The Advantages and Disadvantages of Active Stock ETFs

The differences between active open-end funds and ETFs may look trivial at first blush but can carry important consequences.

A version of this article previously appeared in the May 2021 issue of

. Click here to download a complimentary copy.

Actively managed stock exchange-traded funds have burst into the marketplace, leaving investors to ponder the merits of consuming an active equity strategy in an ETF wrapper. The differences between active open-end funds and ETFs can look trivial at first blush, but they can have important effects. The ETF structure offers benefits and drawbacks, many of which manifest in the three Morningstar Medalist strategies that offer both open-end and exchange-traded flavors, which I’ll examine here.

Advantages

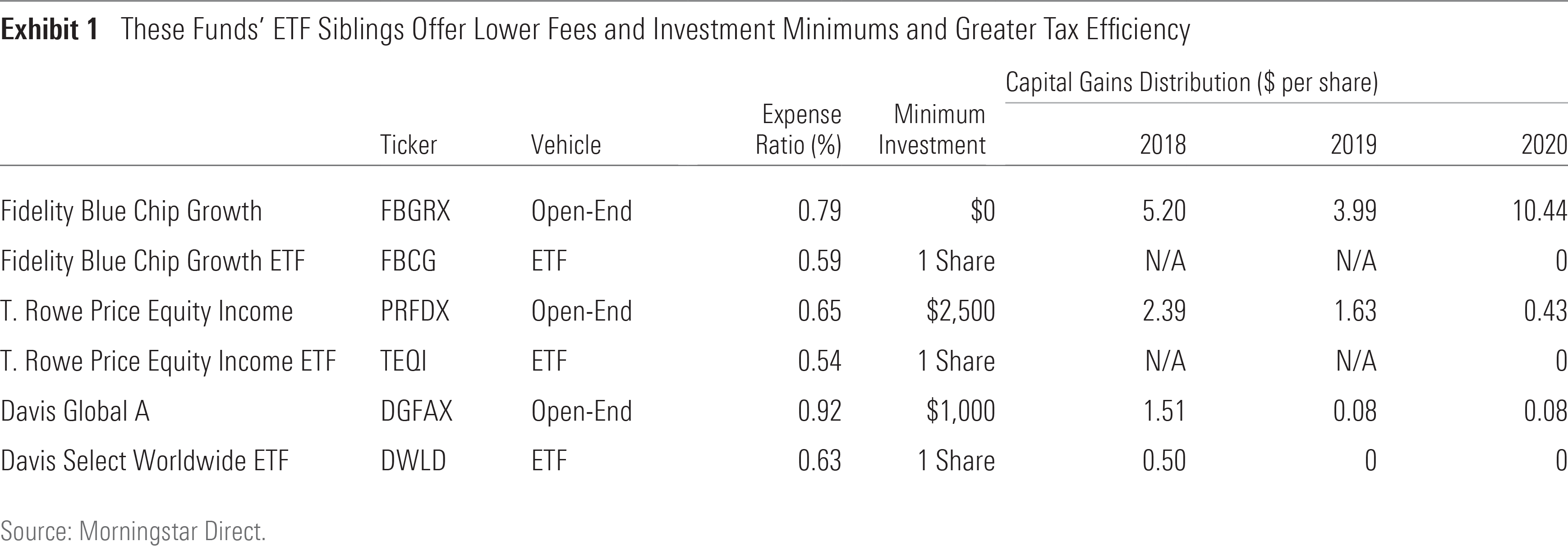

Actively managed stock ETFs’ most pronounced advantage over their open-end fund peers lies in their lower cost. Open-end funds’ fees incorporate marketing, distribution, and shareholder recordkeeping expenses. ETFs don’t factor in these costs. So, while ETFs earn a low-cost reputation because many of them track indexes, even ETFs with active strategies tend to come at relatively attractive prices. Minimizing expenses is critical, as they bite directly into returns.

ETFs typically create and redeem shares on an “in-kind” basis, which makes them more tax-efficient and lowers the cost of trading within their portfolios to the benefit of long-term shareholders. Open-end fund shareholders collectively bear the transaction costs and taxable capital gains distributions that arise from share creation and redemption. ETF investors are responsible only for the costs borne out of their own transactions.

ETFs are available to a broader range of investors. While open-end funds may require a minimum investment, any investor who can cover an ETF’s share price can purchase it.

Drawbacks

The downside to ETFs’ come-one-come-all remit is that they cannot close their doors to new investment, unlike open-end funds. Active open-end fund managers may shut out new investors to manage capacity and protect existing shareholders, especially in corners of the market where capacity can become a concern, like the small-cap space. Indeed, 30% of the actively managed medalists in the U.S. small-cap blend, growth, and value Morningstar Categories were closed to new investors at the end of April 2021. Hot actively managed stock ETFs may encounter liquidity problems or be forced to invest in the managers’ next-best ideas with new money.

Active stock ETFs may also have to draw on narrower opportunity sets than open-end funds. ETFs cannot invest in private companies or sweep privately placed debt into their portfolios. Active nontransparent ETFs, a newer and increasingly popular breed of ETF, can invest only in securities that trade at the same time as the funds themselves. This forces managers to replace foreign stock holdings with depository receipts. Most U.S. active equity funds allocate the bulk of their portfolios to U.S.-traded stocks, but these marginal considerations limit managers’ opportunity sets.

Fidelity Blue Chip Growth ETF FBCG

Some of the market’s best active stock ETFs descend from tried-and-true open-end funds. For example, FBCG, which has a Morningstar Analyst Rating of Bronze, channels the same strategy as Fidelity Blue Chip Growth FBGRX, one of the world’s largest actively managed open-end funds. Morningstar strategist Robby Greengold praises the strategy’s leadership and well-resourced analyst team:

“(Manager) Sonu Kalra’s willingness to pay high price multiples for companies he thinks have sustainably high growth rates courts risk, but over the past decade he’s consistently made good calls. That’s especially been the case within the consumer discretionary and communication services sectors.

“Kalra often tries to get in early, initiating modest positions in small or mid-caps with large-cap potential. In 2010, for instance, he built a 20-basis-point stake in electric-car maker Tesla TSLA, when its market cap was roughly $2 billion. Since then—despite operational issues that underpinned many shorter sellers’ theses—Kalra maintained conviction in what he thought was a disruptive industry pioneer.

“The strategy’s present size poses a challenge. Still, that doesn’t necessarily relegate the strategy to mediocrity. Kalra’s position moves tend to be gradual, and analytical support from Fidelity’s deep analyst bench helps in overseeing in the fund’s sprawling portfolio.

“The portfolio in aggregate doesn’t typically look high-quality on traditional metrics such as return on invested capital and return on assets, given Kalra’s tolerance for owning names that may not yet be profitable. These types of investments can make for bumpy returns. But the types of stocks that make the strategy volatile are often the same ones that have fueled its superb long-term record.”

The open-end and ETF variants of this fund look a bit different. Unlike its mutual fund predecessor, the active nontransparent ETF does not hold Chinese tech conglomerate Tencent because it trades on a non-U.S. exchange. E-cigarette maker Juul Laboratories’ privately held status also precludes it from the ETF’s portfolio. Differences like these caused FBCG to trail the retail shares of its open-end parent by 2.51 percentage points from its June 2020 launch through April 2021.

While FBCG is not an exact replica of its open-end fund parent, its lower fee directly benefits investors. ETF shareholders also dodged a sizable capital gains distribution last December. While ETF investors may wring their hands if the strategy’s privately and/or internationally traded holdings excel, the ETF’s cost and tax benefits provide a unique performance edge of their own.

T. Rowe Price Equity Income ETF TEQI

TEQI hit the market in August 2020, nearly 35 years after its parent fund, T. Rowe Price Equity Income PRFDX. The fund’s ETF and cheaper open-end shares are rated Silver for their seasoned team and balanced approach, writes analyst Linda Abu Mushrefova:

“Longtime value investor John Linehan has successfully steered this strategy in its mutual fund iteration since November 2015 but has run similar value strategies at T. Rowe Price since 2003, starting with T. Rowe Price Value TRVLX, which performed well during his involvement. He’s also backed by associate manager Heather McPherson and T. Rowe’s well-regarded analyst team.

“The team applies a well-rounded approach to equity income investing that emphasizes yield, valuation, and fundamentals. Linehan looks for attractively valued dividend-payers with solid balance sheets. Bottom-up stock selection determines positioning in this portfolio. While yield is the main focus here, Linehan pays attention to each stock’s fundamentals and relative valuation characteristics, too. Unsurprisingly, the fund’s yield isn’t notably high relative to equity-income-focused peers, but it lands in the top half of the large-value category over time.”

Investors inclined to test the fund’s waters before diving in may turn to the ETF version; its Retail open-end fund shares require a $2,500 minimum investment. TEQI’s fee is 11 basis points cheaper than the Retail open-end share class, which adds to its appeal. The ETF’s cost advantage should help it make up ground if the open-end fund sees major contributions from its unique holdings, like preferred shares of German automaker Volkswagen VWAGY.

Davis Select Worldwide ETF DWLD

Although DWLD uses a different moniker than Davis Global DGFAX, it plies the same strategy as its open-end forerunner. Senior analyst Alec Lucas maintains that manager Danton Goei’s skill and conviction support a Bronze rating but implores potential investors to be patient:

“Goei’s picky, value-sensitive process has led him to amplify the portfolio’s risks since this transparent, actively managed ETF launched in early 2017. Its holdings have dropped to just 30 from the low 40s. The percentage of assets invested in its top 10 holdings peaked at 62% in March 2020 and has been around 55% recently, versus 45%-50% during the ETF’s first year.

“Goei’s ability to spot promising companies as well as bargains and hold them through rough patches is what’s most endearing about this ETF. It enabled him to outlast the three other sleeve managers of the former multimanager offering Davis Global and build a competitive record since taking it over in 2016. But it requires ample patience in down markets, such as 2018 and early 2020, when this ETF underperformed.”

DWLD cannot reach the private firms that represented nearly 8% of the mutual fund’s portfolio as of January 2021. That includes Grab Inc, which made headlines in April when it announced it would go public via the largest special-purpose acquisition company merger ever. The ETF version may watch some winning holdings from the sidelines, but it offers a fee 29 basis points lower than the Retail open-end shares. Light-touch investors may prefer the ETF version because it doesn’t demand the $1,000 minimum investment required by the Retail open-end shares.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)