Are Alternative-Weighted Indexes Safer Than the S&P?

Their exposure to smaller, value-oriented stocks brings different risks.

The S&P 500 is becoming more concentrated. John Rekenthaler illustrates this by comparing the sum of top 10 holding weights over the past 35 years. As of Oct. 15, the top 10 holdings (six of which are tech) combined account for 28% of the S&P 500. That is higher even than the 26% from the late 1990s tech bubble.

The S&P 500 recovered from pre-coronavirus-pandemic levels on Aug. 6, and tech stocks helped drive the recovery. Morningstar’s Ian Tam shows how by the bear market’s end, tech stocks added an additional 6% of positive return to the U.S. stock market.

This doesn’t mean a tech crash is coming, but investors may be rightfully concerned.

How would the results have been different if the market weren’t so top-heavy? Alternative-weighted indexes that break the link between market cap and portfolio weight may attract investors looking for exposure to the S&P 500 with less concentration and valuation risk.

Redefining the Market One such alternative is the S&P 500 Equal Weight Index, which the Invesco S&P 500 Equal Weight ETF RSP tracks. As its name suggests, it gives an equal 0.2% weight to all 500 stocks. That reduces exposure to the most-expensive stocks that dominate the S&P 500, but also increases exposure to smaller-cap stocks, which generally have lower-quality fundamentals.

The S&P 500 Revenue-Weighted Index, which Invesco S&P Revenue ETF RWL replicates, gives larger portfolio weights to stocks with larger revenue. The WisdomTree U.S. LargeCap Index, which is followed by the WisdomTree US Earnings 500 ETF EPS, weights companies by earnings. These fundamental indexes end up with less exposure to the most expensive stocks, and more exposure to value stocks, which have a different set of potential risks and rewards.

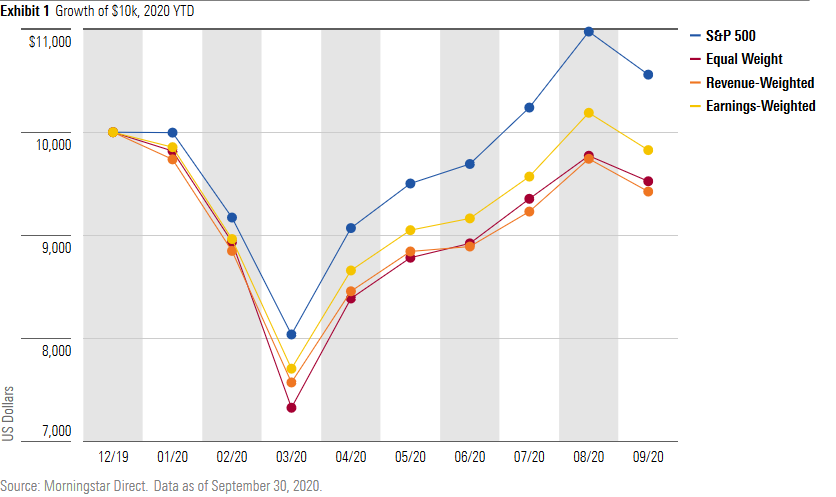

Examining Performance and Volatility We compared the equal-weighted, revenue-weighted, and earnings-weighted indexes to the S&P 500. Exhibit 1 shows performance from January through September, and demonstrates the impact of the coronavirus pandemic.

The year-to-date performance results are clear--the S&P 500 outperformed its alternative index peers throughout.

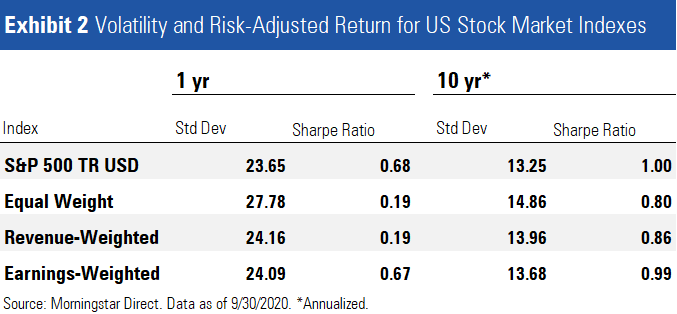

But returns are only part of the investor experience, and stock investors should be prepared to think in terms of years, not months. We also compared standard deviation, to measure volatility, and Sharpe ratio, to measure risk-adjusted return, for both the trailing one- and 10-year periods.

Over the trailing one year, the S&P 500 outperformed its alternative index peers by these measures as well: It had lower volatility and a higher risk-adjusted return. However, this edge becomes less pronounced as we expand the time period. For the trailing 10 years, the S&P 500 still has lower volatility and higher risk-adjusted return, but its peers have caught up considerably. For example, the volatility gap between the S&P 500 and the equal-weighted index is 4.13 points in the trailing one year, but it narrows to 1.61 in the trailing 10 years.

In the short term, the S&P 500 is the obvious winner. However, in the long term, the results aren’t as clear.

Understanding the Results The COVID-19 bear market hit all stocks hard, but especially those of more vulnerable smaller businesses. More-valued oriented stocks have also suffered more during the pandemic. Since the alternative-weighted indexes give more weight to smaller and more value-oriented stocks, they lagged the larger-cap, more expensive S&P 500.

The 10-year figures converge, as different investment styles tend to do over time. Since the alternative-weighted indexes are more value-oriented and the S&P 500 gives more weight to growth stocks, the alternatives may do worse while the S&P 500 accelerates, but that won’t always be the case.

What This Means for Investors There may be sound investment cases for incorporating these alternative indexes into a portfolio, but they won't guarantee a smoother ride. Those looking for less-volatile stock exposure should consider minimal-volatility ETFs, like the iShares MSCI USA Min Vol Factor ETF USMV. For added protection against stock volatility, investors can consider broader portfolio adjustments: Diversification and appropriate stock-bond allocation are the first line of defense.

/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/8b2c64db-28cb-4cb4-8b53-a0d4bc03a925.jpg)