Options-Trading Funds Don’t Have to Be Scary

Although complicated, these strategies can help diversify a portfolio.

A version of this article was published in the January 2022 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor by visiting the website.

Though they can be complex and intimidating, options-trading strategies are worth considering as key components of diversified portfolios. Elevated inflation readings increase the chances of rising interest rates, which would weigh on the standard 60/40 portfolio's fixed-income allocation. Yet it may be possible to maintain the overall risk profile of a 60/40 portfolio but reduce its duration, or interest-rate sensitivity, by layering in options-trading strategies. Indeed, investors have already started adding these funds to their tool kit; net flows into the options-trading Morningstar Category were just shy of $10 billion in 2021.

The threat of rising interest rates can cause bond prices to drop, however, some types of options-trading strategies are not as directly affected. In these cases, interest-rate volatility can be advantageous as they benefit when implied volatility (the market's forecast) is greater than the historical realized volatility and the gap between the two widens. For options traders that sell options, they will collect greater premiums on the options they are selling, helping pay for further options or adding to returns. Interest-rate levels, another component of options valuation, can also enhance returns. As interest rates climb, call options, or the right to buy, become more attractive to investors, which increases demand and therefore pricing. The opposite is true for put options, or the right to sell. Most importantly, if done properly, these strategies don't have to incur high levels of risk or complexity.

Here are some strategies that could help diversify a portfolio as well as an illustration of one possible use case.

JPMorgan Hedged Equity JHQAX, which has a Morningstar Analyst Rating of Bronze, is a solid choice. The strategy trades options at differing levels around the current market price. They first purchase a put option 5% below the current market price of a U.S. equity portfolio while simultaneously selling another option on the same portfolio 20% below the current portfolio price. This approach is designed to provide protection when markets sell off between 5% and 20% in any given quarter. As the option sale proceeds will not cover the purchase price, the managers also sell call options, some 3.5% to 5.5% above the market price. This extra income helps minimize this cost of protection, but effectively caps the portfolio’s upside for that period.

Strategy architect Hamilton Reiner, who joined the firm in 2009 and has nearly three decades of experience, oversees a nimble and experienced team. Comanager Raffaele Zingone brings considerable tenure to the strategy and leads the U.S. structured equity team. JPMorgan’s deep supporting bench and the strategy’s systematic process mitigate concerns over its relatively slim team.

Gateway GATEX is rated Neutral, but its seasoned management merits an Above Average People Pillar rating. The strategy constructs a generic large-cap U.S. equity portfolio before selling call options to collect the income premiums. This is effective in calmer markets, but the managers also buy put options typically between 8% and 12% below the current market price to shield the strategy from declines beyond that range. Lead manager and chief investment officer Michael Buckius has spent nearly 30 years researching and trading options. Three of the strategy’s five managers have more than 20 years of firm tenure, and Buckius and Paul Stewart have contributed to the strategy for over a decade.

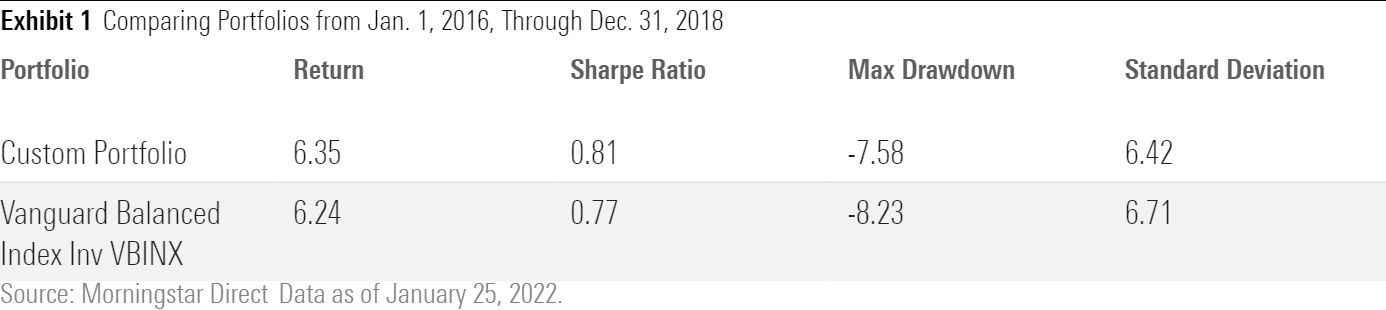

A hypothetical illustration comparing a custom portfolio that incorporates options with Silver-rated Vanguard Balanced Index VBINX, a 60/40 stalwart, shows option trading strategies can help a portfolio retain its risk profile. The custom portfolio puts 80% in the Vanguard fund and 20% in JPMorgan Hedged Equity JHQAX, which effectively reduces the overall equity weight by 12% and the bond helping by 8%. When the 10-year U.S. Treasury rate rose from 1.37% to 3.24% between July 2016 and November 2018, the custom portfolio posted slightly better absolute and risk-adjusted returns--it held up better when the S&P 500 fell 19.4% from Sept. 21 to Dec. 24, 2018, and was less volatile overall.

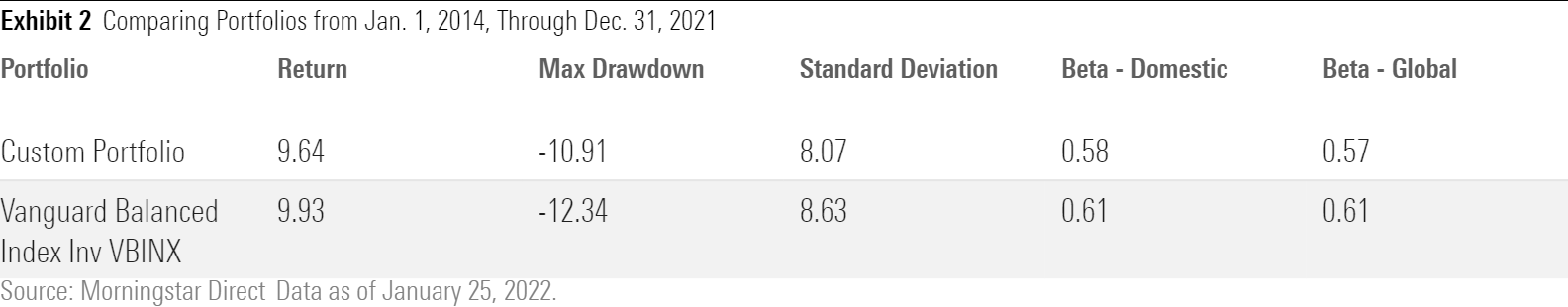

Over longer time frames, adding an options strategy also reduced volatility without sacrificing much return. From January 2014 through December 2021 the custom portfolio gained 29 basis points less than Vanguard Balanced Index, but experienced less volatility, milder drawdowns, and lower equity betas versus the S&P 500 and MSCI All-Country World Index than the 60/40 fund.

Options-trading strategies are not immune to volatility and occasional big losses, but historically they have experienced fewer extreme setbacks than a traditional balanced portfolio and have proved durable in the most stressed periods. Options strategies, while intimidating at first blush, can take the edge off the undesired risks in a balanced portfolio without costing much in the way of returns.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/502d0355-28ed-483c-ae9d-b67bfbf5291b.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/502d0355-28ed-483c-ae9d-b67bfbf5291b.jpg)