How Have Top Bond Managers Handled the Russia-Ukraine War?

Funds with large stakes in Russian and Ukrainian bonds face challenges.

A relatively small portion of most bond-fund managers' portfolios has consumed most of their attention in recent weeks as the war in Ukraine and smothering Western sanctions have caused utter turmoil in the Russian economy and global financial markets.

The MOEX Russia Index, which tracks the equities of the 50 largest and most liquid Russian companies, plunged from the Feb. 24 start of the invasion until the country's stock market closed Feb. 28.

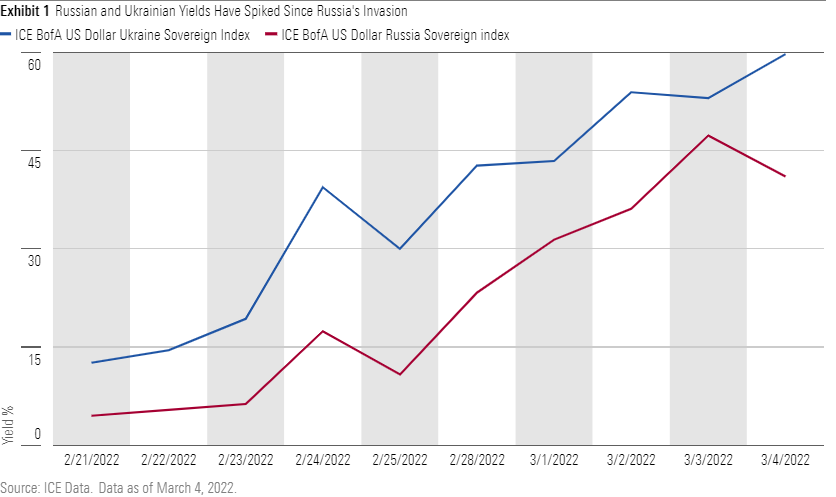

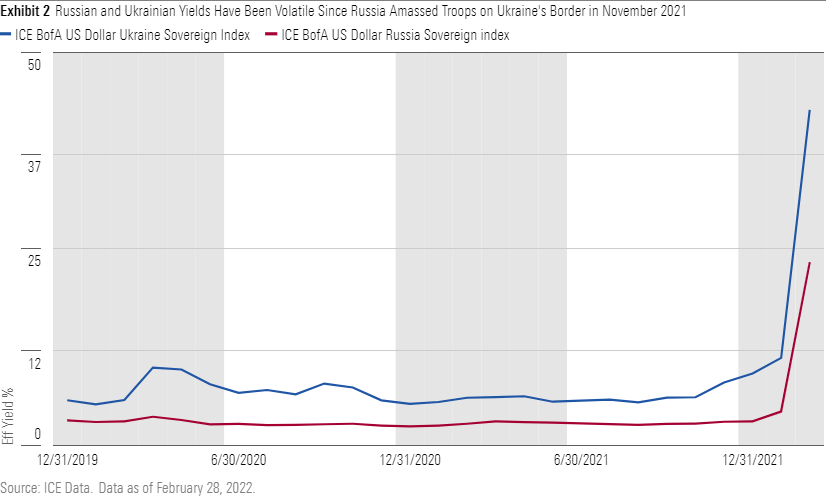

Simultaneously, Russian and Ukrainian bond yields spiked (Exhibits 1 and 2). Crude-oil and commodities prices have rallied, and assets often used as safe havens, such as gold and high-quality developed-markets government bonds have strengthened.

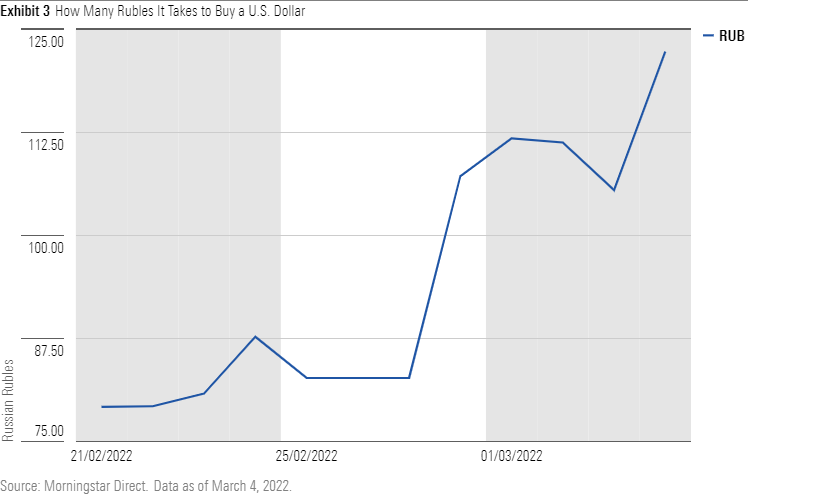

The tumult has had severe ramifications for the world's 11th-largest economy and investors who have had any direct or indirect exposure to it. The ruble crashed to less than one U.S. cent (Exhibit 3) as the Russian central bank hiked interest rates 1,050 basis points to 20% on Feb. 28; Russia has kept local securities markets closed at least through March 4. Local sovereign debt remains untradable, and its prices uncertain. Russia reportedly has made interest payments on its bonds, but sanctions have kept investors from collecting. It's not clear if the bonds are in default.

Meanwhile, Ukraine's ability to make a roughly $300 million Eurobond coupon payment last week shows the country may still be able to meet its obligations, according to TCW's emerging-markets debt team.

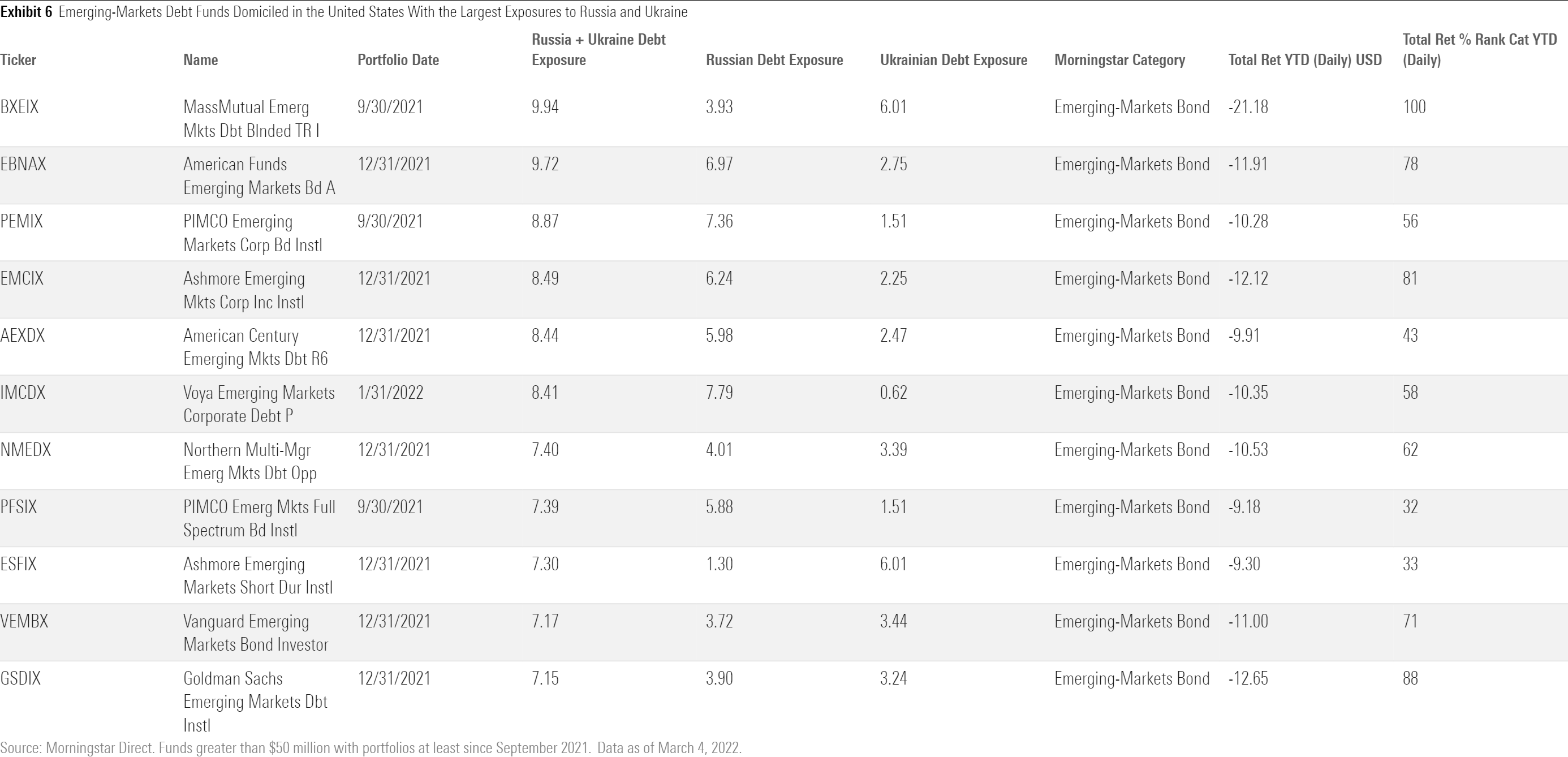

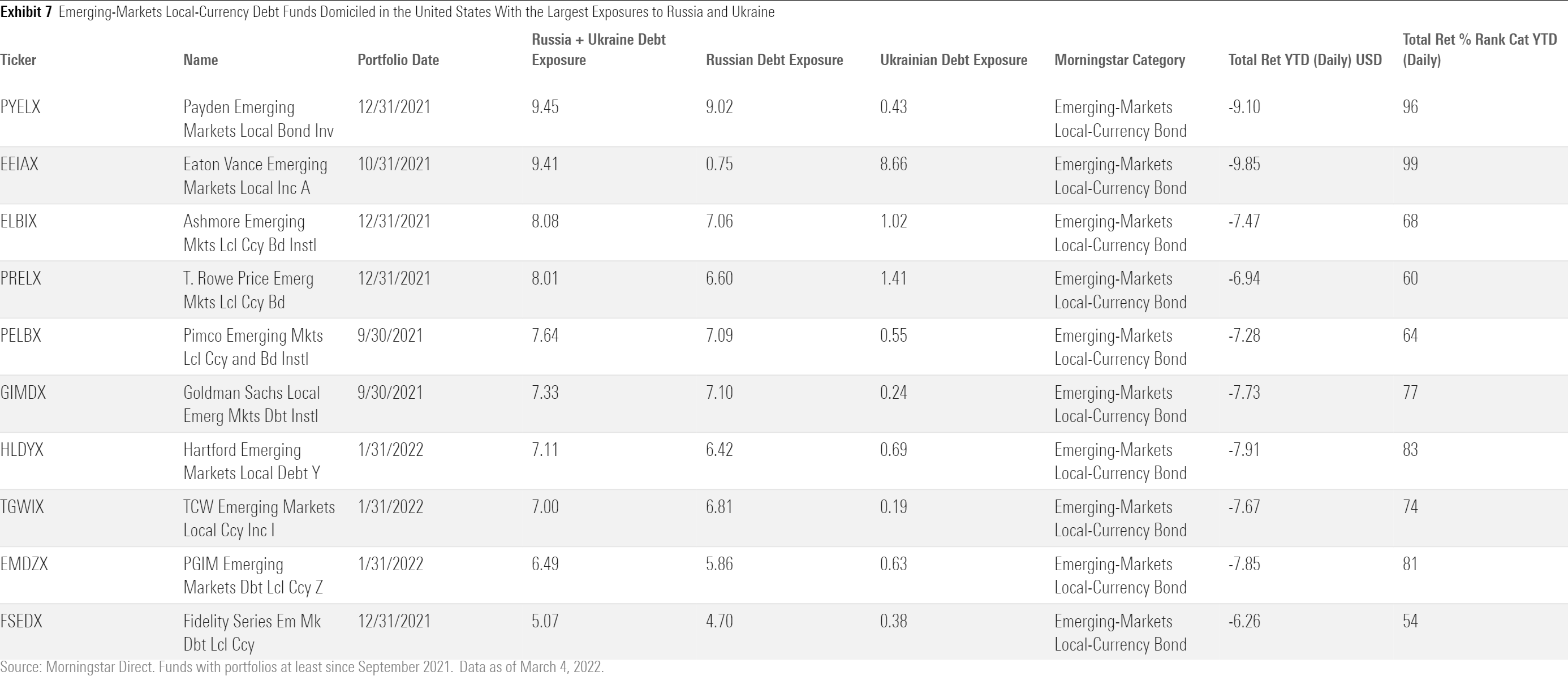

Russian and Ukrainian bonds are not common holdings in most fixed-income portfolios; most investors have little exposure to them unless they own funds from the emerging-markets or nontraditional bond Morningstar Categories.

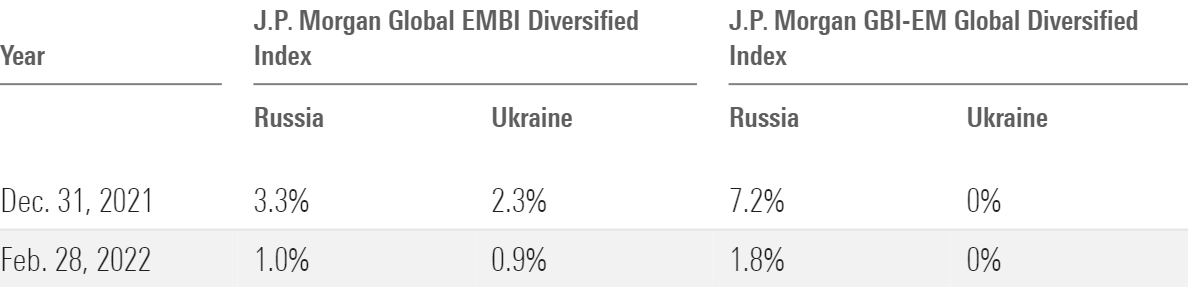

Still, Morningstar analysts checked in with the managers of bond strategies with some of the larger stakes in the countries to see how they're coping. Global bond indexes have negligible exposure to Russia and Ukraine, but global emerging-markets debt benchmarks such as the J.P. Morgan Global EMBI Diversified Index of emerging-markets sovereign and quasi-sovereign bonds denominated in U.S. dollars or "hard currency" and the J.P. Morgan GBI-EM Global Diversified Index, a popular local currency debt benchmark, had modest weights to Russia and Ukraine by the end of February 2022 because of depreciation (Exhibit 4). Old plans to add Ukraine to the local benchmark at the end of March are on hold.

Source: Morningstar.

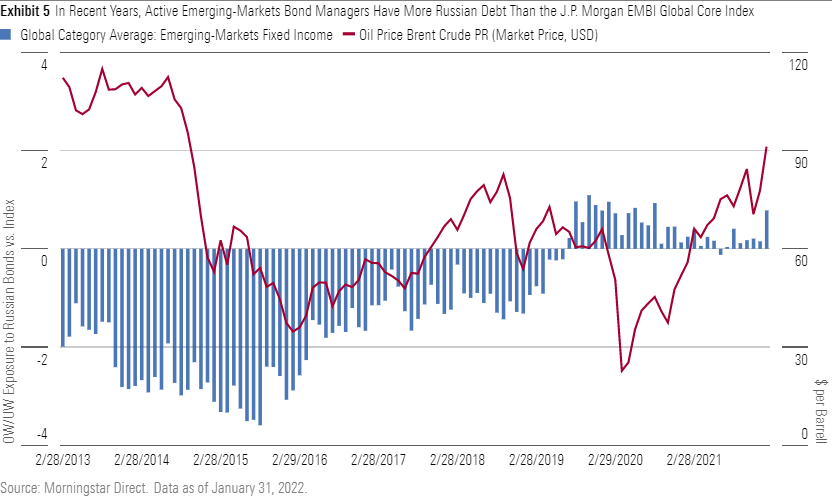

In recent years, many active emerging-markets bond managers have kept more money in Russia than the J.P. Morgan EMBI Global Core Index (Exhibit 5) because of the country's tight fiscal policy, low public debt, strong central bank, and recent high commodity prices. Other managers, however, reduced exposure as they grew wary of rising tensions in Ukraine. Here's how several emerging-markets bond strategies have reacted to the evolving conflict.

TCW Emerging Markets Income TGEIX has had little exposure to Russia in recent years but has been overweight Ukraine in a mix of U.S.-dollar-denominated sovereign and corporate debt. The fund cut its 0.7% in U.S. dollar-denominated Russian sovereign debt and 2.3% in Ukrainian U.S.-dollar-denominated sovereign and corporate debt as of Feb. 23, to nothing and 0.7%, respectively, by March 2.

The same team made similar moves at TCW Emerging Market Local Currency Income TGWIX. Heading into 2022, the strategy had 7.1%, about as much as the benchmark, in local Russian sovereign debt, and 1.0% in Ukrainian local sovereign debt. The team trimmed its Ukrainian debt in January and sold it in early February as the prospects of a conflict with Russia increased. The team maintained its neutral Russia stance to the benchmark at 6% as of Feb. 23. The local bond market has been closed since Feb. 28, and the bonds are priced for a default and unlikely to change soon.

MFS Emerging Markets Debt MEDIX was modestly overweight Ukrainian debt at the end of January, with 3.2% in sovereigns and quasi-sovereign debt. The fund, however, has been underweight Russia versus the benchmark for some time, with about 1.2% in Russian government and corporate bonds. Throughout January, the team shrewdly reduced the fund's emerging-Europe exposure, where they believed valuations had not adequately reflected a potential conflict. The team also used options for broader portfolio insurance.

Pimco Emerging Markets Bond PEBIX entered the year modestly overweight Ukraine. The team hedged this with an underweight in Russia and a tactical Russian ruble short. The Russian debt market remains severely dislocated, and there could be more spill-over effects, such as the effect of higher energy prices and likely drop in Russian and Ukrainian tourism on Turkish assets. The managers, however, do not expect contagion to spread to other emerging markets, noting on Feb. 25 that Latin America had thus far been relatively unscathed.

MassMutual Emerging Markets Debt Blended BXEYX, subadvised by Barings, was one of the few strategies with overweights in both Russia and Ukraine heading into 2022. The team had about 4% in Ukraine debt in late February, which was a 2-percentage-point overweight compared with the J.P. Morgan EMBI in a mix of hard-currency sovereign bonds and quasi-sovereigns. Exposure to Russia accounted for 5.8% (also a 2-percentage-point overweight) and included sovereign bonds and a sliver of corporates. The managers have been holding both overweight allocations for quite some time based on their views on valuations and fundamentals but keep assessing the situation.

Sizing Up the Risks

There have been a lot of scary headlines and volatility, but most investors with diversified portfolios have limited exposure to Russian and Ukrainian securities, which should limit losses caused by the geopolitical turmoil. That said, funds that owned more Russian and Ukrainian securities have done much worse than their benchmarks and category peers this year. Recent events are a stark reminder that emerging-markets debt is prone to idiosyncratic and geopolitical risks, and fund investors should favor strategies with experienced, capable management teams following repeatable investment and risk-control processes.

Morningstar analysts Giovanni Cafaro, Jeana Marie Doubell, Evangelia Gkeka, Shannon Kirwin, and Saraja Samant contributed to this report.

Editor's Note: This article has been updated to correct the weightings in TGEIX and TGWIX.

/s3.amazonaws.com/arc-authors/morningstar/c6bd816b-3f1a-49af-ae14-2efdb6122500.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c6bd816b-3f1a-49af-ae14-2efdb6122500.jpg)