Big March Inflows Make the First Quarter One for the ETF Record Books

Investors continue to pour into stock ETFs, and Vanguard extends its streak atop the flows standings.

Stocks carried their momentum from a strong February into March 2021. The Morningstar Global Markets Index--a broad gauge of global equities--gained 2.54% last month after climbing 2.59% the month prior. Bonds continued to sputter, as rising yields pushed their prices lower. The Morningstar US Core Bond Index slid 0.98%, marking its third consecutive month of losses.

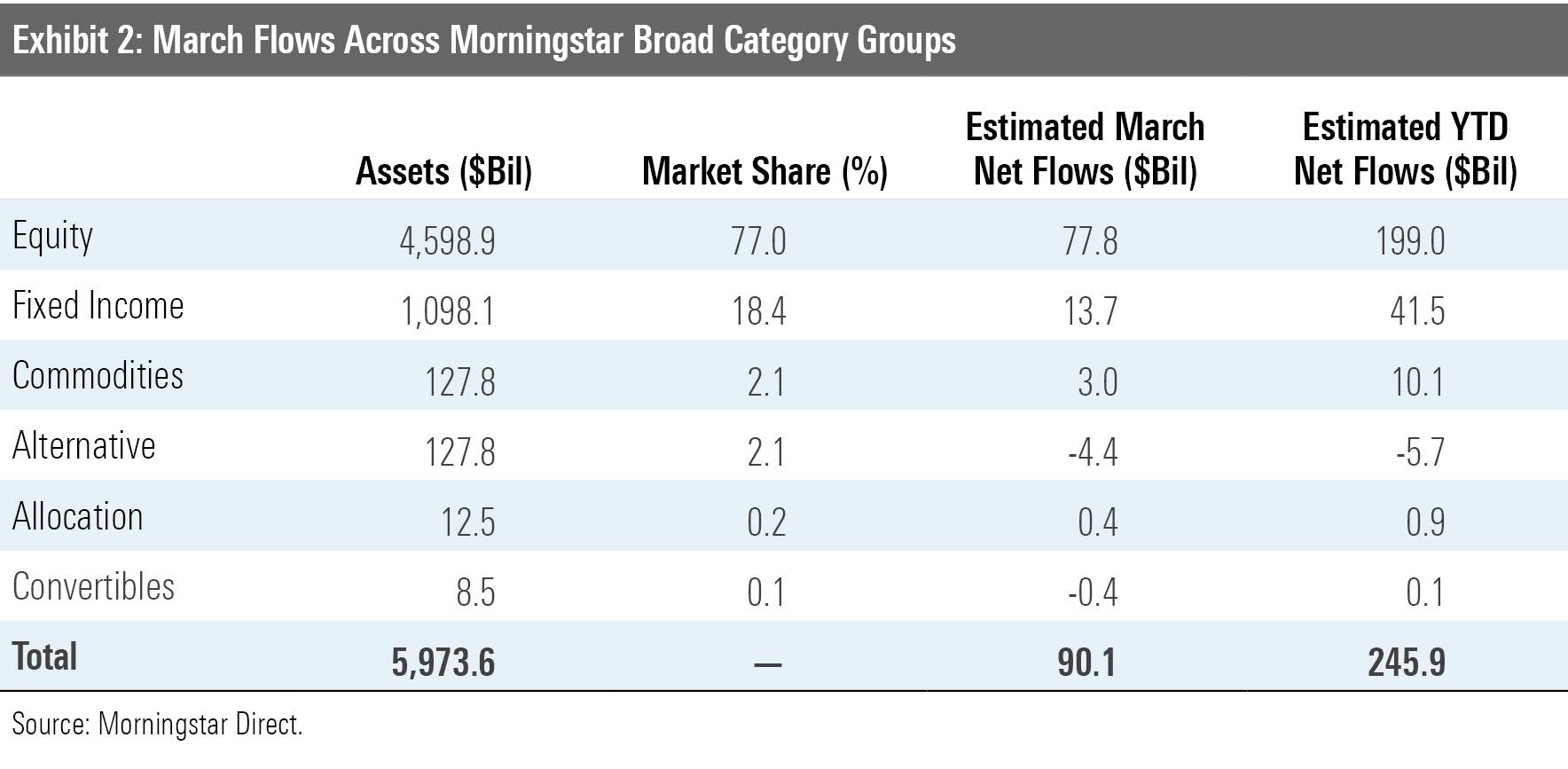

After bond exchange-traded funds dominated inflows for most of 2020, the tide has turned in favor of stock ETFs. They absorbed another $77.8 billion in March, bringing year-to-date net flows to $199.0 billion. Stock ETFs tallied $231.8 billion in flows in all of 2020. Inflows into all ETFs summed to $90.1 billion last month, which fell shy of the $91.4 billion record set in November 2020. While March flows fell just shy of setting a new record, they capped off a record quarter. The $245.9 billion that flowed into all ETFs in the first quarter shattered the prior record of $194.9 billion set in the fourth quarter of 2020 and nearly doubled the prior first-quarter record of $133.8 billion set in 2017.

Here, we'll take a closer look at how the major asset classes performed last month, where investors put their money, and which corners of the market looked rich and undervalued at month's end--all through the lens of ETFs.

Stocks Shoulder the Load

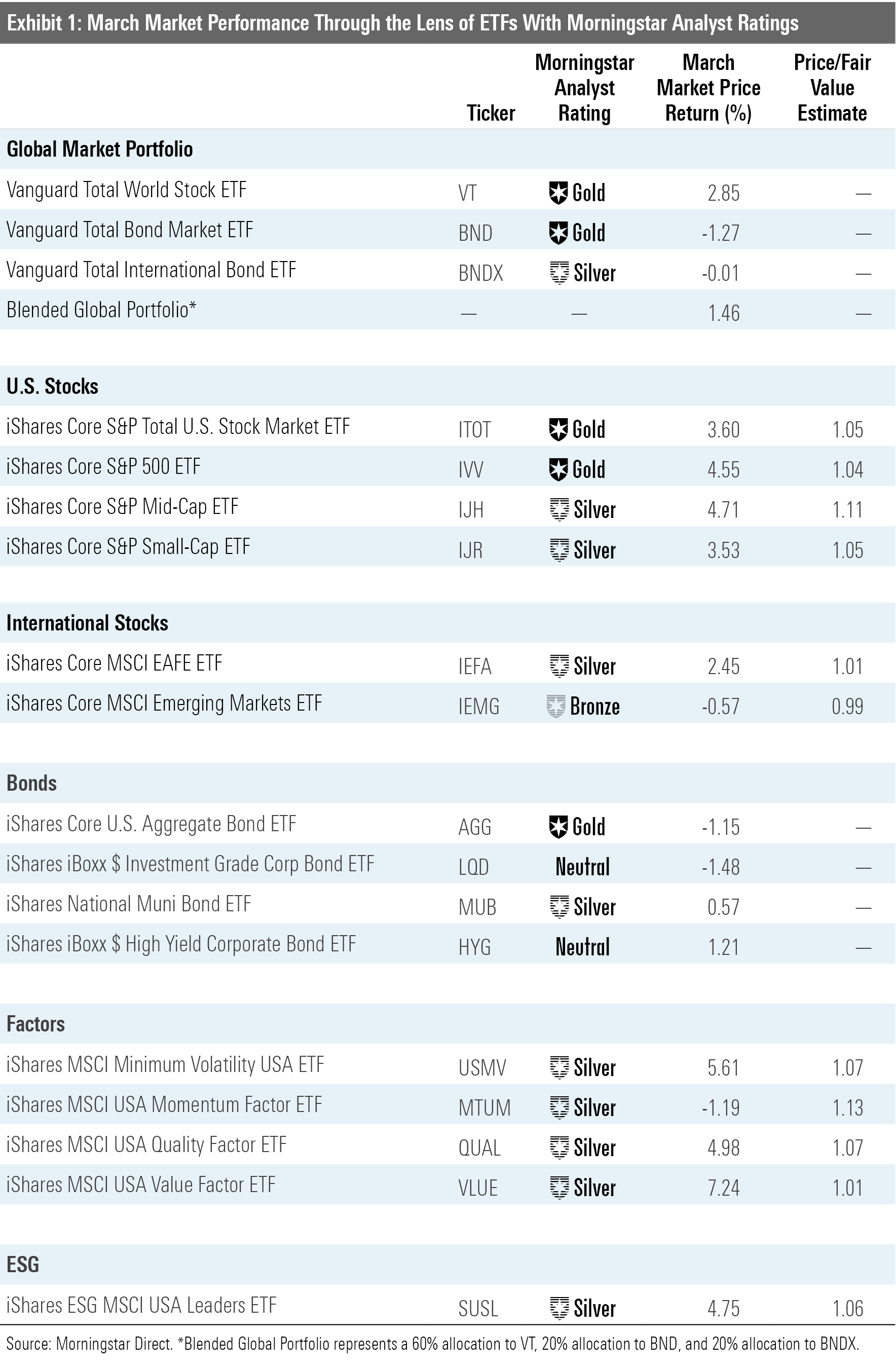

Exhibit 1 features March performance for a sampling of ETFs with Morningstar Analyst Ratings that serve as proxies for major asset classes. Investors in a blended global market portfolio gained 1.46% last month. U.S. stocks, represented here by iShares Core S&P Total U.S. Stock Market ETF ITOT, traded 4% above their fair value at March's end, as measured by the fund's Morningstar price/fair value estimate.

U.S stocks' somewhat lofty valuations are in part a symptom of their strong March returns. During the month, ITOT gained 3.60%, compared with 1.73% for the foreign-only iShares MSCI ACWI ex U.S. ETF ACWX. Optimism about the timeline of a post-pandemic economy likely contributed to this performance, as the U.S. administered nearly 150 million vaccinations and finalized a $1.9 trillion stimulus package.

Small-cap stocks turned in another solid month, but their recent reign over large-cap stocks came to an end. IShares Core S&P 500 ETF's IVV 4.55% March return topped iShares Core S&P Small-Cap ETF's IJR 3.53%, marking the first month it beat its small-cap sibling since September 2020. That said, IJR led IVV by 36.14 percentage points over the six months through March 2021. Meme stock icon GameStop GME helped fuel that outperformance, but small caps as a whole have been on fire since last fall.

U.S. value stocks continued to shine last month, illustrating that not all equities stand to benefit equally from an economic recovery. Stocks with a value label--often found in the energy, utilities, industrials, and real estate sectors--tend to be more economically sensitive than their faster-growing peers. Last March, that was a burden. This March, it was a boon. Gold-rated Vanguard Value ETF VTV posted a 6.66% return, while its Gold-rated counterpart Vanguard Growth ETF VUG gained a relatively modest 1.80%. After trailing VUG for much of 2020, VTV has doubled up its growth twin's returns over the past six months, 27.09% to 13.12%.

The dispersion of returns among single-factor strategic-beta ETFs showcases the changing landscape of the U.S. market as well. IShares MSCI USA Value Factor ETF VLUE outpaced ITOT by 4.15 percentage points over the trailing 12 months, boosted by a 12-percentage-point lead over the past three months. Meanwhile, March handed iShares MSCI USA Momentum Factor ETF MTUM its second consecutive month of losses. The fund traded 13% above its fair value at the end of March, which paled in comparison to its 32% premium it carried at the end of January. VLUE's price/fair value ratio has moved in the opposite direction. After trading at a 6% discount at the end of January, it registered a 1% premium at March's end.

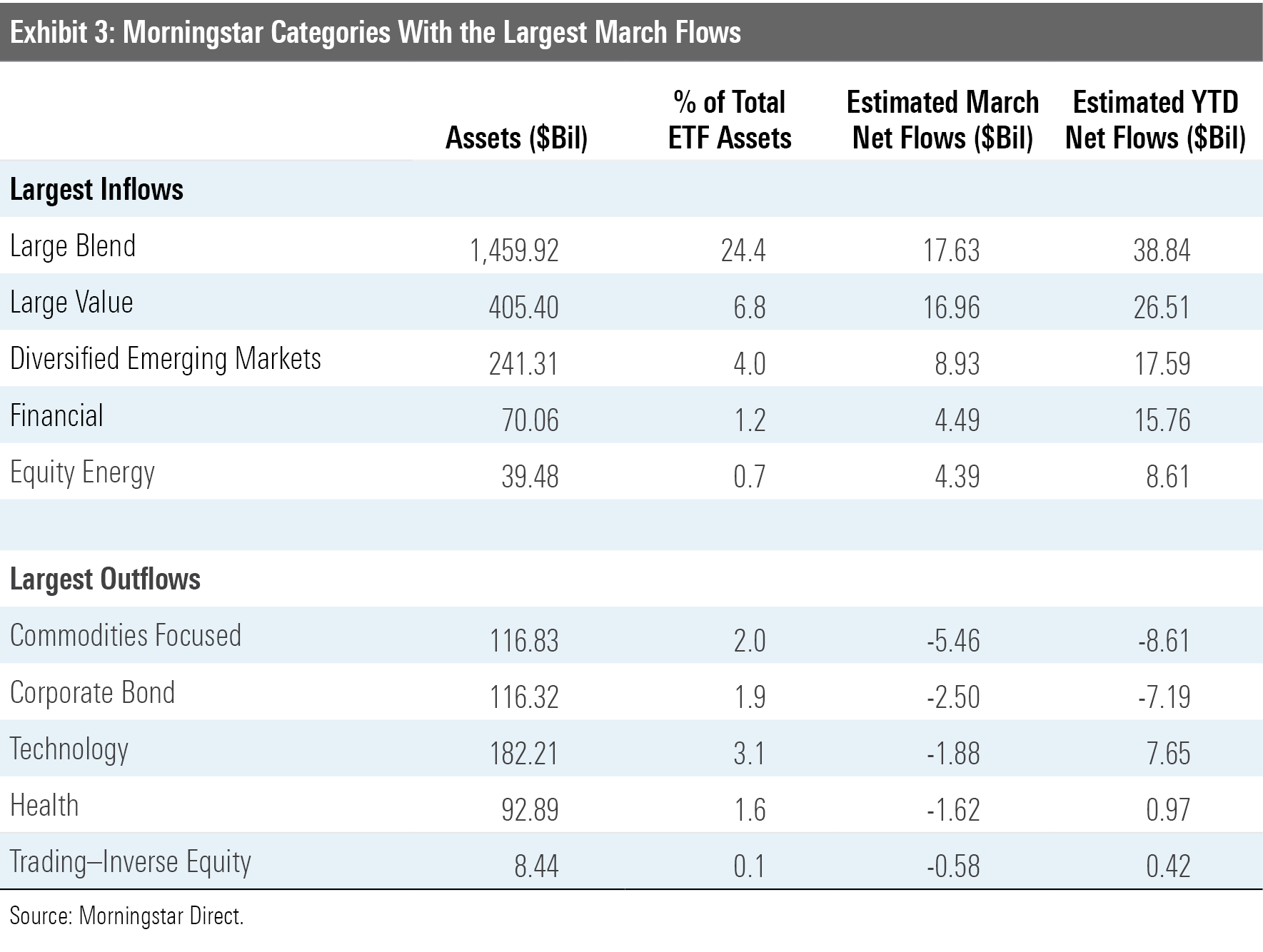

Rising rates helped guide the direction of flows last month. Higher rates depress bond prices and diminish the appeal of the long-term bond funds. To be sure, the corporate-bond Morningstar Category finished with the second-most outflows last month. Commodities-focused funds suffered the biggest outflows, as investors widely sold off gold ETFs, presumably as they reintroduce more risk to their portfolios.

Rates affected investors' preference for stock ETFs as well. ETFs in the financial category pulled in another $4.5 billion last month, cranking their inflows up to $15.8 billion since the start of 2021. These funds have seen a bump because financials stocks tend to fare better when rates climb. On the flip side, ETFs in the health and technology categories saw combined outflows of about $3.5 billion in March. This marked a sharp reversal for technology ETFs, which pulled in $6.8 billion of inflows in February. Technology and health firms project a higher share of their future cash flows to come well down the road, so the present value of their cash flows--and the value of the stocks--can decline more severely when interest rates rise.

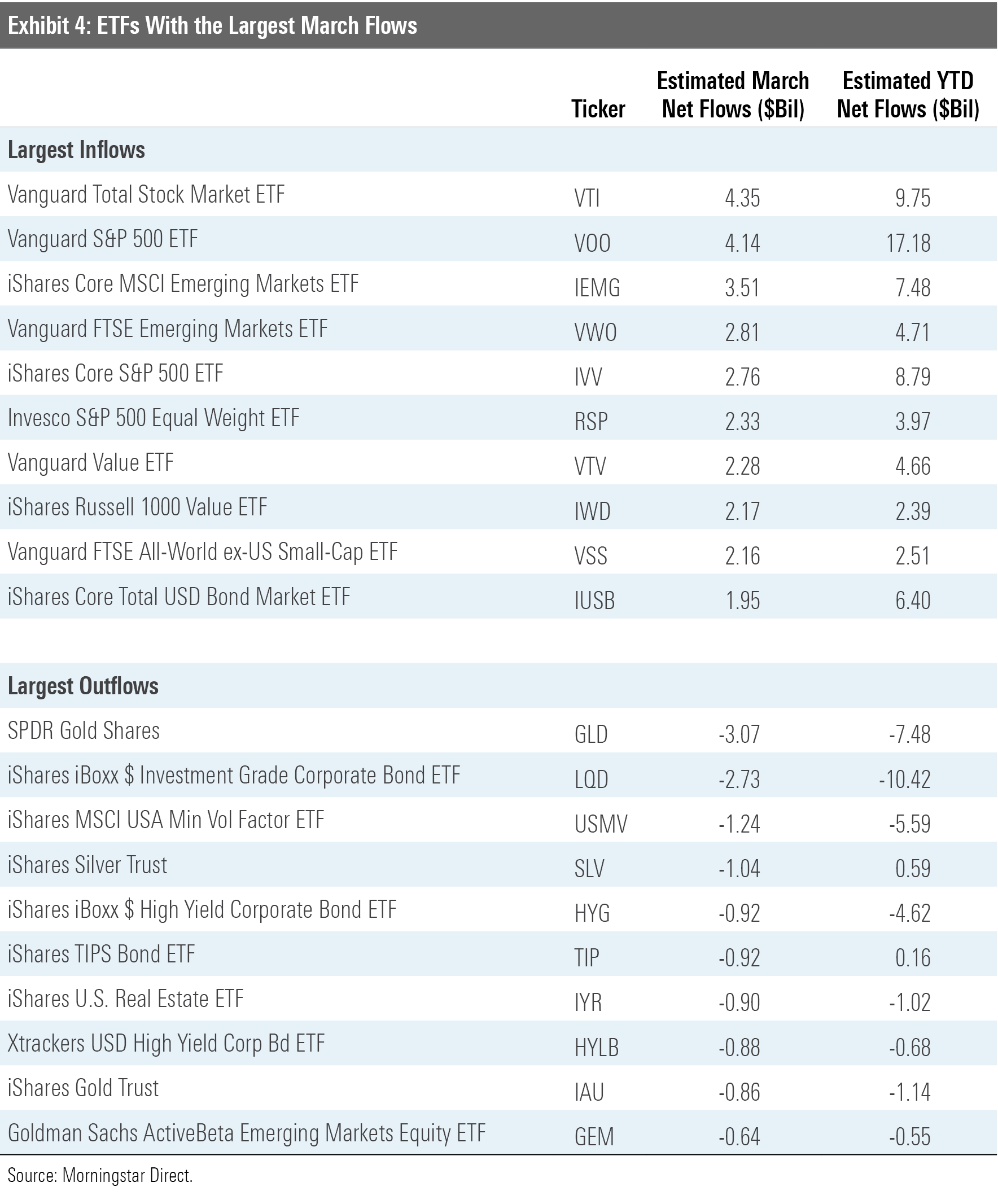

While some investors tinkered with their sector allocation, most opted for a steady diet of broadly diversified market-cap-weighted index funds. Vanguard Total Stock Market ETF VTI, Vanguard S&P 500 ETF VOO, and iShares Core S&P 500 ETF IVV boasted three of the top five largest inflows in March.

As undervalued stocks have been more difficult to find in the United States, some investors have turned their focus to emerging markets. The diversified emerging-markets category welcomed $8.9 billion in new money in March, the lion's share of which went to Bronze-rated ETFs iShares Core MSCI Emerging Markets IEMG ($3.5 billion) and Vanguard FTSE Emerging Markets VWO ($2.8 billion). IEMG traded at a 1% discount to its fair value at the end of March.

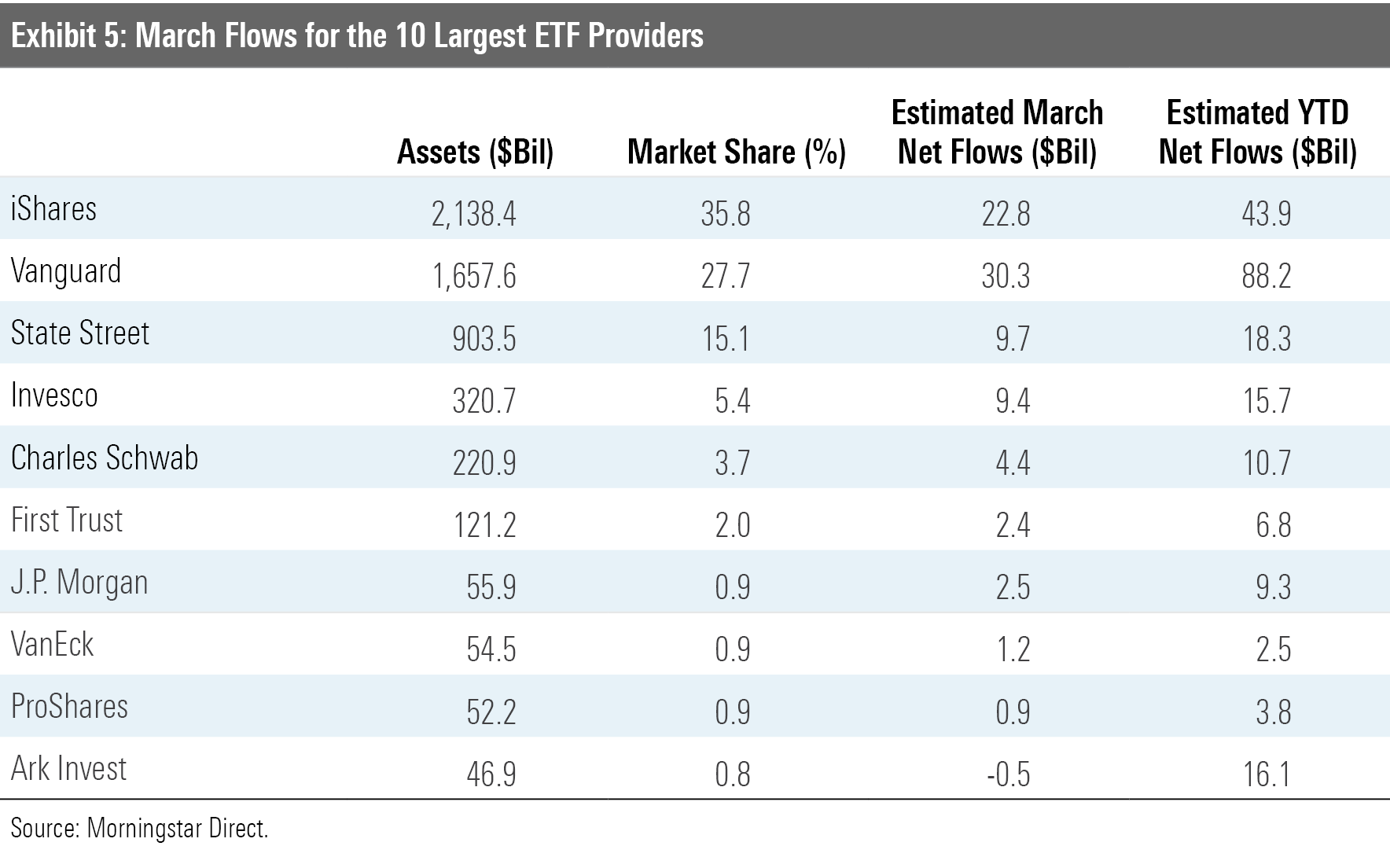

Vanguard Extends Its Streak

Vanguard topped the ETF provider flows league table for the fourth-straight month in March as the firm's ETFs raked in $30.3 billion. Vanguard ETFs counted $88.2 billion of inflows in the first quarter, which is more than double its nearest competitor, iShares. Some of Vanguard's recent ETF flows have resulted from conversions of assets in their funds' Admiral share classes to ETF shares, which are now cheaper than the Admiral shares of the same funds after a wave of recent repricing. The firm has since either directly converted some of its investors' existing Admiral share-class allocations to the ETF share class or otherwise nudged them to do it on their own. That said, the majority of its new inflows have come from new investments, not conversions. Most of these conversions have now run their course, and their impact on the firm's ETF flows has diminished.

ARK Invest, the newest name on the ETF industry's leaderboard, was the only firm among the 10 largest ETF providers to register outflows in March. The firm last saw a month of net outflows in October 2019, after its flagship fund, Ark Innovation ETF ARKK, posted steep losses in the prior two months. A similar story seems to have unfolded in early 2021, as ARKK has trailed S&P 500-tracking IVV by 20.28 percentage points over the past two months. Whether investors jump ship or remain loyal to this fund remains to be seen.

Energy Takes a Step Back

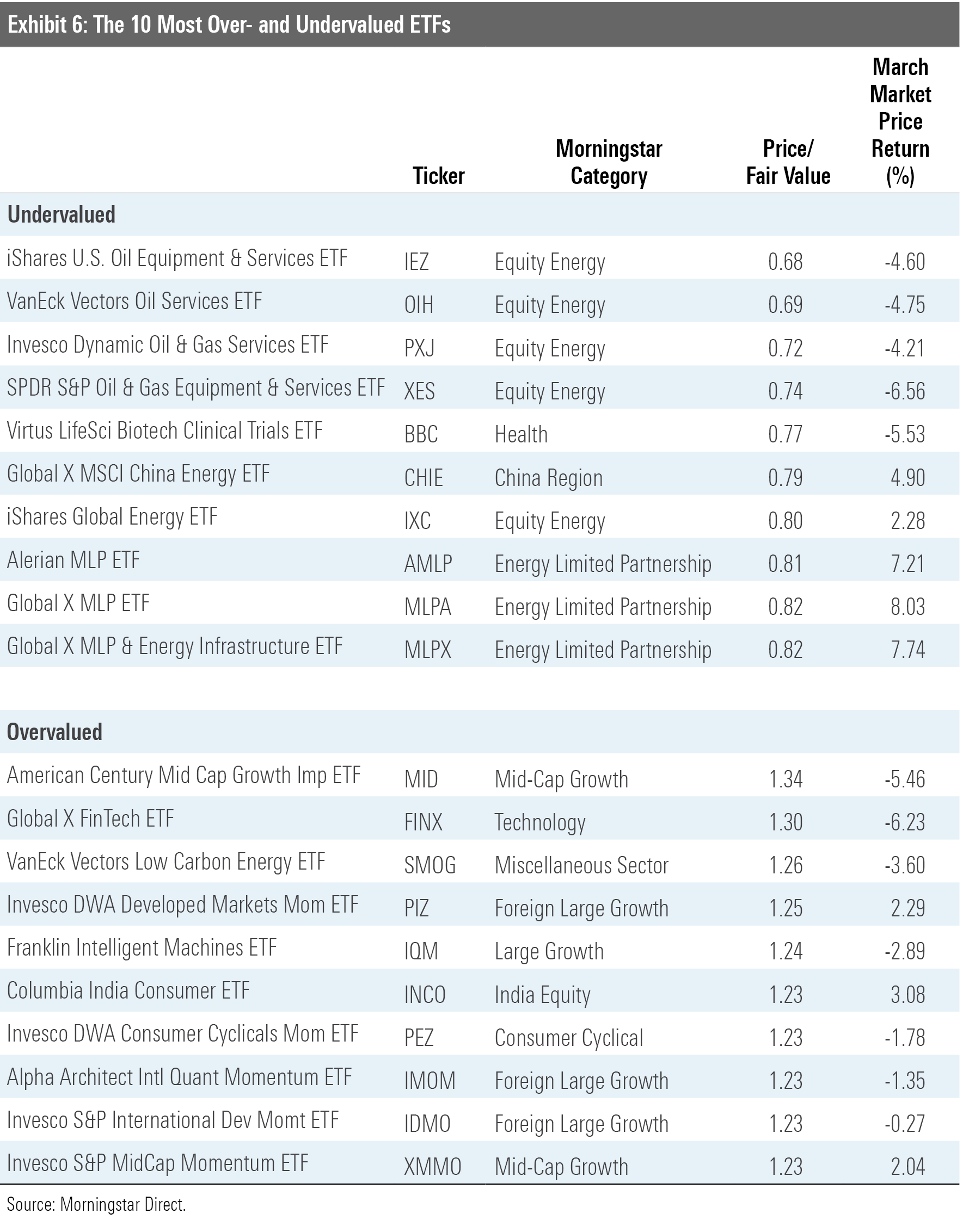

The fair value estimate for ETFs rolls up our equity analysts' fair value estimates for individual stocks and our quantitative fair value estimates for stocks not covered by Morningstar analysts into an aggregate fair value estimate for stock ETF portfolios. Dividing this value by the ETFs' market prices yields the price/fair value ratio. This ratio can point to potential bargains and areas of the market where valuations are stretched.

Exhibit 6 features the 10 ETFs that were trading at the largest discounts and premiums to their fair value estimates as of the end of March. Eight of the 10 trading at the largest discounts belong to either the equity energy or energy limited partnership categories. The energy sector nosedived as the coronavirus pandemic took hold last spring, as demand declined and supply continued to flood the market. As producers ran out of places to store their output, prices collapsed, as did the share prices of firms operating in the sector.

The market is a discounting mechanism, however, that had been pricing in a return to normalcy in the economy and balance in energy markets. The prospect of reopening the global economy had widely lifted oil prices and energy ETFs. But after meaningful strides forward, energy stocks took a step back in March. IShares U.S. Oil Equipment & Services ETF IEZ lost 4.53% last month, encapsulating a difficult few weeks for the energy sector writ large. So, while IEZ's 0.68 price/fair value ratio is a material leap from its 0.29 clip at the end of March 2020, these funds figure to feature prominently in the ETF bargain bin.

Clean-energy darling VanEck Vectors Low Carbon Energy ETF SMOG has ascended the monthly list of ETFs trading at the largest premiums to their fair value estimates. SMOG ranked among 2020's top performers, posting a 118.63% gain for the year. Renewed interest in meaningful, long-term investment in renewables has buoyed share prices and valuations within this segment of the market.

SMOG was joined by a pair of newcomers to the list, foreign large-growth funds Invesco DWA Developed Markets Momentum ETF PIZ and Invesco S&P International Developed Momentum ETF IDMO. Both of these funds spin deliberate momentum strategies, but their newfound spots in the top 10 point to the recent revaluing of developed foreign markets. At the end of March, iShares Core MSCI EAFE ETF IEFA, a broad proxy for the foreign developed market, was trading at a premium after spending months in discount territory.

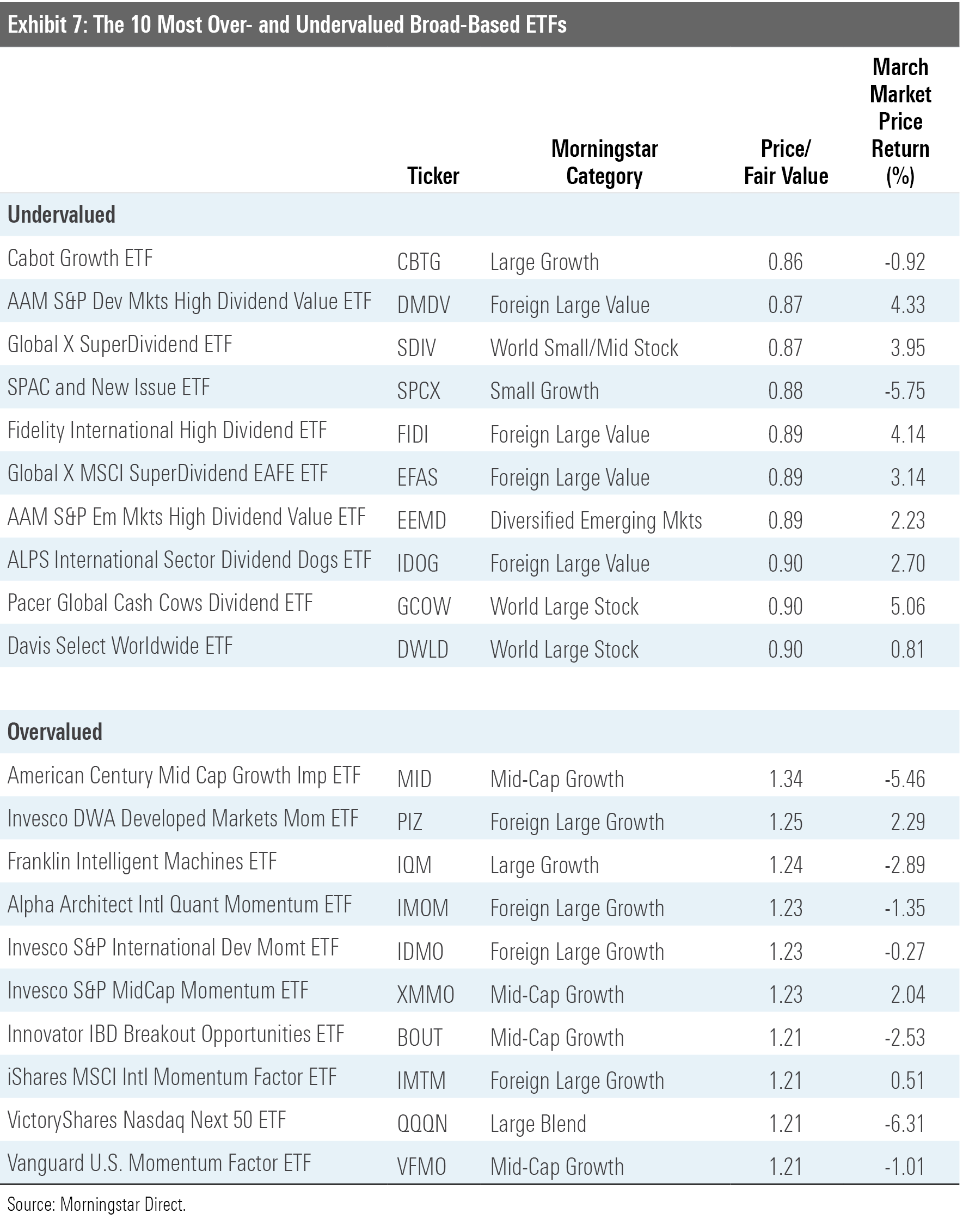

Exhibit 7 features the 10 broad-based ETFs (those belonging to one of the mainline Morningstar Style Box or other broader geographic categories) that were trading at the largest discounts and premiums to their fair value estimates as of month-end.

Six of the 10 most overvalued broad-based ETFs ply momentum strategies-sweeping in the markets' best recent performers. So, it should come as no surprise that Vanguard U.S. Momentum Factor ETF VFMO has fared well as of late. In the first quarter of 2021, it outpaced the Russell Midcap Growth Index (its category benchmark) by 9.93 percentage points. The list also features some thematic ETFs that home in on some of the market's darlings of the moment. For example, Franklin Intelligent Machines ETF IQM gained 109.2% during the 12 months through February--a healthy margin ahead of the 68.6% turned in by the Russell Midcap Growth Index. At the end of March, IQM was trading at a 24% premium to its fair value estimate.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_29c382728cbc4bf2aaef646d1589a188_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)