Now's the Time to Consider These Inflation Protection Strategies

Diversified real assets can enhance a portfolio built for the long run.

The current market environment is a challenge. With the Consumer Price Index registering increasingly higher values, supply-chain challenges mounting, and fiscal and monetary stimulus continuing unabated, it's reasonable for vigilant investors to wonder what will come next. It behooves those with a long investment horizon to curate portfolios that can withstand periods of inflationary pressures while remaining mindful that additions to a portfolio should improve its overall risk/return profile. What are the options?

Commodities, Treasury Inflation-Protected Securities, and equities like REITs or energy producers may provide some benefit against inflation, and in the past we've explored how those assets have improved investors' portfolios. However, it can be a challenge to select a single inflation-sensitive exposure from myriad menu options, let alone to conduct the due diligence needed to formulate a complementary combination of them.

Enter diversified real asset strategies, a type of investment strategy that offers exposure to a spectrum of inflation-sensitive assets in one package. When thoughtfully designed, these strategies not only offer investors inflation-hedging benefits, but they can enhance a portfolio built for the long run.

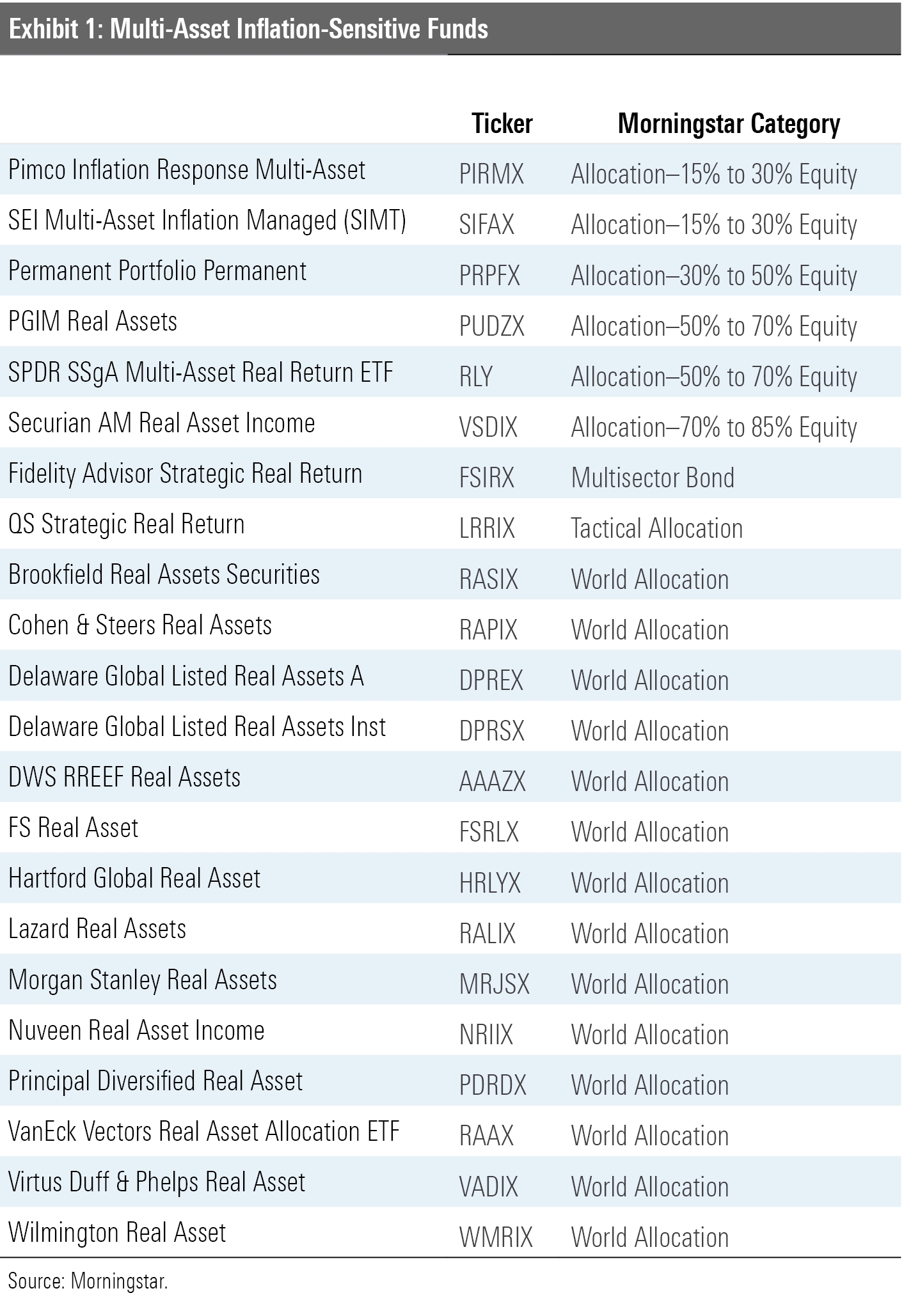

Though there's no unified Morningstar Category for these funds, we've tagged a cohort of 22 such strategies as "multi-asset inflation sensitive." It's a mixed group, and the different category assignments illustrate the variety of approaches that managers take.

This list was curated by Morningstar manager research analysts and not quantitatively assigned based on portfolio data like the Morningstar Categories are, so it's a bit subjective. Still, it's a good starting point for investors looking for strategies that provide exposure to a broad range of inflation-sensitive assets.

What Contributes to a Compelling Diversified Real Asset Offering?

The same factors we consider when rating other allocation strategies are relevant to diversified real asset strategies: well-thought out allocations to underlying assets, a robust approach to tactical allocation, proven underlying security selection, and a strong management team. Managers don't get a free pass just for offering exposure to inflation-sensitive assets, they must still design a thoughtful strategy that can deliver attractive risk-adjusted returns over a full cycle.

Failure to do so may result in a concentrated, risky strategy. For example, a fund that combines real estate and infrastructure assets would suffer outsize losses during a recession, as both assets are highly correlated to gross domestic product growth. On the other hand, a fund that allocates to every conceivable real asset type may ultimately resemble a market portfolio, with a risk/return profile that doesn't differentiate itself from assets already in an investor's portfolio. There's a fine line between concentration risk and sprawl, and good managers can design a product that offers the diversification benefits of real assets in a diversified, risk-conscious manner.

Ultimately, we expect diversified real asset strategies to not only provide inflation-hedging benefits, but also to advantageously diversify a standard stock/bond portfolio. Given the challenges in forecasting and predicting inflation, it's often a fool's errand to tactically market-time these exposures. Instead, investors should focus on a strategy's risk profile, like how volatile it is and how it correlates to other assets in a portfolio.

Below are two Morningstar Medalist strategies that offer investors exposure to inflation-sensitive assets but are also constructed in a way that can improve the risk profile of an investor's total portfolio through a full market cycle. One is more equity-heavy, an appealing option for investors with a higher risk tolerance. The other skews toward higher-quality fixed-income assets, which provide less correlated returns in a more equity-centric total portfolio.

Pimco Inflation Response Multi-Asset

Pimco Inflation Response Multi-Asset PIRMX, which has a Morningstar Analyst Rating of Silver (all ratings as of April 2021), falls in the allocation--15% to 30% category, and the team has purposefully constructed this portfolio to hold limited stock exposure. It invests in a unique mix of assets, holding TIPS, commodities, emerging-markets currencies, gold, and real estate. Pimco selected these assets for their sensitivity to inflation, which it believes to be among the highest for investable asset classes. The well-crafted portfolio design emphasizes diversification. Additionally, Pimco is a leader in investing in these assets; it manages two Silver-rated commodity strategies and a Silver-rated TIPS strategy.

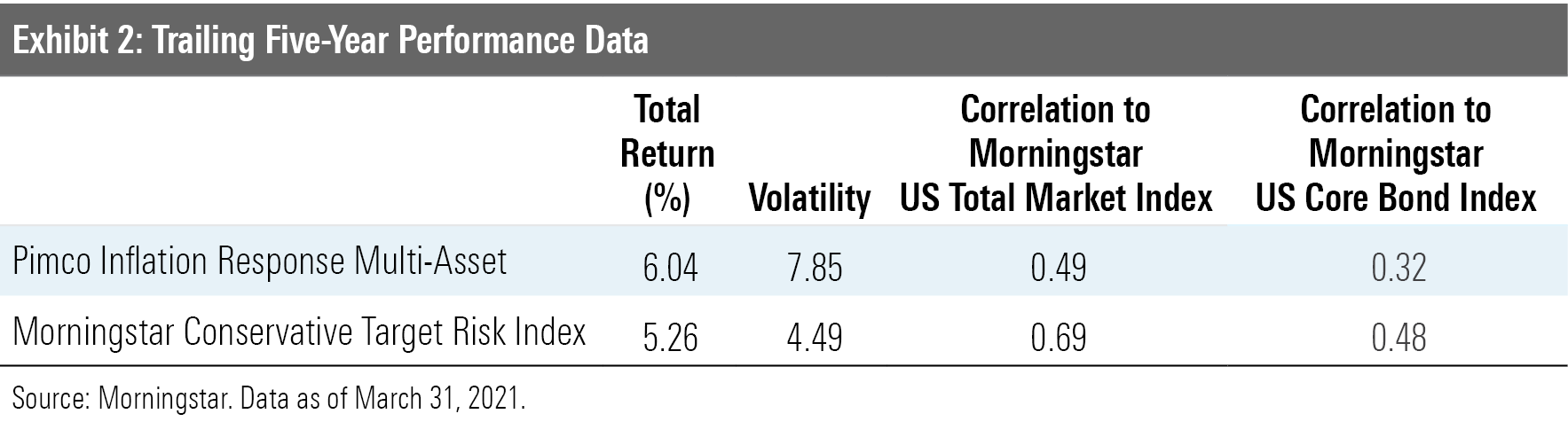

In addition to this strategy's inflation sensitivity, investors also benefit from a niche return stream that often behaves independently of more traditional equity and fixed-income markets, ultimately serving as an effective way to diversify a portfolio. Since its September 2011 inception, the strategy's correlation to the Morningstar US Total Market Index (0.46) and the Morningstar US Core Bond Index (0.27) are among the lowest in the category. That doesn't mean the fund has sacrificed returns: Its 6.0% annualized return over the trailing five years tops its category benchmark, the Morningstar Conservative Target Risk Index, which returned 5.3%. Such performance in the face of significant headwinds for the assets that the fund invests in is an impressive feat and bodes well for a future in which inflationary forces are more pronounced.

DWS RREEF Real Assets

The RREEF team at DWS has built itself up as a leader in liquid real asset investing. It has more than 30 investment professionals dedicated to the space, with teams focusing on real estate, infrastructure, and commodities. All those assets appear in Bronze-rated DWS RREEF Real Assets AAAZX, and the team includes a TIPS allocation as well. The teams that generate ideas for the portfolio have strong track records, including the one that manages the Silver-rated DWS RREEF Real Estate Securities RRRRX strategy. An effective approach to tactical allocation that's damped portfolio volatility and driven better returns complements the bottom-up security selection.

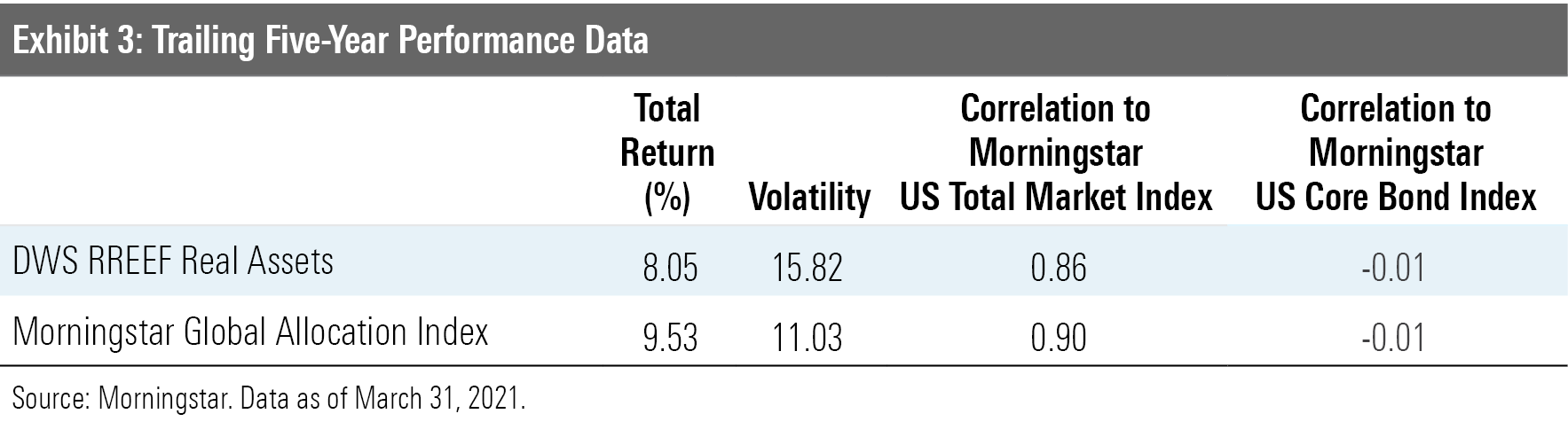

This strategy comes with more equity exposure than the Pimco strategy and falls in the world-allocation category instead of the more conservative allocation--15% to 30% equity category. Its 0.86 correlation to the Morningstar US Total Market Index over the trailing five years is lower than the Morningstar Global Allocation Index's 0.90 but higher than some real asset peers'. That equity exposure has helped drive the fund's strong performance. Its 8.1% annualized return over the trailing five-years is the second-best out of the 22 real asset strategies identified above. The team can take its equity exposure down with tactical tilts; it did so leading up to the March 2020 drawdown by increasing TIPS from 9% of the fund in December 2019 to 17% in March 2020. The higher equity exposure doesn't mean it can't add diversification benefits to a portfolio, but investors do need to consider how it will impact their overall stock/bond split if they add this strategy to their portfolio.

Conclusion

Inflation is difficult to predict, and determining which of the many real-asset-focused exposures is optimal in an inflationary environment necessitates an incredible effort. Diversified real asset strategies address this by offering exposure to a range of assets that, when constructed properly, can further contribute to a portfolio's diversification and ultimately temper its risk profile over a longer time horizon, providing benefits beyond straightforward inflation protection.

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)