Commercial Real Estate Is in Trouble, but Not for the Reason You Think

Offices are only part of the story.

Investors are worried about commercial real estate.

The pandemic has flushed American office workers out of their offices and into their homes, spurring gloomy predictions about the demise of the downtown office. Rising rates have gummed up the works across all segments of the real estate market. Investors have yanked their assets from large private real estate funds, such as Blackstone Real Estate Income Trust BREIT, forcing the fund to intermittently halt redemptions.

There’s a kernel of truth to each one of these stories, which is what gives them teeth. But in the rush to predict the demise of office buildings, investors are at risk of missing the bigger picture. In fact, there’s another category of real estate properties staring down the barrel of a massive paradigm shift, and it’s getting far fewer headlines.

Commercial Real Estate Is Not a Monolith

Commercial real estate evokes the picture of glittering skyscrapers in humming metropolitan areas like Hong Kong or New York, manned by a swarm of office drones carrying briefcases and wearing starchy collared shirts. These are the same types of environments that have become an endangered species amid the work-from-home boom. Downtown offices have attracted a lot of scrutiny, partly because the people who are paid to study the markets and probe them for weak spots tend to work in these types of environments.

Morningstar's Chicago Office

And as far as weak spots go, there are reasons for concern. Offices comprise 80% of new delinquencies in commercial real estate loans, and occupancy rates in major cities consistently hover around 50% of capacity. But the towers we once commuted to comprise just a tiny fraction of the overall commercial real estate market.

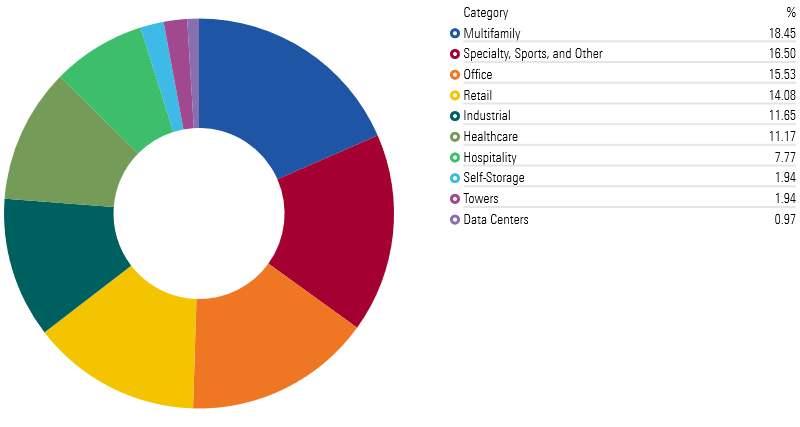

In aggregate, the commercial real estate market is big, diverse, and highly regional. According to NAREIT, the U.S. commercial real estate sector is valued at about $20 trillion as of second-quarter 2021. (There’s a significant lag to this type of research, given the difficulties of obtaining timely pricing data.) This $20 trillion is fairly evenly spread across its component sectors.

Commercial Real Estate Market by Sector

Offices soak up just 15% of that market, equivalent to roughly $3.2 trillion. But since the 1970s, most of that infrastructure exists in the suburbs. Class A properties, which are often situated in densely populated urban cores, comprise less than half of all office space in the United States. And as of June 2022, delinquencies in office real estate are still under 5%. It could take a very long time for things to shake out.

The Bigger Commercial Real Estate Picture

In the meantime, the long, slow metamorphosis happening in the office segment of the commercial real estate market is soaking up oxygen from another story that’s rapidly unfolding in commercial real estate markets.

Remember those other categories? The biggest one, beating office by a few hundred billion dollars, is multifamily residential. Multifamily residential buildings are typically apartment complexes that are owned by commercial landlords.

Real estate loans in this area are looking especially wobbly, for three primary reasons.

- A significant chunk of property developers took out loans in 2021 to finance new construction and redevelop existing stock while rates were cheap.

- Financing for multifamily residential units isn’t always set up in the same way that single-family mortgages are. The interest rates on some multifamily mortgages effectively reset after a certain period of time has passed—typically two to three years. That means many property developers for multifamily units are just now about to enter the gauntlet of higher rates.

- More than half of the cash borrowed by property developers to create this housing stock is provided by small and midsize regional banks.

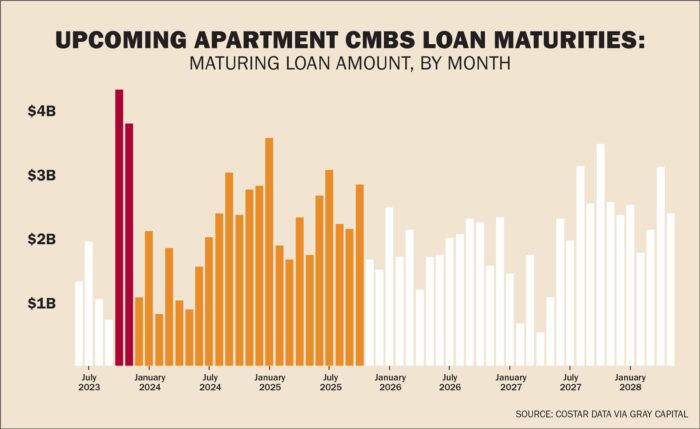

What does all that mean? It means that an $8 billion tsunami of multifamily commercial mortgage-backed securities—or CMBS, for short—is expected to come due, starting in the second half of this year. Some in the real estate market are calling it the “Red October.”

Multifamily CMBS Maturities in Second-Half 2023 Surpass $8 Billion

For reference, $8 billion of office CMBS is supposed to come due in all of 2023.

For Firms With Commercial Real Estate Loans, What Now?

Real estate firms watching this wave of loan maturities building toward the shoreline have limited choices for refinancing. Since the inception of many of these loans, regional banks have come under scrutiny for their risk management practices. The banks that initiated these loans are likely to be in no mood to make accommodations or take concessions; they want their money back.

Plus, new debt is a lot more expensive than the old stuff. Some firms will be able to extend their preexisting loans, but others will have to confront the same choice faced by single-family homebuyers today: Pay more or borrow from someone else.

Pay More

Remember that multifamily real estate conglomerates are different from single-family homebuyers. (Well, most, anyway.) They’re a business. Debt is one aspect of their operations, but they have other levers on their income statement, too.

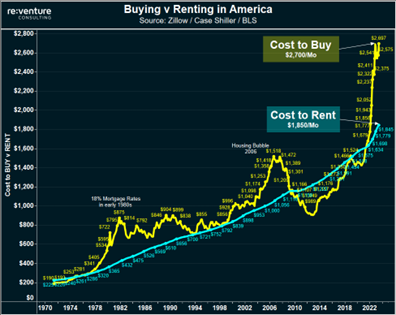

The most straightforward way to offset higher operating costs is to hike up rents. Indeed, asking rents have increased 17% year over year, according to Redfin, the largest such jump since it began collecting the data in 2020. The average cost for an American to rent an apartment is the highest it has ever been in recorded history, at $1,850 a month on average. Given that renting is still 30% cheaper than owning a home, asking rents could climb even higher.

Cost to Buy vs. Rent a Home, in USD Monthly

On the other hand, the national median rent (which adjusts for the luxury and rent-controlled segments of the apartment market) has continuously decreased since its peak at nearly $1,400 in August 2022. The year 2023 is set to see the highest number of new apartments come to market in nearly 40 years, meaning that competition is stiff.

Borrow Differently

As every kindergartner knows, if mom won’t lend you money, then ask dad. So, what choices do real estate firms have available outside of a loan from their preferred regional bank?

There is still debt of a different sort. The nonbank lending sector has exploded in the wake of the global financial crisis, and a whole host of private credit funds exists to facilitate loans with higher loan/value ratios (which effectively means lower down payments for the borrower), lower interest rates, and fewer covenants. They’re able to achieve this because private credit funds are typically quicker to foreclose on struggling properties than banks are. Most of these funds have the chops to turn properties around themselves rather than instantly dump them on a market flush with supply.

Can We Panic About Commercial Real Estate Now?

If you’re a multifamily real estate borrower with a bill coming due, maybe. But if you’re an investor, remain calm. There’s one more crucial detail that I’ve left out. CMBS, at least, have one more backstop: agency guarantees. In the U.S., most commercial mortgage-backed securities are guaranteed by agencies like Fannie Mae, Freddie Mac, and Ginnie Mae. That means that for most lenders, even if they default, the government agency will make investors whole. And for CMBS without an agency guarantee, the data still supports cautious optimism. So far this year, most multifamily borrowers without government backing have successfully repaid their loans—in fact, at higher rates than the rest of the market. Multifamily CMBS’ maturity payoff rate of 75% for the year to date through June 2023 compares favorably with around 55% for all of CMBS over the same period. (Data sourced from DBRS Morningstar.)

For reasons like this, the specific cause-and-effect arcs triggered by higher interest rates are slow-moving and difficult to track. The market is so complex and fragmented that it’s easy to overfit the effects of one event. There are a couple of big takeaways for investors to keep in mind.

- Real estate is not a monolith, and the dynamics of one sector like multifamily may not have much in common with other types of properties, despite existing in the same category (commercial real estate).

- The most glaring areas of stress, like downtown offices, are not always where the biggest dollars are at risk.

- Size your bets accordingly. There’s a big difference between how a publicly traded REIT and an agency-backed CMBS perform, even given the same inputs.

Finally, those abandoning glass office towers shouldn’t throw stones on their way out the door. Instead, they should be turning them over.

Clarification: This article was updated to include data from DBRS Morningstar.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HTLB322SBJCLTLWYSDCTESUQZI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TAIQTNFTKRDL7JUP4N4CX7SDKI.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/eda620e2-f7a7-4aef-bb6c-3fb7f1ac7a38.jpg)