10 High-Quality Stocks on Sale

Here's a peek at the most undervalued constituents of the Morningstar Wide Moat Focus Index--as well as names that have been added and cut.

The Morningstar Wide Moat Focus Index tracks companies that earn Morningstar Economic Moat Ratings of wide and that are trading at the lowest current market price to fair value. Its constituents are a fertile hunting ground for investors looking for high-quality stocks trading at reasonable prices.

In an effort to keep the index focused on the least-expensive high-quality stocks, Morningstar reconstitutes the index regularly. The index consists of two subportfolios containing 40 stocks each, many of which are overlapping positions. The subportfolios are reconstituted semiannually in alternating quarters, on a "staggered" schedule. We re-evaluate the index's holdings and add and remove stocks based on a preset methodology. Because stocks are equally weighted within each subportfolio, the reconstitution process also involves rightsizing positions.

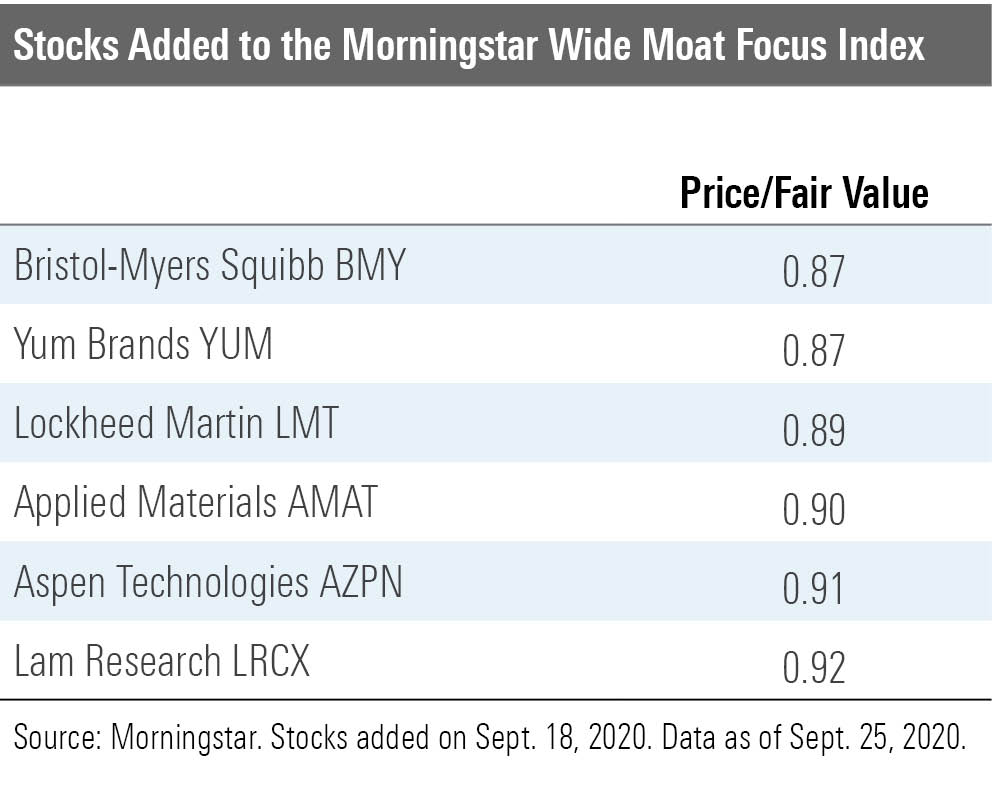

After the most recent reconstitution on Sept. 18, 2020, half of the portfolio added six positions and eliminated five. The index now holds 48 positions.

The Additions Three of the newcomers hail from the technology sector: Aspen Technology AZPN, Applied Materials AMAT, and Lam Research LRCX.

Aspen Technology is a leader in process automation software for complex industrial environments. The collapse in oil prices earlier this year led its energy-related customers to postpone projects, but Aspen's revenue rebounded strongly last quarter as oil prices improved. "Over the medium and longer term, we continue to see growth opportunities as capital-intensive industries advance their digital transformation strategies, especially while companies learn how to operate remotely," comments analyst Dan Romanoff.

Applied Materials and Lam Research, two leading vendors of semiconductor fabrication tools, earn wide economic moat ratings thanks to their equipment design expertise and research-and-development cost advantages. "Applied and its peers have all claimed that customer demand has remained strong despite the uncertain economic climate, which we attribute primarily to equipment investments related to critical technology transitions and multiyear trends such as artificial intelligence, 5G, and cloud computing," relays sector strategist Abhinav Davuluri.

The other adds are from a hodgepodge of industries.

Yum Brands YUM, whose restaurant concepts include KFC, Taco Bell, and Pizza Hut, has come under pressure because of coronavirus-related dine-in service restrictions. In this climate, we suggest investors focus on those players that can use their scale to be more aggressive on pricing, boast healthy balanced sheets, and provide a robust digital ordering, delivery, and drive-thru experiences, says sector strategist R.J. Hottovy. "In our view, Yum Brands satisfies the value and access investment criteria, and we think the company offers a dynamic global consumer growth story despite near-term disruptions," he concludes.

We think the market is undervaluing drugmaker Bristol-Myers Squibb's BMY strong pipeline, says sector director Damien Conover. In fact, we expect that several major drugs in the pipeline can blunt the eventual generic pressures to the firm's top drug Revlimid (for treading blood cancer). "Over the next 12 months, we expect approvals for ide-cel (multiple myeloma), CC-486 (blood cancer), liso-cel (blood cancer), Opdivo (favorable renal cancer), and Zeposia (ulcerative colitis) along with key data for relatlimab (melanoma), Opdivo (adjuvant melanoma and lung cancer), and TYK2 (psoriasis)," argues Conover.

Dig deeper: Innovation Supports Growth at Big Pharma/Big Biotech Companies

Lastly, we think Lockheed Martin LMT is the highest-quality defense prime contractor. The U.S. Department of Defense's increasing focus on great power competition is a long-term tailwind for Lockheed and other contractors, notes analyst Burkett Huey--though there may be some short-term sluggishness. "As the U.S. budget is looking increasingly bloated with pandemic relief, we're expecting a near-term slowdown in defense spending to flat or even negative growth, but we think that contractors will be able to continue growing due to sizable backlogs and think that defense budget growth is likely to return," he asserts.

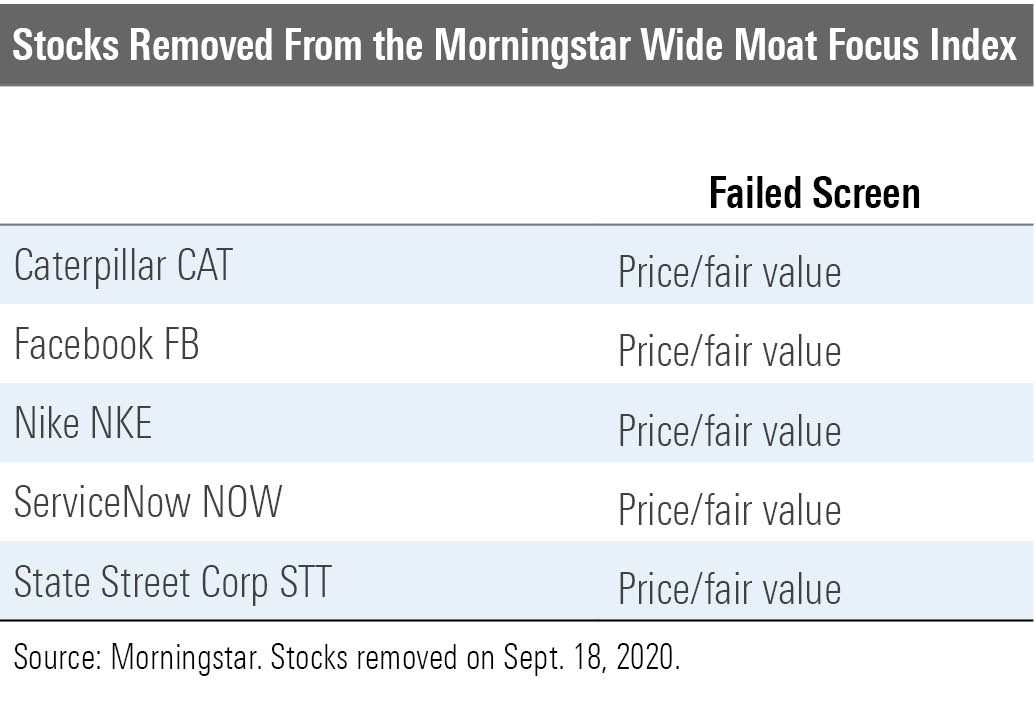

The Removals Stocks can be removed from the index for a few reasons: If we downgrade their economic moats or if their price/fair values rise significantly. All of the removals in the latest reconstitution were pushed out by stocks that were trading at more attractive price/fair values at the time of reconstitution.

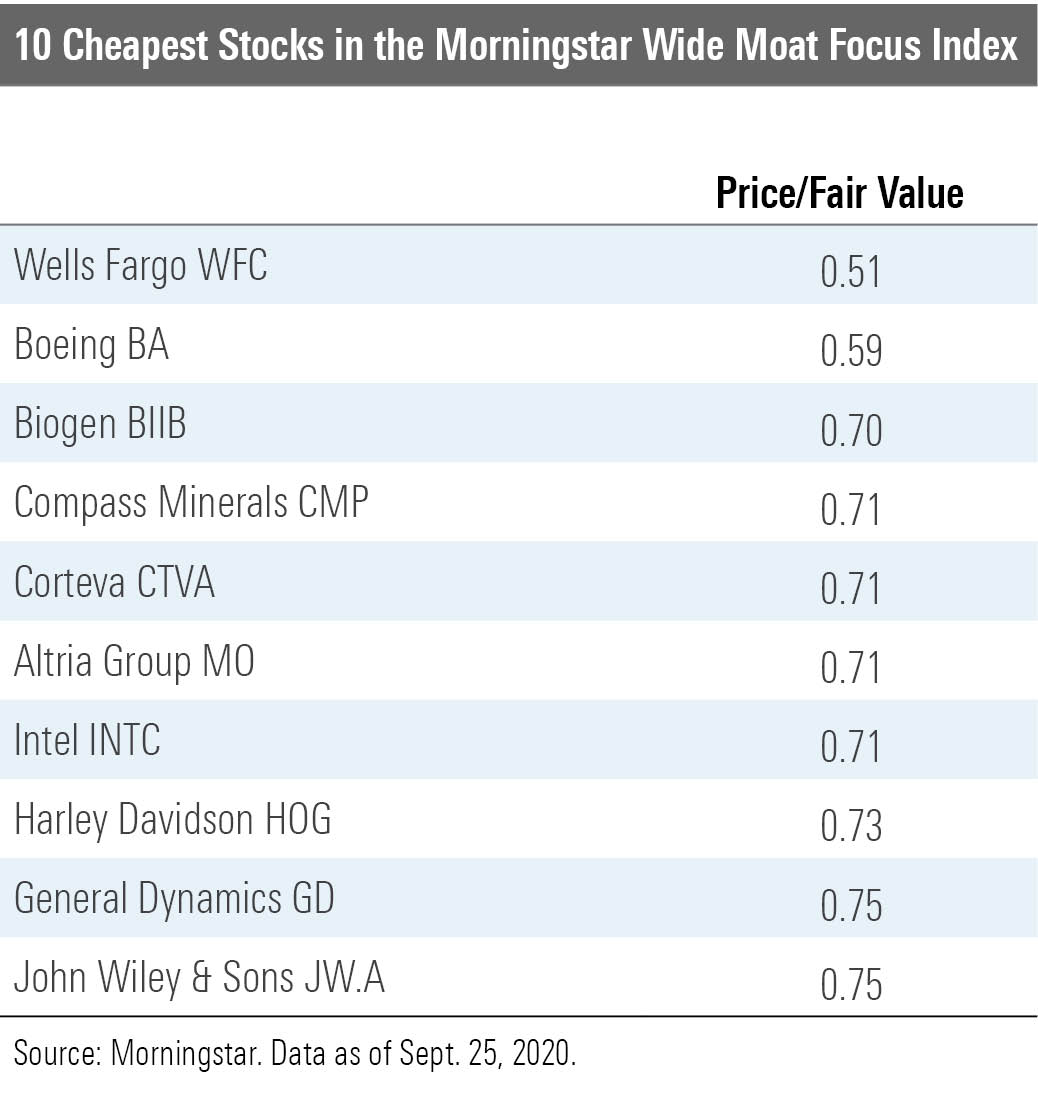

High-Quality Stocks in the Bargain Bin Here are the 10 cheapest stocks in the Morningstar Wide Moat Focus Index as of Sept. 25.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Neither Morningstar, Inc. nor its investment management division markets, sells, or makes any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ECVXZPYGAJEWHOXQMUK6RKDJOM.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KOTZFI3SBBGOVJJVPI7NWAPW4E.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/V33GR4AWKNF5XACS3HZ356QWCM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35408bfa-dc38-4ae5-81e8-b11e52d70005.jpg)