Who Are the Robo-Advisors You Can Trust?

How Morningstar assessed and compared 16 leading digital advice providers.

What makes a good, trustworthy robo-advisor? Morningstar thinks low costs, sound approaches to constructing portfolios and matching investors with them, responsible corporate parents, and breadth of services are the most important qualities. These are the main factors a team of six analysts used to assess and compare the growing robo-advisor market in our recently published and first ever 2022 Robo-Advisor landscape report.

We’ve already shared key insights from that paper in this article on what robo-advisors are and who should use them. Here, we’ll discuss how we assessed 16 leading robo-advisors and provide an overview of those results. Future articles will take a closer look at the robo-advisors with the highest and lowest scores in our assessment as well as those whose strengths mask weaknesses investors should be aware of.

The overarching aim of the report and these follow-up articles is to highlight the robo-advisors best positioned in our view to help investors reach their goals, caution against the services least equipped to do that, and to push the industry toward greater transparency and investor-friendly practices.

Morningstar's Approach

The first step in these efforts began more than nine months ago with our team spanning asset classes and specialties. Focusing on U.S.-based robo-advisors widely available to individual investors, we formed an initial view of each service through a combination of regulatory filings and online information, supplemented by additional insights from robo-advisors’ survey responses, follow-up interviews, and product demonstrations.

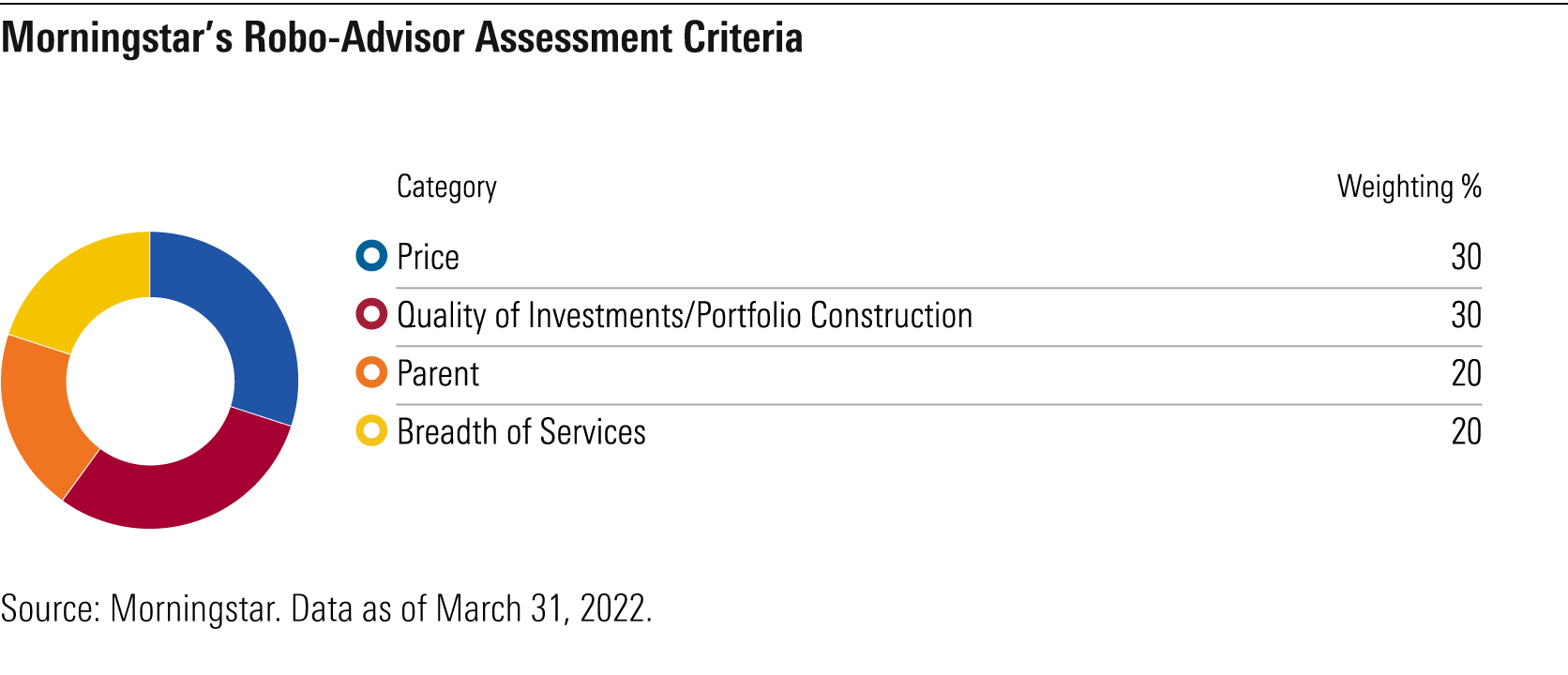

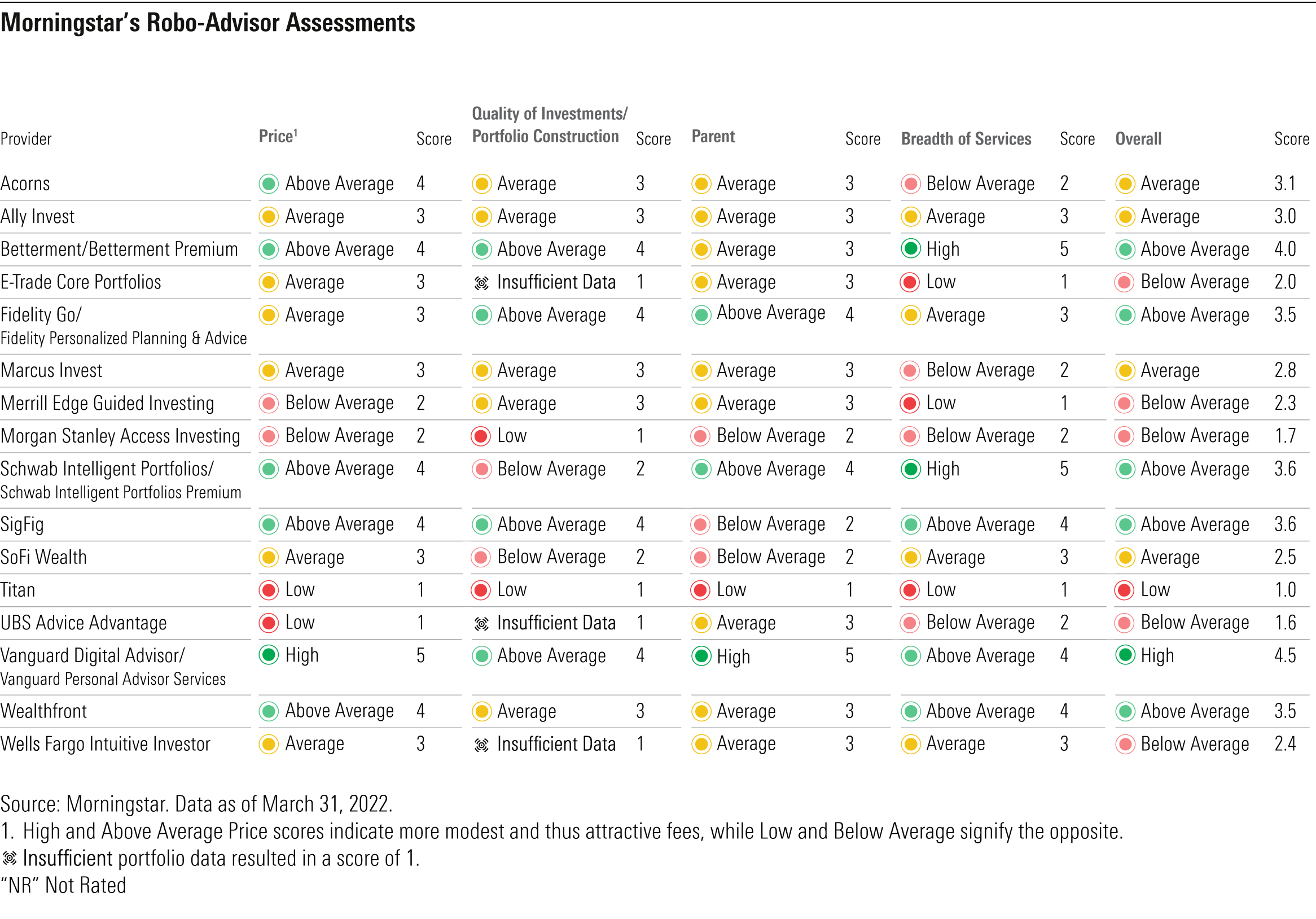

The next step was a formal assessment based on the factors most likely to help investors succeed. Drawing on the Morningstar Analyst Rating for funds and other evaluations, we scored robo-advisors on a five-point scale along four dimensions: total price (30% weighting); the process used to select investments, construct portfolios, and match portfolios with investors (30%); the parent organization behind the digital platform (20%); and breadth of services (20%). We summed each weighted component to arrive at an overall score, which we then used to rank the robo-advisors.

Since information about the risk levels, asset mixes, and underlying funds is essential for consumers to make an informed decision before signing up, we assigned each provider that fell short a Quality of Investments/Portfolio Construction score of 1 out of 5. The providers penalized for insufficient disclosure were E-Trade Core Portfolios, UBS Advice Advantage, and Wells Fargo Intuitive Investor.

Results: Vanguard Tops the List, but Betterment Is Not Far Behind

As the accompanying exhibit shows, Vanguard Digital Advisor (and its premium sibling Vanguard Personal Advisor Services) was the only program to receive a High overall assessment. Betterment, Fidelity, Schwab, SigFig, and Wealthfront each came in at Above Average.

Vanguard didn’t receive the top mark in every category. None of the offerings had a High assessment in Quality of Investment/Portfolio Construction, for example. It was hard to stand out in this category as most robo-advisors use low-cost exchange-traded funds from either Vanguard or iShares and rely on standard risk tiers (conservative, moderate, moderate growth, growth, aggressive) with a diversified mix of stocks, bonds, and cash. Because this overall approach is sound, we consider it a baseline expectation for the type of portfolios robo-advisors should provide.

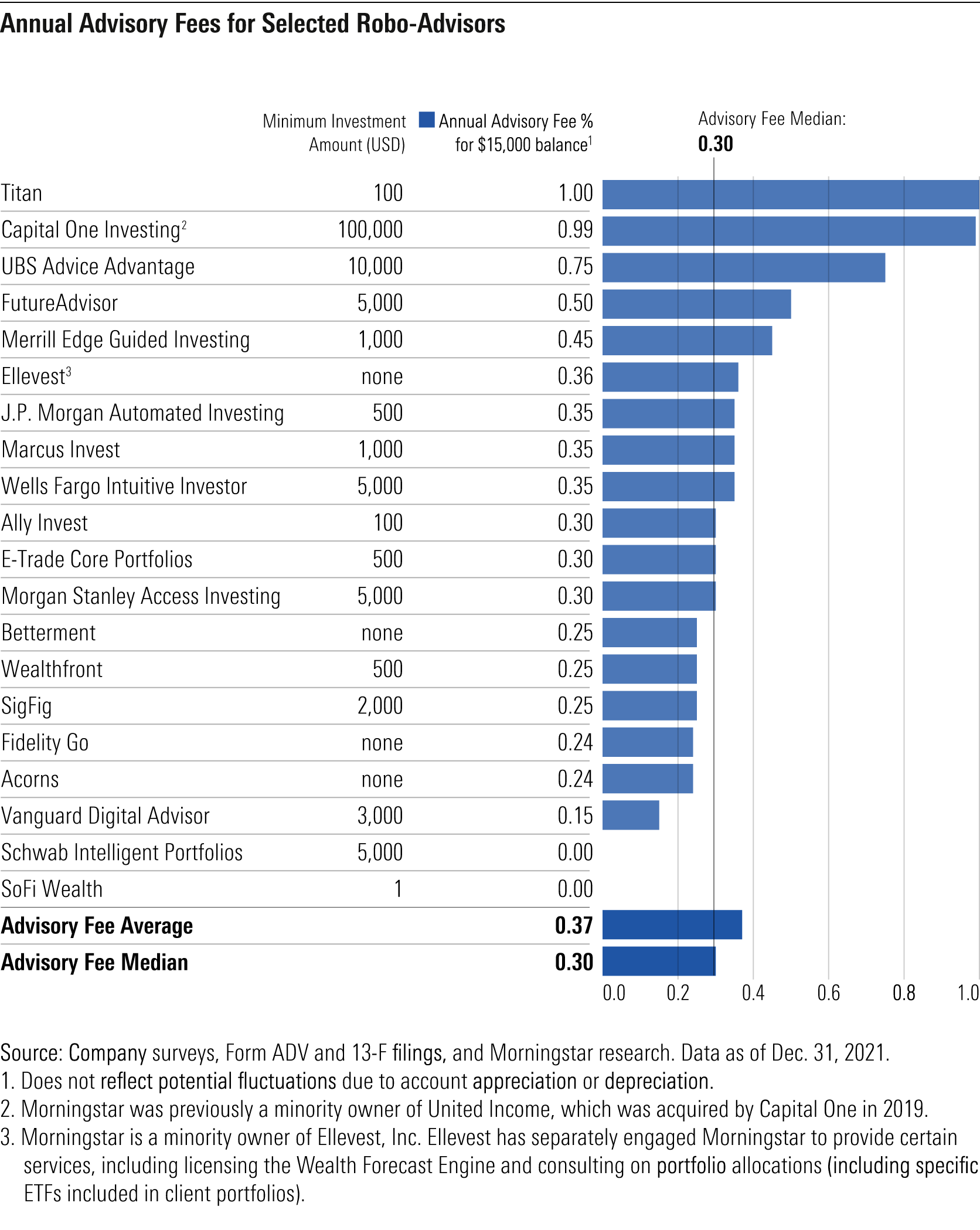

Vanguard did, however, set itself apart on Price as the only robo-advisor with a High category assessment. At 0.20% per year for advisory and underlying fund fees, Vanguard Digital Advisor isn’t the cheapest entry-level offering, but it is most likely to serve new investors well for its cost in relation to value. The same is true of Vanguard Personal Advisor Services for those with more-complicated needs or preferences. Its advisory fee starts at 0.30%, which is relatively cheap for a higher-end service that combines automated features with human financial advisors.

Although Schwab Intelligent Portfolios and SoFi Wealth appear to be bargains, concerns about each led to Above Average and Average Price assessments, respectively. Schwab Intelligent Portfolios comes with no advisory fee for accounts with at least $5,000 but allocates a significant portion of client assets to low-yielding, in-house cash accounts. That drags on returns in up markets while generating revenue for Schwab, which receives the spread (or difference) between the revenue it earns on asset balances and the yield it pays investors.

SoFi Wealth will be hard-pressed to maintain its current pricing, and it suffers from other weaknesses. SoFi charges no advisory fee and has waived the expense ratios for its two proprietary funds that together make up nearly two thirds of each portfolio’s equity allocation. The service, however, seems as much designed for monetization through cross-selling as for serving investment needs. Its two SoFi ETFs track growth benchmarks, which could create opportunity costs if value stocks continue to regain popularity.

These concerns regarding Schwab and SoFi illustrate the importance of Parent considerations; in this category, too, Vanguard receives the only High assessment. Owned by its U.S. funds--and indirectly by their shareholders--Vanguard has historically provided them with strong investment options and reduced fees as the firm grows. Its advice business has become increasingly central to its growth plans, and Vanguard continues to add robo-advisor capabilities while hiring advice personnel.

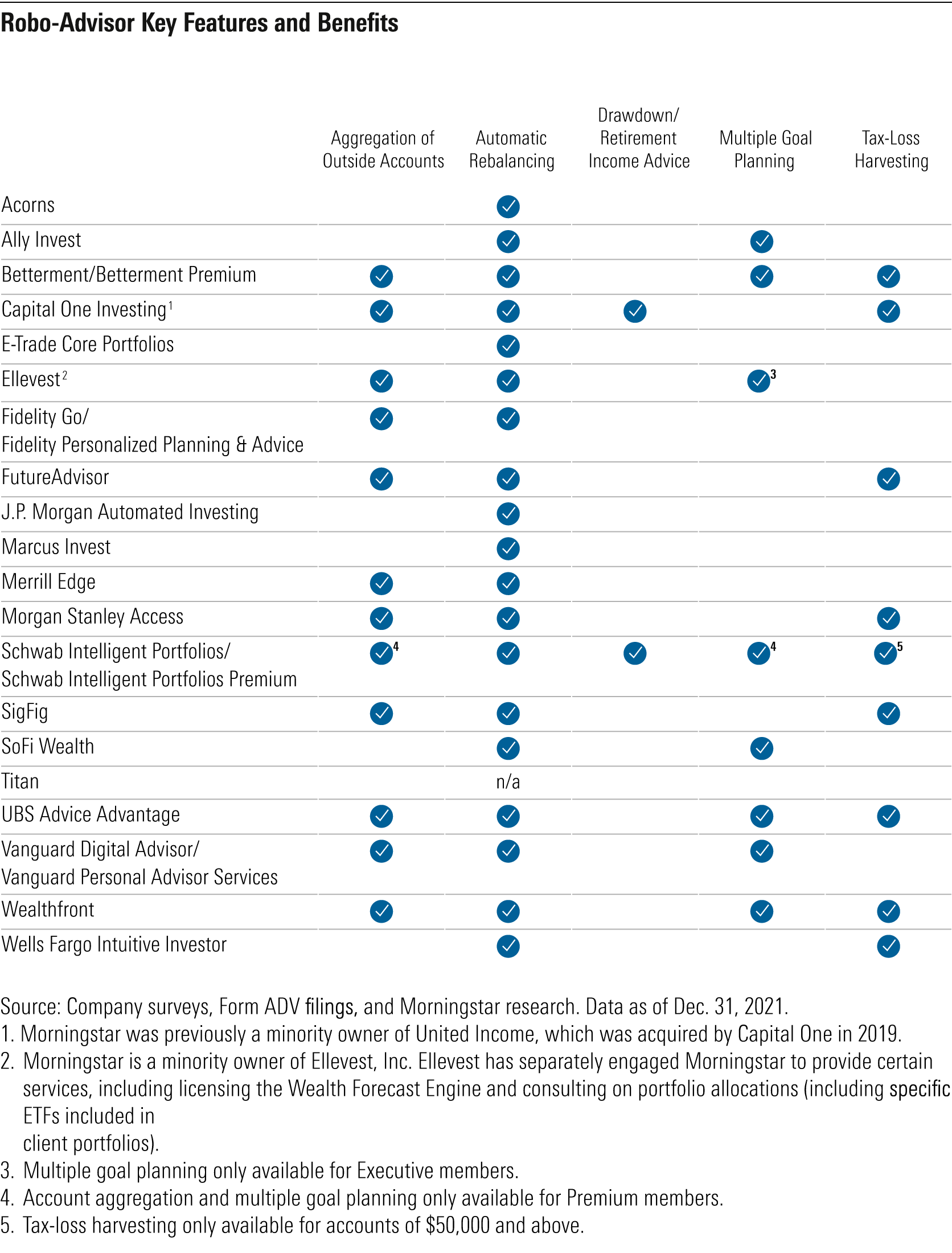

Still, the one category in which competitors have a current edge on Vanguard is Breadth of Services. Here, Betterment and Schwab have the only High assessments. They both include key features that Vanguard also has, such as aggregation of outside accounts and access to certified financial planners, but Betterment and Schwab distinguish themselves by including tax-loss harvesting as well.

Overall, Betterment ranks second on our list. It publicly documents on its blog how it builds and maintains various target-risk portfolios with exposure to several major asset classes while also attempting to maximize their tax efficiency. It focuses on the amount and timing of the money a client needs when advising on allocation, and its wide range of services includes holistic help with retirement investing, goal planning, and prioritizing various accounts.

Keeping Watch

Current rankings will almost certainly evolve over the course of the next year, however. Leading robo-advisors are competing for new business by adding investing and planning capabilities. Vanguard, for example, plans to add environmental, social, and governance portfolios to its basic service soon--though that is something many other services have already done, including Ally Invest.

Morningstar plans to keep watch on the industry and update investors annually as it changes. In the meantime, new investors, whose modest assets precluded them from receiving financial advice in the past, now have excellent options for getting started with robo-investing.

/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/08b315db-4874-427f-b3b1-f2b84a16e609.jpg)