How Big Fund Families Voted on Climate Change: 2020 Edition

Vanguard, State Street, and Fidelity increased support for shareholder resolutions aimed at tackling climate change, while BlackRock voted ‘no’ more than 80% of the time.

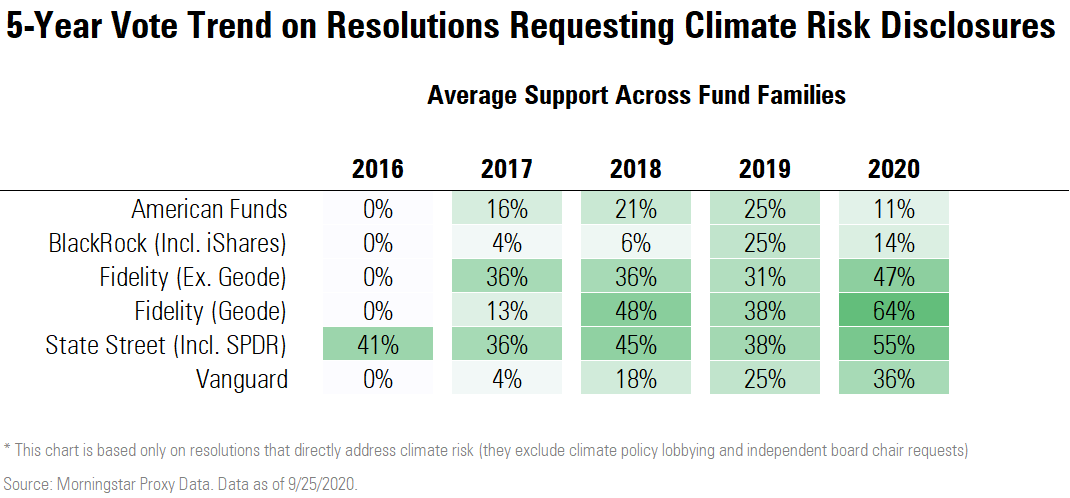

Support for resolutions requesting climate-related disclosures, of which there were only 14 in 2020, rose at Fidelity, State Street Global Advisors, and Vanguard but fell at American Funds and BlackRock BLK from 2019. Support for a broader set of resolutions that incorporate climate governance considerations show a similar ranking among the most influential investment fiduciaries. With their massive amounts of money under management, these firms are often among the largest shareholders at many of the world’s biggest companies. Their yay or nay votes frequently make the difference between a shareholder proposal passing or failing.

While 2020's results mark a higher level of support than BlackRock had given such proposals from 2016 through 2018--when its backing never made it to double digits--the 2020 level of "for" votes was down to 14% from 25% in 2019.

Continued low support for climate change proxy resolutions at BlackRock is therefore particularly notable. In January, its CEO Larry Fink said, "We are facing the ultimate long-term problem. … Every government, company, and shareholder must confront climate change."

Elsewhere among the top five, support for climate change proposals showed some meaningful increases. Notably, for the first time in the history of Morningstar's proxy vote data base, State Street Global Investors and Fidelity’s index fund arm, Geode, the unit that runs the firm's index funds and casts its votes separately--supported a majority of the climate-related disclosure requests that shareholders placed on the ballot.

At Vanguard, too, backing rose during the 2020 proxy season, which ended 30 June 2020. Vanguard's funds voted in favor of 36%--or five out of 14 resolutions--this year, up from 25% (four out of 16) in 2019, zero in 2016, and 4% in 2017 (two out of 47).

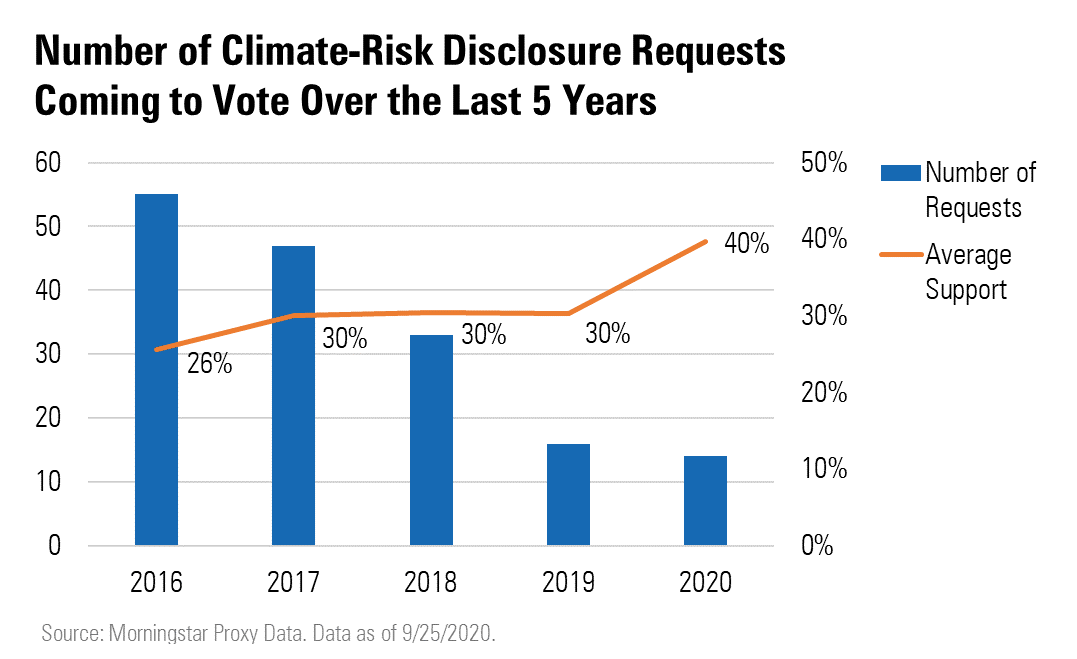

The backdrop for these votes is that fewer and fewer climate-risk-focused resolutions are coming to vote. Just 14 came to vote in 2020, down substantially from previous years. However, those were supported at record levels by shareholders. Notwithstanding, the message is clear: Shareholders want to know more about how companies are addressing climate risks.

The decline in numbers is partly due to more willingness by some companies to engage with investors about the kinds of issues subject to the proposals. When companies engage with investors in productive discussions, investors often agree to withdraw a shareholder resolution.

But the declining numbers also reflect growing hostility from the Securities and Exchange Commission toward climate change proxy proposals. The SEC now routinely sides with corporate management when asked for permission to leave resolutions off the ballot on proposals asking for greenhouse gas emissions targets and disclosures.

This deters shareholders from filing resolutions in the first place: Without the credible likelihood that proposals could reach the ballot, companies have little reason to engage meaningfully with investors.

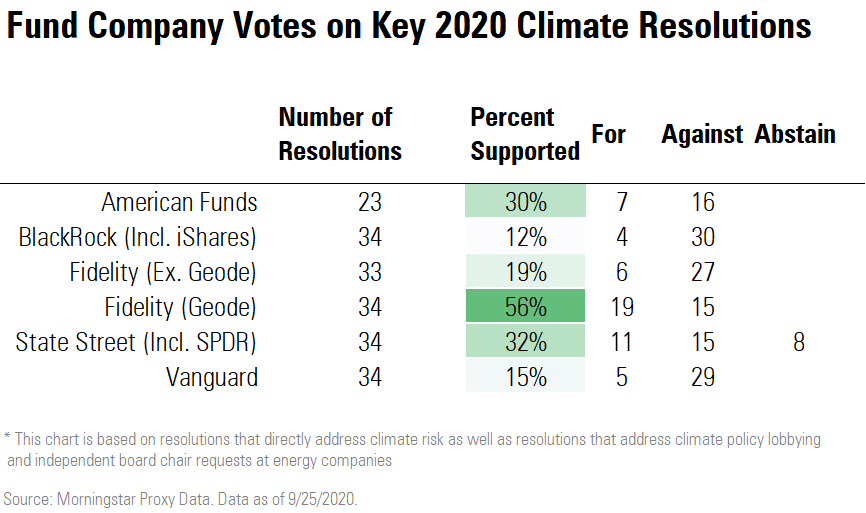

Votes on 34 Key Climate-Relevant Resolutions To take a broader view of shareholder-proposed climate actions, we compiled a set of 34 key climate-relevant resolutions. This set includes the 14 resolutions requesting climate-related disclosures, as well as 20 others filed out of concern for energy companies' broader climate governance--asking for lobbying disclosures and independent board leadership arrangements at large oil and gas and electric utilities companies. We mapped these to fund company votes and again found that BlackRock ranked last in support and Geode ranked first.

Twelve of the 20 additional resolutions asked for greater transparency around lobbying, both direct and via fees paid to trade associations that, in turn, lobby on climate policy and spend on political campaigns. Nine of those 12 were based on a frequently filed model resolution, with supporting arguments that highlight risks specific to climate policy lobbying. The other three were filed by European asset manager BNP Paribas and asked for an explanation of how the company's lobbying aligns with the goals of the Paris Climate Agreement.

Eight of the 20 additional resolutions requested that the board chairperson role be held by an independent director, not the CEO of the company, recognizing that a major governance obstacle to addressing the challenges presented by climate change is nonindependent board leadership, such as was the case for a proposal at Exxon Mobil XOM.

All 12 of the key resolutions identified by the Climate Action 100+ investor coalition, or CA100+, were included in the additional 20.

On average, the climate-linked key resolutions earned 37% support from shareholders, with five earning majority support and one, a vote at JPMorgan JPM, coming within a fraction of a percent of majority support (49.62%).

One resolution included in the group of 14 climate-related disclosure requests was filed at T. Rowe Price TROW--the sixth-largest U.S. fund company. It asked the fund company to review its historical voting record on climate change and explain any incongruities between voting practice and its voting policy, in which T. Rowe identifies climate risk as a key area of engagement.

Climate Votes Out of Step Four of the five large fund companies offer mutual funds and exchange-traded funds that have environmental, social, and governance mandates. We dug deeper into the votes on ESG funds to see if they aligned with the principles that investors might expect around climate change.

Some notable cases show that these votes were completely out of step with the general shareholder vote.

- BlackRock and Vanguard's ESG funds voted against the resolution at JPMorgan that missed a majority vote in support by less than 0.5%. This resolution asked the board to explain efforts to reduce greenhouse gas emissions associated with the bank's lending activities; JPMorgan is considered to be the biggest fossil-fuel lender globally. BlackRock and Vanguard are JPMorgan's largest shareholders, owning 6.70% and 7.86% of the company, respectively. Had these two supported the issue, the resolution would have passed with more than 60% support.

- BlackRock and Vanguard's ESG funds voted against a resolution on Phillips 66's PSX ballot requesting transparency about the physical climate risks in expanded petrochemical operations. BlackRock owns 6.94% and Vanguard owns 8.75% of the company, and both voted "against." Nevertheless, the resolution passed with 55% support, implying that the resolution was supported by 71% of other shareholders, including State Street, the company's third-largest shareholder.

- At Dollar Tree DLTR, the board was asked to set and disclose greenhouse gas emissions targets. An overwhelming majority of shareholders--74%--agreed with the proposal. However, BlackRock's ESG funds voted against the measure alongside others in the BlackRock and iShares fund suite, representing around 8.6% of the vote. On this resolution, Vanguard's ESG and other funds supported the measure with a 10.9% voting stake.

- The Fidelity Women's Leadership Fund FWOMX opposed the climate lobbying alignment resolution filed at Chevron CVX by BNP Paribas, earning 53% shareholder support overall. By contrast, the resolution was supported by the Geode-managed Fidelity index funds. This resolution was one of the 12 flagged by CA100+.

Low voting support by the largest asset managers contrasts with the credentials of the resolution sponsors. Six were filed by ESG-specialist asset managers Trillium Asset Management, Boston Trust Walden, Zevin Asset Management, Jantz Management, and Green Century Capital Management. Three were filed by French asset manager BNP Paribas, which is ranked 28th globally by assets. A further six were filed by the Office of the New York City Comptroller on behalf of a collection of public pension funds that is ranked as the fifth-largest in the United States.

For example, Vanguard's ESG funds voted against a climate change resolution at Bloomin Brands BLMN that was sponsored by Green Century. The proposal asked that Bloomin, which owns Outback Steakhouse, to provide an accounting of efforts to mitigate supply-chain greenhouse gas emissions, including deforestation and land use change. The resolution earned 27% support from shareholders. BlackRock and Vanguard hold a combined 28% of shares in the company, yet both voted against across their respective suites of funds.

Of the 12 climate-linked resolutions flagged by CA100+, BlackRock, which joined the $42 trillion coalition in January, opposed all but two. Fidelity and Vanguard opposed every one of the resolutions.

Overall, even as support for climate on the ballot continues to grow in line with a growing sense of urgency across financial markets, the largest investment fiduciaries continued to oppose many of the measures calling for transparency and stronger climate governance.

Editor’s Note: An earlier version of this article incorrectly stated the level of Fidelity ex-Geode’s support of disclosure requests. Geode supported a majority of climate-related disclosure requests, not both Fidelity ex-Geode and Geode.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)