Digital investment advice is booming. As access to these services has increased, so have investors' questions about their suitability, cost, and range of offerings.

Digital investing platforms, or robo-advisors, offer financial advice and limited human interaction. This combination of services is becoming increasingly appealing, thanks to Generation Z's ability and preference to handle its finances online, the pandemic-driven shift to virtual interactions with advisors, and increasing interest in novel assets like cryptocurrency.

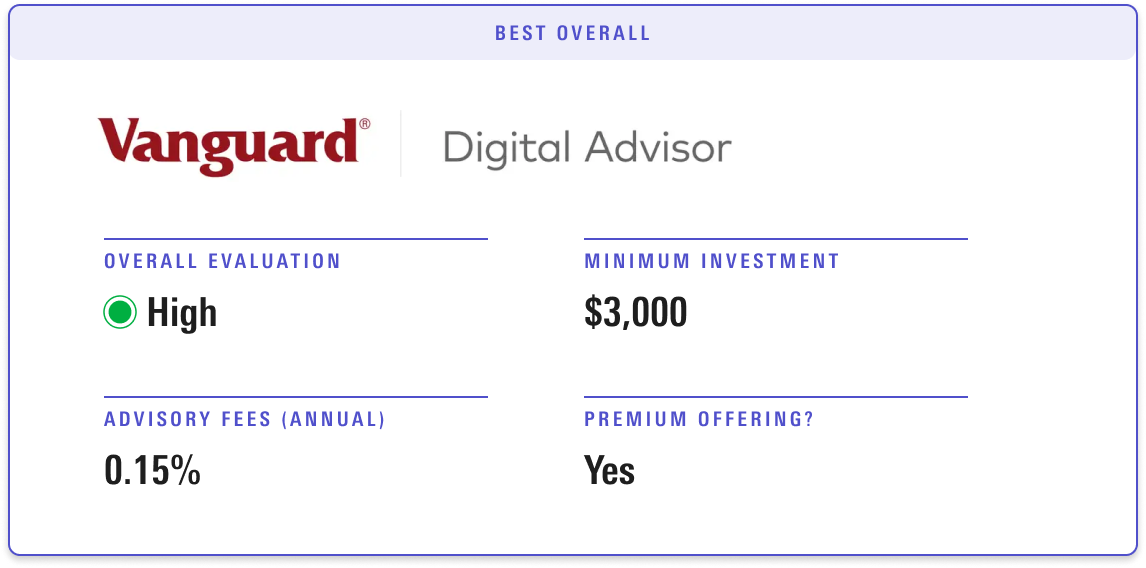

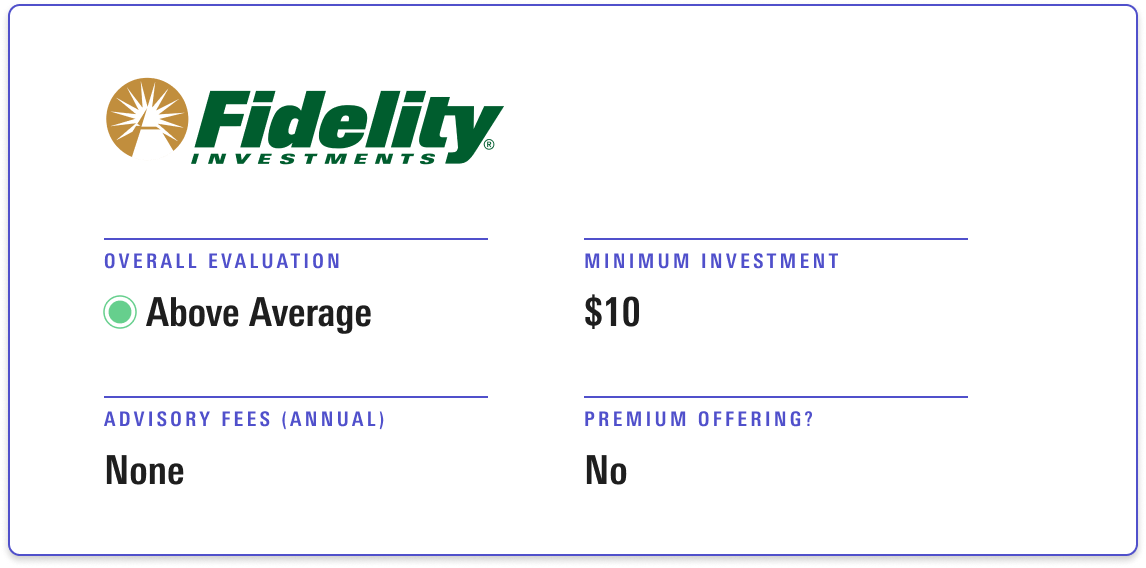

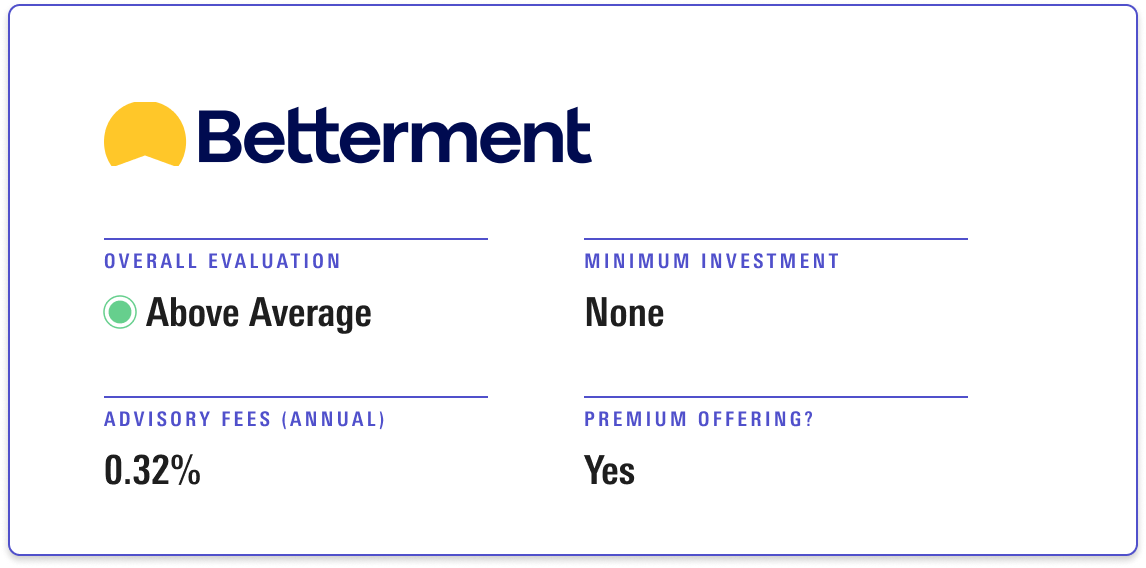

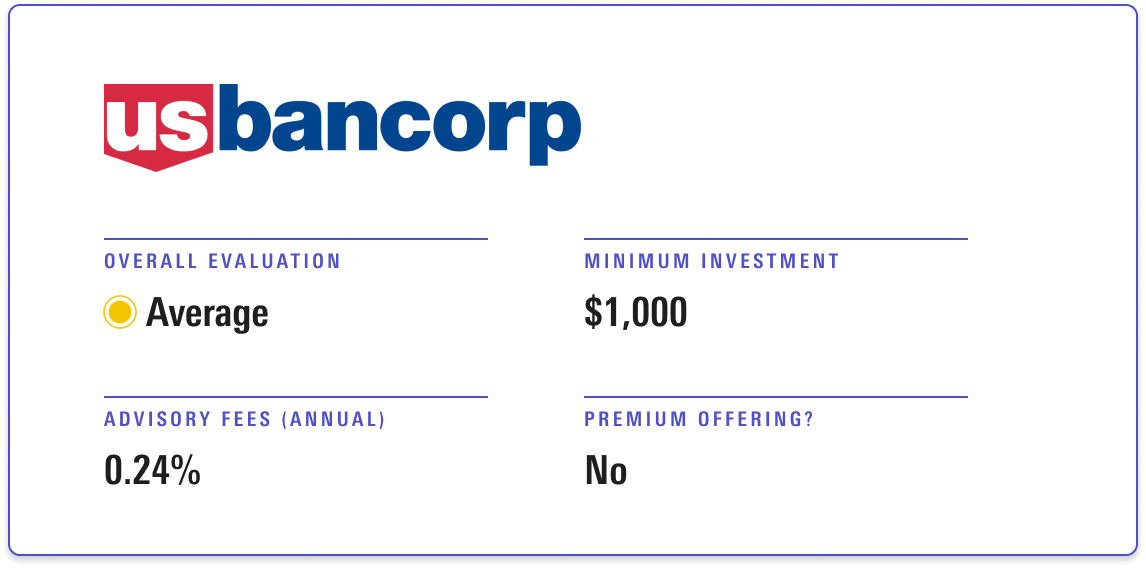

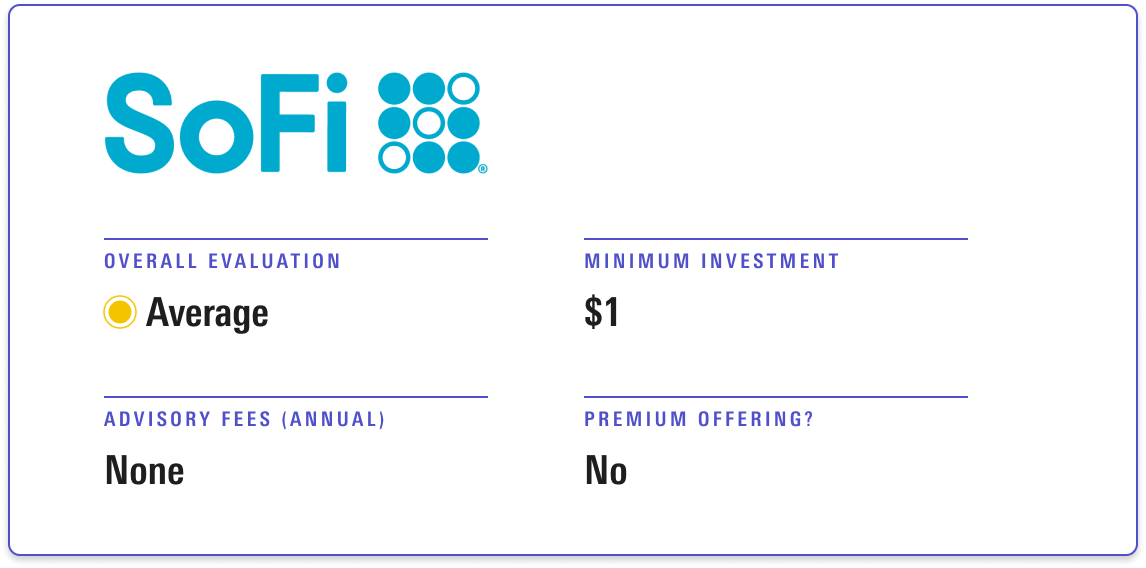

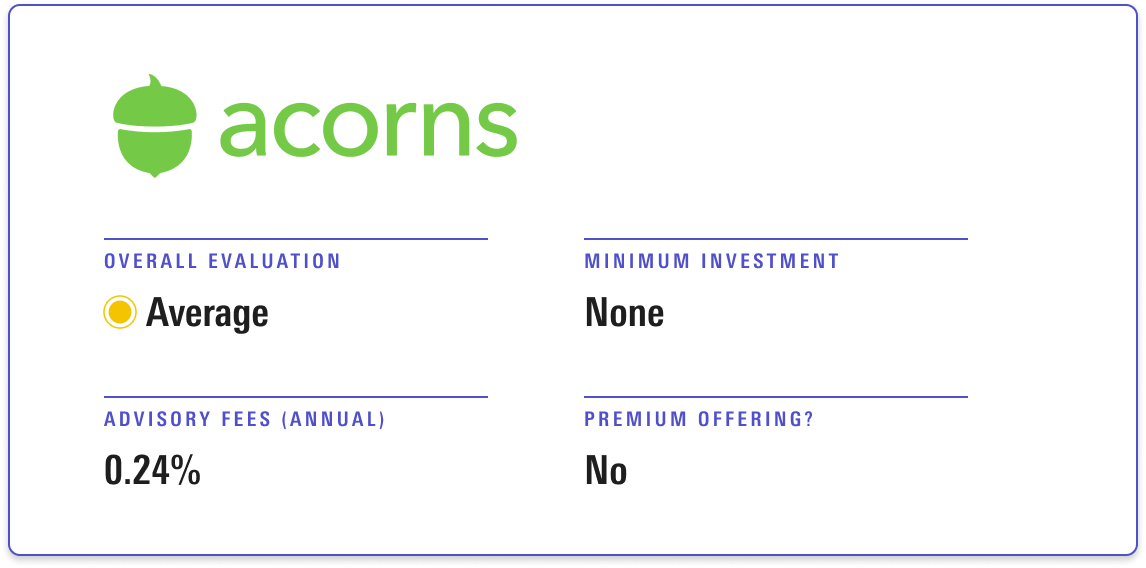

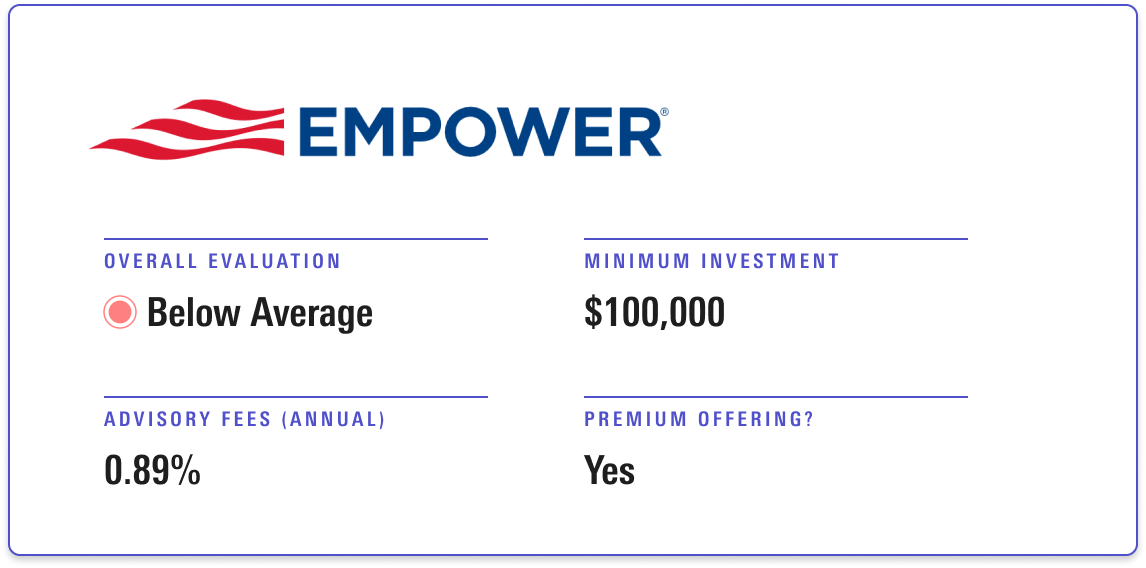

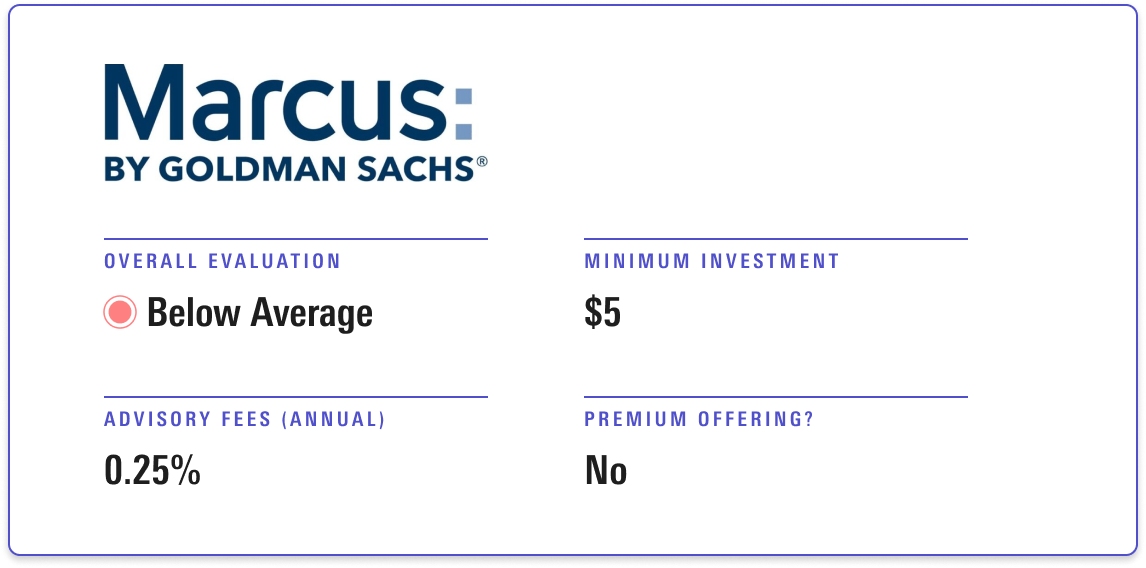

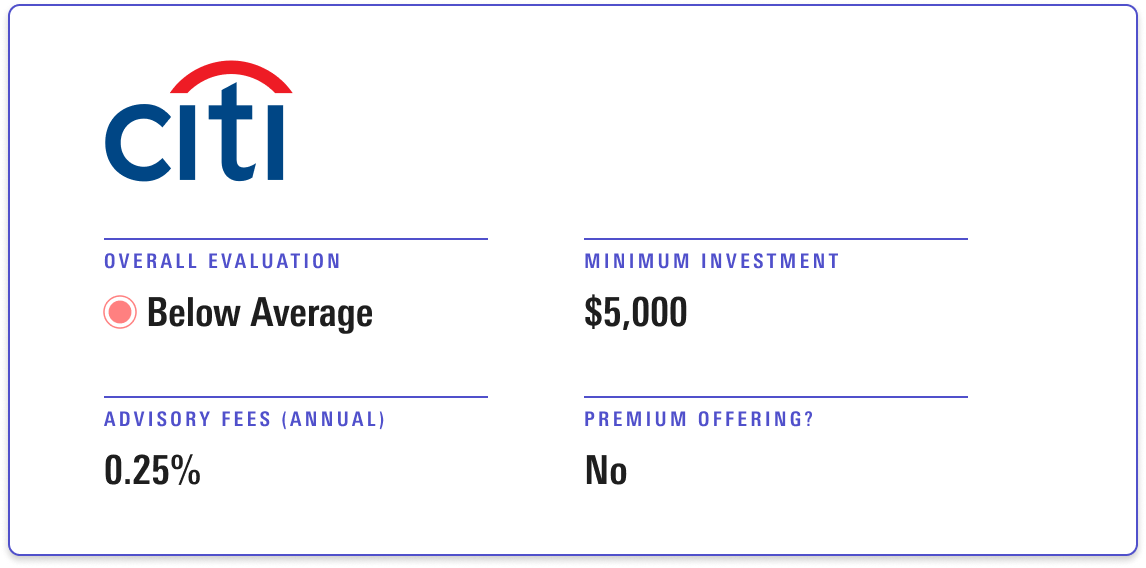

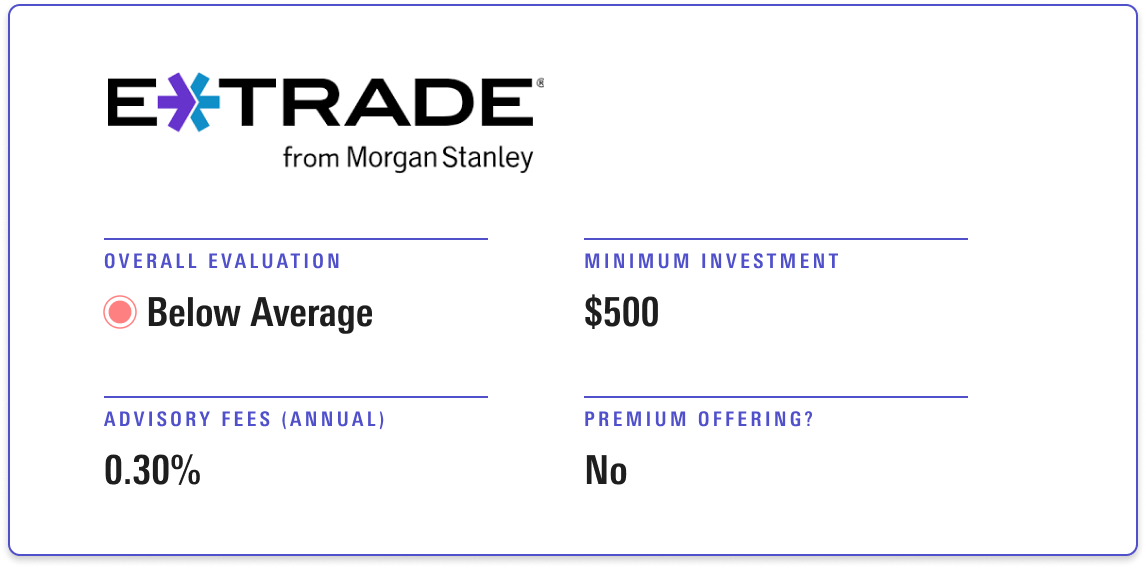

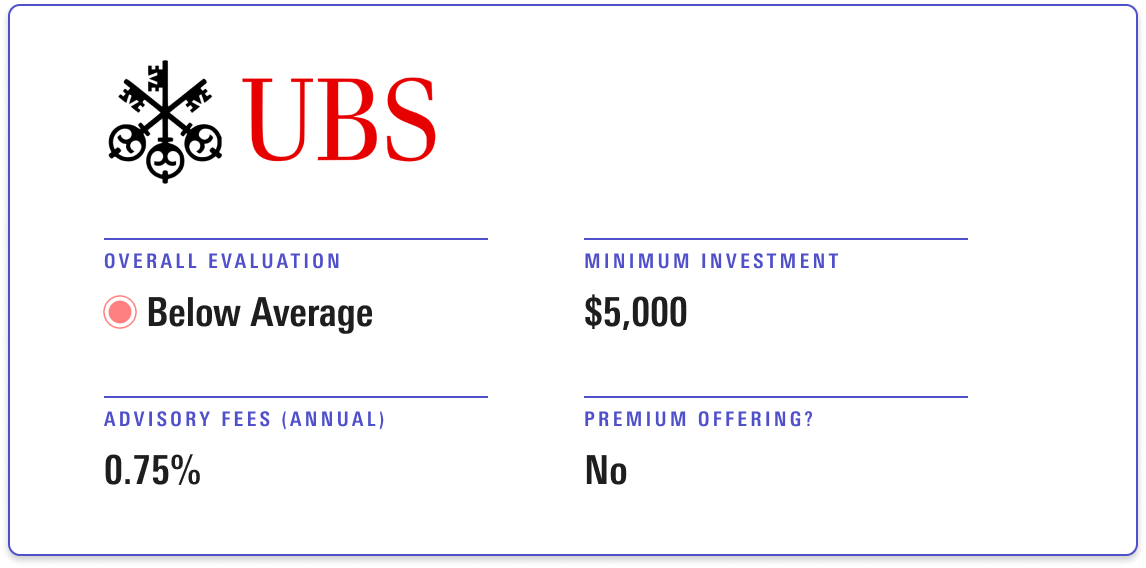

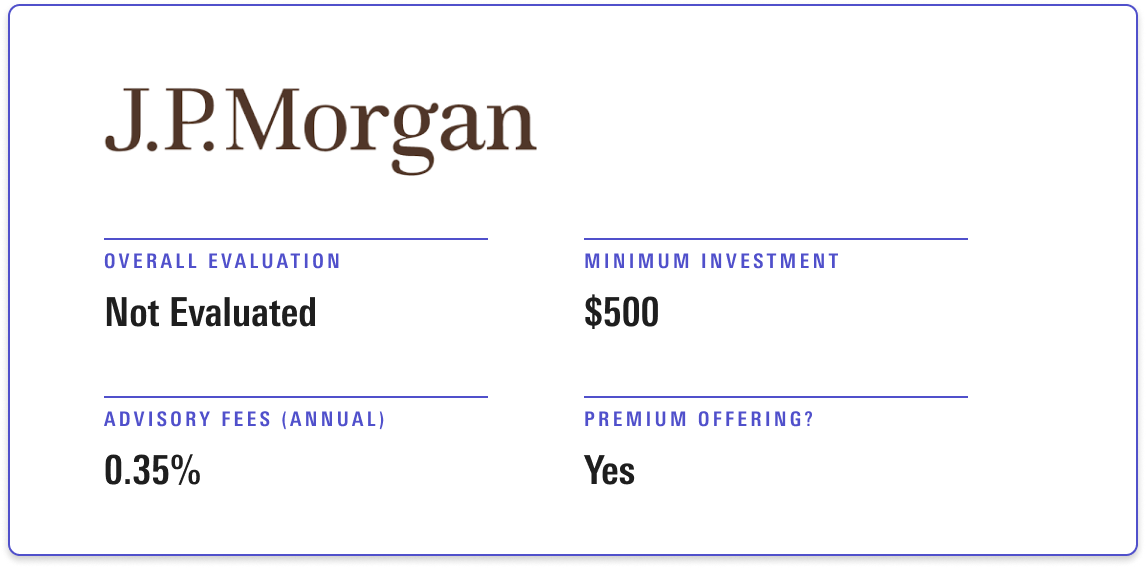

In a report with my colleagues Alec Lucas, Dan Culloton, David Kathman, Drew Carter, Elizabeth Templeton, Gabriel Denis, and Lan Anh Tran, we took a closer look at what the top robo-advisors can (and can't) do and the type of investors who could benefit from using one. And if robo-advisors sound like a good fit, consider our list of top providers to better understand the options that could work for you.

You can also dive deeper into the details in the full research report.