Cost Inflation Weighs on Consumer Defensive Sector

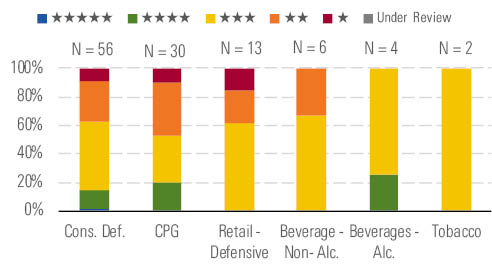

Tobacco still looks undervalued.

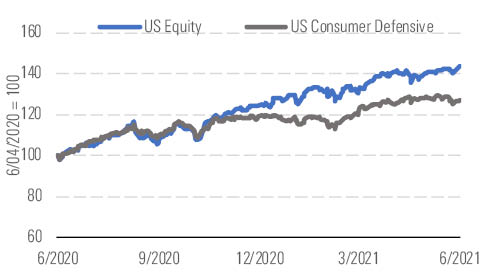

Despite posting a nearly 3.9% gain in the second quarter, the consumer defensive sector again lagged the market’s appreciation by more than 400 basis points.

Consumer defensive gains remain more measured than the broader market. - source: Morningstar

However, we continue to view the sector as a bit heated, with the median consumer defensive stock trading at a 4% premium to our intrinsic valuation versus the 4% and 2% premiums we valued the sector at in March and December, respectively. At present, just 14% of our consumer defensive coverage trades in 4- or 5-star territory (down from just 20% three months ago). As has been the case, tobacco names still offer some upside, trading at a 5%-10% discount to our valuation, as the market seems to underappreciate the cash generation the businesses boasts.

We see relative value in tobacco. - source: Morningstar

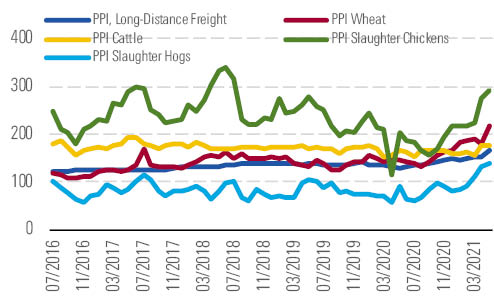

For the sector as a whole, we don’t think the competitive and macro environment can facilitate meaningful opportunities for financial improvement in the year ahead. For one, cost inflation (as it relates to labor, raw materials, transportation and logistics, as well as packaging) is running rampant. More specifically, the U.S. Bureau of Labor Statistics cites that long-distance freight, wheat, and cattle are each up, at a mid-20s, mid-40s, and midteens rate, respectively, between March 2020 and May 2021. And we don’t expect that these pressures are poised to subside over the near term, particularly as demand remains elevated and given the supply chain disruptions that are wreaking havoc across industries.

Inflation for raw materials and freight is picking up steam. - source: Morningstar

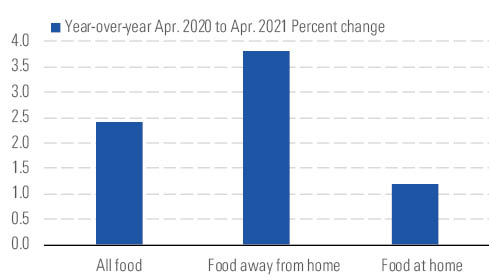

As such, a number of operators have suggested that they intend to raise prices at the shelf to offset these higher costs. Although the Consumer Price Index for food at home and away from home are up 1.2% and 3.8%, respectively, as of April 2021 versus April 2020, we think further increases are likely.

In response, food prices are beginning to edge higher. - source: Morningstar

However, we don’t believe that charging higher prices is the only lever consumer product manufacturers can maintain to stem these costs. Rather, we expect that firms are also working to drive out inefficiencies within their organizations. But with prices likely to rise throughout the grocery store, we also think it’s imperative for consumer packaged goods operators to continue investing in both consumer-valued product innovation and marketing support to ensure brands stand out at the shelf or run the risk of sustained volume contraction.

Top Picks

Kellogg K Star Rating: ★★★★ Economic Moat Rating: Wide Fair Value Estimate: $83 Fair Value Uncertainty: Medium

We think investors should consider wide-moat Kellogg, which is currently trading more than 23% below our assessment of intrinsic value. Kellogg has benefited from pandemic-related gains in the retail channel (which drives 90% of its sales) as consumers continue to spend more time at home. But even before the pandemic, we thought Kellogg was taking steps to profitably reignite its top-line trajectory—abandoning direct-store distribution in favor of warehouse delivery, divesting noncore fare and stock-keeping units, and upping investments in its manufacturing capabilities and brands.

Coca-Cola Femsa KOF Star Rating: ★★★★ Economic Moat Rating: Narrow Fair Value Estimate: $67 Fair Value Uncertainty: Medium

Shares of narrow-moat Coca-Cola Femsa, the largest franchise bottler of Coca-Cola by volume, trade about 22% below our intrinsic valuation. The firm mainly operates in Mexico and Brazil but has operations in other Central and South American countries. Shares have been hit by factors largely outside of the firm’s control, from COVID-19 currency impacts to wage insecurity across key markets. Although COVID-19 challenges continue to linger across its territories and the region faces general macro uncertainties, the firm continues to invest in commercial capabilities that should cement its competitive position.

Pilgrims Pride PPC Star Rating: ★★★★ Economic Moat Rating: None Fair Value Estimate: $33.50 Fair Value Uncertainty: High

We consider no-moat Pilgrim's Pride an attractive investment, with shares trading nearly 30% below our fair value estimate. We believe Pilgrim's is poised to benefit from the recovery from the pandemic, China removing its ban on imports of U.S. chicken, and from the global protein shortage caused by African swine fever. The firm’s margins have suffered as a result of its 50% food-service exposure (which skews toward quick-service restaurants), but we expect margins to improve in 2021 as the food-service market recovers, exports gain momentum, and higher feed costs are mitigated with price increases, hedging, and operational improvements.

/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZZNBDLNQHFDQ7GTK5NKTVHJYWA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HE2XT5SV5ZBU5MOM6PPYWRIGP4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c612f59b-89e0-422a-8f71-3eb1300d1a2c.jpg)