Bond Investors: Mind Your Overseas Currency Exposure

Currency risk can make your international bonds go wild.

A version of this article was published in the February 2022 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

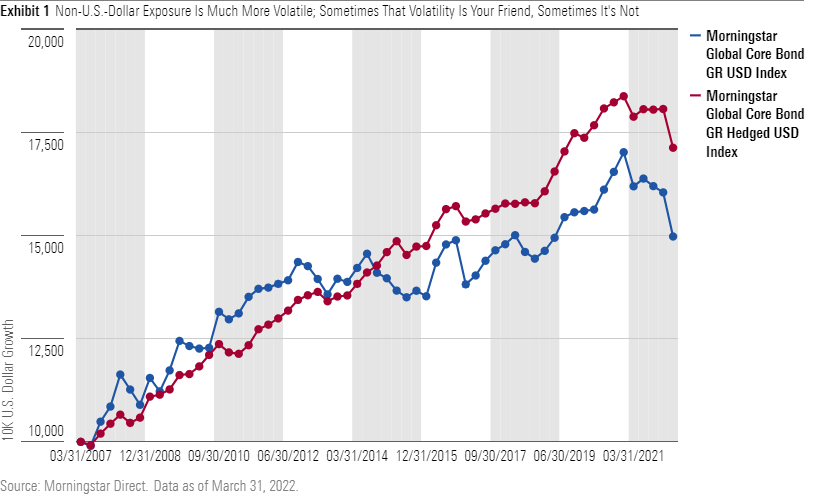

Over the past 15 years, global-bond benchmarks with non-U.S.-dollar exposure have been much more volatile, as measured by standard deviation, and underperformed their U.S.-dollar-hedged global-bond counterparts. Sometimes this volatility can prove beneficial, which was the case from April 2007 to mid-2014. However, volatility is not always your friend; since mid-2014, non-U.S.-dollar exposure has hurt results.

Last year was no exception. After another strong year for the U.S. dollar, bond funds with exposures to currencies that declined versus the greenback felt some pain in 2021. This pain continued for some foreign currencies in the first quarter of 2022 as the Russia-Ukraine War led investors to flee for the relative safety of the world's main reserve currency, the U.S. dollar. Among the fixed-income Morningstar Categories, non-U.S.-dollar exposure is the highest for world-bond and emerging-markets bond funds. That said, overseas currency exposure routinely shows up within intermediate core-plus, multisector, and nontraditional bond funds. For example, scores of core-plus bond strategies have sported high-single-digit to low-teens stakes in overseas debt and nondollar currencies in recent years.

Sharp declines in non-U.S. currencies can easily erode or wipe out income streams and can therefore have a significant impact on a bond fund's risk/return profile. Last year was a tough one for the euro and yen, which were down roughly 7% and 10%, respectively, versus the dollar. In strong dollar years, emerging-markets currencies can post even larger losses, making them among the most potent tools available to fixed-income managers. Last year, some of the largest losers versus the greenback were the Turkish lira (negative 44%), Argentine peso (negative 18%), and Chilean peso (negative 16%). Still, non-U.S. currencies can help as well. As seen in Exhibit 1, currency exposure can lead to much better or worse returns

Of course, avoiding currency risk altogether is possible with a strict, U.S.-only mandate. Another path is to buy a fund that fully hedges non-U.S. currency exposure back to the U.S. dollar. Pimco International Bond (U.S. Dollar-Hedged) PFOAX and its unhedged sibling (Pimco International Bond PFUIX) nicely illustrate the hedging impact. In addition to non-U.S. currencies, duration has also had a tough start to 2022, causing Pimco International Bond (U.S. Dollar Hedged) to lose 3.7%. However, the unhedged version of this strategy slid 6.3%. Over the medium and long terms, the unhedged version's max drawdown was at least twice as painful as its U.S.-dollar-hedged sibling's. Notably, from November 2008 to mid-2009, it plunged 21% versus 9% for the hedged version.

Within the intermediate core-plus bond category, there are several strategies that incorporate a combination of unhedged overseas bond positions (both from developed and emerging markets) as well as modest long or short currency positions in their investment processes. For instance, the team at Western Asset Core Plus Bond WACPX has been one of the more avid investors in volatile emerging-markets fare. Its emerging-markets debt stake stood at 13% at the end of 2021, with the team citing the real yield (which is adjusted for inflation) differential between emerging and developed markets as well as valuations as key drivers. The strategy's roughly 15% in non-U.S.-dollar exposure included small stakes in the yen and Australian dollar, though it was predominantly in emerging-markets currencies such as the Russian ruble and Mexican peso. That, as well as the strategy's longer duration relative to its core-plus bond category peers, took a toll and contributed to the fund's 8.8% loss for the first quarter of 2022, which lagged nearly all peers.

While corporates and securitized debt constitute the bulk of PGIM Total Return Bond's PDBAX portfolio, it also regularly uses non-U.S. debt and currencies. The fund held 5% in foreign developed-markets government and 6% in emerging-markets issues at year-end, both of which have fluctuated in recent years based on the team's adjustments to the overall credit exposure. The strategy's currency exposure is well diversified across roughly 30 modest long and short positions (less than 50 basis points apiece). Still, that nondollar exposure, as well as significantly longer duration than its core-plus bond category peers, contributed to the fund's 6.5% loss that landed near the bottom decile of peers for the first quarter of 2022.

Both strategies have experienced some larger drawdowns at times compared with peers, partly owing to the inclusion of more-volatile currencies. And they could continue to experience steeper losses as they did in the emerging-markets currency selloff in mid-2018 and the coronavirus downturn in early 2020.

Non-U.S. currencies are generally meant to be minor drivers of return for core bond funds. These managers have a lot of other levers to pull to offset air pockets like we've seen in recent years, but it's crucial to invest with teams that have the depth and breadth of support required for this volatile tool.

/s3.amazonaws.com/arc-authors/morningstar/c6bd816b-3f1a-49af-ae14-2efdb6122500.jpg)

/s3.amazonaws.com/arc-authors/morningstar/9117d33d-7edf-4c01-b517-49ddd5f2b25c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/G3DCA6SF2FAR5PKHPEXOIB6CWQ.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c6bd816b-3f1a-49af-ae14-2efdb6122500.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/9117d33d-7edf-4c01-b517-49ddd5f2b25c.jpg)