Don’t Count Out World Allocation Strategies Just Yet

What history shows us.

A punitive decade for the world allocation Morningstar Category exasperated investors and contributed to outflows, mergers, and liquidations over that period, but as Joni Mitchell once sang, “I’ve looked at life from both sides now, from win and lose and still somehow, it’s life’s illusions I recall, I really don’t know life at all.” Same could be said of the world allocation category, whose constituents must hold at least 40% in non-U.S. securities and allocate across stocks, bonds, and cash. These structural biases translate to a performance profile that is either starkly advantaged or disadvantaged relative to more geographically concentrated alternatives. With this in mind, we’re asking: If the category’s poor showing for much of the 1990s was followed by more attractive 2000s, is a similar shift possible following the category’s poor showing in the 2010s? Does the category contain compelling options for investors despite these challenges?

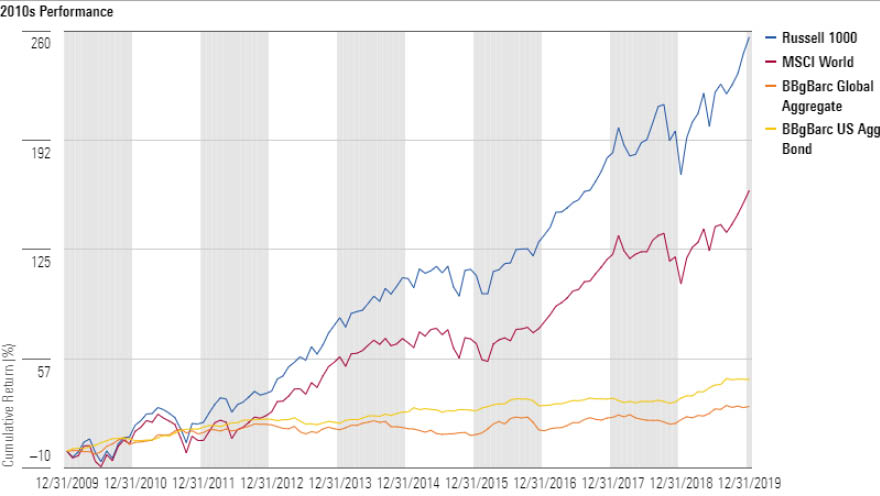

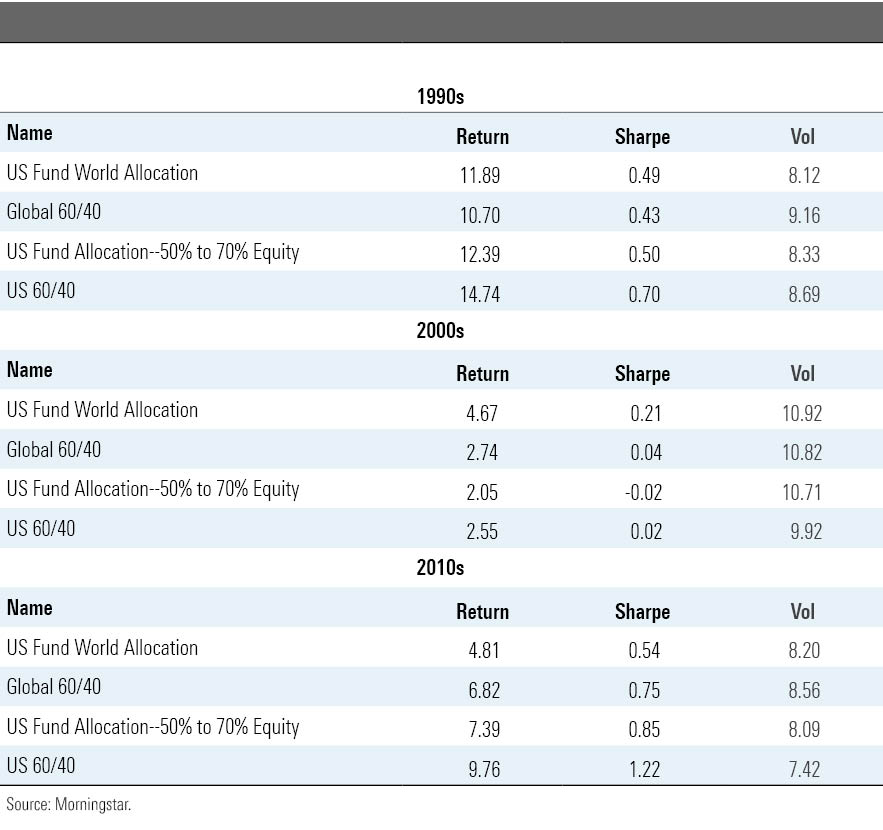

Let's Start With the Market Context Consider the world allocation Morningstar Category not only relative to its disappointing recent history but also over multiple decades and market cycles. The 2010s' decade was characterized by an epic equity bull market, during which U.S. stocks outperformed global indexes by more than 100 percentage points. Morningstar analyst Dan Sotiroff provides an explanation that identifies three factors--a strong U.S. dollar, more exposure to red-hot tech names in U.S. indexes, and fundamentally stronger earnings for U.S. companies--as contextualizing that performance. U.S. fixed-income indexes also topped their global peers, with multiple eurozone debt crises occurring in Greece, Spain, and Italy, among others. This culminated in a sizable divergence in 2014, which saw the Bloomberg Barclays Global Aggregate Bond Index return just 0.6%, compared with 6.0% for the Bloomberg Barclays U.S. Aggregate Bond Index. Aside from that year, the indexes largely moved in line with each other.

Most of the 1990s were similarly disappointing for world allocation strategies. That decade is remembered for the technology bubble that formed in the latter half, boosting U.S. equity performance relative to global equity, all while emerging-markets assets struggled. World allocation strategies were at a structural disadvantage until that bubble burst, the aftermath of which caused drawdowns of nearly 50% in both global and U.S. stocks. The rebound was more beneficial for global investors and drove better results for world allocators in the early 2000s, but global and U.S. funds alike suffered when the great financial crisis (2007 to 2009) hit.

Many world allocation strategies benefit from active management, and the 2000s were a good decade for active managers; the average fund in the category topped a global passive 60/40 benchmark by almost 200 basis points annualized. Allocators with exposure to emerging-markets stocks enjoyed particularly strong performance. China’s gross domestic product went to 6.1 trillion in 2010 from 1.2 trillion in 2000, and the cohort of Brazil, Russia, India, and China, know as the "BRIC block," enjoyed similarly strong decades as they were relatively sheltered from the turmoil in financial markets throughout the developed world.

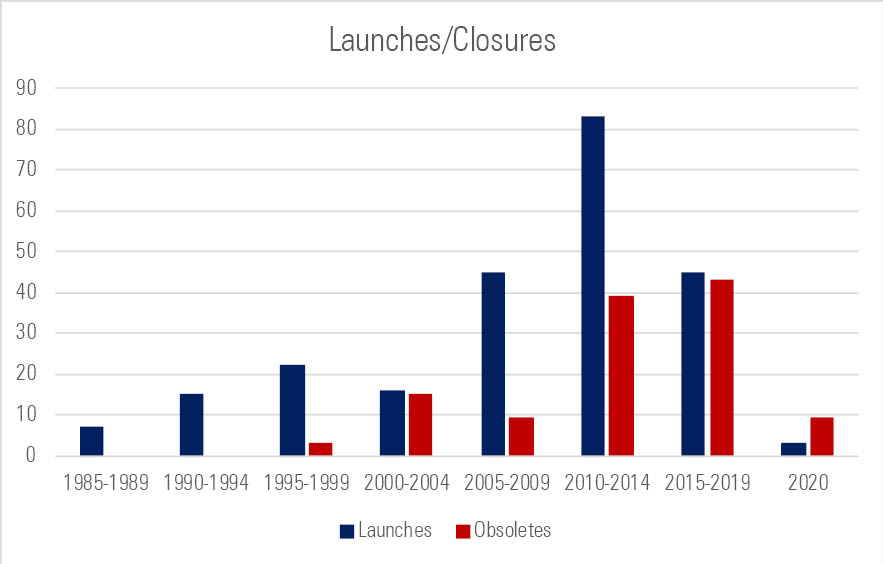

The Cointegrated Effects of Performance, Investor Sentiment, and Flows The aforementioned evolving-market contexts have significantly shaped the category. Less exposed to the tech sector than the U.S. markets, world allocation funds were attractive to investors still reeling from the dot.com bubble burst in the late 1990s. This ushered in a golden age for the world allocation Morningstar Category; it registered positive inflows for 14 consecutive years until 2015. Inflows were more tempered after a $30 billion peak in 2007, as target-date funds became increasingly popular, but they were still significant and well above the typical 50%-70% equity fund.

As is generally the case, such flows drew the attention of asset managers. From 2005 to 2009, 40 allocation funds launched, with another 80 funds introduced to the category from 2010 to 2014. Forty-five world allocation strategies joined the category between 2015 and 2019, with a few more thematically focused than the traditional stock and bond versions; seven focused on multi-asset income and five on multi-asset inflation protection. However, only one of these recently launched thematic offerings cracked the $500 million bar of assets under management by November 2020, while two of the multi-asset income funds were liquidated. In fact, out of the 45 world allocation strategies that were launched over that period, 13 were merged or liquidated by November 2020, and only three had more than $1 billion of assets under management.

In fact, since 2015, as the outperformance of U.S. stocks intensified, world allocation funds have been in net outflows each calendar year. These patterns indicate that when broad geographic diversification improves performance prospects, investors seek world allocation strategies and firms comply with that search, but many investors depart when more concentrated markets, such as U.S. equities, are on an enticingly extended bull run.

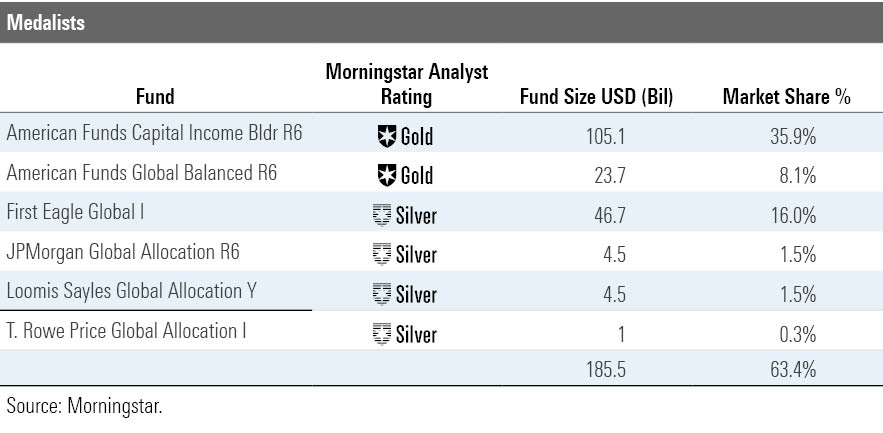

Despite These Challenges, the Category Contains Compelling Options The landscape has become more concentrated over time as asset managers keep rationalizing their lineups and investors are more discerning when selecting options. As of December 2020, the six strategies we discuss below had a least one of their share classes rated Gold or Silver by Morningstar Analysts. Collectively, they had more than $185 billion in assets under management or a market share of 63.4%.

Our favorite world allocation funds reflect the heterogeneity of the category. For instance, Gold-rated American Funds Global Balanced RGBGX is a global version of the traditional balanced fund. It shares some research and management resources with American Funds Capital Income Builder RIRGX, which also earns a Gold rating, but in contrast to the latter, it doesn’t have an income mandate and a value tilt. Silver-rated First Eagle Global SGIIX also leans toward value, but it differentiates further from most world-allocation Morningstar Category peers by its unusual, conservative portfolio that may have hefty stakes in cash and gold bullion. For its part, Silver-rated T. Rowe Price Global Allocation’s TGAFX distinct structure stems from its 11% neutral allocation to alternatives, which primarily consists of a Blackstone hedge fund of funds. Management benefits from fairly strong underlying building blocks while taking modest tactical bets whereas JPMorgan Global Allocation GAOZX, which also earns a Silver medal, takes a more tactical approach to asset allocation as the fund has the flexibility to take stock or bond exposure anywhere from 10% to 90% of the portfolio. Last, world allocation strategies may also differ from each other by their regional breakdown. For instance, Silver-rated Loomis Sayles Global Allocation LSWWX has maintained an overweighting in U.S. stocks since 2015; at the end of October 2020, they accounted for 45% of its portfolio versus 28% on average in the category and 35% in the Morningstar Global Allocation Index.

Where Does This Leave World Allocation Strategies Now? Last year, world allocation funds lagged their U.S.-focused counterparts, and the category remained in net outflows while there were more mergers and liquidations than launches. Yet the category continues to host prominent strategies that have fared well despite this challenging environment and could shine even further should U.S. stocks start underperforming. If the 1990s and 2000s exhibited markedly different outcomes for world allocation investors, it is possible that the 2010s and 2020s might offer a similar experience.

/s3.amazonaws.com/arc-authors/morningstar/447471ef-4d55-424a-91b7-4694438f43ad.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

/d10o6nnig0wrdw.cloudfront.net/05-02-2024/t_60269a175acd4eab92f9c4856587bd74_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/447471ef-4d55-424a-91b7-4694438f43ad.jpg)