory fee.

Schwab’s high cash allocations are more troublesome still. The SEC is now investigating the initial disclosure language about them, and Schwab set aside $200 million in 2021’s second quarter to cover potential settlement costs. These portfolios’ cash allocations range from 6% for the most aggressive to 29.4% for the most conservative. Even at the low end of that range, the cash allocation is out of step with other managed investment portfolios.

True, Schwab portfolios’ highest cash allocation is a bit less than Ally Invest Cash Enhanced’s 30%. Yet Ally pays its customers nearly 5 times more in interest. Schwab Intelligent Portfolios currently pays an annual percentage yield of just 0.13%.

Schwab Intelligent Portfolios’ modest cash yield shows that its service, which is nominally “free” for investors with at least $5,000, comes with hidden costs. Those enticed by getting digital investment management without paying for it may not realize that Schwab is using the cash portion of their assets primarily to generate revenue. Schwab receives the spread (or difference) between the fee income it earns on asset balances in Schwab Bank and the yield it pays investors. While this spread varies, it likely exceeds the amount investors would pay if Schwab charged them an investment advisory fee.

Cross-Selling and Misleading Marketing

SoFi Wealth clients with as little as $1 can start an account and access financial-planning services without paying an advisory fee. While those attributes are attractive, cross-selling and misleading marketing are a cause for concern.

Parent company SoFi Technologies SOFI was originally a student loan refinancing business that later expanded into personal loans, credit cards, and mortgages. It launched SoFi Wealth in May 2017 to provide members with low-cost exchange-traded fund portfolios. The offering now includes taxable or tax-advantaged fixed-income allocations that can be blended with an equity allocation according to five standard risk tiers.

The service, however, seems as much designed for monetizing clients as for serving their investment needs. The company’s strategy emphasizes increasing product adoption to spur firm profitability in what it calls its “Financial Services Productivity Loop.” As a publicly traded firm since June 1, 2021, SoFi is now under pressure to generate earnings, but it has lost money each year since 2019 for a total of $947.7 million. That raises concerns about SoFi’s client acquisition strategy in comparison to loss-leader approaches used by profitable firms like Fidelity.

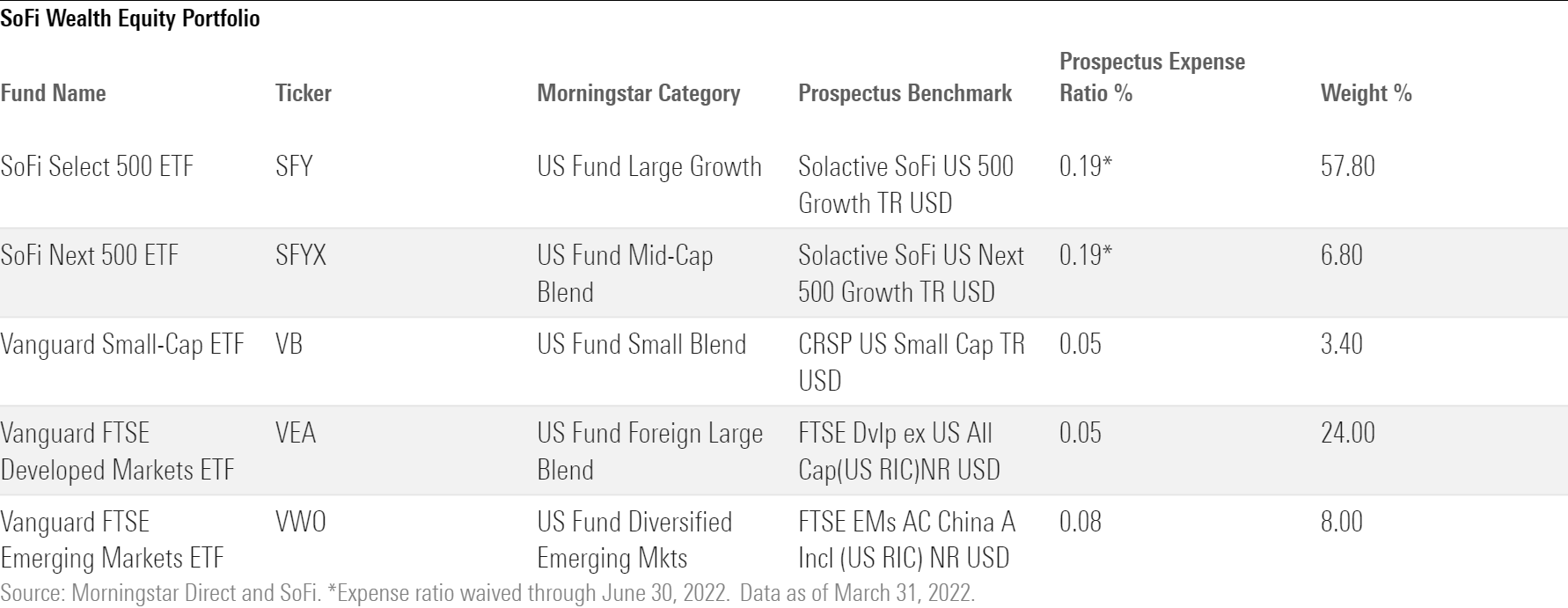

Despite its losses, SoFi has waived the 0.19% expense ratios for its proprietary SoFi Select 500 ETF SFY and SoFi Next 500 ETF SFYX, which together account for about two thirds of the model portfolios’ equity exposure. Should those waivers expire, the ETFs’ expense ratios would no longer be in line with SoFi’s low-cost aims. Moreover, the current tax-advantaged fixed-income allocation includes a pricey iShares high-yield corporate ETF that charges 0.48% per year, more than 3 times a similar iShares high-yield ETF’s cost.

SoFi offers clients access to financial advisors by phone, virtual meetings, and electronic messages at no extra charge. SoFi’s advisors must have Series 65 licenses and either have the CFP designation or be actively working toward it. SoFi provides a broad range of advice, including advice on goals, saving, investing, budgeting, debt repayment, home buying, and insurance.

But SoFi’s advice comes with potential hidden costs. As mentioned, its business model is based on cross-selling various services that generate additional revenue, such as student loan refinancing, personal loans, private student loans, home loans, and estate planning referrals.

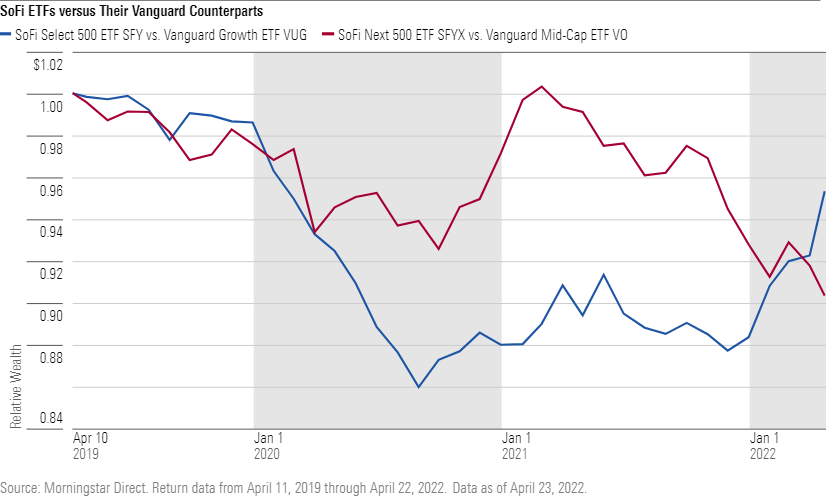

There are other disconcerting signs. Despite names suggesting core exposure, both proprietary SoFi ETFs track growth benchmarks and thus introduce style bias into the portfolios’ equity exposure. These funds have also underperformed comparable third-party options. For example, from their April 2019 inclusion in SoFi’s offering through late April 2022, SFY and SFYX have lagged Vanguard Growth ETF VUG and Vanguard Mid-Cap ETF VO (low-cost, market-cap-weighted alternatives from the same Morningstar Categories) by 1.9 and 3.7 annualized percentage points, respectively. Put otherwise, they’ve returned about $0.95 and $0.90 for every dollar returned by their corresponding Vanguard ETFs, as the accompanying exhibit shows.

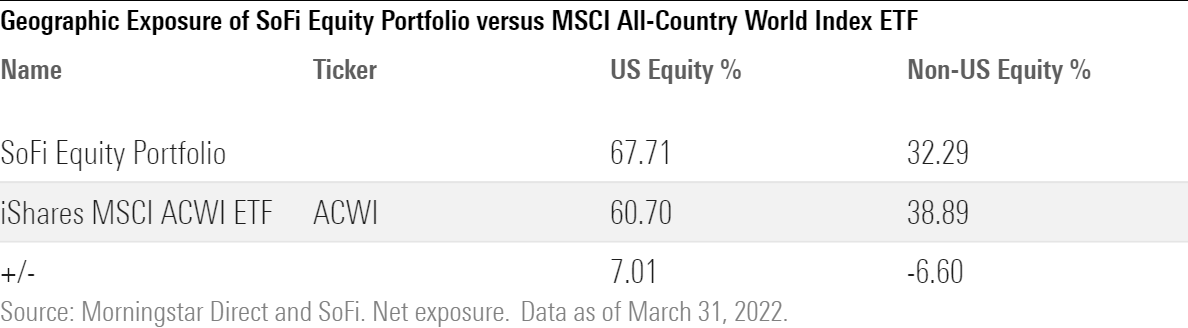

SoFi portfolios also tilt more toward U.S. stocks than broad global benchmarks. As of March 2022, SoFi’s 67.7% domestic equity allocation was 7 percentage points heavier than that of iShares MSCI ACWI ETF ACWI.

Although growth stocks have struggled versus their value counterparts in 2022, that wasn’t the case in mid-2021 when SoFi marketing material presented the back-tested results of its portfolios. At that point, the SoFi portfolios’ biases toward growth and U.S. stocks enhanced their results. And SoFi used those enhanced results to promote its offer’s performance versus a blended benchmark. That isn’t all. The marketing material added to the blended benchmark a 0.48% management fee, even though benchmark-tracking passive options are available for a fraction of that fee.

Be Wary of Deals That Seem too Good to Be True

In the end, selecting the right robo-advisor requires the same wariness as selecting the right human advisor. Investors should look beneath the surface of deals that seem too good to be true and weigh their implicit trade-offs.

Those who opt for free advisory services and/or funds often give up something in return so that the robo-advisor can make money. It could be the opportunity cost of putting a disproportionate amount of assets in a low-yielding in-house cash account. ETFs that are free today because of waivers might not stay that way, and cross-selling can be a cost that investors endure in the interim. Style and geographic biases might also be embedded within a portfolio more because of what an asset class has done in the past than what it will do in the future.

Investors can and should avoid these pitfalls. Elsewhere, we’ve discussed what makes a good robo-advisor and identified the ones investors can trust. That article is an excellent starting point for turning the promise of robo-advisors into reality.

Correction: A

previous version of this article cited the 0.05% rate that Schwab Bank was paying for its high-yield savings account rather than the 0.13% rate the Schwab Intelligent Portfolios program was then paying on cash.

Correction: A previous version of this article cited the wrong rate for Schwab Bank High Yield Investor Savings accounts. The rate paid in the Schwab Intelligent Portfolios program is 0.13%, not 0.05%.

/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)