Measuring ESG Risk in 3 Undervalued Small-Cap and Emerging-Markets Stocks

The Morningstar Sustainalytics ESG Risk Smart Score is a first stop for hard-to-research companies.

It can be hard enough to invest in the stocks of smaller companies or those domiciled abroad, especially those with headquarters in emerging markets. Disclosure can be lacking, access to management can be difficult, and Wall Street or media coverage might be nonexistent. But when it comes to investing in small-cap or emerging-markets stocks through an environmental, social, and governance lens, it’s even harder.

One easy starting point is the Morningstar Sustainalytics ESG Risk Smart Score. This score uses the tools of artificial intelligence and machine learning to replicate the analyst-driven ESG Risk Rating.

This score can be used as an initial indicator for ESG risk, pointing to where to best spend limited time. Below, we dive further into the challenges of measuring ESG risk in small and emerging-market companies and outline the details of the ESG Risk Smart Score. And to showcase this process, we’ve highlighted a trio of undervalued stocks—asset manager AllianceBernstein AB, Indonesian nickel miner TBP Group NCKL, and Chinese private education provider Edvantage 00382—where the ESG Risk Smart Score provides important insights to consider.

How to Measure ESG Risk in Small-Cap and Emerging-Markets Companies

Despite recent advancements, the lack of standard disclosures around material ESG issues is a clear obstacle for all investors.

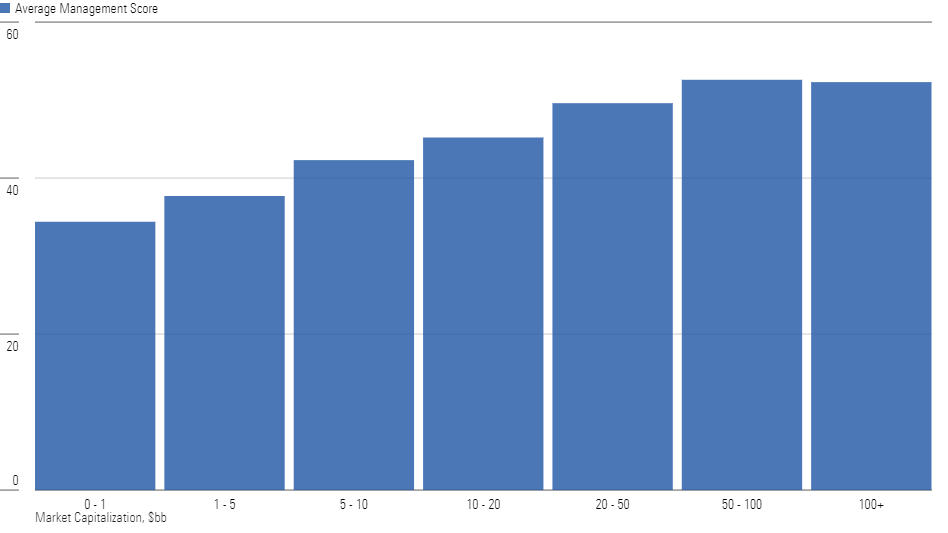

Highlighting this challenge, the estimated management score—a component within the ESG Risk Rating denoting the percentage of ESG risk that a company’s management team has succeeded in mitigating—tends to be higher for larger companies, on average, versus smaller-cap firms.

Larger Companies Are Assigned Higher ESG Risk Management Scores

While larger companies may be able to manage their ESG risks more effectively, smaller companies may simply have fewer resources to dedicate to disclosing risks or have related management systems in the fashion that Morningstar Sustainalytics is looking for, rather than truly reflecting a lesser ability to manage them.

This means that more work is often needed to properly understand ESG risks outside of large-cap developed-markets stocks.

Measuring ESG Risk Using the ESG Risk Smart Score

To this end, Morningstar Sustainalytics has developed a tool—the ESG Risk Smart Score—that estimates the financially material ESG risks for over 30,000 companies globally.

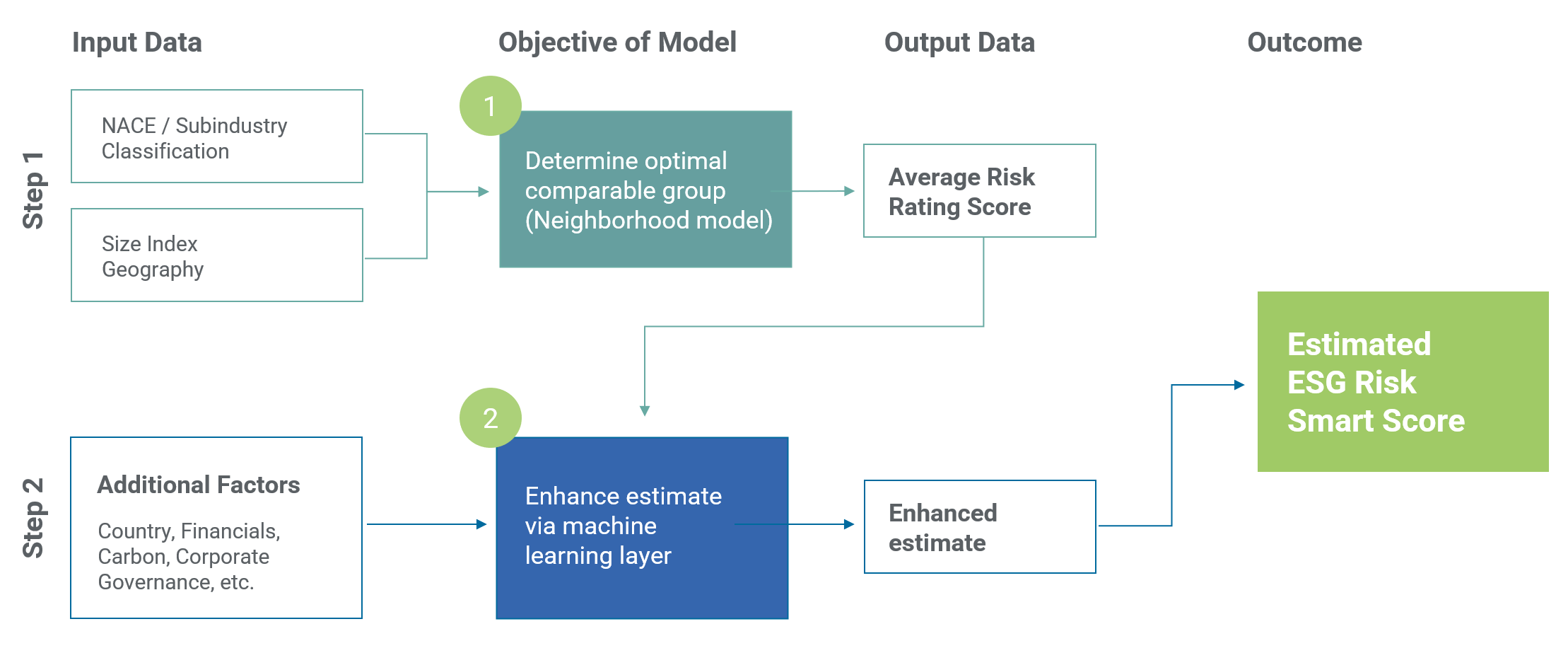

The ESG Risk Smart Score uses a two-step approach. The first is a simple average of analyst-driven ESG Risk Ratings from groups of similar companies, based on industry, country, or size overlap. The second is a machine-learning process to improve the estimation of ESG risk by combining additional financial and ESG variables of the target company into the estimate.

Estimating the ESG Risk Smart Score Is a Two-Step Process

Industry Insights From the ESG Risk Smart Score

While the ESG Risk Smart Score cannot fully replace a comprehensive, analyst-driven ESG Risk Rating, it can extend ESG risk signals to a larger universe of companies not covered with ESG Risk Ratings and for which limited information is available.

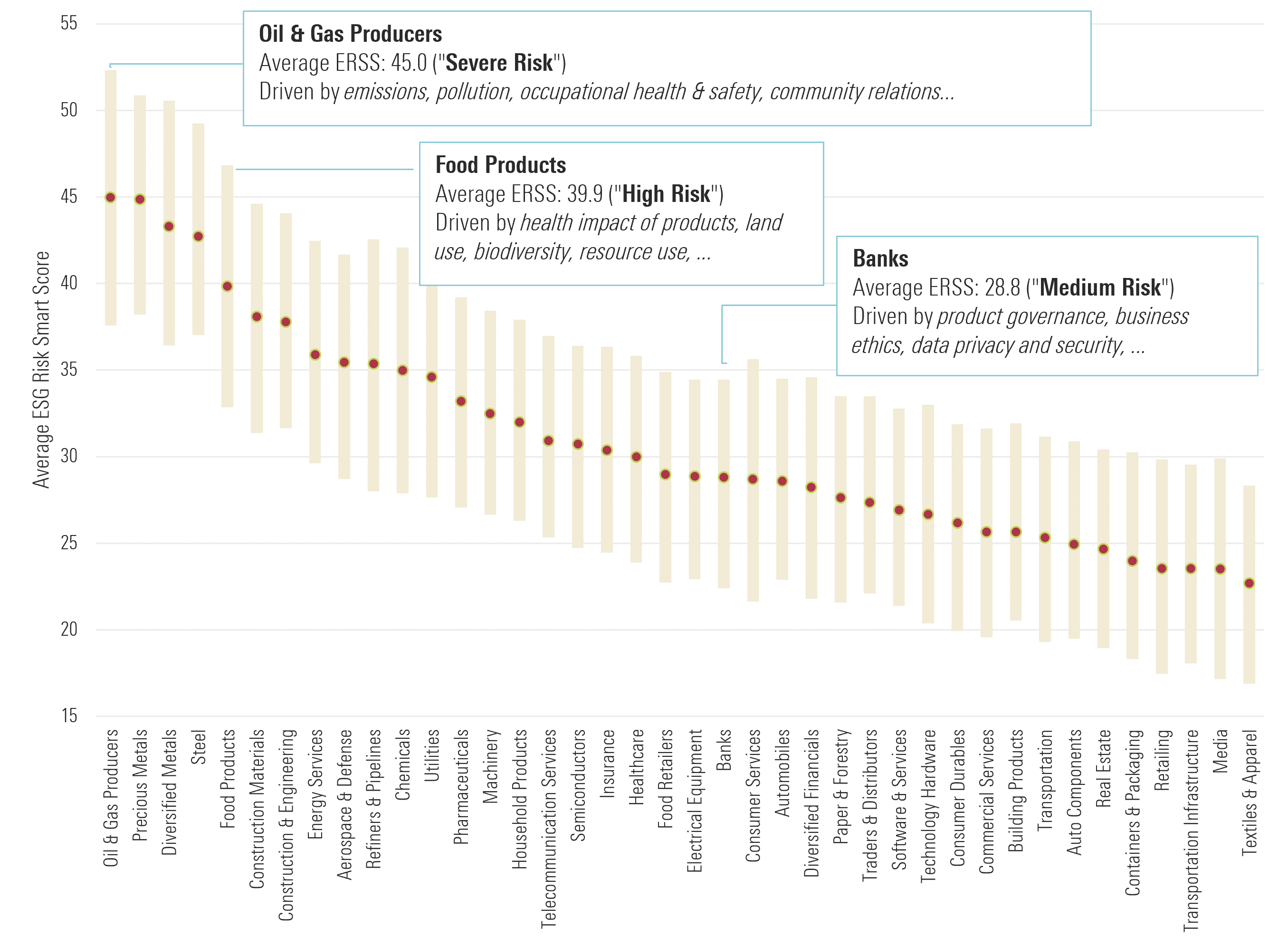

Immediate insights from ESG Risk Smart Scores are the different levels of ESG risk attributed to different business activities. Unsurprisingly, on average the ESG Risk Smart Score assesses a “severe risk” for heavy and extractive industries. However, the ESG Risk Smart Score also highlights potential risks in industries that are less obviously associated with ESG issues. For example, on average it assesses a “high risk” for food products and a “medium risk” for banks. The chart below shows an overview of the ESG Risk Smart Scores for different industries, along with some examples of ESG issues that drive the underlying ESG Risk Ratings.

ESG Risk Smart Scores Show Varied Results by Industry

Digging Deeper: The ESG Risk Smart Score Is a Useful Starting Point in Measuring Company Risk

Given the reliance on general company information and a few data points, the ESG Risk Smart Score shows the typical ESG risk of issuers similar to an analyst-driven assessment of a company but does not fully capture a company’s idiosyncratic approach to ESG and sustainability. As is often the case in small-cap and emerging-markets investing, additional research and due diligence are typically needed, but this extra work can help uncover undervalued opportunities that might be off the beaten path.

Below are examples in each category where the ESG Risk Smart Score points to medium and severe ESG risk, but deep dives from Morningstar equity analysts highlight undervalued opportunities.

AllianceBernstein, Morningstar Rating: 3 Stars, Price/Fair Value: 0.90

The ESG Risk Smart Score for AllianceBernstein is 20.6, slightly better than the average ESG Risk Rating of 24.4 for the asset-management subindustry but still within the “medium risk” category.

AllianceBernstein’s ESG Risk Smart Score is comparable to the ESG Risk Rating scores of larger global asset managers like Invesco (22.6) or T. Rowe Price (16.9), indicating that typical ESG issues for asset managers, such as product governance, ESG integration, and business ethics, could apply to a similar extent to AllianceBernstein, which has a Morningstar Economic Moat Rating of none. This also aligns with the perspective of other stakeholders, including a recent review of asset managers’ responsible investment policies by the nongovernmental organization ShareAction, which placed AllianceBernstein in the middle of the peer group (number 32 out of 77) with relatively strong performance on governance and stewardship but some gaps, such as incorporating biodiversity, in its responsible investment policies.

Outside of ESG risks, AllianceBernstein has faced fee pressure, asset outflows, and weakened profitability. While it may take some time for the business to recover alongside improved equity and credit market performance, Morningstar’s equity analysts think that the firm is managing its ESG risks well and see a decent margin of safety in the current share price.

TBP Group, Morningstar Rating: 3 Stars, Price/Fair Value: 0.83

The ESG Risk Smart Score for narrow-moat Indonesian nickel miner Trimegah Bangun Persada, or TBP Group, is 46.3, putting it in the “severe risk” category. Nickel miners in Indonesia face a number of environmental and social issues (especially contamination of ecosystems with hazardous mining waste) as reported by The Japan Times, FDI Intelligence, and The Washington Post. Some of these reports refer directly to TBP’s parent company Harita Group.

Morningstar’s equity analysts believe these risks to be manageable by TBP but also acknowledge the ongoing concerns and need for continued management of potential pollutants and worker relations.

In the end, the ESG Risk Smart Score here provides an important signal. The stock trades at a sizable discount to the estimated fair value, suggesting some ESG risks are already priced in, but it’s up to each individual investor to consider whether these potential returns match their own risk tolerance and preferences.

Edvantage Group, Morningstar Rating: 5 Stars, Price/Fair Value: 0.38

Edvantage’s ESG Risk Smart Score of 20.7 is higher than typical ESG Risk Ratings for other private education providers in China (such as New Oriental Education & Technology Group at 15.0 or China East Education Holdings at 14.0). In fact, the risk exposure indicated by the ESG Risk Smart Score is close to the default exposure of 23.0, which companies in the consumer services subindustry would receive absent any ESG risk management. In this case, the ESG Risk Smart Score is likely a conservative estimate, given Edvantage’s efforts to manage key ESG issues (human capital, data privacy and security, product governance, and corporate governance), as detailed in the company’s ESG report. Being on the border of the “low risk” and “medium risk” categories, the estimated ESG risk exposure does not raise red flags.

While Morningstar Equity research assigns Edvantage a narrow moat supported (among others) by the high quality of its schools, investors should also keep in mind the Very High Morningstar Uncertainty Rating that is due to long-term regulatory risks related to the Chinese government’s stance on private education in general.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/35091ad9-8fe9-4231-9701-578ec44b5def.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/35091ad9-8fe9-4231-9701-578ec44b5def.jpg)